Challenger Exploration (ASX: CEL): Planning on Becoming a Globally Significant Gold Producer, Two Projects in South America, Drilling 150,000 meters; Kris Knauer, CEO & Managing Director Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/29/2021

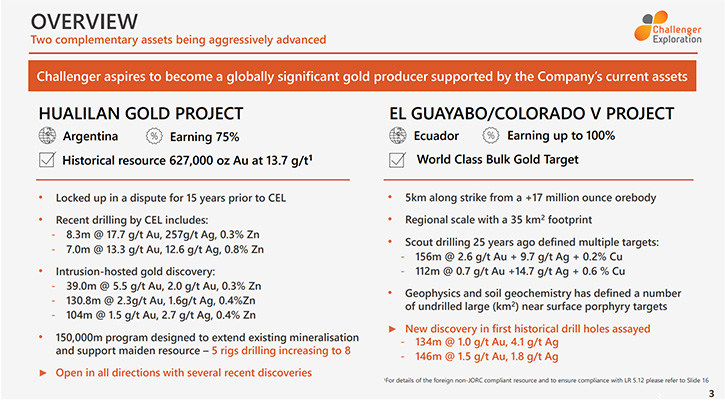

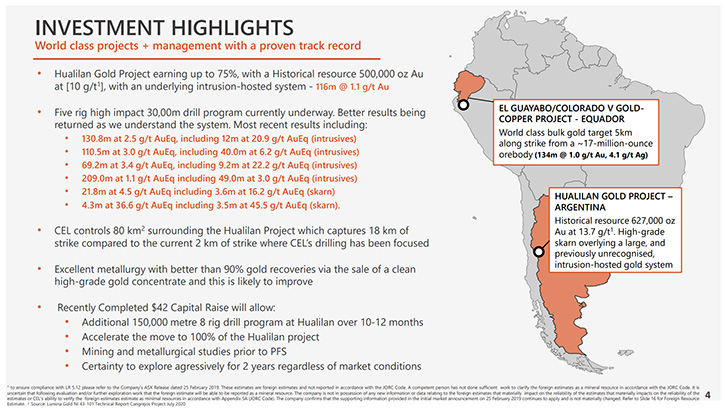

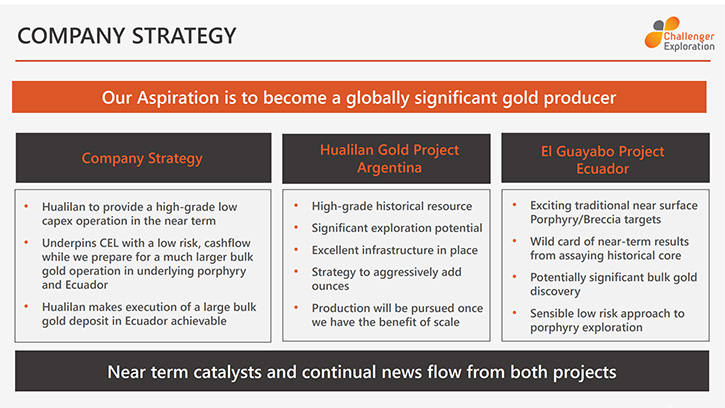

We spoke with Kris Knauer, CEO and Managing Director of Challenger Exploration (ASX: CEL). Their aspiration is to become a globally significant gold producer, with their two projects in South America. The Hualilan Gold Project, located in San Juan Province Argentina, is a near-term development opportunity. It will provide a low risk, high margin source of cashflow, while the Company prepares for a much larger El Guayabo Gold/Silver/Copper project, in Ecuador. Plans, for the rest of 2021, include a fully funded, ongoing 150,000 meters exploration drilling, in Argentina, which in eight months will result in a maiden resource. At the same time, Challenger is doing metallurgical work, which has produced some nice results.

Challenger Exploration

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Kris Knauer, who is CEO and Managing Director of Challenger Exploration. Kris, could you give us an overview of your Company and what differentiates your Company from others?

Kris Knauer: In terms of an overview, South America focused on two assets. The lead asset is very much in Argentina, an historical resource of about 500,000 ounces, at about 10 grams gold equivalent, which was open in all directions and still is. Sitting under that, we have a big intrusion-hosted discovery, with typical intercepts of 100 to 200 meters, of between a half a gram and a gram and a half, which looks like it has significant scale. That's one of four or five mag anomalies, the first of which we've drilled, and mineralization has been everywhere.

