First Mining Gold Corp. (TSX: FF, OTCQX: FFMGF, FRANKFURT: FMG): Developing and Permitting the Springpole Gold Project, One of the Largest Undeveloped Gold Projects in Canada; Dan Wilton, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/6/2021

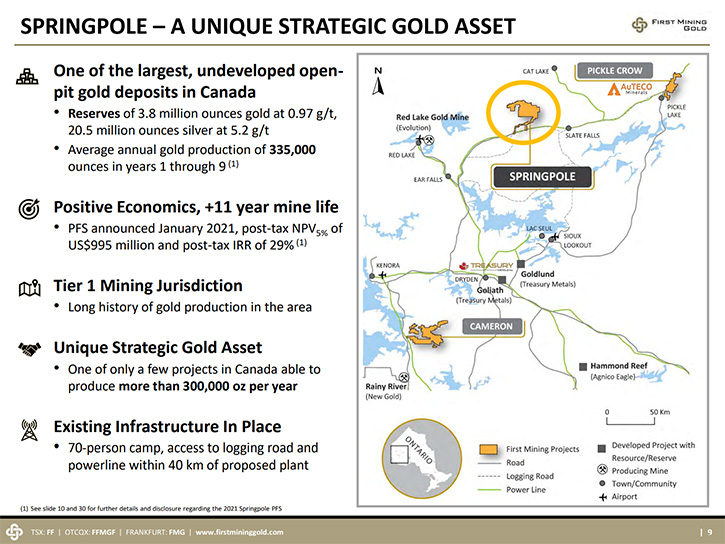

We spoke with Dan Wilton, CEO and Director of First Mining Gold Corp. (TSX: FF, OTCQX: FFMGF, FRANKFURT: FMG), a Canadian gold developer, focused on the development and permitting of the Springpole Gold Project, in northwestern Ontario. Springpole is one of the largest undeveloped gold projects in Canada. First Mining Gold has announced a positive Pre-Feasibility Study for Springpole in January 2021 and is currently busy with permitting. The Company also holds a large equity position in Treasury Metals Inc., which is advancing the Goliath Gold Complex gold projects towards construction. In addition, First Mining Gold holds a portfolio of six gold projects in Eastern Canada. Plans for 2021 include more metallurgical work and other optimizations at Springpole.

First Mining Gold Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News. I'm talking with Dan Wilton, who is CEO and Director of First Mining Gold. Dan, could you give our readers/investors an overview of your Company and what differentiates it? What have been some of the exciting things that have occurred in the last year or so? What are your great plans for 2021?

