Glenn J. Mullan, Chairman, President, and CEO of Golden Valley Mines and President of PDAC: Successful Prospect Generator

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/26/2017

Golden Valley Mines Ltd. (TSX- V:GZZ) is a junior exploration company whose original and continued core exploration focus is the

Abitibi Greenstone Belt “Grassroots Exploration Project”. The project consists of a series of distinct properties, located in the

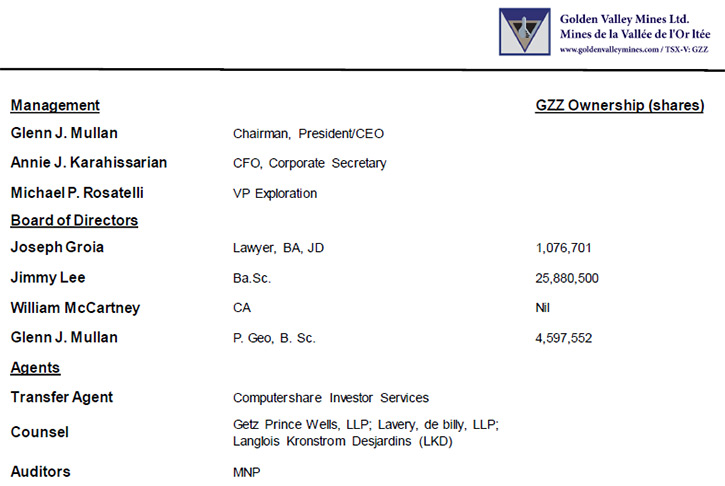

economically significant and historically prolific Abitibi Greenstone Belt, Canada. We learned from Glenn J. Mullan, Chairman,

President, and CEO of Golden Valley Mines, as well as President of PDAC, that the board and the management of the company are all

shareholders, with >25% of the shares held by insiders. Golden Valley's main assets are the shares it holds in other public

companies, plus multiple joint ventures, several partnerships with other companies, who in each case have the obligation to fund

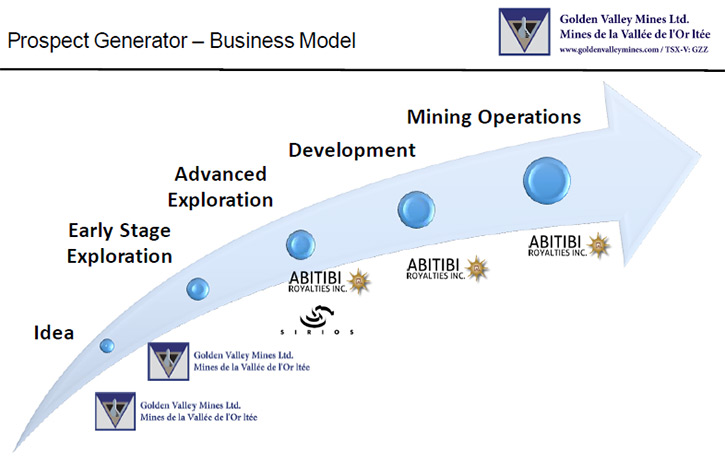

exploration. According to Mr. Mullan, Golden Valley utilizes a prospector's business model, to own shares, royalties, properties, and

not dilute its’ own shareholders.

Éléonore Mine West of the Cheechoo Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Glenn J. Mullan, Chairman, President,

and CEO of Golden Valley Mines, Ltd. Glenn, could you give our readers/investors an overview of your company and what's happening

currently?

Mr. Glenn J. Chair: Sure. Golden Valley is a different twist on a very conventional model. All junior mining companies

are involved in exploration, to some degree, with all the risks that entails. We've tried to build an asset base, and use it to

support, not just our share price, but all of our exploration activities so that we don't dilute our shareholders.

Our board and management are all shareholders ourselves. It would be one thing if it were a new company, 20-25% of the shares

held by insiders, but we've been around for 17 years. In fact, the insiders have doubled their position in the past 12 months. That's

quite a unique feature for a junior mining company that's been around for more than a decade.

