Interview with Rudi P. Fronk Chairman and CEO of Seabridge Gold Inc. (TSX: SEA, NYSE: SA): Increases the Shareholders Leverage on Gold by Increasing Ounces of Gold in the Ground Per Share

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/16/2016

Rudi P. Fronk reveals how Seabridge Gold Inc. (TSX: SEA, NYSE: SA) increases the shareholders leverage on gold by increasing ounces of gold in the

ground per share. They have more gold reserves than Goldcorp, Kinross, or Agnico Eagle, and are top 10 in the world. They are updating their 2012

prefeasibility plan using current metal prices as well showing the economic impact of 2 new deposits they have added since 2012.This year Seabridge also

acquired Snip Gold, which adds a project with high grade potential. Seabridge is a world class operation that provides great leverage to the gold market.

Since their formation in 1999, gold has moved up 370% while Seabridge has moved up 2200%. Anyone who has an interest in gold should take a close look at

Seabridge Gold.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Rudi P. Fronk, Chairman and CEO of Seabridge Gold. Well,

this has been an exciting year for you. What differentiates Seabridge Gold from other companies, what's been going on this year at Seabridge Gold and your

plans going into next year?

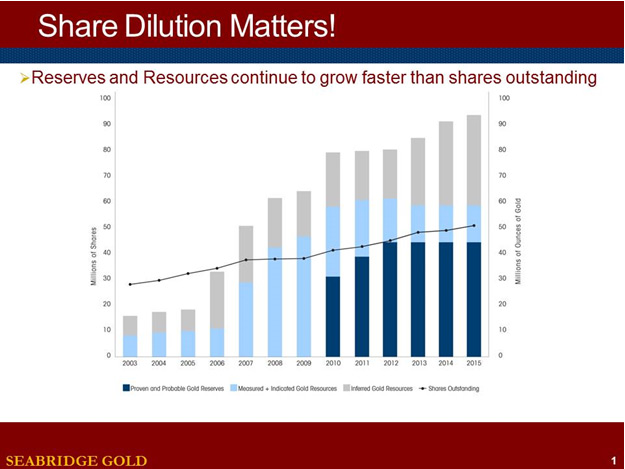

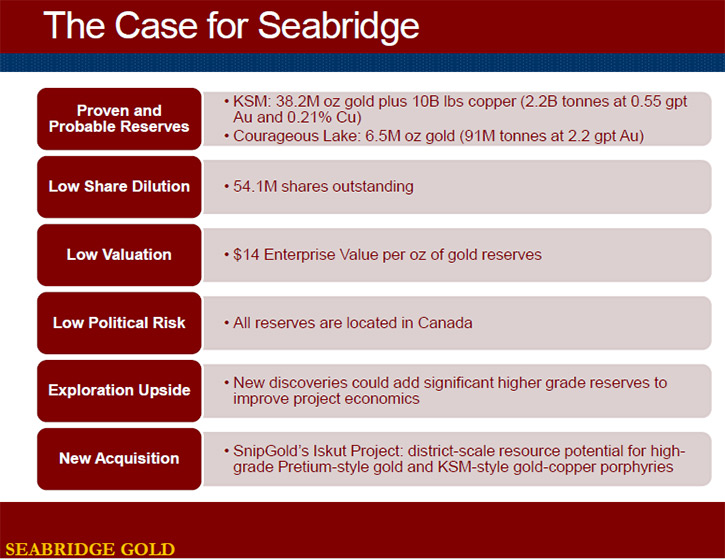

Mr. Rudi P. Fronk: Seabridge Gold has been designed to provide what we think is the best leverage play to a rising gold price. We do that by

continually increasing our ounces of gold in the ground on a per share basis. If you look at most of the industry, our view is that it is actually

destroying their shareholders' leverage to the gold price by issuing a lot of shares and then not offsetting that dilution with accretion to reserves and

resources, accretion to production, or other important value driving metrics. Everything we have done for the past 17 years is designed to improve the

leverage to the gold price by ever increasing ounces of gold per common share.

Dr. Allen Alper: That sounds great! Could you tell our readership something about the extent of your resources and your properties? I know you have

rather large gold resources.

Mr. Rudi P. Fronk: Sure, not only resources, but also large reserves. We actually have one of the largest reserve bases on the planet, top 10 in the

world, more gold reserves than Goldcorp, Kinross, or Agnico Eagle. If you look at our two major projects, KSM, located in British Columbia and Courageous

Lake, located in the Northwest Territories, combined we have 45 million ounces of proven and probable gold reserves and 10 billion pounds of copper.

Dr. Allen Alper: That's fantastic. Could you elaborate on what's been happening this year with Seabridge Gold?