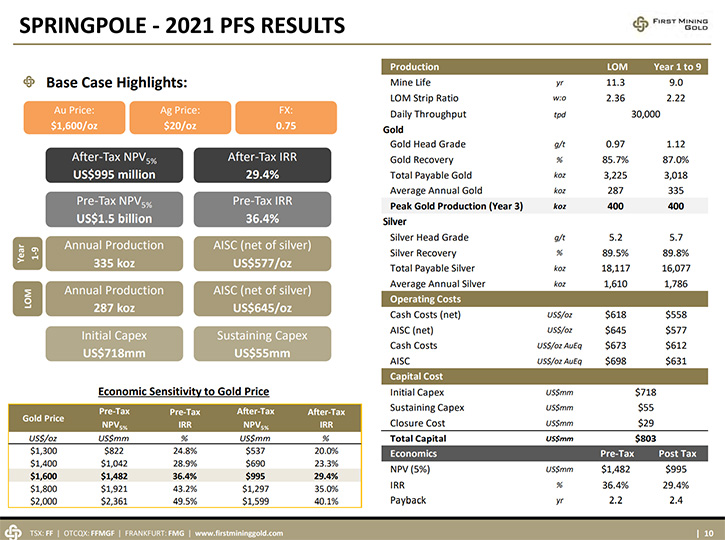

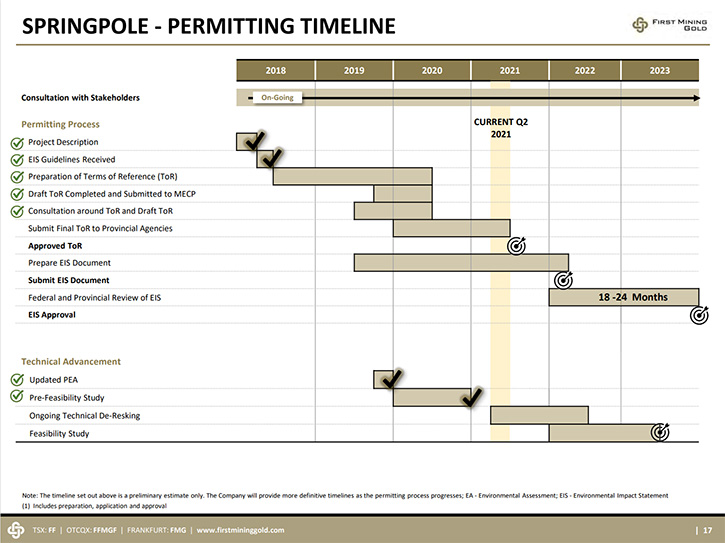

Dan Wilton:First Mining is primarily focused on advancing our Springpole project, which is one of the largest developed gold projects in Canada. It's located in northwest Ontario, just about 100 kilometers east and a little north of Red Lake. We put out a feasibility study on Springpole, earlier this year, showing an after-tax NPV at a $1,600 gold price, just shy of a billion dollars US and a very attractive after-tax IRR, at just shy of 30 per cent. We're now moving that project through further technical de-risking. Ultimately, this year, we are completing an environmental impact statement and expecting to get it submitted by the end of the year or very early next year to start the formal clock, in the permitting process, in Ontario and federally on the environmental side.

Dr. Allen Alper:

That's outstanding.

Dan Wilton:

What fundamentally differentiates us, and this has changed a bit since our last conversation, is that we're now sitting with, what I think is one of very few strategic projects available in the gold sector right now. If you look at the number of projects that can potentially produce in excess of 300,000 ounces a year, with all in sustaining costs in the lowest quartile of the cost curve that you could build for less than a billion dollars US, that have exploration upside of an entire greenstone belt beside them and ultimately are sitting in a Tier 1 jurisdiction, you get a very, very small number. We think, fundamentally what differentiates us, is the really strategic nature of this Springpole deposit.

Dr. Allen Alper:

That sounds excellent! It's great to have such an outstanding project and have brought it along so well, from the pre-feasibility study, which is a very robust study.

Dan Wilton:

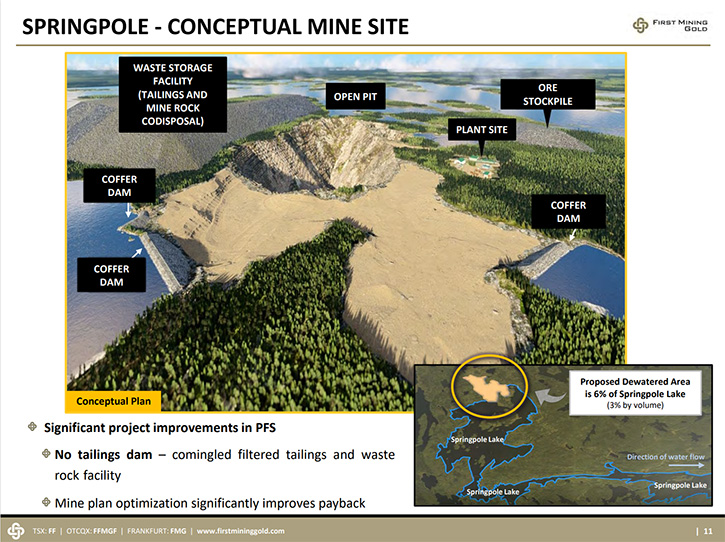

Yeah, we're very happy with the way the pre-feasibility came out. We had a very good Team that worked on it for more than a year. There's some very important thought that went into some of the scoping and changes in the project, including the fact that we've removed the conventional tailings dam from the design. We went to a dry stack, filter tails and waste rock disposal facility, which was influenced by a number of concerns expressed by the communities we're working with on the project.

Water has always been their primary concern, protecting the water and the environment for future generations. Our communities have a very good understanding of mines, because of their exposure to other mining projects in their traditional territories. But ultimately, one of the big questions that was asked is, "What happens when the tailings dam breaks and the tailings end up in the lake?" Our solution to that, through this feasibility study, was to demonstrate the viability of removing the tailings dam completely. That has other technical challenges. But it really presents a very robust, environmentally sound opportunity to move the project forward. It is a great framework for us to be discussing and coming to agreement on a project scope with our communities, before we submit that environmental impact statement.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors your plans for 2021?