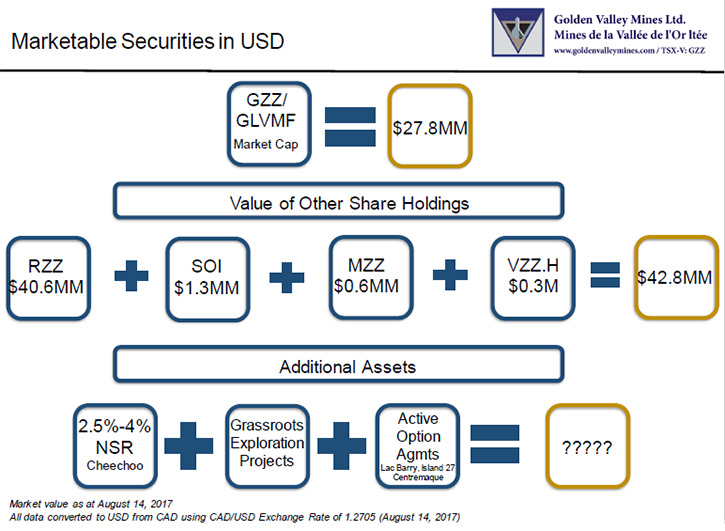

We have a number of assets that are quite unique. Some of those assets are shares in other public mining companies. To a

certain extent, there is a relationship between them (between Golden Valley and the shares of the other public companies). They're

either related by properties, by royalties, by management, key shareholders or by equity in other public listings. Golden Valley's

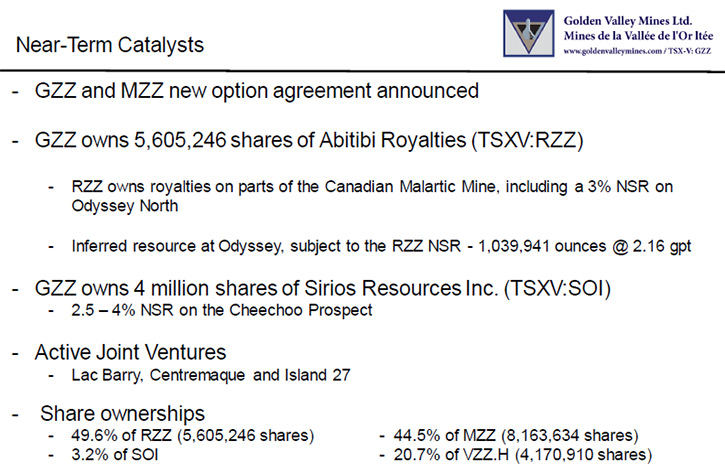

main assets are the shares it holds in another public company called Abitibi Royalties, RZZ on the TSX Venture Exchange. That company

trades at around $9-$9.25 Canadian. It would have a market cap of about $106 million Canadian. Golden Valley owns almost exactly half

of it. The exact percentage is 49.2% or 49.3%. If you took only that asset, it would be worth more than Golden Valley's entire $36M

(CDN.) market cap.

By itself, that would be an interesting asset to own, but Golden Valley is still very much an explorer. We have multiple

joint ventures, several partnerships with other companies, who in each case have the obligation to fund exploration. Golden Valley

doesn't dilute itself. Golden Valley owns shares in other public companies. It owns properties. It has fully funded partners, who

have to contribute 100% of the ongoing exploration expenditures. We get a free ride. That was always the intention from the very

beginning. Golden Valley owns shares, Golden Valley owns royalties, Golden Valley owns properties, but Golden Valley does not dilute.

That's really the spin on a very traditional concept, but done in a way that's quite unique, I think, and I hope.

Dr. Allen Alper: That sounds excellent, an excellent approach for development, for growth, and for exploration, and to

increase the wealth of your shareholders. Could you tell us a little bit more about the various properties you have and some of the

relations you have with other companies?

