Vulcan Energy Resources (ASX: VUL): Extracting Geothermal lithium Brine, Upper Rhine Valley, Germany, from One of the Largest Resources in the World; Vincent Ledoux Pedailles, VP of Bus. Dev. Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/21/2021

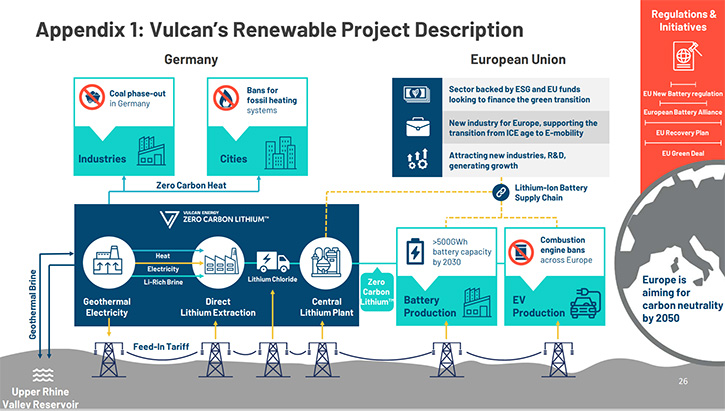

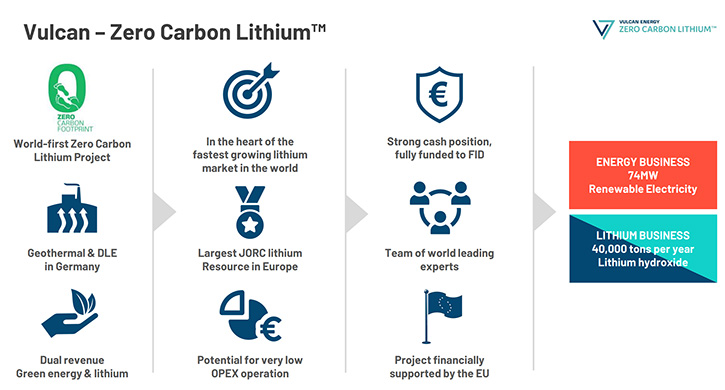

We spoke with Vincent Ledoux Pedailles, who is VP of Business Development for Vulcan Energy Zero Carbon Lithium. Vulcan Energy Resources (ASX: VUL) aims to decarbonize the transition to EVs, via world-first, Zero Carbon Lithium business, with Direct Lithium Extraction (DLE) tech & geothermal energy. Vulcan Energy is extracting geothermal brine, from the Upper Rhine Valley in Germany, producing renewable energy and at the same time, sustainably extracting lithium from one of the largest resources in the world. There is no current lithium production in Europe and more than 80% of lithium chemicals are coming from China. Vulcan Energy will address Europe's needs for both local and sustainably produced lithium.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Vincent Ledoux Pedailles, who is VP of Business Development for Vulcan Energy Zero Carbon Lithium. Vincent, could you give our readers/investors an overview of your Company, what differentiates it from others and update us on what’s happening with your lithium project?

Vincent Ledoux Pedailles:Vulcan Energy is a Company aiming to become the first zero carbon lithium producer in the world. We are extracting geothermal brine from the Rhine Valley in Germany, allowing us to produce both renewable energy on one site and also, to extract lithium, sustainably, from the largest resource in Europe and actually one of the largest in the world. We are looking at supplying the European battery and car makers, which today represents the fastest growing market for lithium in the world.

