TRU Precious Metals Corp. (TSXV: TRU; OTCQB: TRUIF; FSE:706): Portfolio of 5 Gold Properties, Highly Prospective Central Newfoundland Gold Belt; Joel Freudman, Co-Founder, President, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/25/2021

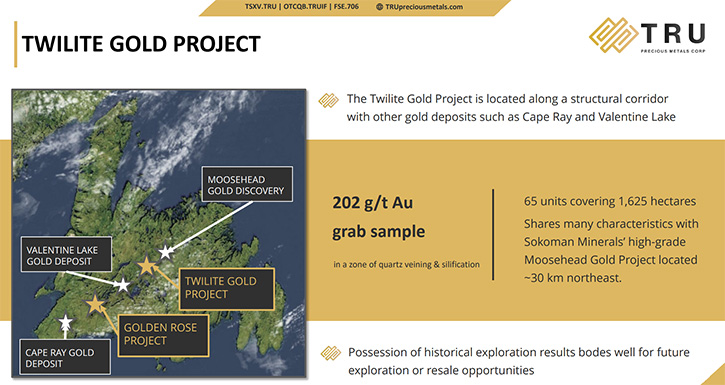

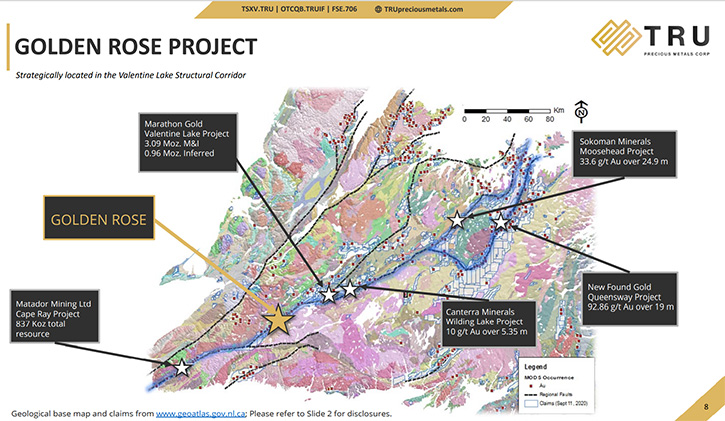

We spoke with Joel Freudman, who is the Co-Founder, President, CEO and Director of TRU Precious Metals Corp. (TSXV: TRU; OTCQB: TRUIF; FSE:706). TRU has assembled a portfolio of 5 gold exploration properties, in the highly prospective Central Newfoundland Gold Belt. TRU is focused on the two properties along the Valentine Lake Cape Ray Shear Zone: The Golden Rose Project, located on strike, with Marathon Gold’s Valentine Lake Project, and the Twilite Gold Project that shares many characteristics with Sokoman Mineral’s high-grade Moosehead Gold Project, located ~30 km northeast.

Courtesy of Altius Minerals Corporation

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News. I’m talking with Joel Freudman, who is the Co-Founder, President, CEO and Director of TRU Precious Metals. Joel, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