Dan Wilton:

It feels like we've been in 2021 for a long time already, but we've done a lot. The big plan that we finished was the pre-feasibility study, which was announced in January and published in March. Now there is a defined set of follow-up tradeoffs, studies and optimizations that we want to do. First of which, is another round of metallurgical work. We think there are upside opportunities in the recoveries. We're testing a couple of different floatation technologies: potentially finer grinding of the flotation concentrate and playing with the leach parameters, in terms of retention time and in terms of pH. If there are a few more percents that we can eke out of the recoveries, we're optimistic we're going to be able to do that.

We've collected a100K sample. It's at the lab and that work is ongoing. There are a couple of really important optimization studies, around the tailings and waste rock disposal, as well as understanding and mapping where the generating waste rock might be, so we know how we're going to deal with it. Ultimately, we think there's an opportunity, on the capital cost side, for the filtration of the tailings. It potentially comes down to moving the area filter plant closer to where the tailings are going to be deposited. It means you may not have to dewater them as much, which could mean quite a bit fewer filter presses, which could mean quite a bit lower Capex.

The filter plant, in our pre-feasibility study, was scoped at $100 million plus and was part of the $718 million upfront capital, so it's a significant piece. If there are some opportunities there, we're very excited to find them. The other opportunity we are looking at is the further electrification of the plant. We've scoped it to connect into the provincial power grid, with a new 230 kV power line. This area of northwestern Ontario is blessed with lots of hydro generation. We want to understand what the opportunities are for us to limit the use of diesel on the site, helping the greenhouse gas footprint of the project. Ultimately, it has the potential to take trucks off the road that are going back and forth to the project every day, so that has some important safety benefits for our indigenous community members, who are also going to use that road.

We think all of those go to some really interesting optimizations of the project that we think show real opportunities for some improvement. That's our technical thinking. Then on the environmental side, we are finalizing the collection of baseline environmental information. We are blessed that the First Mining and its predecessors, have been collecting baseline data on Springpole for 10 years, so we are the beneficiary of an amazing data set. We've just made some very important additions to our Team. Between our environmental advisors and our team, they have worked on or led the permitting for pretty much every open pit mine in Ontario in the last 15 years.

We have a great Team that's come together. We've identified any last gaps in the data set for the environmental impact statement. We're collecting that data and making sure that we understand what those baselines are. Our goal is compiling the data and working with our indigenous communities to ultimately scope the project that we want to submit as a draft EA, at the end of this year, early next year.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors about your background, and more about your Team and Board?

Dan Wilton:

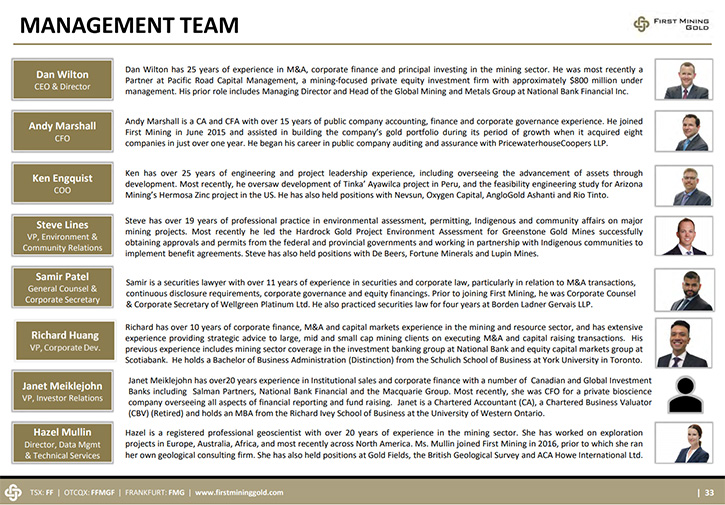

I come from a Corporate Finance and Equity Investing background. Prior to joining First Mining in 2019, I spent five years as a Partner, in a mining focused private equity fund, called Pacific Road Capital and we invested mostly in development projects. One of the big investments that we'd made was in a Company, called Luna Gold, which we saved, in 2015, from a very uncertain fate. We updated the pre-feasibility and they brought in a new Team and it was launched as Equinox Gold. It's still run by Christian Millau, whom I hired as the CEO of Luna Gold and brought in much of the Team that's still running Equinox. I'm very happy and proud of that involvement. So that's my background.

We have made very important additions to the Team in the last few months. At the beginning of 2019, we recognized that we needed a different set of skills around our development. We brought in Ken Enquist, as our Chief Operating Officer. Ken's done an amazing job. I think that's very clearly demonstrated by the quality of the pre-feasibility study, together with the quality of the Team we've been able to build on the technical side with Ken. We've made some other very important changes, most recently bringing in Janet Meiklejohn, who's on the phone, with us. She is our VP Investor Relations. Janet has spent much of her career in Institutional Equity Sales and brings a different perspective into how we are going to be able to grow our investor base at First Mining.