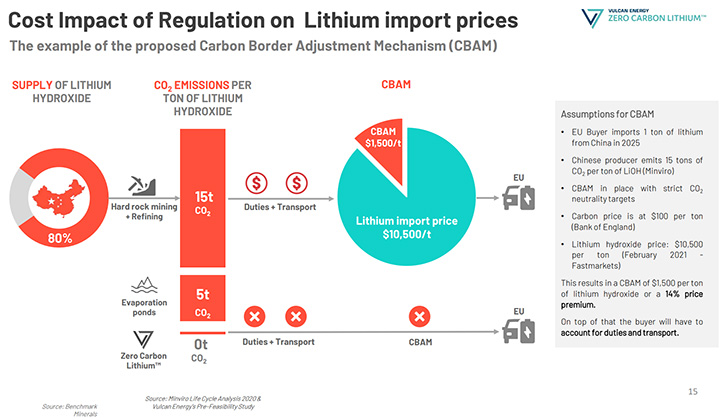

There is currently no lithium production in Europe. More than 80% of lithium chemicals are coming from China, which is an environmental risk as they emit more than 15 tons of CO2 per ton of lithium chemical, produced in China. The alternative to that is to be producing lithium from South America, where you are going to be consuming a lot of water, in one of the driest places on Earth. Our projects will address Europe's needs for both local and systemically produced lithium.

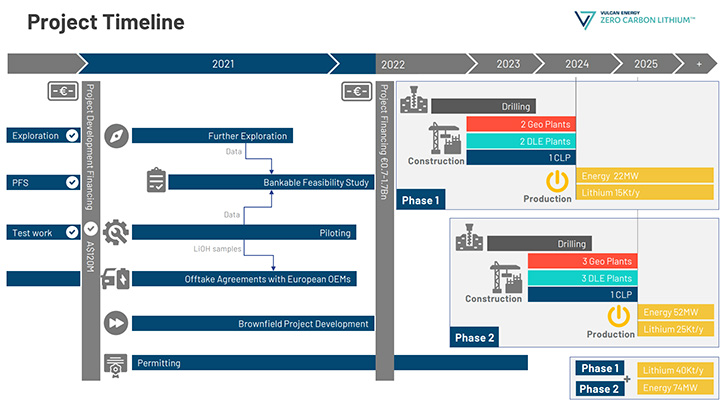

The Company has been trading since late 2019. One of the biggest steps for our Company was earlier this year, when we published our PFS. On the back of this PFS we raised around A$120 million to finance the project developments. Since then, we’ve done a number of things, we’ve started up our pilot plant in Germany, which is currently producing some samples we can send out to off takers. We also started the construction of a demonstration plant, which will be ready by the end of the year. The goal for us is to start production of lithium and energy by mid-2024 and then ramp up towards 40,000 tons per year by 2025, 2026. That's just a high-level summary of the company.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers a little bit about the process and the quality you're achieving and your plans going forward?

Vincent Ledoux Pedailles:

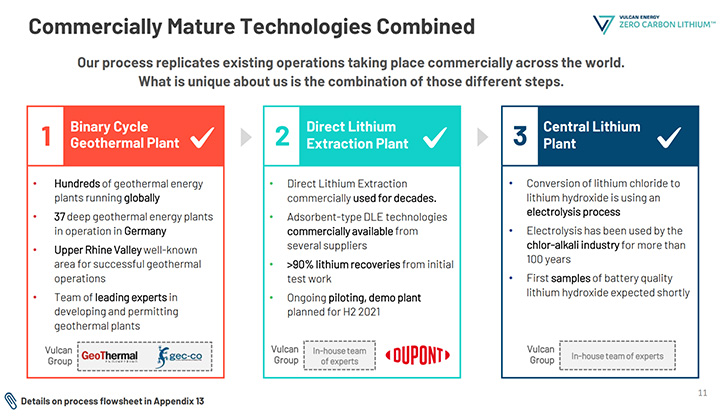

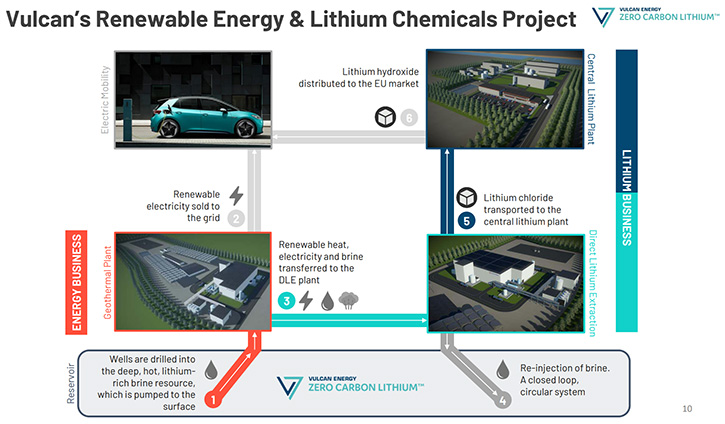

Typically, lithium is produced from either extracting a hard rock from a pit mine in Australia and then it converts into lithium chemicals in China or is produced using brine from South America. And mostly using evaporation plants to concentrate the solution and then convert it chemically into either lithium carbonate or further lithium hydroxide. We are using a hard geothermal brine to produce this lithium, which means that we extract this hot geothermal brine from the underground reservoir in the Upper Rhine Valley.