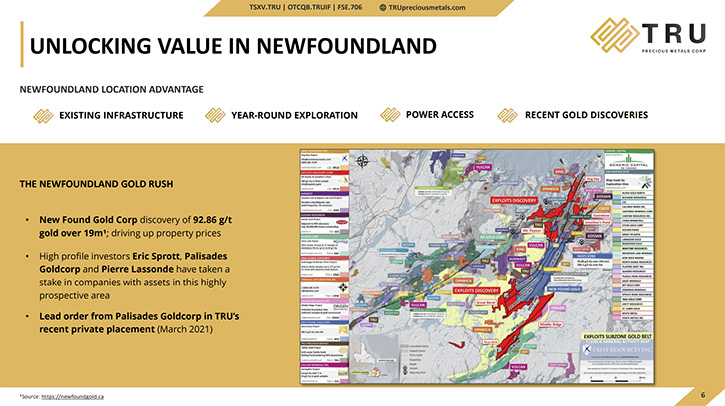

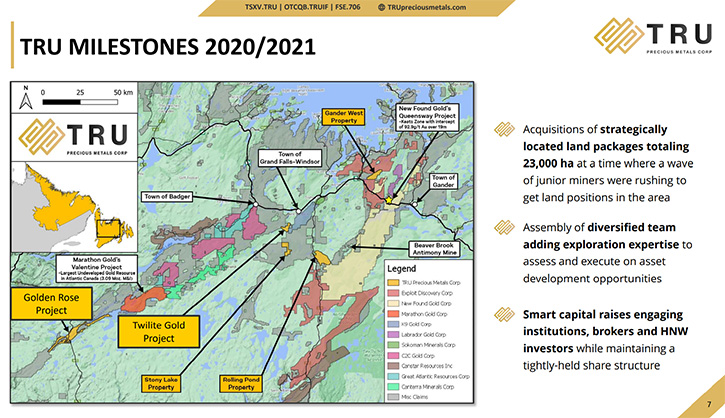

Joel Freudman:TRU Precious Metals is in the Central Newfoundland Gold Belt, which is a hot area right now. We have five properties in the region. We're well financed, we have a full Team that we've built out, a good cap structure, a very acquisitive, deal oriented business model. But what differentiates us from the 30, 40, 50 companies that have kind of rushed into the area after us? I'd say the key differentiator would be our properties, simply because we have good ground and therefore other competitors, and peers cannot acquire that ground.

In particular, we have two properties along the Valentine Lake Cape Ray Shear Zone. It's basically a geological feature, that runs diagonally through the province of Newfoundland, which is in the eastern end of Canada. There are a number of small deposits throughout the Province of Newfoundland, but in this Valentine Lake zone, there are actually two major known gold deposits. One of them is Marathon Gold’s Valentine Lake, which has four plus million ounces of gold, being developed into a mine, over the next two years. They continue to add ounces there as they do step-out and confirmatory drilling.

The other one on the Shear zone, is Matador Mining's Cape Ray Deposit about 840,000 ounces, and they're continuing to expand the resource there. TRU Precious Metals has our flagship asset, the Golden Rose Project, right between those two deposits. We’re right between the four-million-ounce Marathon Valentine Lake Deposit and the 840,000-ounce Matador Cape Ray Deposit. We really couldn’t be any better situated in the province.

And we also have another property, farther up, called Twilite Gold, which just hasn't seen as much exploration yet, although it certainly has been explored quite a bit about 20 years ago, earlier stage, as well as a bit of shallow drilling that was intersecting gold intervals. There is a long, very promising geological corridor. We have two properties on it. So, two good kicks at the can to unearth something decent there in the structure. Other people simply can't get that land because we already have it.

Twilite Gold is 100% owned. We have Golden Rose under option, from TSX-listed Altius Minerals, and we have the option to acquire 100% of that property as well. We're well underway, on our share issuance commitments, under that option agreement. We're starting exploration and we're more than adequately funded to do that. I think that's really the differentiator, maybe it's a differentiator our company has that no one can reproduce. We have other good things that I can talk about. But if you're investing in a junior mineral exploration play, you certainly want to go for the ones that have the most prospective geology and I think that's what sets us apart from most of the pack.

Dr. Allen Alper:

That sounds excellent. It sounds like you’re in a great region. It’s one of the most exciting regions being explored right now in Canada. That’s really great! Could you tell us a little bit more about your plans for 2021 and going into 2022?

Joel Freudman:

We just put out a large overview press release, on May 31st, about our exploration plans for the year. We are doing drilling at our Twilite Gold property, which is great because I understand that drilling is appealing to the market. Ultimately, drilling is the best way for us to determine what's under the surface of our properties. We've announced a minimum 1,200-meter drill program. Drills are currently turning, and we have our exploration guys giving me updates.

In addition to the drilling at Twilite, we're doing some early-stage work at our non-core properties. It's simply that we only have so many resources to go around, so we can't focus on all the properties, although certainly we do like the other properties, we have to focus our personnel and our dollars on properties where they're the most advanced. Twilite Gold drilling is underway.

We are also going to be doing surface level work at Golden Rose, in order to test out various gold showings along that property. There are about 45 kilometers of strike length on the Shear Zone that I was referring to. There's a lot of ground to cover over this highly prospective deposit-bearing structure. So, part of our job, before just running in and drilling, is getting a handle on how many good targets there are, on the property, for more detailed exploration, things like geophysical surveys, trenching, perhaps before drilling.

Later this year, we envision doing a 5,000-meter drill program across the Golden Rose Project, particularly to test out the most prospective zone, called the South Woods Lake Zone, where there are already a number of historical drill holes, probably 40 or 50. So we have a pretty good early-stage handle on the prospectivity of that target zone. We think there are a lot of exploration catalysts for the Company immediately, and over the rest of the year, which is quite exciting.

On the Corporate level, we're in the midst of closing a $3.5 million flow through financing, led by Eric Sprott. It's an all-institutional round, so that's a positive, because that's going to more than fully fund our exploration plans for this year and, at this point, for 2022. We have lots of money to spend on exploration and to explore what we do have. We're an acquisitive company. We did five property acquisitions during five months between last September and this January. And so, we're going to be evaluating property level and corporate level M&A over the coming months and the rest of the year.

