Integra Resources Corp. (TSX-V: ITR; NYSE American: ITRG): Developing DeLamar Project, Idaho, USA, 4.4 Million Oz of Gold Equivalent, Very Robust PEA, Very Low CAPEX; George Salamis, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/2/2021

We spoke with George Salamis, President and CEO of Integra Resources Corp. (TSX-V: ITR; NYSE American: ITRG), a development-stage mining company, focused on the exploration and de-risking of the past producing DeLamar Gold-Silver Project, in Idaho, USA. The DeLamar project has a resource of 4.4 million ounces of gold equivalent (all categories), a very robust PEA, 10-year mine life, and a very low CAPEX. Next steps include a PFS that is expected to be even better than the PEA. Integra is continuing to do exploration work at high-grade targets, around the current resource. Integra is led by the Management Team from Integra Gold Corp., which successfully grew, developed and sold the Lamaque Project, in Quebec, for C$600 M in 2017.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with George Salamis, who's President and CEO of Integra Resources. George, could you give our readers/investors an overview of your Company, and also what differentiates your Company from others?

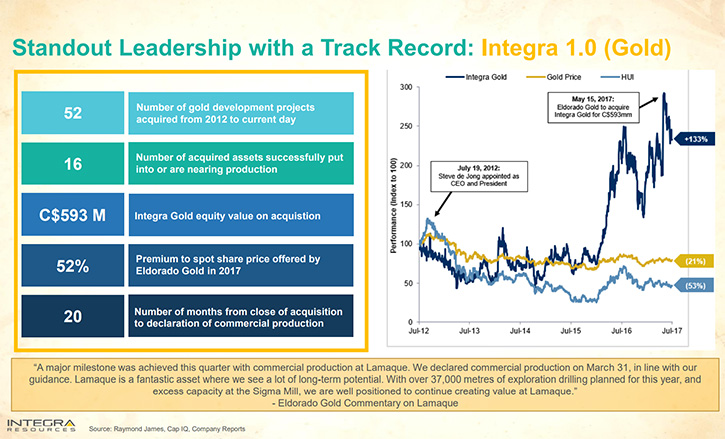

George Salamis: Sure. As an overview of the Company, Integra Resources is a Company that was born from Integra Gold. With Integra Gold, our pedigree was, the sale of a large gold project in northern Quebec. Four years ago, we were underground in a gold producing district, about to move forward, when Eldorado Gold, stepped in with a friendly offer, a 52% premium at the time, and the rest is history.

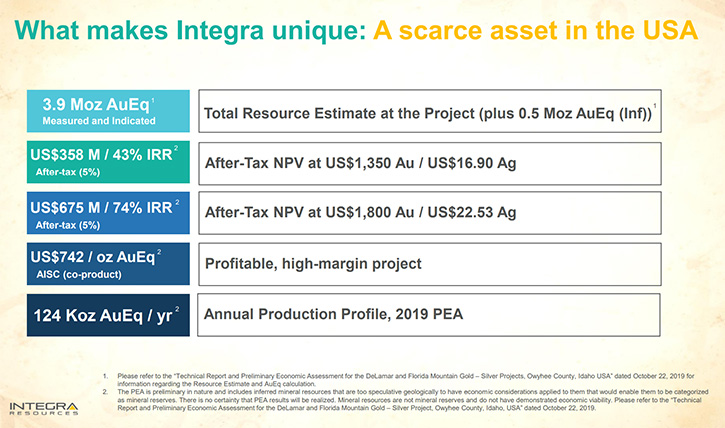

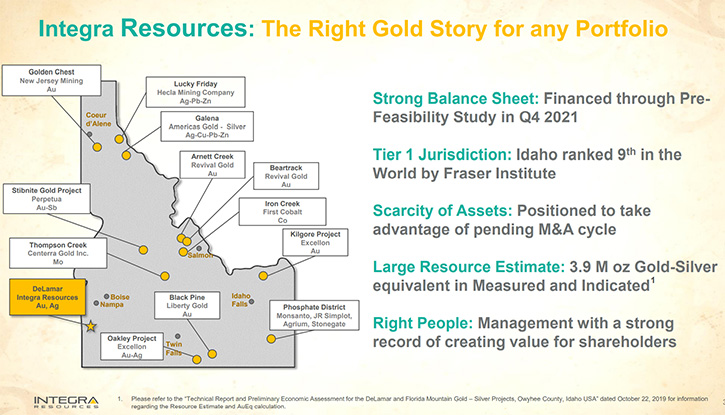

$600 million was made, our shareholders were happy, so we created Integra Resources, which essentially, is the same Team, replicating that model of success, this time in southwestern Idaho. What differentiates us from some of our competitors, is the fact that we have a very large resource, 4.4 million ounces of gold equivalent in southwestern Idaho. It's a district that's produced a lot of gold and silver, over a long period of time, and we're restarting production from where Kinross, a very large gold producer, left off in the early 2000s.