Mr. Rudi P. Fronk: This year is proving to be an interesting year for us. We're now in the process of updating our 2012 pre-feasibility study that

was used as the basis for the Environmental Assessment for the KSM project in British Columbia which was finally approved in 2014. The updated pre-

feasibility study will redefine the project’s reserves and economics based on today’s metal prices, costs and foreign exchange rates. A lot has changed

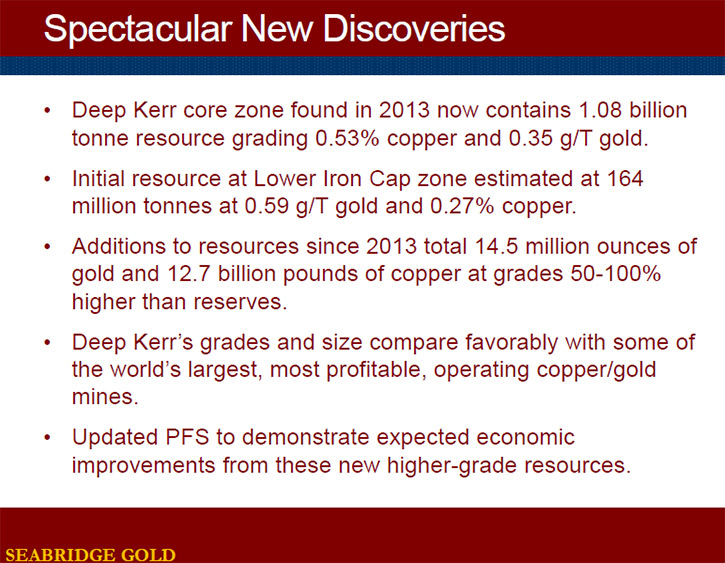

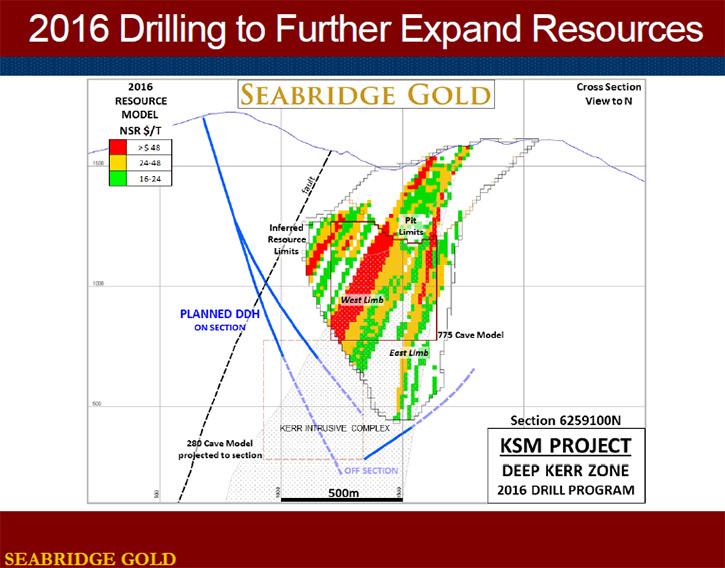

since the 2012 study. We have continued exploration activities at KSM and have added two new zones, the Deep Kerr Zone and the Lower Iron Cap Zone.

Collectively, these two zones have added over a billion tonnes of resources at grades that are at 50% or higher than our existing reserve grades. The

updated pre-feasibility study will also show what the potential benefit would be from integrating these two new deposits into the mine plans and their

impact on the economics of the project. In addition to the study, we have also continued drilling at Deep Kerr and expect further resource additions.

We also took advantage of the downturn in the gold space over the past few years by going out and looking for acquisition opportunities that would be both

accretive and meaningful, essentially replicating the early years in Seabridge when we took advantage of the down gold market from 1999-2002 and acquired

KSM and Courageous Lake.

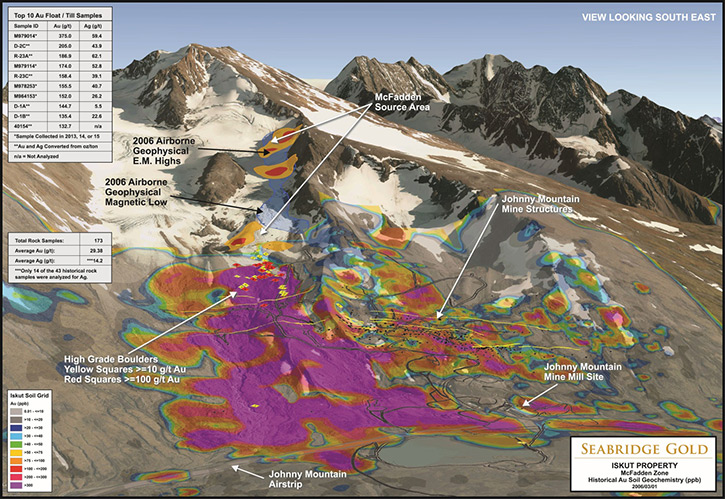

In June, we completed the acquisition of SnipGold. SnipGold gives us a new big project named Iskut that is also