We have our hands fairly full right now. But we will still consider transactions that we think would either bring in revenue or some sort of return for shareholders, whether that's optioning or something like that, that would bring in cash. Our shares are great acquisition currency. At the property level, where we can consolidate land packages, we can do smaller tuck in acquisitions that would cement our position along the Shear Zone.

Dr. Allen Alper:

That sounds excellent. Those are great plans and 2021. It will be an exciting time for your shareholders and stakeholders.

Joel Freudman:

We're doing what we can to make it exciting! That's for sure!

Dr. Allen Alper:

That’s great. Could you tell our readers/investors a bit more about your background, your Team and your Board?

Joel Freudman:

My background is as a securities and mergers and acquisitions lawyer. I'm quite deals oriented. A number of the Co-Founders, people on our Board, and on our Management Team are people with significant capital markets and transactional experience. That tends to color our view of how we run the Company and the business here. It can't just be blindly spending all the money in one shot and exploring. You have to be cautious with the Treasury, but also looking for a variety of ways to build the share price and build the deposit or development potential.

My background is transactional, legal, as well as capital markets for the last five years. The rest of our Management Team, our CFO has over 30 years of accounting experience and he's also CFO of a couple of other junior mining companies. Our VP of Property Development, who runs exploration, as well as property M&A, has over 30 years of geological experience. He’s a Geoscientist, based in Grand Falls-Windsor in Newfoundland. That's where he lives. He’s a 15-minute drive from Twilite, where we're drilling right now. Think about that, right, 15 minutes by car from his house to a project, where we're drilling for gold.

Talk about location! Such a good location! I think that really speaks to it as well as the access to a project. Our VP has 30 plus years’ experience on the ground, about 16 years’ experience at the executive level, at another mining public company about a decade or so ago. He spent a lot of his career in an executive role in a public mineral exploration company, which is quite a hard skill set to find in central Newfoundland.

Our Exploration Manager has over 30 years of experience as well. We actually were able to recruit him from Maritime Resources, which is developing their own gold deposit in Newfoundland. That covers the exploration side at the management level.

Our Board’s Lead Director, who's like our Chairman is also a securities and mergers lawyer by training, significant experience with junior mineral exploration companies. He had experience in Africa and Latin America, in mineral exploration. We have another geologist on our Board, who has over 20 years of experience across North America, in particular, with mining projects. That rounds out the Executive and Leadership Team.

I'd be remiss if I did not also mention the fact that we have probably about another half dozen to a dozen people working for us in a variety of capacities. We've built out a Field Team, Newfoundland-based. Several of whom are geologists, not just prospectors. We have a highly educated Field Crew. Then at our “virtual” head office, we have people in Fredericton, Toronto and in Vancouver across a variety of functions like administration, finance, corporate communications and capital markets. I think we have quite a strong team, which is a differentiator for us. I think a lot of people talk up the Team. I know how fast we've moved and how aggressively we've built out the team, while still trying to hire the best people we can land. I think that's been a competitive advantage for us, as well, in terms of how we can move quickly and seize opportunities.

Dr. Allen Alper:

Well, it sounds like you have an excellent Team and Board, very diversified and very strong and capable to move your Company forward rapidly.

Joel Freudman:

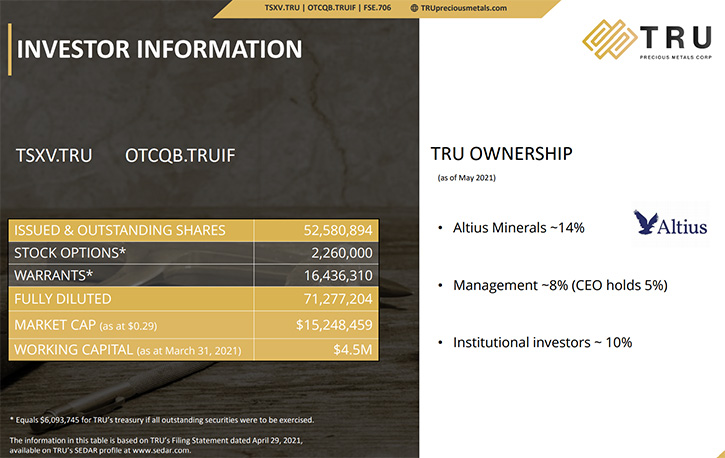

We're doing the best we can, which takes a longer time, to try and set up for a sustainable viability, with growth. But I think it's been borne out in practice. Our Team has gone from CEO, CFO and a four-person Board to now probably 15. We've gone from one property in September to now five properties. Our market cap has gone from a few million dollars to a $23 million market cap. We have numerous institutions in our shareholder base, from initially only a small share float. We have a TSX-listed major shareholder with about a 14% stake.

