Justin Cochrane, President, CEO & Director of Nickel 28 Capital Corp. (TSXV NKL) Updates us on Nickle 28’s Outstanding First Quarter

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/22/2021

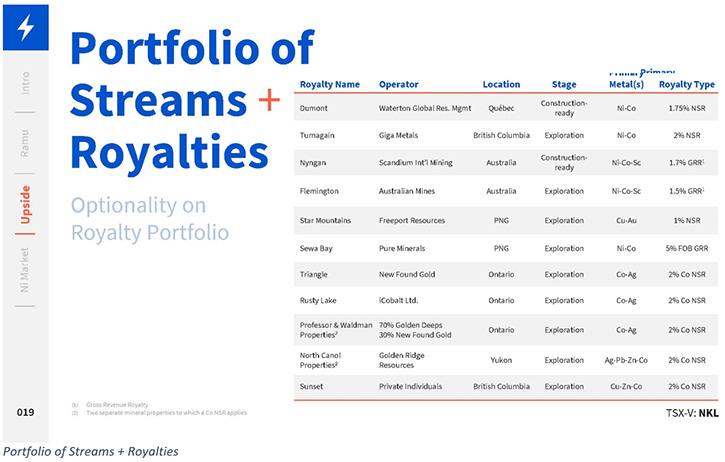

Justin Cochrane, President, CEO & Director of Nickel 28 Capital Corp. (TSXv NKL) updates us on Nickle 28’s outstanding first quarter. Nickel 28 Capital Corp. is a nickel-cobalt producer through its 8.56% joint-venture interest in the producing, long-life and world-class Ramu Nickel-Cobalt Operation, located in Papua New Guinea. Ramu provides Nickel 28 with significant attributable nickel and cobalt production, thereby offering our shareholders direct exposure to two metals, which are critical to the adoption of electric vehicles. In addition, Nickel 28 manages a portfolio of 13 nickel and cobalt royalties, on development and exploration projects in Canada, Australia and Papua New Guinea.

Dr. Allen Alper:

I'm looking forward to talking with you and updating our readers/investors on what's happening with Nickel 28. It’s been an exciting year so far.

Justin Cochrane:

It’s been a great year! The nickel price is certainly helping, and the operation is performing exceptionally well. It’s been an exciting 12 months and should be a very good next 12 months as well. We’re pretty excited!

Dr. Allen Alper:

That sounds excellent! That’s sounds great, you’ve also done great on your balance sheet too, isn’t that correct?

Justin Cochrane:

Yeah, absolutely. We just reduced debt by $15.4 million at the beginning of the year. It was a great performance the last half of 2020. We started off this year just as well, if not better! So, we are expecting this year to be just as good.

Dr. Allen Alper:

Well, that sounds excellent. While we're waiting for Anthony, could you talk a little bit about the primary accomplishments this year and also a little bit about what Ramu is doing.

Justin Cochrane:

Absolutely. I would say the biggest accomplishment so far this year would be that $15.4 million dollar reduction in debt. That was done on January 1st of this year. In Q1 2021 Ramu had just exceptional performance, its best quarterly performance ever, as a mine, when you look at free cash flow. We just announced Q1 2021 results a couple of days ago and costs in Q1 were $1.70 per pound of nickel. The nickel price was almost $8 a pound on average. Meaning our margin was just less than $6.30, which was the best margin that we've ever had in the Company's history, on a quarterly basis. So just an outstanding quarter!

Dr. Allen Alper:

Well, that's excellent. Your stakeholders and shareholders are being rewarded by that performance.

Justin Cochrane:

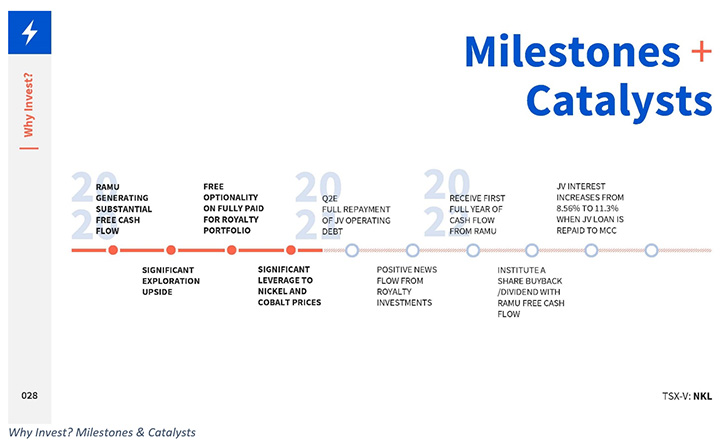

I think so. We’ve seen the share price basically double, jump almost 100% from where we started the year. We had a nickel price that over the last four quarters has gone up on average, every quarter. The nickel price has been strong again in the second quarter of this year. What that means for shareholders is we’re going to be repaying our JV debt at as rapid a pace as we ever have, as shown by the $15.4 million repayment in January.