Then in Ecuador, we basically sit five Ks away from a 17-million-ounce ore body that's going through permitting and we think we have the other side of that ore body. Having said that, we'll start some drilling in another few weeks, but in terms of an aggressive work program, there are not a lot of incentives until that nearby deposit gets permitted.

Dr Allen Alper: Well, that sounds exciting. That sounds like you're in two great regions. Could you tell our readers/investors what your plans are for the remainder of 2021 going into 2022?

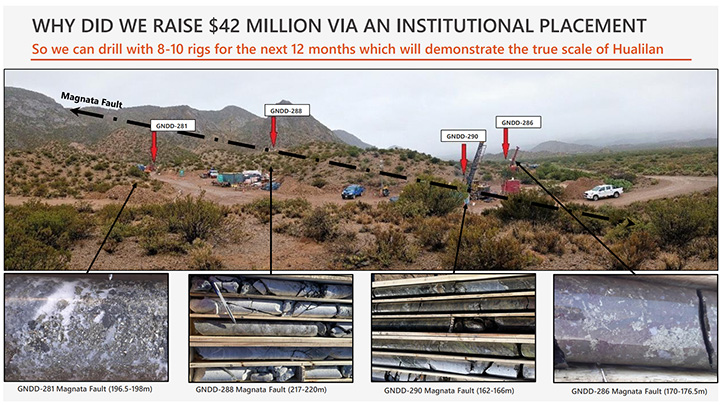

Kris Knauer: We've recently raised $42 million. So, we have about AU$50 million cash in the bank. What we've committed to in Argentina or our Hualilan Project is we have six rigs going now. We'll have two more rigs arriving by the end of June. There's an aggressive drill-out and exploration program there in Argentina, where we'll do another hundred and we're fully funded for another 150,000 meters, which is what we've committed to do. We'll drill, drill and drill for the next eight or nine months. Following that, we'll put out a maiden resource. We track the resource internally, but there's not much point putting out a resource, while the rate of growth of that resource is still exponential, because whatever you put out, it's not going to do it justice. So, we'll wait until we've drilled a lot of this out.

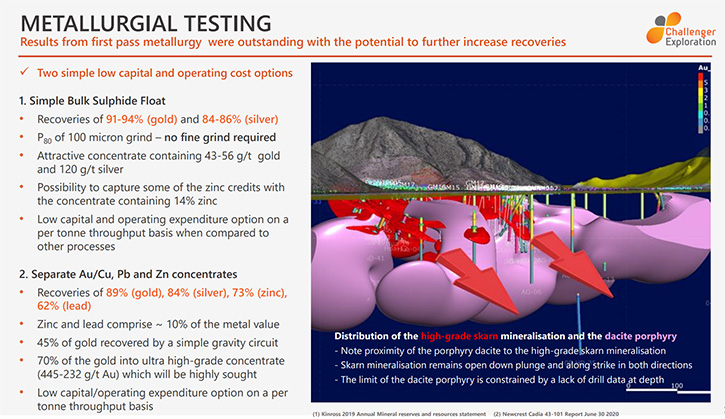

We're also doing metallurgical work along the way. It has some really nice metallurgical test results, but we want to get the met and some of the other work, associated with the PFS, done while we're drilling it out as well. We're fairly confident that it's going to be a very big resource that'll be economic.

Dr Allen Alper: Well, that sounds exciting for your shareholders and stakeholders.

Kris Knauer: Yeah. It's been a really nice ride for the last 18 months, not because we're clever. That's just the factor of the geology. We just got lucky, with the project.

Dr Allen Alper: Well, it's great to have the financial resources to drill out the properties. That sounds excellent!

Kris Knauer: Yeah.

Dr Allen Alper: Kris, could you tell our readers/investors a little bit about your background, your Team, and your Board?

Kris Knauer: I am an exploration geologist. I worked as an exploration geo for about seven years and then got into the market, initially as a mining analyst. And then I moved into the corporate area. I jumped out about 10, 12 years ago, got control of a little listed mining company. We put some Saudi assets into it, which became Citadel Resources and four years or five years of hard work later, that Company was taken over for a billion dollars. So I've taken a startup from nothing to a big exit before.

My Chairman, Fletcher Quinn was actually the Founding Chairman of Citadel Resources with me, so he's gone through the hard yards with that project as well. Exploration Manager, Stuart Munroe is ex-SRK. He was Head of their golds in Australia. He did the investigative report for the IPO, and I could tell, as soon as he got on the ground, he wanted to come work for us.