On our permitting and environmental, we brought in Steve Lines, who joined us in December as VP Environment and Community Relations. Steve spent six and a half years, prior to joining us, permitting the Hard Rock Gold Project in Ontario, which would be probably the closest comparable project to Springpole, in terms of size and in terms of complexity. Although, if you ask Steve, he'd say the Hard Rock model was a lot more complex than what we are working with at Springpole. We've now had Steve's entire Team join up, which is a Team of five people, who spent the last six and a half years, taking the Hard Rock project, from a scoping study through to a construction permit.

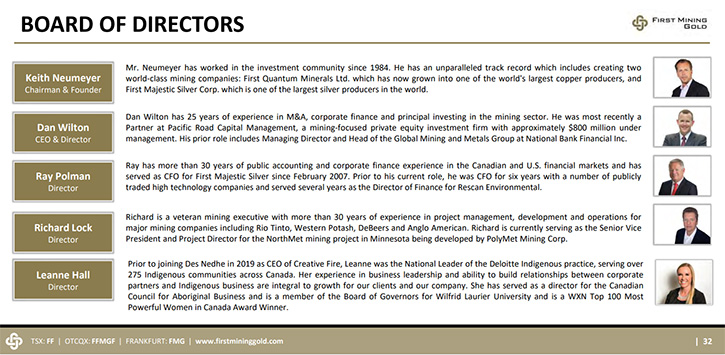

The opportunity Steve sees and the clear path forward, that we all see is getting Springpole through this environmental assessment. We can't talk about the Board, without talking about our prolific Chair, Keith Neumeyer, who's the Founder of First Mining and Founder and CEO of First Majestic Silver. Ray Polman, the CFO of First Majestic is a great and contributing Board Member. In the last year, we've added two new Board Members, including Leanne Hall, who joined us. She's the CEO of a Company called Creative Fire. She has spent much of her career working with indigenous communities and working in the mining sector on project development, community development and community relations. She brings a really fantastic background and perspective to our Board discussions. Richard Lock, on our Board, joined us in April of last year. Richard is a project development professional, with experience working on and building some of the biggest projects in the world, in the mining sector. So, a great diverse and talented Board.

Dr. Allen Alper:

You have an excellent Team and outstanding Board. I can see that your shareholders and stakeholders will have great confidence in your ability to bring Springpole to production, make money for your shareholders and protect the environment.

Dan Wilton:

That is the goal. We have stakeholders who are very important constituents, going forward over the course of the next few years. There's nothing more important than that collaborative task. We're working very hard at that right now.

Dr. Allen Alper:

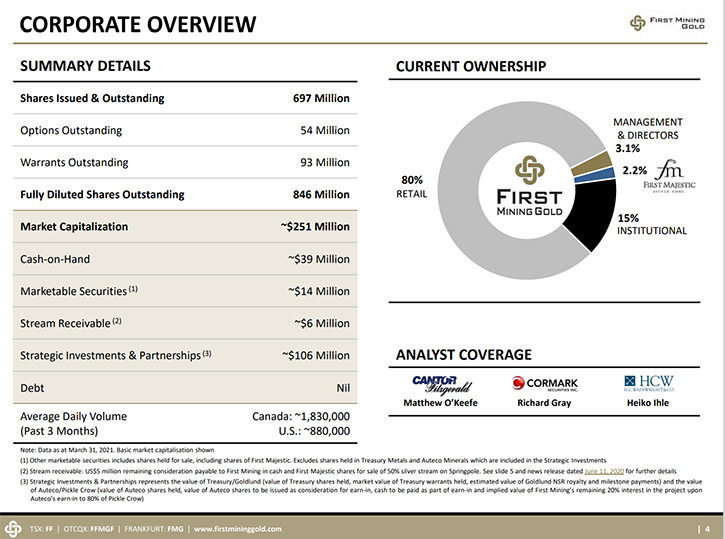

That sounds excellent. Could you tell our readers/investors about your share and capital structure?