We're expecting something similar after the first half of this year, which will mean that we should be generating positive cash flow from Ramu in the second half of this year, which is almost six months to a year earlier than anticipated. It's been a great last 12 months.

Dr. Allen Alper:

Well, that’s excellent, that’s really outstanding performance. Could you tell our readers/investors a little bit more about the financial results of Ramu and how that's doing? Also, could you tell us about the potential of Ramu production increasing and the potential for cost reductions.

Justin Cochrane:

Ramu, as a mine, produces around 33,000 tons of nickel and about 2,900 tons of cobalt on an annual basis. The mine is operated above its nameplate capacity of 32.6 thousand tons of nickel in every year since 2017, since the mine ramped up. Which is the only nickel project in the world that can say that. It's had that kind of nickel performance! MCC, our Chinese partners, who operate the mine, have just done a fantastic job. They have looked at the ability to expand the mine at various points in time.

There is an opportunity to double the capacity at Ramu, which is a significant upside scenario for us, as we don't actually have to fund our capital commitment as part of that, we would just naturally be diluted. Our interest in the mine would be diluted, but the dilution formula is very favorable to us. Most importantly for shareholders, we have a current interest of 8.56% in the Ramu mine. But as we repay our construction debt, which we anticipate will happen over the next few years, our interest automatically increases to 11.3% at no additional cost to Nickel 28.

Two meaningful pieces of upside exist at Ramu today, which are quite near term. The first is the repayment of our operating loan. We expect that to happen in the first half of this year. After we repay that operating loan, we start getting 35% of our attributable cash flow. That amount is over $9 million US a year, at today's commodity prices. So very significant cash flow generation again, which we anticipate will start in the second half of this year.

Then the repayment of the construction debt, which to date sits around $81 million that will be repaid over the next several years. Once that's repaid, our interest in the project increases to 11.3%. Then following that repayment of construction debt, we also have an option to acquire an additional 9.25% stake in the project, which would take our interest to 20.55%, so over a 20% stake in one of the largest and best performing nickel assets in the world. That's just our Ramu Project, of course. As you know, we have 13 other royalty investments inside the Company as well.

Dr. Allen Alper:

Well, that sounds excellent. It's great to be so profitable and have an opportunity to increase the profit as time goes on and to be developing and benefiting from the operation of such a fast project like Ramu. What kind of life does it have? My understanding is it’s quite substantial.

Justin Cochrane:

Based on our reserve life, we have about a 15-year mine life remaining. But our operating partner doesn't have any need to do reserve-based drilling beyond 15 years, it’s lots of room to manage the mine plan. On a resource life basis, we have almost 35 years of resources and that resource base of 35 years is only on 15% of our exploration license at Ramu. We believe this is a mine that will operate for well over 50 years. We’re pretty excited about the project.

Dr. Allen Alper:

That’s excellent. Could you tell our readers/investors all about the royalty portfolio and some of the most interesting aspects of it?

Justin Cochrane:

We do have 13 different royalties inside the Company. We will focus on two primary royalties and the first is a 1.75% NSR on the Dumont Nickel-Cobalt Project in Quebec. This is a fully permitted, construction ready project, one of the largest undeveloped Nickel-Cobalt reserves in the world. It is a nickel sulfide mine in Quebec, Quebec being one of the best jurisdictions in the world to build a mine. This is a mine that, once it's operational, will generate over US$10 million in revenue to Nickel 28.

The project today is owned by Waterton Private Equity. As we understand, Waterton is actively looking for a joint venture partner or buyer for that project, so we're pretty excited about what that could mean for the project and putting it on a development path, in the near term. The second royalty asset of note is the Turnagain Project in British Columbia. Turnagain is owned by Giga Metals. It is undergoing a feasibility study now and Nickel 28 has a 2% NSR on that project. That project, once operational, would generate over US$8 million of cash flow to Nickel 28 using today's commodity prices.