Our CFO is Scott Funston. Scott basically is a long-term ASX CFO. He focused on some assets they had in Brazil, which became Avanco Resources, and they took that from basically IPO and startup through to about a half a billion-dollar takeover, three years ago, now taken over by OZ Resources. Scotty has taking a startup through DFS, into production and then been taken over as well. So, we are a Team that's been there before and done that.

Then in Ecuador, we have about seven or eight Ecuadorian geologists on the ground, mostly English speakers and all Western-trained. And in Argentina, we have a Team of about 14 exploration geologists, who are, predominantly Western trained, two really good senior geologists and then a bunch of core handlers, core cutters. We have a Team of about 50 in Argentina on site. Our policy is to employ 100% local people in Argentina and Ecuador. In my experience, fly in, fly out just doesn't work in South America.

Dr Allen Alper: Well, that sounds great. You have a great background, Team and your Board, so that's excellent. Could you tell our readers/investors a little bit about your share and capital structure?

Kris Knauer: In terms of capital structure, fully diluted, post our raise, we have about 1.1 billion shares on issue. They're trading at $0.27, so market cap of about $270 million fully diluted, take out the $50 million cash, so an EV of about $200 million. And that is fully diluted for everything, performance shares moving to 100% of the project, so market cap of roughly US$160 million on a project in Argentina that hopefully will end up as a multi-million-ounce deposit, by the time we finish this drilling program. The way the market looks at us, we probably have Ecuador thrown in for free, there where we think we have the other half of a 15-million-ounce ore body. The other half of that project is held by a TSX-listed-Company, Lumina Resources, which owns the Cangrejos Project.

Dr Allen Alper: Well, that sounds excellent. Those are two fantastic projects. Could you tell our readers/investors the primary reasons they should consider investing in Challenger Exploration?

Kris Knauer: The primary reason is our Argentinian Hualilan Project. There're not many projects, in the world, where you have eight rigs that'll be drilling, for the next 12 months and keep expanding the Project. Most of the drill holes, we're drilling, are extending this thing. You look at a current market cap of $200-odd million and we think we're going to be the next Company to emerge in South America, with a plus five-million-ounce ore body. What's a five million ounce ore body worth? They generally trade a couple of hundred dollars an ounce. So, you do the sums of $200 million to potentially a billion-dollar market cap, in the next 12 or 18 months and really, that's the value prop. And then, throw in Ecuador for nothing, where potentially we think we have the other half of a 15-million-ounce ore body.

Dr Allen Alper: Oh, that sounds fantastic. Kris, is there anything else you'd like to add?

Kris Knauer: In terms as to why the project is there, the Argentinian project or Hualilan has been locked up in dispute for 15 years. So, it basically had missed the last 20 years' modern exploration, which is, I suppose, one of the reasons why its simple geophysics, and the IP and mag have allowed us to expand this thing so easily, and also the way the ore body works. Because it has that high-grade component, sitting above this big low-grade component, it lends itself to basically a multi-phase production where you start with this smaller low CapEx operation, where you might treat a million tons per annum, of six-to-seven-gram material, and then year four or five, you can expand out a cash flow and potentially get to seven, eight million tonnes per annum, treating at a gram a tonne intrusion-hosted material.

So you can get yourself into a mid-tier production level. From a low CapEx point of view, you're certainly looking at sub US$100 million, to get into production, simply because you have that high-grade starter operation, and also simple metallurgy, at a fairly friendly grind-size, a simple single-stage sulfide float's recovering better than 90% of the gold into a nice clean high-grade gold concentrate. So we don't need the back half of the plant or the gold room, and we don’t need to use cyanide, with the associated permitting as well. So it's a pretty simple operation. It's one of those that's almost idiot-proof.

Dr Allen Alper: Well, that sounds excellent. That's really great potential. And this year is going to be very exciting as you drill and discover.

Kris Knauer: Yeah. No, look, it's all going along nicely at the moment.

Dr Allen Alper: Is there anything else you'd like to add, Kris?

Kris Knauer: You're going to have the constant news flow that comes with eight rigs on site and another couple of rigs going in Ecuador. So, for the next 6 to 12 months, it's going to be a good time to be a shareholder. And there's a potential opportunity, at the moment, because we raised $40 million at $0.28 about two weeks ago. So, the market's has a little bit of indigestion at the moment, while some of that placement stock works its way through the system, which is why there's a window, at the moment, where you can get the stock for just under that placement price, while we can't exit. And unfortunately that happens with most placements.

Dr Allen Alper: Oh, it sounds like an opportunity for investors!

https://challengerex.com/

Kris Knauer

Managing Director

+61 411 885 979

kris.knauer@challengerex.com

|

|