Namibia Critical Metals Inc. (TSXV: NMI): Rare Earth Project Fully Funded, All the Way Through to Commercial Production by JOGMEC Partners and Exploring Emerging Gold District of Central Namibia; Darrin Campbell, President Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/17/2021

Darrin Campbell, President of Namibia Critical Metals, tells us more about their projects in Namibia. Namibia Critical Metals Inc. (TSXV: NMI) holds a diversified portfolio of exploration and advanced stage projects, in the country of Namibia, focused on the development of sustainable and ethical sources of metals for the battery, electric vehicle and associated industries. The two advanced stage projects, in the portfolio, are the Lofdal Heavy Rare Earths project and the Epembe Tantalum-Niobium project. The Company also holds significant land positions in areas favorable for gold mineralization.

Namibia Critical Metals

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Darrin Campbell, who is President of Namibia Critical Metals. Could you, Darrin, give us an overview of your Company and what differentiates your Company from others?

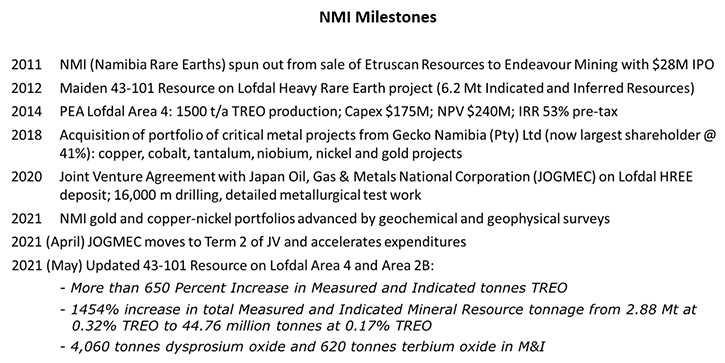

Darrin Campbell: Absolutely. Well, thank you again for the invitation. Namibia Critical Metals was established first in 2011. It was a spin-out of a sale of our previous Company called, Etruscan Resources. Etruscan had brought three greenfield gold projects through to production and then sold to Endeavor Mining, and Namibia Rare Earths, as we were then known. Now Namibia Critical Metals, was a spin-out from that sale. In 2011, we did an IPO for about 28 million and then quietly went about building our portfolio. The flagship project was the Lofdal Heavy Rare Earths project. We believe now, almost 10 years later, that we have established Lofdal as one of the premier heavy earth projects in the world.

We've just recently put out an updated 43-101 resource report on Lofdal on May 20th, and the increases that we've seen in this resource report, from our maiden resource report in 2012, are quite significant. Our measured and indicated tons of TREO resource are up over 650%. We've brought that resource from about 6 million tons indicated and inferred to about 43 million tons. And for us, more importantly, the numbers included in that resource update, the total measured and indicated resource tonnage, has gone through the roof by more than 1400%.

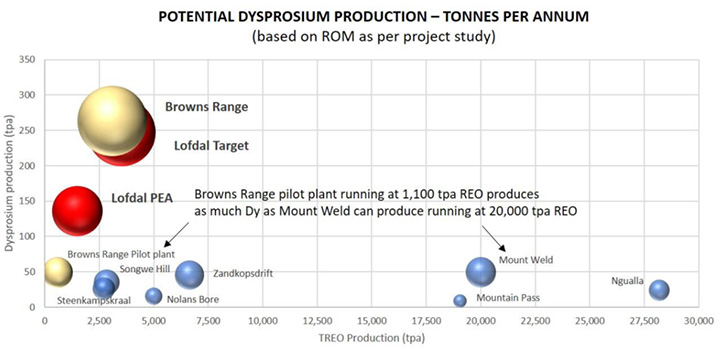

The most important is the amount of contained dysprosium and Terbium oxides that we now have in our resource. One of the criticisms of Lofdal in the past, when we put out our maiden resource report in 2012 and PEA in 2014, was that we were just too small, and we just didn't have enough tonnage of heavy earths, or dysprosium and terbium specifically, and we were looking at only a seven-year mine life. So, people in the investment community had a hard time justifying a CapEx of $150, $175 million for such a small project.