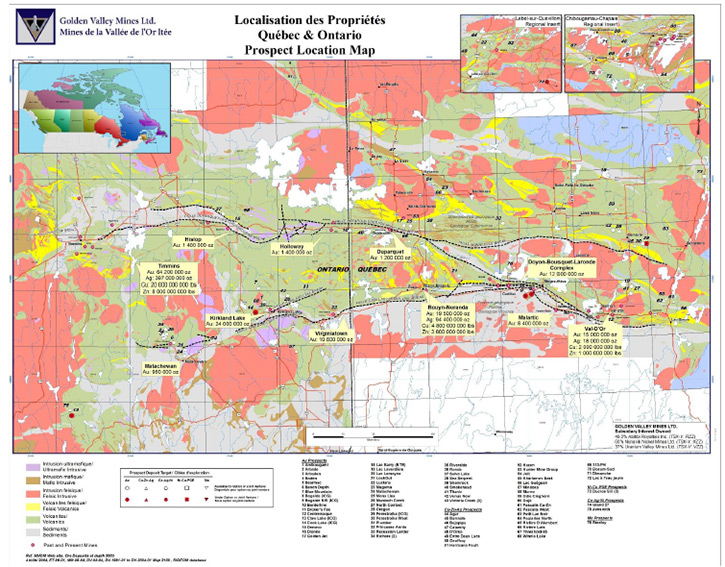

Mr. Glenn J. Chair: Yes, of course. We're based in Val d'Or, Quebec, which is pretty much the center of the Abitibi

greenstone belt, really the center of gold and base metals production in eastern Canada. We have about 70 different properties or

property interests, including royalties. Of those, about two-thirds of our properties or royalties are in Quebec and about one-third

are in Ontario. Normally, we've spent a little bit of our own money to help refine geological targets for drilling. We use a

prospector's business model. If you think about an independent prospector, that person would usually try to spend as little of their

own money as possible, while trying to find a partner to fund more expensive exploration activity. Golden Valley does the same thing,

but on a public scale. On a typical property, Golden Valley would spend in the hundreds of thousands of dollars, not millions,

hundreds of thousands and often less than $100,000, and then try to find a partner to take the commitment to a different order of

magnitude, including drilling. All of the expensive components of exploration are undertaken by our partners.

In a normal year, Golden Valley spends from its own treasury a few hundred thousand dollars on field exploration, and most years,

it's significantly less than $500,000. Our partners over the past five years have spent over $5 million in each of the calendar years

going back for each of the past many years. We spend, call it, $500,000 Canadian, and our partners spend $5 million or more, and in

some years much, much more than that. You'd have to go pretty far back, to find a year where it was less than that. It's a different

model because instead of going to the market and undertaking dilutive financing, our partners have the obligation to fund the

exploration, and Golden Valley's shareholders enjoy that benefit.

Some of the properties are gold. Some of them are copper-zinc. A couple of them are uranium and other commodities. We work in

Quebec and Ontario principally, although depending on the cycle and the stage of the economic cycle, in the past we've worked in

Africa, we've worked in South America, we've completed due diligence recently on properties in Central America, but really it's very

difficult to compete with Canada for the cost of acquisitions, the cost of exploration, and the net benefit on the risk-benefit

scale, so for now, we're really working only in Quebec and Ontario. Most of the properties are gold. About 55% of the properties are

gold, with most of the remaining balanced between copper-zinc and a couple that are also in cobalt.

In each case, the funding obligations are falling to our partners. Our cobalt property is a recent transaction with a private

Australian group. They have the commitment to spend $5 million over four years. That'll leave us with a 20% free carried interest and

a 1.5% NSR. That's very typical of the type of transactions that we do on gold properties or base metals. We have multiple joint

ventures with different partners, all public companies in the gold space. Together with that, we own shares in other public

companies, royalties that are spread across Quebec and Ontario. That's really a unique twist on a very traditional business plan. We

do engage in direct exploration. We just don't pay for it. That's the part that makes us quite unique.

Dr. Allen Alper: Excellent approach! Could you refresh the memory of our readers/investors about your background and your

team?

Mr. Glenn J. Chair: Of course. I like to describe myself as a prospector primarily, because we spend most of our time

trying to create wealth for our shareholders using our experience in different places, mostly in Quebec, Ontario, other parts of

Canada, and other continents. I've only been involved in three companies. All three of them were founded by myself.