Dr. Allen Alper: Sounds great. Could you tell us a little bit more about your deposits, your resources, and also your plans for 2021, going into 2022?

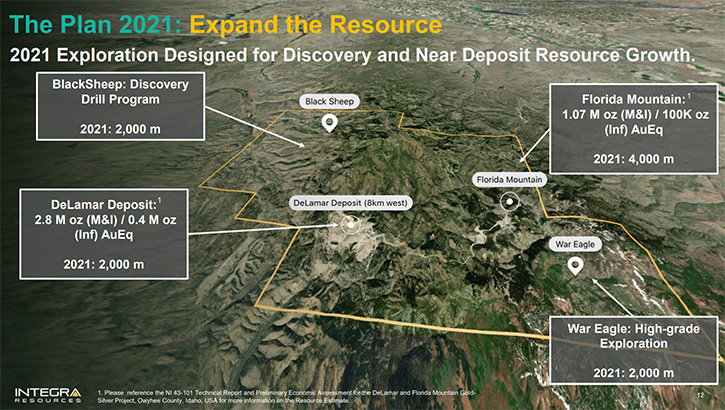

George Salamis: We acquired the projects from Kinross, the DeLamar Mining Project in southwestern Idaho, which is essentially located about an hour and 45-minute drive; southwest of Boise. There was no declared resource at the time. For the last three and a half years, we've been busy doing a few things growing the resource base, which is at 4.4 million ounces of gold equivalent. Then we did these very necessary de-risking studies, starting with a preliminary economic assessment, a few years ago, which showed really strong economics of something that would not cost a lot of money to build. A few years ago, we were able to demonstrate 124,000 ounces a year, of gold equivalent production. So that's gold and silver, over a 10-year timeframe, for under $200 million.

Very low capital intensity! What we're leading up to this year is a pre-feasibility study, the next big de-risking milestone for the project. We believe that PFS is going to look even better than the PEA, from a myriad of perspectives, not the least of which is from a production perspective, still with a low capital intensity, and just a low cost to build. That comes from the fact that the backbone of our production will be heap leaching, with a small milling component.

And while we're doing all of this, we're still exploring. We have four drill rigs active on the project. We continue to drill away on these various targets, that are peripheral to the resources that we have identified; both the DeLamar Project, and the neighboring Florida Mountain Project, with lots of high-grade, which points to the historical aspect of this district. There's been a lot of gold and silver produced historically in this district, both really high-grade underground, and low-grade open-pit production, over a long timeframe.

Dr. Allen Alper: That sounds so great! Sounds like this year, and going into 2022, will be exciting times for your stakeholders and shareholders.

George Salamis: It sure will be. We’re looking forward to the advanced studies and that pre-feasibility study, which is necessary for us to go into the permitting phase of the project. In addition, we're keeping our foot on the gas of exploration constantly. And one of the things we're looking at right now, is of real interest to our shareholder base, and prospective shareholders, the high grades that we're obtaining from our exploration program, underneath one of our low-grade deposits.

We now have 79 high-grade drill intercepts, beneath a bulk tonnage, low-grade deposit, which is really speaking to a lot of upside potential, perhaps a million ounces or more, of high-grade, underneath a low-grade deposit. And if we can bring that into the realm of a resource, and then a mine plan, and a study, that could be a real game changer for the overall project.

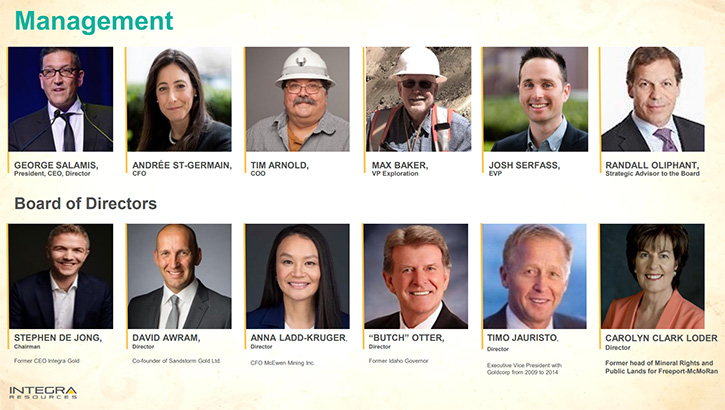

Dr. Allen Alper: Sounds excellent! George, I know you and your Team have an outstanding record of accomplishment. Could you tell our readers/investors a little bit about yourself, your Team and your Board?

George Salamis: Sure can. In terms of our track record, our latest achievement was the sale of the Lamaque asset, under the banner of Integra Gold to Eldorado. One of the amazing accomplishments there, from a corporate perspective, was we were on track to get things right from a development and operations perspective. We had forecast a level of production, as a junior mining company, in my new mine builder, that Eldorado was now achieving. They've gone on to build a very profitable mine operation, which we were essentially forecasting back in the day. It's rare, Allen, that junior miners get it right, but Eldorado is certainly proving that they can. So, I look at that as a major achievement. Over the last 20 years, I've been involved in about $2 billion worth of successful M&A transactions, where major mining companies have taken over projects of which I've been an executive, which have turned into successful mining operations in most cases. I'm proud of that.