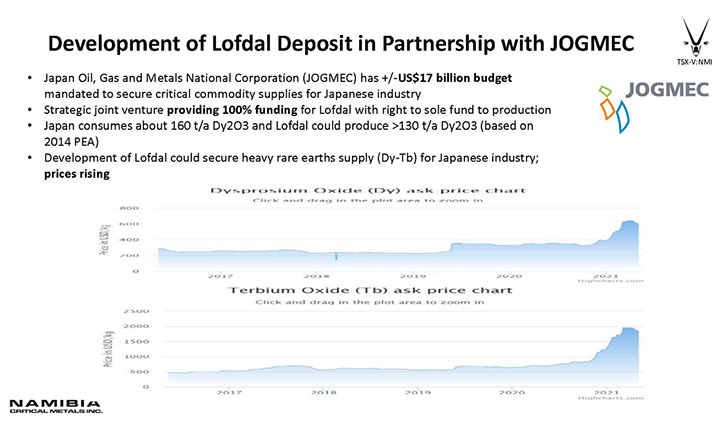

With this resource update, we have clearly changed. It should change that perception. We now have contained dysprosium in all categories, including our very first measured category, we're looking at 4,700 tons of dysprosium oxide and over 700 tons of terbium. And if you're not familiar with what dysprosium and terbium are used for, they're two key components in the production of permanent magnets, which in turn are used in electric vehicle motors, wind turbines and other electronics. These are the two main products that our Japanese partners JOGMEC are after, and it is what drew them to Lofdal in the first place.

Dr Allen Alper: That sounds excellent. That's great news for your investors and your stakeholders and shareholders, the increase in resources. That's excellent.

Darrin Campbell: Yeah, it's really impressive, and this isn't hyperbole. We truly believe that we 100% are in the top upper echelon of heavy rare earth projects in the world. The contained amount of dysprosium and terbium that we have is not easy to find in the world outside of China, and having our JOGMEC partner, about whom I should go into a little more detail. That's another big key differentiator for us. We have a joint venture partner now in JOGMEC that has absolutely the technical and financial muscle to fast-track this project. And that's exactly what we expect.

JOGMEC is the Japan Oil and Gas Metals National Corporation. They're essentially a Japanese government agency, and they have a mandate to secure natural resource supplies for Japanese industry. Almost a decade ago now, they did a similar joint venture, with an Australian light rare earth explorer, called Lynas, and to date, they have funded Lynas to the tune of about 250 million US and are looking to secure a light rare earth supply from Lynas. They have now turned clearly to our project Lofdal, to be their heavy rare earth supplier for the next decade, and that's exactly what we intend to be.

Dr Allen Alper: Oh, that sounds excellent. It sounds like you're in a great position to have a great resource and a great partner and access to funds to explore and develop your project.

Darrin Campbell: Absolutely, and another obvious key component, with all rare earth projects, is first of all, you have to find them in economic quantities and then you have to be able to extract and process them, economically. Another really important workflow that has been ongoing, with our JOGMEC partners, is to do a lot more metallurgical work and improve our flow sheet that was originally conceptualized in our 2014 PEA. And we've done it. We spent a lot of time on that and a lot of funds from JOGMEC on fine-tuning that, and we believe we're very close to finalizing the revised flow sheet that will eventually produce a thorium-free, mixed heavy rare earth carbonate product for export to Japan. And so we foresee a really good opportunity to reduce both the CapEx and the OpEx of this project that was originally envisioned in that initial PEA. So, a lot of really good progress in a lot of fronts!

Back to the resource update, we believe also that that's really just the tip of the iceberg for us. Our geological team has made incredible in-roads, this last year, with our JOGMEC partners, really cracking the code of this deposit. And for the first time this year, we did a step out of drilling away from our main zone, which is known as Area 4, and we established our very first satellite deposit, known as Area 2B. With only 4,000 meters of drilling in Area 2B, we added over 4 million tons of resource to this project. We think there is still considerable upside in additional areas, known as 5A, B and C, to add significantly more mineralized resources to this project. So, the criticism that we had in the past that we had only a seven-year mine life, in a small project, we believe now, with this resource update, we have the potential to be a generational mine that will operate for decades, not years.

Dr Allen Alper: Oh, that sounds excellent. What are your major plans for 2021 and going into 2022?

Darrin Campbell: In conjunction with our JOGMEC partners, we're spending a lot of time on fine-tuning our flow sheet and our hydrometallurgical work. The next logical steps would be to do an updated PEA and then look to fast-track this through to a PFS stage, within the next 12 to 14 months. Another really big development that we announced in December, of this year, was our receipt, from the Ministry of Mines and Energy in Namibia, of a letter with their intent to grant us a mining license. This is really significant. This is a mining license that we originally applied for back in 2016 and is now expected to be issued officially imminently, within a matter of days or weeks.

This is a significant development for our JOGMEC partners, who are looking not only for economical deposits throughout the world, but also mining licenses to be able to put them into production, equally as important, and we believe we've just handed them both in our first year of partnerships, so fantastic development. And once the mining license is issued, it comes with certain timelines, within which, to get into production. So based on these two developments, the big resource update and an issuance, imminently, of a mining license, we foresee this project rapidly accelerating, much quicker, through to development than we would have thought possible six months ago.

Dr Allen Alper: That's excellent. That's really fantastic news for your shareholders and stakeholders. So you're in a great position right now.

Darrin Campbell: We believe so.