Canadian Royalties was the first one. It ended up being listed on the TSX at the time, or the TSE as it was called, the

Toronto Stock Exchange, and ended up being taken over by a Chinese company called Jilin Jien Nickel Industry Co., Ltd. It's in full

production now, and has over 300 hundred employees, $2 billion spent on project development capex, and that mine is in operation in

northern Quebec. It's a nickel-copper-platinum group mine. I was the founder and the largest shareholder until the Chinese took it

over and put it into full production. That was one company that I started.

The second one is Golden Valley Mines. We've been around for 17 years, and very much engaged in grassroots exploration. At a

certain point in time, when we determined there was a real risk in losing our main gold property, because we had issued shares on

Golden Valley and because we determined that there was a real risk in losing it in a transaction, our main property, we decided to do

a spin-off. The spin-off formed a company (our third of the three) called Abitibi Royalties, RZZ. That's the small royalties company

that's now the focus of most of our attention.

Abitibi Royalties owns royalties in part of the largest gold mine in Canada, the Canadian Malartic. On that mine, we own

royalties covering parts or all of the following zones, the Odyssey North, Odyssey South (the northern and most western portion of

it), the Charlie zone, the Gouldie zone, the Norrie Deeps zone, the Shaft zone, and the Jeffrey zone. Those are all parts of the

Canadian Malartic Gold Mine on which Abitibi Royalties owns royalties, ranging between 2% and 3% NSR, meaning Net Smelter Returns.

Golden Valley owns about half of that company. That's really the focus of our attention and our main asset.

That's all tempered, of course, with all of the other joint ventures we do on less evolved, less advanced properties, mostly

grassroots exploration, but gold properties, base metal properties, cobalt properties, always the same model where the partner

undertakes the obligation to fund.

Dr. Allen Alper: That sounds excellent. It sounds like you and your team have done a fantastic job of helping increase the

wealth of your shareholders, so that's excellent. Could you tell me a little bit more about some of the other members of your team?

Mr. Glenn J. Chair: The core of our team has actually been working together for about 15 years. We started with the

company called Canadian Royalties, Inc., that was taken over by the Chinese. After that transition and after the new owners took

over, most of us moved over to Golden Valley Mines, which quite literally was two buildings away in this very small town (Val-D’Or,

population about 32,000) in northern Quebec. Our CFO, the Chief Financial Officer, has been with us for more than 15 years now.

Michael Rosatelli, Vice President Exploration, has been here for the entire time as well. That would be the core of the management

team.

The consultants, prospectors, and the support staff, I won't say they come and they go, because most of them have been here

the entire time as well, but certainly the level of activity ramps up to mirror the state of the industry. When things were very

quiet, and prices were down, and commodities were down, and financings were hard to come by, we curtailed our exploration activity. I

won't say we hibernated, because we never stopped looking at properties and opportunities, but we definitely cut back our ambitions

and our expenditures, and kept looking at properties only without doing any direct drilling.

We formed a number of partnerships during those quiet times, and we're bearing the fruit from a lot of those now. Some of our

partnerships or partners include Alexandria Minerals, Bonterra Resources, Sirios Resources, Battery Minerals to name a few that come

to mind. We've done a lot of joint ventures over the past 17 years, and that's really provided essentially all of the capital that's

gone on into our properties.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit more about your capital structure?

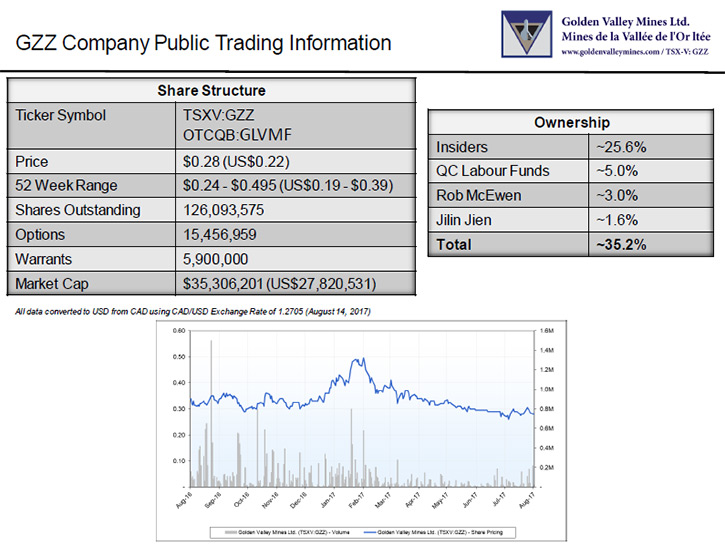

Mr. Glenn J. Chair: Yeah. We have about 126 million shares issued. The board owns about 26% of that, together with two or