Dan Wilton:

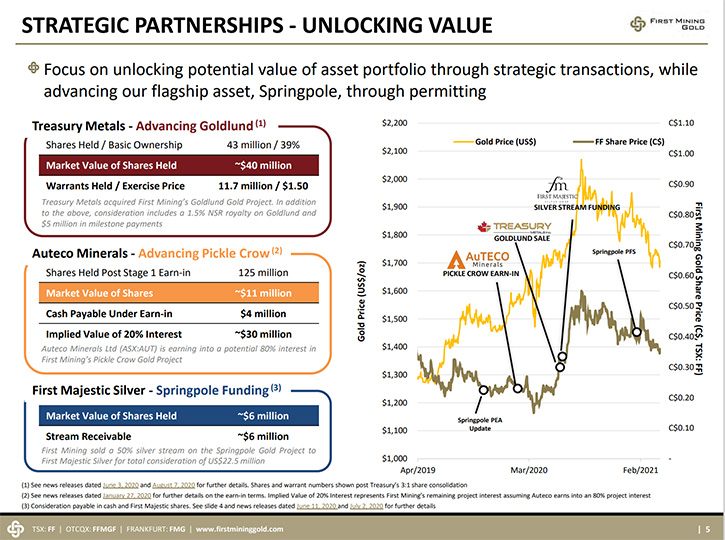

We have today, about 700 million shares outstanding, and the share price is about US 28 cents today. So that translates to a market cap, in Canadian dollars, of about $250 million CAD. What's important about that is, we have a number of strategic investments and by virtue of a few of the opportunities, we raised financing in the last year. We're sitting today, with about $40 million of cash and another $10 million plus of securities. Largely shares of First Majestic, we received as part of our Silver Stream financing.

We are working with $50 million plus of liquidity today. That really gives us the runway that we need to be able to get the Springpole project through this environmental assessment process. Some of the strategic investment partners are spending money. Some really exciting work is going on at our projects of which we're owners, we're partners. Treasury Metals, which is developing the Goliath Gold complex. We sold them our gold project last year, which is in the early days of a 50,000 meter drill program. We are moving that forward to pre-feasibility, after a really interesting and robust PEA that they put out earlier this year. On our Pickle Crow Project, we're partnered with an Australian group called Auteco. That is more than halfway through a 45,000 drill program. Some fantastic results!

Pickle Crow was mined for 30 years. It has three shafts and many kilometers of underground infrastructure that would cost you hundreds of millions of dollars to replicate today. They're having great success finding new structures. They are really explorers. That's going well. The other thing that's very important, around the Springpole project, is we've started now, for the first time since we've owned it, looking at regional exploration. Where ultimately, it is our goal to demonstrate (and we really believe this is there) that 5 million ounces is the starting point of Springpole, not the endpoint. We've been working on two different fronts, one looking at our existing land package to find exploration targets. Number two, we've started optioning a few other projects around us, because there are some interesting mineralization and some decent structures. Some, of which, actually have drill permits ready that we aspire to be drilling later this year or early next year. We've added about 6,000 hectares of exploration property, right in the heart of this Green Belt, so we're really quite excited about that.

Dr. Allen Alper:

That's amazing. The projects you have going on are so successful and your flagship Springpole project is moving along and the potential for growth of resources is great. I think you have everything going for you.

Dan Wilton:

Well, it has not been an easy road to get here to be honest, it's been a lot of hard work. We've worked very hard to put together the Team that I really believe has the capability to get us through these critical milestones. I can't say enough about the work the Team's done and continues to do, advancing Springpole and helping to surface value through some of the other projects.

I think, with all of it, we're still sitting and trading at a phenomenally attractive price, relative to our peers. As we demonstrate progress, on a number of fronts and move Springpole through the process and hopefully demonstrate exploration success there, we hope that the industry is waking up to just how strategic this project really is. When that happens, our Shareholders are going to be very, very well rewarded.

Dr. Allen Alper:

That sounds excellent, Dan. Could you highlight the primary reasons our readers/investors should consider investing in First Mining Gold?

Dan Wilton:

Number one, it's the strategic nature of Springpole. This is a very robust, large scale asset that is very strategic in nature. Number two, we have capital and the Team to move it through the critical value milestones. Number three, we have exposure to 120,000 meters plus of exploration at all of our projects. So very lucrative to exploration success. Number four, we're trading at some of the most attractive values, of our peers in the entire industry.

Dr. Allen Alper:

Well, those sound like very compelling reasons for our readers/investors to consider investing in First Mining Gold. Dan, is there anything else you'd like to add?

Dan Wilton:

No, I covered most of it.

Dr. Allen Alper:

Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://firstmininggold.com/

Daniel W. Wilton

Chief Executive Officer and Director

Janet Meiklejohn | Vice President, Investor Relations

Direct: +1 604 639 8825 | Toll Free: 1 844 306 8827 | Email:

info@firstmininggold.com

|

|