located in British Columbia only 30 kilometers from KSM. At Iskut we see a large porphyry system that likely not only has the large bulk minable deposits

like we have at KSM but also high-grade epithermal potential like Pretium, our neighbor at KSM, has at their Valley of the Kings project. At Iskut there

are two former mines that produced over one million ounces of gold at grades of almost one ounce per tonne.

Dr. Allen Alper: That's great that you've expanded your resource base and also acquired another company in British Columbia. That sounds very good.

Mr. Rudi P. Fronk: The other benefit of the acquisition is following our discipline on ounces of gold per common share. To acquire SnipGold, we

issued about 700,000 shares of Seabridge, and for that we got a measured and indicated resource of 2.2 million ounces of gold at their Bronson Slope

project, so just on the front end alone, we added over 3 ounces of gold per common share based on the shares we issued, but it doesn't stop there. We

believe that the exploration potential at Iskut is phenomenal, and we'll start to demonstrate that over the next couple of seasons as we implement larger

programs.

Dr. Allen Alper: That sounds like great potential, and sounds like an excellent plan. Could you tell our readers a little bit about your background

and your team and your board?

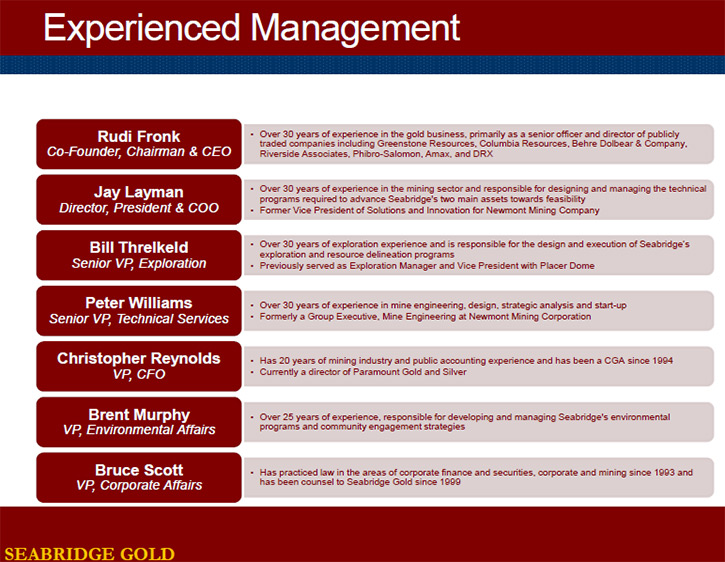

Mr. Rudi P. Fronk: Happy to do so. I've been in the business for some 30 years now. I am a mining engineer educated at Columbia University. I’ve

built mines in third world countries, and I've had mines expropriated in third world countries. I learned over my career that political risk is real,

which is why we have been focusing exclusively on North America. Along with myself comes a very seasoned management team. We have former executives from

both Newmont and Placer Dome as part of our senior management team. Jay Layman is our President. Jay spent 15 years at Newmont, with his last role

managing all of their technical services. Peter Williams joined us about two years ago. Peter spent over 30 years at Newmont with his last role running

their global mining engineering practice. Bill Threlkeld has been shepherding our exploration for the past 17 years. Prior to that he was in charge of

exploration for Placer Dome in Latin America.

Brent Murphy has been coordinating our permitting and environmental activities. Prior to that, he spent time with BHP, managing their Canadian

environmental practice. Chris Reynolds, our CFO, has over 20 years of financial experience in the mining sector for both operating and development

companies. Our board also comes with a number of seasoned veterans. We have Scott Barr, who was a senior technical expert at Newmont, and prior to that at

Freeport. We have Fred Banfield, who's recognized as one of the best deposit modelers and mine planners in the business. Eliseo Gonzalez-Urien ran global

exploration for Placer Dome for over 10 years. Richard Kraus was the CEO of Echo Bay Mines. John Sabine is one of the top legal M&A experts in the mining

space in Canada. And finally, the most recent addition to our board is Gary Sugar, who spent 32 years as a banker at RBC in Canada, and also is a former

director of Osisko Mining and Romarco Minerals. It is a very seasoned team that covers all the bases.