The hot geothermal brine allows us to first produce energy. We use the steam to power turbines and produce electricity. And this energy is also going to drive our direct lithium extraction process. Direct Lithium Extraction or DLE, is not the most conventional way of producing lithium today. However, it allows you to produce lithium much faster and also at better purity, but it's not widely used in South America for brine operation because it's energy intensive. It does require a lot of energy, which when you are located remotely in Chile or Argentina is not easy to access. We are producing a lot of energy and if you look at our entire process, we will always be a net supplier of renewable energy to the grid.

The extraction process works. You'll receive the brine from the geothermal plants and the brine goes through a number of pipes and columns. Inside those columns you'll have a resin, and the resin is basically going to physically separate the lithium from the brine and leave the other impurities and the water behind. The impurities and the water are then reinjected into the ground in a closed loop operation. So, the only thing we extract from this brine is the lithium, which is actually a lithium chloride, that needs to be converted further into lithium hydroxide so that you can then sell to the markets.

The main difference with DLE, compared to a typical brine extraction process, in South America, is that it's much faster. We’re talking about the production process, which only takes hours and it's also a process, which doesn't leave a lot of footprints. Actually, the DLE processing plants are very small. We don't need to build very large evaporation systems. It also allows you to extract much more lithium from the ground and from the brine. In Argentina or in Chile, when you extract lithium from using evaporation ponds, you only maybe extract 40% to 60% of this lithium from brine. We've achieved already more than 90% recovery from the brine, using the direct lithium extraction process.

Dr. Allen Alper:

Could you tell us a little bit more about the energy source and a little bit more about why this process is zero carbon?

Vincent Ledoux Pedailles:

We are producing energy in the form of both electricity and heat from geothermal plants. We are looking at not just developing one geothermal plant, but actually several geothermal plants across our licenses. We've secured more than 1,000 square kilometers of licenses across the Upper Rhine Valley, which means that we have access to a majority of this reservoir, which is full of geothermal brine and lithium. The plan for us is actually to build five different geothermal plants, across those licenses. and a geothermal plant will have a capacity of around 16 to 17 megawatts.

This electricity that we are going to be producing has a big advantage in Germany, because in Germany, when you produce electricity from a geothermal plant, you have a feed-in tariff in place. Which means that you are guaranteed by the states to be allowed to sell the electricity at €25 cents per kilowatt hour for 20 years. So basically, your revenue generation on the geothermal part and on the energy part is fully de-risked.

We're not producing electricity at full capacity, because parts of the energy we extract from the ground is going to be used in the form of steam to power the direct lithium extraction process. Potentially, we could be producing more electricity, but part of the heat is actually diverted towards the direct lithium extraction process to power the lithium chloride separation from the brine. But overall, if you look at the different operations, we will be able to produce around 75 megawatts of zero carbon electricity.

What's important to consider, is that there's a lot of development in Europe around renewable energy, but most of it is solar and wind. But, companies and municipalities also want access to baseload power. And this is something you are able to offer from a geothermal plant. From a geothermal plant you're also able to offer renewable heat, which is at the moment mostly supplied by coal energy in Germany. The coal is being replaced slowly, but surely. What we are doing with geothermal energy, in the form of heat, of electricity is we displace coal energy from the grid.

Dr. Allen Alper:

Excellent, could you tell our readers/investors a little bit about the timing of developing a project and moving it into production?

Vincent Ledoux Pedailles:

At the moment we are operating our pilot plant 24/7. We are shipping our first samples to off-takers, within the next month or so. At the same time, we are currently building our demonstration plant, a larger version of our pilot plant, which will allow us, by the end of the year or early next year, to produce several tons per month of lithium hydroxide, to be sent to our selected off takers.