I'm really proud of the Team that we've assembled here. From our Executive Team to the Technical Management on the ground, we are second to none. I've seen them grow over a period of time, into wonderful and very successful executives, driving this forward. And I think that's a key ingredient to any successful mining venture, you really need a good successful Team. And we certainly have that.

Dr. Allen Alper: That sounds great. It's a very impressive team. I went to your website, and looked over your accomplishments, and the qualifications of your Team. They're outstanding! That's excellent! George, could you tell our readers/investors a little bit about your share and capital structure?

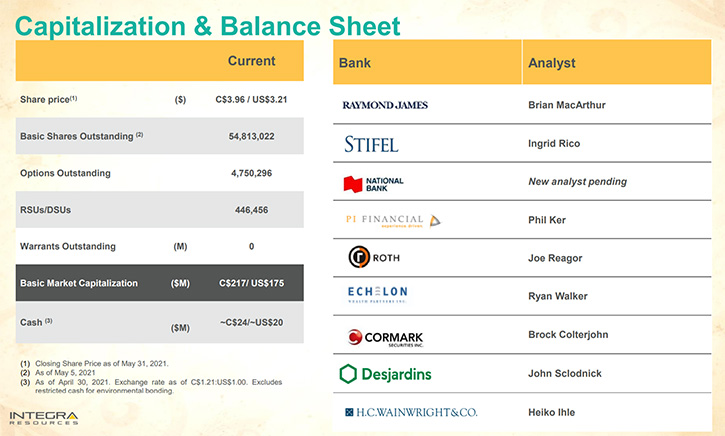

George Salamis: Sure can. We have close to 54 million shares outstanding, a very tight share structure. Management has participated in all the financings that we've done, so we own about 6% collectively. Also, on our share registry, is Kore Mining, the very large gold and silver producer, focused on the US, they're regarded as a mid-tier gold and silver producer. They would own about 6% of the Company as well. And of course, a very strong and prestigious group of institutional shareholders have made a lot of money on Integra Gold, and followed their investment into Integra Resources, and are still there to this day. They would account for 60% of the overall shareholding in the Company. The balance would be retail shareholders, both in the US and Canada.

We listed last year on the New York Stock Exchange, under the symbol ITRG, because this asset is in the western part of the US, it's of interest to a US audience. We've been growing the US retail shareholder base, through that NYSE listing. Of course, we have another listing on the Toronto Stock Exchange Venture, under the symbol ITR. We trade actively on both stock exchanges. It's a tight shareholder base, not a lot of shares outstanding, not a lot of big share count. We have close to $20 million in the treasury currently, so more than enough money to take us beyond the next big milestone for the Company. We're in really good shape in all respects.

Dr. Allen Alper: That sounds fantastic. Very few junior miners have the resources you have, a great property in a great area, with great infrastructure, and a high safety level, and well-financed to move forward. So that's all excellent!

George Salamis: Indeed.

Dr. Allen Alper: George, could you tell our readers/investors, the primary reasons they should consider investing in Integra Resources?

George Salamis: First and foremost, I think, the expression "Back the horse, and back the jockey" applies here. The jockey in this case is the Team, which we've talked about a lot, with this great track record of delivering success. I think that's probably close to the top of the list. In terms of the betting on the horse, the horse being the DeLamar Gold and Silver Project, in southwestern Idaho, there are very few large, low capital construction projects in Tier 1 Jurisdictions. The US and Canada, being widely regarded as Tier 1, low risk, jurisdictions. There's a real scarcity of these types of really large developable assets in these Tier 1 Jurisdictions. I think, that should be a key focus for the investor.

The third element is the low cost to build this asset. This is an asset that, we can build, without waiting for a major mining company to take us over, because it's not going to cost a lot of money to build it. If we were to need to finance this project today, given our share structure, and given our access to capital markets, we could finance this project, and build it today if it were ready to go. So, I think those three aspects are really key.

Dr. Allen Alper: All those are very compelling reasons, for our readers/investors to consider investing in Integra Resources. You have a great Team, a great property, and a great location, and financial backing. So, it sounds excellent! Really excellent, George! Is there anything else you'd like to add?

George Salamis: I'm really blessed to work with a great Board of Directors, a diverse, talent-based, with technical skills and mine-financing abilities, to stakeholder relationship experts, and the former governor of Idaho himself, Butch Otter, a two-term governor. He decided to join our Board just over a year and a half ago. When Butch retired from politics a few years ago, he was obviously given a lot of offers, to join a number of different Companies, and he picked us. Because he thought, the Team was right, the asset was right, and the project had a really good shot at being built quickly, within the next three to four years. So, I have a great Board to work with, at Integra Resources.

Dr. Allen Alper: That's great, excellent! That's really outstanding! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.integraresources.com/

George Salamis

President, CEO and Director

ir@integraresources.com

1 (604) 416-0576

|

|