Cobre Limited (ASX: CBE): Well-Funded, Exploring Highly Prospective Copper Projects in Botswana and Western Australia; Martin Holland, Executive Chairman and Managing Director Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/19/2021

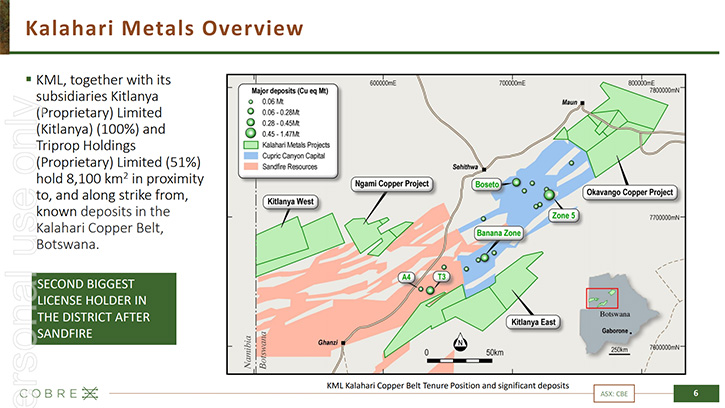

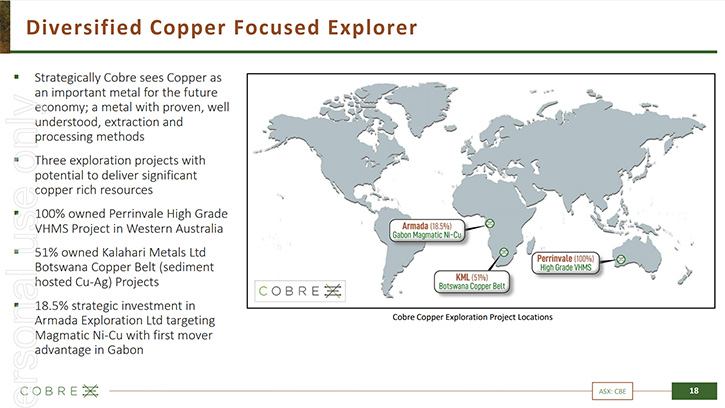

We spoke with Martin Holland, who is the Executive Chairman and Managing Director of Cobre Limited (ASX: CBE), a copper exploration growth Company with prospective projects in Botswana and Western Australia. Cobre Limited owns 51% of Kalahari Metals Limited (KML), a private UK Company that controls approximately 8,100 km2 of tenements, within the very prospective Kalahari Copper Belt (KCB) in Botswana. In Western Australia, Cobre has discovered an extremely rare VHMS deposit, enriched in high-grade copper, gold, silver, and zinc within its Perrinvale Project area, in the Panhandle Greenstone Belt.

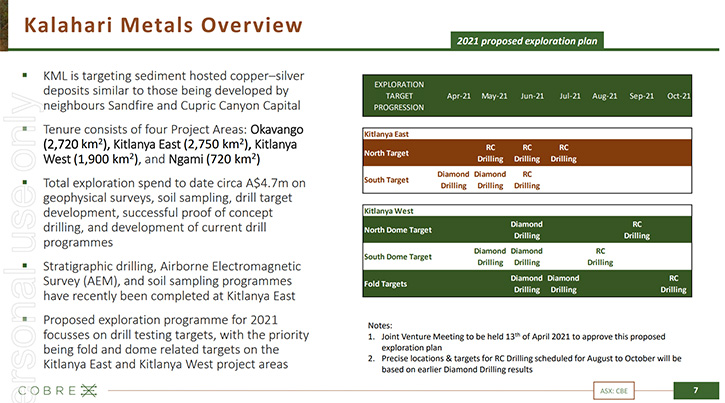

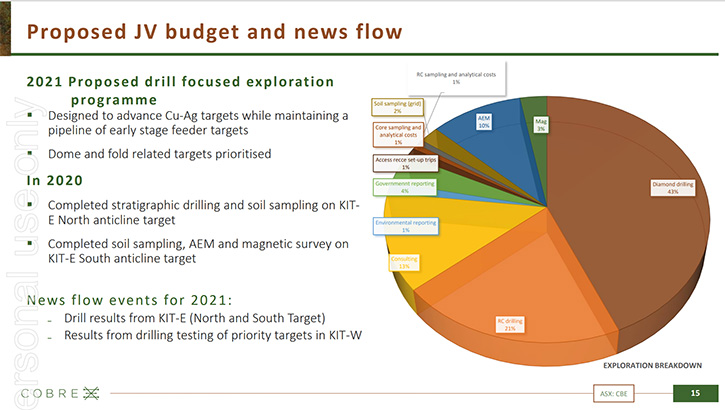

In addition, Cobre has recently commenced a 7,000-meter drilling campaign, in Botswana, in the areas adjacent to the Sandfire Resources' copper-silver deposit. With $10 million in the bank, the Company is well-funded for work for the rest of the year.