This is one of the world's largest Nickel-Cobalt projects. What's unique about both Dumont and Turnagain is their nickel sulfide projects. They have a unique property, within their tailings that naturally absorbs CO2. They are both exploring the potential of these projects being carbon neutral sources of nickel and cobalt supplies. If you can imagine the North American and European battery makers and what you have and Dumont's and Turnagain, is a potential North American supply of carbon neutral nickel and cobalt.

We believe both of those projects, just on that basis, could receive premium pricing for their concentrate and pretty excited about what that means for a green economy. In particular, when you think about electric vehicles and automakers, in their need to source green and environmentally friendly metals. Very excited about those two projects and there’s another 11 royalties at various stages of exploration and development behind those two primary royalty assets.

Dr. Allen Alper:

That's excellent. You’re in an outstanding position to have large cash flow right now and two amazing projects, moving forward and having other great royalties. Why don't you tell our readers, investors what is happening, with the electric vehicle market? Also about the electric storage market and the role that nickel and cobalt is playing in that market.

Justin Cochrane:

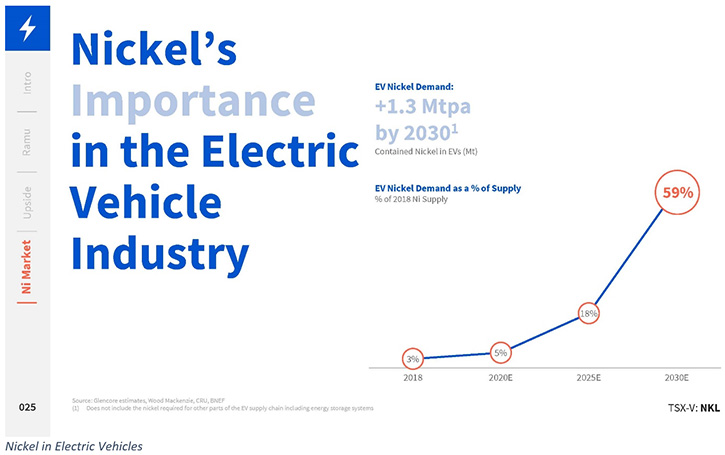

What we have seen in the EV market is that through 2020 it continued to grow at a rate of over 4% with over three million vehicle sales, over the course of the year. That, of course, in spite of all of the global slowdown that we experienced because of COVID-19. Sales have been exceptionally strong. All the news around the global automakers seems to circle around their electric vehicle plans. I believe readers just a couple of days ago would have seen Ford’s F-150 electric vehicle that was released, just an outstanding looking truck. And of course, this is the greatest selling passenger vehicle, I believe, over the last 40 years. Ford's move to create an electric vehicle of their F-150 is a huge move for the industry. That was a milestone event for the electric vehicle industry.

The reason why we all care about nickel and cobalt, within the electric vehicle market, is nickel and cobalt are the key inputs into the lithium-ion battery, the NMC battery, where there's a move towards higher nickel content in those batteries, to increase energy density and range. Also, manganese and cobalt are key inputs into those chemistries. What it means is, as we look over the next five to 10 years, the adoption rates for electric vehicles, will require significantly more nickel and cobalt to be produced and supplied, to meet the demand from these automakers and battery makers worldwide.

That means you need a much higher nickel and cobalt price to incentivize that new nickel and cobalt production. What we have in Ramu and in our royalty portfolio, is a number of tremendous assets to provide significant leverage to higher nickel and cobalt prices. The same is true in the energy storage market. There's been significant new investment by governments, around the world, that are looking at grid storage as the source of stability for their power grids, new sources of storage for many industrial and other commercial applications to support those operations.

A big move in energy supply, but EVs are really the focus for this industry. We're quite excited and really would not have forecasted the kind of growth that we've seen, even looking back three to five years ago. I don't think anybody was forecasting the kind of growth we've seen in electric vehicles, and it just seems to be picking up pace at an alarming rate. You have Tesla, with a larger market cap than any other automaker in the world, by quite a margin. That's pretty exciting for the space.