The goal for us is to be running this demonstration plant and it is going to be supplying data that will inform our DFS. We are planning on publishing our DFS by the middle of next year. Once we submit our DFS, the middle of next year, we will organize our project financing for phase one, and potentially for phase one and phase two at the same time. The goal for us is to start drilling for geothermal wells towards the end of 2022. Construction will follow and we are aiming on starting a commercial operation, from phase one, in mid-2024 and commercial production from phase two, a year later in mid-2025.

Dr. Allen Alper:

That sounds excellent. That sounds like the timing fits very well with the development of electric vehicles and the production of batteries.

Vincent Ledoux Pedailles:

Absolutely. We are talking to pretty much every single player across the European supply, cathode makers, battery makers and OEM, and we really see that 2023, 2024 and 2025 is really the inflection point for lithium demand in Europe. Battery capacity is starting already now, and we'll keep adding capacity, during the next few years.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors little bit about the resource, etc?

Vincent Ledoux Pedailles:

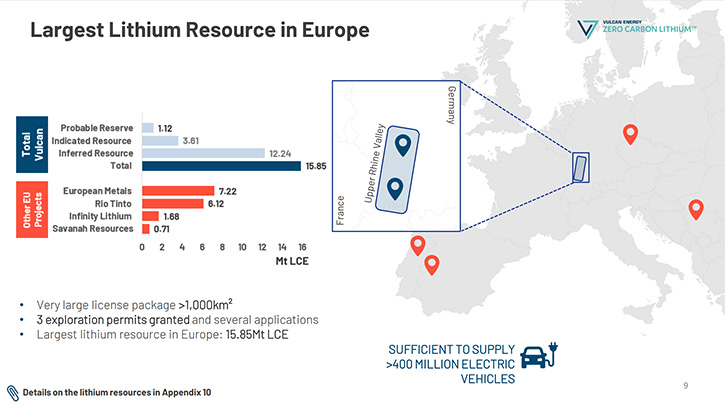

The resource we have defined so far is only out of two of eight different licenses. So out of the two licenses we currently have, we've identified a resource of 15.85 million tons of lithium carbonate equivalent. This is enough to power more than 400 million electric vehicles. It's a very large resource, largest in Europe, one of the largest in the world. We've also identified roughly 1.2 million tons of reserves; this is obviously going to increase. The reserves define production targets of around 40,000 tons of lithium Hydroxide, per year, for 30 years.

This is only using 1/15th of the resource we've identified in the ground. The resource has the potential to grow because we have additional licenses, and the reserves also have the potential to go further. For us, if we want to grow, we just need to build more geothermal plants, produce more energy and adjust the geothermal plants, and build additional direct lithium extraction plants. We will be able to ramp that capacity further, because we know that the demand in Europe is going to be very strong. Obviously, we need to start somewhere, but if we need to make it bigger, there's enough in the ground to make it happen.

Dr. Allen Alper:

That sounds excellent. Vincent, could you tell our readers/investors a little bit about yourself, the Team and the Board?

Vincent Ledoux Pedailles:

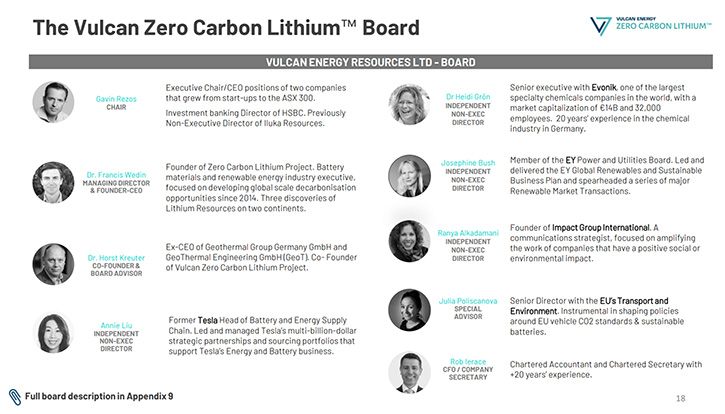

I've been in and out of the lithium industry for around 10 years. My first job was working for a company called Talison Lithium in Australia, which still today, is operating the largest lithium mine in the world. I've been working for a number of consulting companies, mostly in chemicals and battery metals. I also worked as a lithium expert, for the European Commission, and I used to work for another lithium project in Europe based in Spain. I’m now in charge of Business Development at Vulcan, mostly dealing with long-term supply agreements and OEMs.