three others, including Robert McEwen, Chairman, President, and CEO of McEwen Mining Inc. and ex-Goldcorp Chairman. Rob owns about

3%. There's one Quebec labor fund, a Quebec Government financial institution, that supports mining, exploration and natural resource

development. The labor fund owns about 5% of Golden Valley. A Chinese nickel company owns 2-million shares. Then our board owns

over 26% now. That number has doubled over the past year. If you add up those four groups, namely Robert McEwen, the Quebec funds,

the Chinese nickel company and our board of directors, you're at about one-third of the issued shares, in fact, slightly higher

(35%). In itself, that's pretty unique for a company that's been around 17 years.

We're very widely distributed. The balance of the 66% that we don't tightly control is held by the retail market. We're not

an institutional play because we're grassroots. It is the type of a story that appeals to the very broad base of mostly Canadians,

but some Americans and Europeans that like grassroots, early-stage exploration. A pretty broad base of shareholders that spans the

whole range of those who like gold and gold only, and those who like commodities in the other space, base metals, uranium, some other

energy minerals, and most recently cobalt. Because our model is very traditional and easy to understand, grassroots exploration with

someone else paying for it, that actually attracts a subset of the investors who are more used to the conventional model of dilution,

dilution, dilution.

We try to stay away from that because we're the major shareholders ourselves. Along with Rob McEwen, the Quebec funds and our board

and management group, there are 10 shareholders, who have more than a million shares each. Each one of those 10 individuals is a

person from different professions, including oncology, accounting, forestry, a car dealer, so a pretty broad base of people from

different industries who like mining exploration stories and who bought their Golden Valley in the secondary market. Of course,

people that buy that much stock tend to call fairly often, and we like to think we know where the shares are because they tend to

stay fairly close to the story.

Dr. Allen Alper: Excellent! Could you tell us a bit about your thoughts on what's happening with gold and some of the other

minerals and metals?

Mr. Glenn J. Chair: I'm always a bit shy to talk about what I think the gold price will do, because if I'm consistent in

one thing, it's in being wrong for 40 years on what I thought the price of gold was going to do. Maybe this time I'll say I think

it's going down so that maybe it'll go straight up, but be that as it may, gold is the one commodity that really reflects volatility.

Some of that is hedging, of course, and some of it is political. There's a number of components and assumptions that underlie gold

prices that tend to be like the tides.

They come and they go, and because we can’t control that part, we really try to focus on the elements of the industry that we

can control or at least exert an influence over. We're always doing some due diligence on properties and affordable opportunities.

Sometimes they tend to flow to the gold space, and that has been the case for the last six, seven years. There was a period of time

where most of our properties were base metals, copper-zinc prospects. There was a period of time about a decade ago now where many of

our properties were uranium properties. The softening in uranium prices caused us to move away from that, although we still retain

those properties.

The commodities reflect different parts of the economic cycle and the supply-demand phenomenon. Part of it five, six years

ago, if your readers recall, it was often China, China, China, and the consumption of the Chinese economic miracle, as it was called,

that really caused base metals prices to be so dominant, especially nickel. That has waned and has ceased to be the driver. As the

precious metals have come back into the focus again, we've kept our grounding really on those commodities to echo the market

interest. It's not exclusive, so it's very difficult to know what commodity prices will do looking forward. So we try to have a hedge

into the other commodities, never forgetting the best opportunities are usually at market bottoms.

We're not shy about looking at commodities that are out of favor. I mentioned nickel before. Nickel is one. Uranium is

another. Certainly for a junior mining company, we can afford to look at opportunities and properties that are out of favor if we

have fundamental reasons to think the market might take a shine to those commodities in the near term. That does represent a key part

of our focus and our strategy, while never losing sight of where the financings are, where the opportunities are, and where our

shareholder interests are.