Cobre Limited

Dr. Allen Alper:

This is Dr. Allen Alpert, Editor-in-Chief of Metals News, talking with Martin Holland, who is Executive Chairman and Managing Director of Cobre, Limited. Martin, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

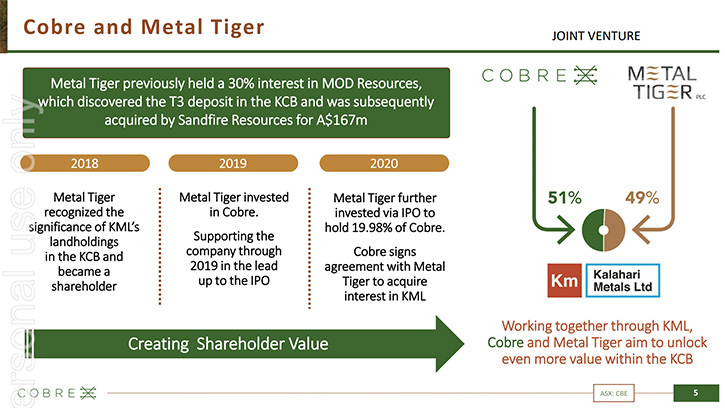

Martin Holland:Cobre is a commodity Copper-focused exploration Company that is geographically diversified across a number of mining friendly jurisdictions. We have Cu exposure in Western Australia with a VHMS discovery that the Company found in 2019, and more recently an acquisition in Botswana via a joint venture with Metal Tiger (51% Cobre and 49% Metal Tiger). The JV owns around 8,000 square kilometers of the Kalahari, Copperbelt in Botswana which makes us the 2nd largest holder in the belt.

The Kalahari Copperbelt is regarded as the most prolific, up and coming Copperbelt globally, as rated by the US Geological Survey. It's the number one in the world to explore for new sedimentary copper deposits and copper right now. The balance of the belt is owned by Sandfire Resources (ASX: SFR), which is also listed. They are in a strong position and permitted to start up a new mining operation on the belt.

We are currently drilling there at the moment. The JV has just commenced a 7,000-meter drilling campaign. A combination of both RC and diamond drilling is currently being undertaken with the aim of unlocking a new discovery on the belt. The areas that we're drilling are adjacent to recent discoveries that are now turning into mines by Sandfire.

Dr. Allen Alper:

Well, it sounds like you are in the right district to potentially find a large copper deposit, when copper looks like it's going to be in short supply, as electrification takes place.

Martin Holland:

It's also a district scale opportunity, so it provides the maximum base to the upside on copper. What we have here, is a large district scale opportunity from an exploration perspective. Any unlocking of a new discovery in that area will set us apart from many other juniors just based on the scale size of it and also location jurisdiction.

Dr. Allen Alper:

That’s excellent. Could you tell our readers/investors your primary plans for 2021, 2022?

Martin Holland:

Yes, 2021 is mainly focused on copper exploration in Botswana, in the Kalahari, Copperbelt.. The Company is well funded, we have $10 million in the bank at the moment. Our joint venture partner, Metal Tiger, is also contributing to our ongoing expenditure from an exploration perspective. We have the capital available to explore the area so there will be a lot of exploration that will happen, testing all the targets that were structurally designed over the last couple of years. There’s quite a lot of news flow expected to be generated from this current drilling program and throughout the remainder of 2021.

In parallel with exploration in Botswana, we’ve completed groundwork in Western Australia, on our VHMS discovery that we found in 2019. Those results came in at 5m at 9% Cu, a good gold grade around 3 g/t with silver and zinc as well. A true VHMS discovery. Now we're on the hunt in that area to find another VHMS Pod in the area, so there's going to be a lot more groundwork to define targets in Western Australia. VHMS tend to cluster so we are excited about further exploration in this region.

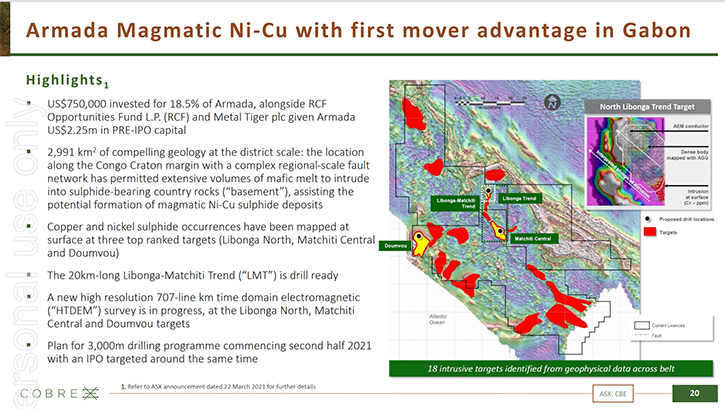

In parallel with that, we've made an active investment in a private Company, called Armada Metals, of which Cobre owns 18.5%. We have invested in Armada, alongside RCF, and also Metal Tiger, and we're taking that company to a listing on the ASX later 2021. Armada represents another district scale opportunity focused on magmatic nickel and copper exploration in Gabon. Armada is being run by Ross McGowan, who was one of the members, receiving the award for the discovery of Komoa that Ivanhoe now runs. So that's the rundown on what's happening for CBE throughout 2021.

