Many mining companies come and go, starting then failing then merging then morphing. Investors in this sector expect rapid flame-ups and flame-outs, and there can be a lot of money made there. However, some companies in the industry remain consistent players, even if they don't make headlines every day.

One of those companies is Agnico-Eagle Mines Ltd. (TSX: AEM). Agnico-Eagle started informally in 1952 when 5 silver mines consolidated. Five years later, they officially became Agnico. Agnico operated consistently out of northern Quebec and, in 1972, merged with Eagle Mines Ltd. Then things remained quiet. Agnico continued to produce out of northern Quebec. Over the years, Agnico-Eagle bought and sold mines quietly, producing consistent results, and starting a dividend payout in 1982 that has continued to this day.

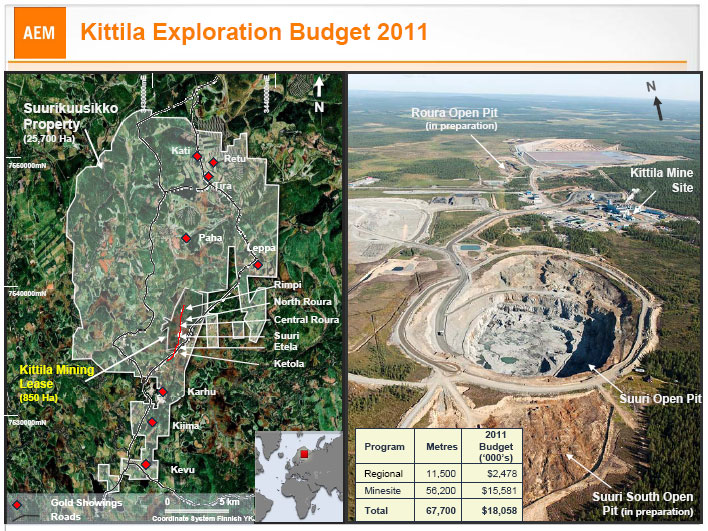

But things changed for Agnico-Eagle in 2000. They started to move forward aggressively with a renewed vigor. In 2005, they acquired the Suurikuusikko gold deposit in Finland. In 2006, they acquired the Pinos Altos project in Mexico. In 2007, they acquired the Meadowbank gold project. In 2008, they began production at the Goldex mine in north-western Quebec. In 2009, they began gold production in Kittila (Finland), Lapa (Canada) and Pinos Altos (Mexico) mines. In 2010, they began gold productions at the Meadowbank mine in northern Canada.

This tipping point is the result of many factors coming together, not the least of which is Eberhard "Ebe" Scherkus, President and COO of Agnico-Eagle Mines Ltd. We spoke to Mr. Scherkus at AME Mineral Round-UP. We wanted to get a picture of his work with the company and his influence on the company's impressive growth in the past 5 years.

He started by telling us about his background in the industry, which started even earlier than for most: "I got into mining because of my dad," Mr. Scherkus said. "My dad was a landed immigrant and he landed in the mining town of Val d'Or in Northwest Quebec in 1952. I was only five months old. I grew up in the remote mining community. My dad would always take me to the mine whenever he was on-call. So it sort-of got ingrained in me by osmosis. After that, I went to university and studied mining then started working in various mines

in northwestern Quebec and northwestern Ontario. This opportunity arose with Agnico-Eagle over 25 years ago. I have been with the company in various functions as a project manager, mine manager, VP of operations, and currently president and COO. So it's been a long history of over 25 years." He became president and COO in 2005, just around the time of Agnico-Eagle's tipping point.

There's no secret to how Agnico-Eagle made such aggressive strides forward. The first reason is their constant search for the right project: "We never stop evaluating projects. At this conference, we have [many senior leaders in the company] who are looking at opportunities. We have numerous meetings set up," said Mr. Scherkus.

The second reason for their success is an awareness of their strengths and weaknesses. Mr. Scherkus told us exactly what made Agnico-Eagle the company it is today: First, their early-stage exploration acquisitions. "We like to use our skillset of finding and evaluating properties very early on in the exploration cycle. We like politically secure areas and areas around existing mines or existing mines. We won't go into areas where we are not welcome. We have acquired properties and projects and initial resources or indications of gold mineralization. We've been able to recognize it early on, use our skill set and then drill it off very aggressively. That's the type of situation we look at. We will never spend more than 10% to 12% of our market cap on an acquisition. We don't believe in betting the farm and buying existing or operating mines. They are difficult targets to merge. There are not many turnaround situations out there. So we look at early-stage projects."

Their other strength is strategic investments in drilling in order to extend existing mines. Mr. Scherkus said: "The key is to keep exploring, keep drilling. We have over 35 drills working in the company and that has been the key to our success: Spend the money in the ground and you never know when lightning will strike."

Then Mr. Scherkus gave a couple of examples: "The Kittila mine in northern Finland is a good example. When we first looked at it almost 8 and a half years ago, it had a resource of 1.6 million ounces and now the resource reserve is almost 8 million ounces." And later he added, "We are very active explorers and when we started Laronde, we said we had a mine life of 10 years… and that was 15 years ago."

The result of this aggressive growth has had a positive impact on the company: "We've just built five new mines over the past five years so the company has been transformed completely. We are a much larger company, and as a result, we now have a significantly larger exploration budget, we have internal expansion projects, and also we have opportunities we can look at. And there are definite opportunities we can look at."

More specifically, they are enjoying lower costs and increasing opportunities, as Mr. Scherkus explained: "We are doing very well. Our costs are in the mid-$400's, so even at current prices of about $1330 per ounce, it's a very healthy profit margin. And, our mines are built so our capital demands are quite limited. We have a very aggressive exploration project. We are evaluating internal expansion opportunities."

Next, we asked him about some of the current projects that Agnico-Eagle was working on. He said, "Our most exciting project right now is the Meliadine project in Nunavut, just outside of Rankin Inlet. We will be completing the feasibility study there, within two years, we hope to get it permitted within 2 ½ years, and then start mine construction. That's an exciting development. We're also looking at expanding our Kittila mine by 50% in northern Finland. We expect to have that study completed by September of this year. Then on the exploration front, we're getting some pretty exciting gold values at depth in our Goldex project in north-western Quebec; that could significantly increase the life-of-mine of that project. Its current mine life is 8 years so that's another significant development on our plate."

Agnico-Eagle may have once been a quiet and consistent player in the industry, but today it has an impressive five-year track record that builds upon the consistent wins of the past, and the company's projections for the future are just as exciting: "When you look at our track record of delivering mines, what we have done, how we have transformed, how we have transformed our growth profile over the last four years, it has been incredible. We see another 40% - 50% growth in our production profile in the next 3 to 4 years, so there will be continued growth. Also, we have increased our dividend significantly over the past quarter so we are one of the few companies that have consistently paid dividends for the past 28 years. Look for increasing dividends and increasing growth going forward.

So, what lesson does Mr. Scherkus take away from the past five years of busy growth? He summarized: "I think our next acquisition will be exciting. We're getting close. After building 5 mines, there's almost a down-period where we're potentially only building one. We're starting to warm things up again but you'll never see us go into a frenzy to build 5 mines at once."

That's a smart move. Now that Agnico-Eagle has an exciting base of good projects to build on, they can strategically move forward and continue to be a consistent industry player.

REFERENCES

Agnico-Eagle: http://www.agnico-eagle.com/

Cambridge House's Vancouver Resource Investment Conference: http://cambridgehouse.com/conference-details/vancouver-resource-investment-conference-2011/15