Eric Sprott is going to be coming into the shareholder base. We have other institutions in there too. Palisades Goldcorp. was a lead order for our last financing. These things do play out over time, it's our job to continue to work hard, to set the company up for success, to move aggressively where we need to seize opportunities, to keep up with or lead the market, depending on what's going on. Then, ultimately to deliver on our exploration program, including our drilling, that's currently underway to meaningfully build value and set a fundamental geological base for the Company.

Dr. Allen Alper:

Well, you have a great share structure and some very impressive backers. That's a great position to be in! Because what you need in the mining sector are the right properties, the right team, and the ability to get finances to carry out the projects.

Joel Freudman:

Yeah, I agree. On the financing front, in March, we closed a $3.5 million financing and that was meaningfully oversubscribed. Our initially announced plans were one to two million. So, we are very happy with the response there. That was the one that was led by Palisades Goldcorp, but we had other institutions come in. We also had good financing support, from a number of brokers at probably most of the independent investment banks in Canada. They were bringing their clients, and, in some cases, brokers would participate directly as well. I think that's a good show of support. That was $3.5 million bucks that came into the Company, in addition to over a million dollars we previously had in the Company. That put us somewhere around $4.5 million in working capital.

Now we're in the midst of raising a follow on $3.5 million flow through, which is tax advantaged mining financing up here in Canada, with a $2 million lead order by Eric Sprott. We're probably talking like $7 to $8 million treasury, half of it's earmarked for exploration because it's flow through money. Our exploration budget that's been disclosed is about $2.1 million for the rest of the year. We’re going to be doubly financed for our exploration program, but we still don’t want to rush out and blindly spend it. We do want to be targeted and systematic with our exploration programs. But if and when we hit good results, we have the money to really attack the projects. We're very well financed and we're very fortunate to be in that position.

Dr. Allen Alper:

Well, that sounds excellent. It sounds like the Company is in a great position to move forward and explore and in a great neighborhood, with great gold discoveries on both sides of you. Could you summarize the primary reasons our readers/investors should consider investing in TRU Precious Metals?

Joel Freudman:

I think the key features are highly prospective properties, well financed, and a strong Management Team, which is relentlessly working to unlock shareholder value. We have a hardworking team, attacking the properties we have, which I think is important, as well as the capital markets and general corporate side. Without getting into all the geology, I've heard a number of comparisons of Newfoundland to the Abitibi Gold Region in northern Ontario and Quebec, which is a prolific gold region. In Newfoundland, the rush really only started last year. It's still probably early days for the runway of the region, which means hopefully a lot more discoveries to come from us and others and also room for the market caps of these Companies to grow. In particular for TRU, I can say we're undervalued relative to comps. It depends on which comps you look at.

In terms of upside potential, we're in the low 20s. If you look at a Company like a Sokoman or Exploits, who are further along in their work plans, some of those Companies are $75, $80, $100 million market cap. For us, being around $20 to $25 million, without really having done much work on our properties, we're only getting started, and without having been marketing the Company for a long time. Of course, I want a higher share price, but I think there's room for us to grow into a higher market cap, provided we can justify it with our exploration results. We have all the pieces in place, it's up to us to deliver. I think if we do deliver, there's no reason that we shouldn't trade in line with the larger, more advanced comps, which would imply good upside and good returns for our shareholders, as well as a more developed Company, in which people would have an investment. So that's what we're working towards.

Dr. Allen Alper:

Well, those sound like very compelling reasons for our readers/investors to consider investing in TRU Precious Metals. Joel, is there anything else you’d like to add?

Joel Freudman:

I think that's pretty good coverage. Our tagline is “relentlessly working to unlock shareholder value.” We have a very dedicated Team, who is constantly trying to come up with ways, on the exploration side and/or the capital market side, to build the value of the Company. I think if you want to bet on people, who are thinking like owners, that's an additional way to look at the investment. I own about 5% of the Company. We have a number of large, longer term shareholders each around 4% to 7% 5% to 10%. There are a lot of people here who are heavily invested financially and reputationally to grow the Company and expand the value of the Company. If people want to toss their hat in the ring and come along for the ride, we’d welcome it.

Dr. Allen Alper:

Excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.trupreciousmetals.com/

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

|

|