Dr. Allen Alper:

Oh, that's excellent. Nickel 28 is in an excellent position to meet the demands of the growing electric vehicle and storage market. Could you tell our readers/investors a little bit about Anthony and both of your successful and accomplished careers?

Justin Cochrane:

I've been in the finance industry and specifically the royalty and streaming business for the last 15 years. I started my career as an Investment Banker, for a decade, spent the last 15 years of my career specifically in royalty and streaming. I was the Head of Corporate Development for Sandstorm Gold for five years. Then joined Anthony, about five years ago, and launched Cobalt 27. Cobalt 27 raised a billion dollars in debt and equity in under 13 months. We built up the largest stockpile of cobalt in the world and just had a tremendous experience there.

We sold a number of our cobalt assets about a year and a half ago and spun off the remaining assets, which include this portfolio, into Nickel 28 and are very excited about the potential future for Nickel 28. Anthony and I are very large shareholders. Anthony and I and the rest of the Board and Management Team own almost 20% of Nickel 28. Our interests are exceptionally well aligned, with that of our shareholders, and we believe we can drive significant shareholder value through cash flow and news flow. Cash flow from Ramu and news flow from our royalty investment portfolio. We intend to use cash flow to buy back stock and start paying a dividend to get shareholder-friendly initiatives to return capital and hopefully significantly increase the share price, in the meantime.

Dr. Allen Alper:

That’s excellent. It's great to see Management having skin in the game, along with investors. It shows you have great confidence in your Company and you're willing to put your money up front. I know Anthony is well-known in the industry and is so accomplished. Could you say a couple words about him?

Justin Cochrane:

Absolutely, yes. Anthony has been in the mining, metals and energy sector his entire life. He started out as a lawyer. But following that became a principal investor for a large mining & energy hedge equity fund in New York, then went to work in private equity in London and was doing that for a number of years before he and I partnered up. So very distinguished, with a long career in finance. He has a very special mind, in terms of strategizing on opportunities to create shareholder value and look at unique assets for the Company. And he's been a great partner of mine for four or five years now.

Dr. Allen Alper:

Sounds excellent. Could you tell us a little bit more about your capital and share structure?

Justin Cochrane:

The Company has 85.7 million shares outstanding today, and is trading around an 80 cent share price, which drives to a market cap of about $67 million Canadian, which is about $55 million US. We have about 91.5 million in joint venture debt that I referenced before owing to MCC. What's important to note about that debt is it's nonrecourse to the company, it's perpetual, there's no amortizing aspect to the loan. It is purely a cash sweep that exists, as we've talked about previously, and has an interest rate of only 5%. It's a very attractive piece of debt that we continue to repay and have been repaying at a fairly rapid pace over the last several years.

We have about $6.5 million of cash and investments. The enterprise value of the Company is about $140 million. What I would point out is the debt continues to be repaid at a rapid pace, with a market cap of only $55 US. We're expecting over $9 million in cash flow, on an annual basis, coming from Ramu, starting in the middle part of this year.

Investors are only paying about six times cash flow from Ramu, again starting just a couple of months from now, on an asset that we believe has a mine life in excess of 50 years, if not longer. All the upside scenarios around repayment of debt and increased interest in Ramu that we've talked about and, of course, the royalty portfolio that we're very excited about. I would encourage shareholders, when they look at our capital structure and our valuation, to consider the cash flow potential of these assets, the upside potential around our royalty assets and hopefully, like me, investors can conclude that the stock is still very, very cheap and has lots and lots of room for upside.

Dr. Allen Alper:

That sounds excellent. It does sound like there are compelling reasons for readers/investors to invest in Nickel 28. Is there anything else you'd like to add, Justin?

Justin Cochrane:

The only thing I would add again would be to encourage investors to think about the value proposition, with the Company and also to focus on the royalty portfolio. I do think and anticipate that there'll be some positive news out of the royalty portfolio this year that can have a very meaningful impact on our share price. Then continue to follow Ramu's results and our repayment of Ramu’s debt, because I think there's going to be some very exciting upside scenarios for shareholders in the near term.

Dr. Allen Alper:

Definitely 2021 is a very exciting time for Nickel 28’s investors and stakeholders.

Nickel 28 Contact Information

4 King Street West, Suite 401 Toronto, Ontario CA

M5H 1B6

info@nickel28.com

nickel28.com

|

|