Dr. Allen Alper: Sounds like an excellent approach. Could you tell me a little bit about your role in PDAC and what your

thoughts are as PDAC is getting ready? I believe you're President of PDAC, is that correct?

Mr. Glenn J. Chair: Yes, sir. The PDAC is an interesting organization. I guess the best way to describe it is as

venerable. It's been around for 85 years. I think it was formed in 1932, pretty much during the depths of the Great Depression. That

being the time that it had its origin, it's evolved from a very parochial, small organization based in Toronto at the time, and then

representing provincial interests in Toronto, and ultimately becoming a national organization, until now it's probably better

described as Canadian but with a global reach.

We're very proud of some of the elements of the PDAC. One is that this year, 2017, we had folks attend the PDAC convention

from 130 countries. There's no other industry in Canada that can make that claim. Really, that's phenomenal. It doesn't just

represent mineral-producing areas and mineral-exploring areas and prospective countries. It represents investors and governments from

definitely every continent and every region of the globe. We had over 24,000 people come to the convention this year, and given that

it was March in Toronto, they aren't coming for the weather. They're most definitely coming for the convention and the programming

that we're quite proud of offering to PDAC members.

Then beyond that, one of the things that Canada is very good at is exporting mining, mining technology, mining knowledge.

Canadians are working in 102 countries at last count, which pretty much represents every country that has mining in the globe. 34 of

them in Africa, pretty much every inch of South America. There's a lot of exploration going on by Canadian companies in Central

America. Certainly, every part of the United States that's prospective for mining probably has mining companies that are based either

in Canada or operated to some extent by Canadians. Mining, mining exploration, and hockey are probably the things we're pretty good

at on a global stage. You'll find Canadians prospecting anywhere where there's decent rocks, in terms of economic potential.

In terms of being President of the PDAC, it's a good opportunity. It's an interesting organization because it's fairly old

and well established. We have an interesting method by which one becomes the President, requiring that you accede to the board, from

the board to the executive committee, from the executive committee to second vice president for two years, then first vice president

for two years, President for two years, and then past president for two years. There's actually an eight-year track in that cycle. A

lot of that is born from that 85-year-old experience. If anything, I've learned a lot inside the PDAC that I can export and take back

with me to our little junior companies in terms of governance, and certainly very important for networking, given how international

the PDAC has become, nearly 25% of the PDAC attendees are now International. That is a significant change from our historic pattern.

Dr. Allen Alper: That's fantastic. I enjoyed the PDAC. We've been going to it for 18 years, and we've been media sponsors, so

we're very proud of the organization and enjoy it.

Mr. Glenn J. Chair: Thank you for your sponsorship.

Dr. Allen Alper: It's a great organization. It is the best event we go to all year-round.

Mr. Glenn J. Chair: We certainly have a lot of competition, but we stay focused on the value proposition as well. We

would like to think that when times are good, people and companies go to many events. Of course they'll go to the PDAC, but our real

challenge is to make sure that when the mining industry goes into a down cycle, that if they only attend one event, we want it to be

ours. That's definitely been a key part of our platform, to make sure PDAC remains attractive to its core audience in challenging

times as well as in good times, so thanks for your support.

Dr. Allen Alper: It's a great organization, and a great job. What are the primary reasons our high-net-worth readers/investors

should consider investing in Golden Valley Mines?

Mr. Glenn J. Chair: Of course. It begins with the opportunities. I don't think there are very many junior mining

companies that have the kind of properties and assets that Golden Valley has. It wasn't pure luck. We spent 17 years working,

exploring, developing, investing in the properties. A few of them have evolved to the point where we now enjoy some of the benefits

from that past work, namely royalties and royalty revenue that are accruing to the Abitibi Royalties investment. That was a company

that was spun out of Golden Valley Mines in 2011, and by itself, that would be an interesting story and a proposition to be followed

by many of your readers and investors.