The Company was co-founded by Dr Francis Wedin, who has a background in lithium. He was involved in the discovery of Pilbara, which is now a large spodumene producer in Australia, exporting to China. And co-founded, as well, by Dr. Horst Kreuter, who has a background in the geothermal industry and is considered the leading geothermal expert in Germany, with more than 30 years of experience.

Our Chairman is Gavin Rezos, who is an ex-investment banker and lawyer, with a number of Board positions, including at Iluka. And we've appointed a number of non-executive Directors during the year, including Annie Liu, who works very closely with me, who was in charge of the battery supply chain at Tesla, for a number of years. And also including Dr Heidi Grön, who is a Senior Executive at Evonik, one of the largest chemical producers of that in Germany.

That's the Team on the product development side. We acquired two geothermal engineering companies earlier this year, which is adding 60 employees to the team, strictly focusing on the energy side. And we are also growing the team on the lithium side. We also have a collaboration agreement, with Dupont looking specifically at our direct lithium extraction technology.

Dr. Allen Alper:

You and the Team have extremely great experience and great backgrounds, so that's excellent. Could you tell us a little bit about your share and capital structure?

Vincent Ledoux Pedailles:

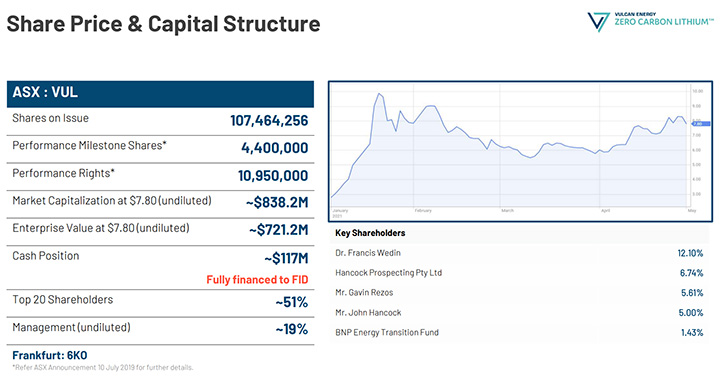

Currently we are listed on the ASX. We' have a market cap around $800 million Australian. We have a cash position roughly of $117 million. All top 20 investors account for roughly 51% and Management accounts for slightly less than 20%. Some of our key shareholders includes Hancock Prospecting, which is led by Gina Rinehart, the richest person in Australia. She has a background, in mining, coal, iron ore, etc. And one of our largest shareholders is the BNP Energy Transition Funds. Both players came in when we organized the capital raise, back in January this year. And we are listed on the stock exchange in Australia, however, our project is in Europe, in Germany, our teams are mostly located in Germany, as well. Eventually we will move closer to Europe. In time it will become a fully European Company.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Vulcan Energy?

Vincent Ledoux Pedailles:Vulcan is perfectly in line with what automakers and battery makers are currently looking for, which is a green, sustainable and local way of producing lithium in Europe, where we currently are not producing any lithium. We are also perfectly in line with what the European regulation is currently looking at implementing, which is to fully integrate the lithium hydroxide supply chain in Europe. Making it from extracting raw materials to producing electric vehicles, 100% European, and also making the supply chain greener.

We are well funded and we have a Team of experts, both on the geothermal side and on the energy side, who have done this before and we'll do it again, even bigger, with Vulcan Energy. We also work very closely with a number of automakers and battery makers and hopefully will be able to be in a position to announce collaboration agreements in the very short term.

Dr. Allen Alper:

Those sound like very compelling reasons for our readers/investors to consider investing in Vulcan Energy. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://v-er.eu/

Level 11, Brookfield Place

125 St Georges Terrace

Perth WA 6000

ABN: 38 624 223 132

+61 8 6189 8767

info@v-er.eu

|

|