Dr. Allen Alper:

Well, that sounds excellent. Can you tell our readers/investors a little bit about your background, your Team and your Board?

Martin Holland:

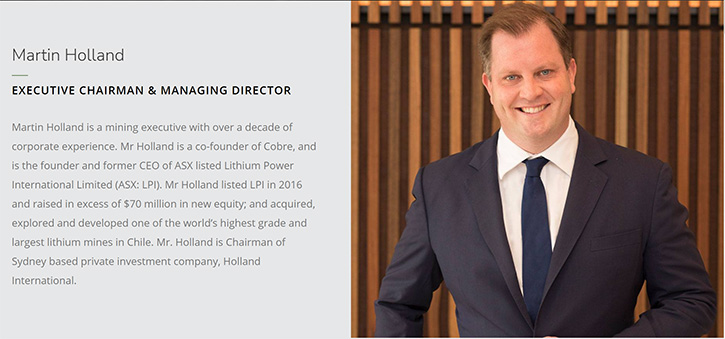

Yes, I've been involved in the junior end of mining and exploration for over 12 years now, and I’ve listed four junior resources companies on the Australian Stock Exchange. More recently, I'm an Executive Chairman and Managing Director of Cobre, and Executive Director of OzAurum Resources (ASX: OZM), which is a gold explorer in Kalgoorlie. Before that, I founded and was the CEO of Lithium Power International (ASX: LPI), where I raised $70 million dollars of new equity for the Company- taking it from an exploration story through the DSF and environmental permitting. I have a finance background, focused on M&A and corporate activity that focuses on the resource sector.

Dr. Allen Alper:

That’s an excellent background. Could you tell us a little bit more about your other Team Members?

Martin Holland:

We have Andrew Sissian, who is Co-Founder of Cobre. He has a banking background and is the Finance Director of Cobre. We have Michael McNeilly, who is the CEO of Metal Tiger, which is Cobre’s largest shareholder, with over 20% of Cobre and then invested millions of dollars into Cobre today. He sits on the on the Board of Cobre as a non-executive Director. Michael Addison is the Founder of Genex, which has just closed out a billion-dollar infrastructure development, on a pump storage facility in Queensland. Michael also has a background in banking and that's the Board as a whole.

Dr. Allen Alper:

Well, you and your Board Teammates have a great background of accomplishment, so that's excellent. Could you tell our readers/ investors a little bit about your shared capital structure?

Martin Holland:

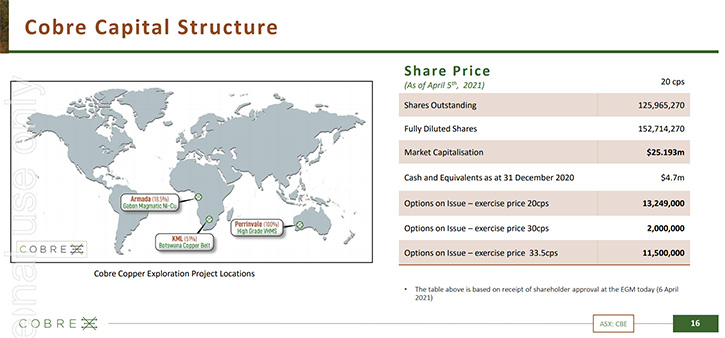

We’re sitting, at the moment, with about 160 million shares on issue and with a market cap of around $25 million AUD, with around $10 million in the bank.

Dr. Allen Alper:

Sounds like you're in good shape to carry out exploration, so that's excellent! Are there any key shareholders?

Martin Holland:

Yes. Key shareholders are Metal Tiger, whom own 21%, which is a natural resource fund dual listed on the AIM and ASX. They were involved in the Kalahari Copperbelt, for many years, through a Company called MOD Resources, of which, they owned around 30%. Then Sandfire bought out MOD Resources, for ~$170 million. They're now one of the largest shareholders of Sandfire.. And myself, I own a substantial percentage of the Company it's around 7%. Underneath that, we have a lot of institutional and sophisticated investors, on our share registry, and known mining investors and individuals in the market.

Dr. Allen Alper:

Well, that sounds excellent. Good to see that your interests are aligned with shareholders and that you have skin in the game. So that's excellent!

Martin Holland:

I have a lot of passion and focus on this Company, and I'm looking at building quite a large copper exploration focused company with assets around the world, and to give our shareholders the highest beta exposure to copper. That's whilst also putting as many holes in the ground as possible, with our money in the ground strategy, and building really strong technical teams on projects that we acquire.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Cobre?

Martin Holland:

The main reason is that we are a focused copper exploration company. We have belt scale exploration assets, in very good jurisdictions. With the copper price increasing and the demand for copper increasing, having a portfolio of assets, around the world, focused on VHMS, sedimentary CU and Cu/Ni magmatic sulphides, we tick a lot of boxes on different types of copper mineralization, to give our shareholders the best exposure, to getting the maximum reward possible in a copper super cycle.

Dr. Allen Alper:

Those sounds like very compelling reasons for our reader/shareholders to consider investing in Cobre. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.cobre.com.au/

Martin Holland

Executive Chairman and Managing Director

holland@cobre.com.au

|

|