Golden Valley is more than that. We do grassroots exploration. We have multiple partnerships, not just in gold and not just

in Canada, but we have partnerships that fund the exploration in gold, in base metals, in cobalt, and historically we've been

aggressive in uranium and other commodities. We explore primarily in Canada, and within Canada, mostly in Quebec and Ontario, but

again, historically as the markets have allowed, we've explored and worked different opportunities in South America and Africa. Right

now, definitely, Quebec and Ontario are our anchor and the main focus.

The main reason I think that your high-net-worth readers/investors might be interested is because the major shareholders are

the board of directors and our management. Because we've been around for 17 years, it's more than an oddity, it's more than good

fortune that the board has doubled its investment over the past 12 months. That's an important attribute for people to be aware of,

and to generally be aware that we're aggressive explorers, and we own significant assets in gold and in base metals. Thank you for

your interest.

Dr. Allen Alper: That sounds like excellent reasons for our high-net-worth readers/investors to consider investing in your

company. I wonder if you could give our readers more background on how you got into geology and what your thoughts are about the

whole area.

Mr. Glenn J. Chair: A boring story, to tell you the truth. I read a book by a gentleman called Pierre Berton called

Klondike, which was the story of the Klondike gold discovery in the Yukon in 1897 and '98. I was enraptured reading that story, about

the hardship so many people endured, to go through - mostly - the Chilkoot Pass, the Alaskan side, to get into the Yukon and to do

that through winter, so far north, in an area with really no infrastructure. That story just filled me with the power of gold and the

visions of hope and difficulty that those prospectors and early participants experienced.

From that moment, I knew I wanted to be a prospector, and so I became a geologist. I earned the degree, but have always

worked independently, and always worked on projects and tried to move them forward by using our capital and trying to find other

people that might embrace those concepts and be willing to support us.

Typically, we spend money on the early stage exploration. We do the grassroots geology, geophysics, and try to find partners

to undertake the drilling and the more expensive components. That's a model with which, although difficult, and I acknowledge that

it's difficult, we've had good success. We've formed over 30 joint ventures, during our time with Golden Valley, and there's been

over $50 million spent on our properties during the tenure with Golden Valley, so some good things have come from that by sticking

with that model, because it's quite unique in an industry that is better known for dilution of shareholders. We're the exact

opposite. We try to protect our shareholders from dilution and attract partners to our ventures. If people like grassroots

exploration, I would definitely encourage them to take a good look at Golden Valley and our business model.

Dr. Allen Alper: That sounds great. What kind of advice would you give to students who are considering a career in geology or

exploration?

Mr. Glenn J. Chair: I hope you have thick skin and a strong back, because certainly if you're going to enter the Earth

sciences industry, it requires people that can adapt to changing cycles and climates, economic conditions. Whatever the commodity of

a person's choice or employment happens to be now, it surely will change over the decades to come. Certainly we encourage people to

keep an open mind, and to not embrace only a single commodity, precious metals or base metals. Keep an open mind and allow yourself

to become familiar with the geology and the opportunities in different contexts, different geological environments.

For young people who are so used to being told, "We have no opportunities. There are no jobs here now," no is such a

temporary word. It really only means no now. We are very diligent and persistent at pursuing opportunities, and that's really what it

takes to be successful in mining, persistence. It's really no different for a student that's just setting out in our industry. If

anything, there are some great opportunities and great skill sets that are there now that weren't there when most of us graduated.

Sometimes, those students don't think about their own capacity to be entrepreneurs and to set out on their own. From my own personal

vantage point, I'm always encouraging people to think about forming their own business and exploring in a way that was much more

conventional decades ago, but consider prospecting as a vocation.

Dr. Allen Alper: That sounds like excellent insight and advice for a potential geologist. Just as a curiosity, an hour ago I

interviewed Eric Owens. He mentioned that he had lunch with you today.

Mr. Glenn J. Chair: Yes, we both had chicken.

Dr. Allen Alper: That's great.

http://www.goldenvalleymines.com/

Glenn J. Mullan

Chairman, President, and CEO

Golden Valley Mines Ltd.

152, chemin de la Mine École

Val-d’Or, Québec J9P 7B6

Telephone: 819.824.2808 ext. 204

Email: glenn.mullan@goldenvalleymines.com

|

|