Dr. Allen Alper: Well, you definitely have a great background. You have a very strong team and an excellent board. That's very good.

Mr. Rudi P. Fronk: I think you'd be hard pressed to find a company in our space that has as seasoned a team as we do, both in terms of senior

management and a board.

Dr. Allen Alper: That's excellent. Could you tell me a little bit about your balance sheet, your share structure, your capital structure?

Mr. Rudi P. Fronk: We have 54 million shares outstanding and about 57 million shares fully diluted. As of now we have about $25 million of working

capital and no debt. We'll exit this year with a strong cash position of over $10 million. We fund ourselves year by year. Until we get the results of

this year's programs, we don't know how we want to spend dollars next year. We need to look at the results of this year’s programs to come up with

programs that will add value next year, both in terms of accretion of ounces, adding value and de-risking our assets. We don’t load up the treasury and

dilute our shares just because we can.

We've been fortunate that over the past 17 years, in down markets and up markets, we've always been able to

raise the dollars required to fund our programs. I believe the discipline that we've shown over the years of minimizing equity dilution, and making sure

that whatever equity dilution we suffer is more than offset by accretion to ounces, has resulted in our ability to fund our opportunities as they arise.

Dr. Allen Alper: That is excellent. That is really fantastic. I know so many mining companies, junior mining companies that diluted their shares

and the value.

Mr. Rudi P. Fronk: It's not just the juniors. If you look at the ten year period from 2005 to 2014, when the price of gold essentially went from $400

an ounce to a high of $1900, and now settled back here at about $1300, the 10 largest gold companies that make up the XAU more than doubled their shares

outstanding, and during that time they also increased their debt by over 40-fold. During that time, production only went up slightly. If you actually look

at it, every per share metric of the major companies, whether it be reserves per share, production per share, or other metrics, has been cut in half

because of the dilution they suffered. It's not just the junior space, it's also the seniors that have been carpet bombing the market with their paper.

Dr. Allen Alper: Well, I think that was a great accomplishment on your part and your team not to suffer that problem. That's really great. What are

the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Rudi P. Fronk: Well, I think track record's important. I think investors that invest in gold stocks expect the value of those stocks to go up

faster than the gold price. That's where the leverage comes from, but if you look historically over the past 17 years, the senior companies actually have

under-performed the gold price. Since we started Seabridge in 1999 through to the present, gold is up about 370%, our shares are up about 2200%, whereas

Newmont, Barrick, and the HUI have under-performed the price of gold. Then if you look more specifically at those periods of time when the gold price was

very strong, like from 2004 to the beginning of 2008, our share price went from single digits to the high 30s.

Then again, we had that same magnitude of move coming out of the financial crisis in 2008, from single digits again to the high 30s again by 2011.

I think when you look at where to invest your dollars, if you believe the price is gold is going higher, or if you want some portfolio insurance using

gold, Seabridge has always delivered on its promise to leverage the gold price in terms of out-performing gold and other gold stocks in a rising gold

market. We believe we are now in the early stages of another bull market in gold and our shares once again are doing what they are designed to do, provide

leverage to a rising gold price. Our shares have already tripled from last year’s bottom, but still have a long way to go get back to previous highs. And

remember, the last two times we reached the high $30s per share, we did not have any reserves nor did we have an approved project like we now have at KSM.

Dr. Allen Alper: That sounds excellent. Could you tell me what are your thoughts and what are the experts' thoughts on what might be happening with

gold going forward?

Mr. Rudi P. Fronk: Well, we remain extremely bullish on gold going forward. We actually write quite a bit about gold on our website. If you go to our

website and pull down the investor tab and click on "The Case for Gold," you'll see very regular commentary on the gold market. Our view is that in the

current environment, based on flawed policies of central banks around the world including quantitative easing and more recently with negative interest

rates, the stage has been set for higher gold prices. The trigger will be when investors finally come to the realization that central banks don’t have a

clue what they are doing.

That doesn't even speak to the amount of credit that's been created, unproductive credit over the past many years, that has not created any

meaningful economic growth. Gold is the only form of money that has lasted the test of time. We believe that if you want to preserve wealth, that you need

to have a portion of your net worth tied up in the only currency that can't be manipulated by a central bank, and that's gold.

Dr. Allen Alper: Well, that sounds like an excellent analysis. You and Seabridge Gold are to be commended.

http://seabridgegold.net/

106 Front Street East

Suite 400

Toronto, Ontario M5A 1E1

Canada

Tel: 416.367.9292

Fax: 416.367.2711

info@seabridgegold.net

|

|