Dr Allen Alper: Could you tell our readers/investors a little bit more about your background, your Board, your Team?

Darrin Campbell: Our Board has a really strong track record of project generation and development, particularly in Africa, dating back to our Etruscan Resources days. Our founders and former Chair and still advisor, Gerry McConnell and Don Burton, were responsible for bringing three greenfield gold projects through to production and sale to Endeavor Mining. Our current Chair and long-serving Director, Bill Price, has a really impressive resume and deep history in capital markets in the US. He was the former Chairman and global Chief Investment Officer for Dresdner RCM Global.

My background is as an accountant by trade. I'm a CPA, based here in Canada. I've been working, with resource companies, for the last 20 years, taking them through from private companies through to public listings. I managed one specific project through to production. I was one of the financial leaders involved in bringing Nova Scotia's first underground gold mine into production, within the last 15 years. So, we have a really deep bench of technical advisors: our Vice-President of exploration, Dr. Rainer Ellmies, who is based in Namibia, runs all of our in-country operations. Rainer has a really impressive resume of greenfield discovery in Namibia, including being the discoverer of our Lofdal heavy earth project. And we also have, as I mentioned, a deep bench of technical advisors, both on the metallurgical side and geological consulting, and a really experienced field geological team based in Namibia that we work with.

In addition, in 2018, we made a strategic decision to diversify our project portfolio, and we entered into an acquisition agreement, with one of the largest private mining groups in Namibia, known as the Gecko Group or Gecko Namibia. In that transaction that we did in 2018, we acquired the suite of properties; copper, cobalt, tantalum, niobium, nickel and gold. As a result, Gecko became our largest shareholder, and now owner, currently at 41% interest. And they have really deep talent, of technical advisors and entrepreneurial leaders that are key advisors for us, going forward as well. So there are a lot of experienced members on our team.

Dr Allen Alper: That sounds great. It sounds like you have a very talented, diverse and very strong Team to move your Company forward. So that's excellent.

Darrin Campbell: Absolutely. And now that we have JOGMEC as our joint venture partner, they have also brought to bear their full resources. They are a huge Company. They have an 18 billion US, per year, budget and have brought a lot of large projects into production throughout the world. Their expertise, not just their financial muscle, but also their technical expertise that they're bringing to the project, cannot be understated. It's been fantastic.

Dr Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

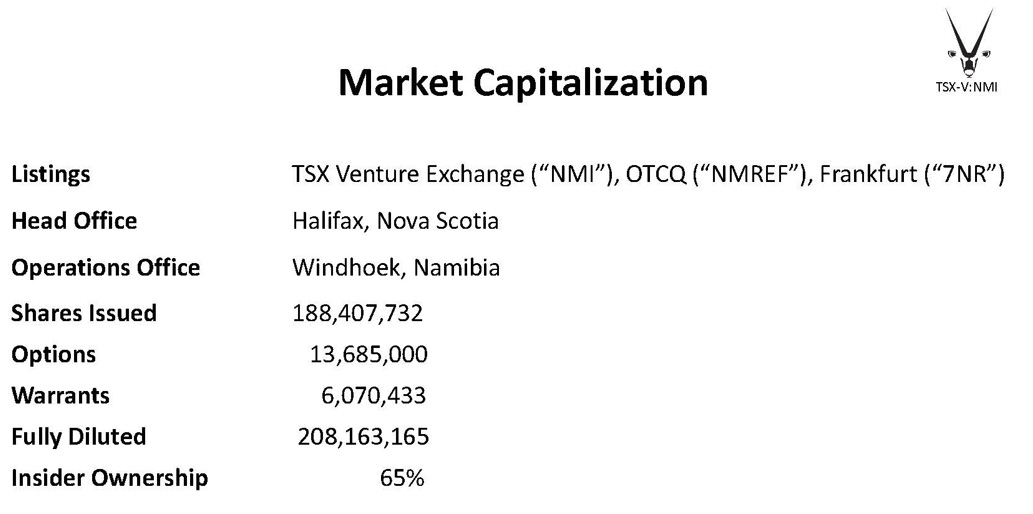

Darrin Campbell: Absolutely. So we're traded on the TSX Venture Exchange in Canada. We also have listings on the OTCQ Pink Sheets, in the US and Frankfurt exchanges as well. Current shares issued are just over 188 million issued, 208 million fully diluted. Current market capitalization, as of yesterday, is just under 72 million, and insider ownership makes up about 65% of issued and outstanding. So this is a very tightly-held stock. And of that 65% ownership, 41% is owned by our single largest shareholder, the Gecko Group, and then another 24% is owned by officers and Directors.

Dr Allen Alper: Well, it's good to see that Management and the Board have skin in the game and are determined to make a go of the Company.

Darrin Campbell: Absolutely. 100%.

Dr Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Namibia?

Darrin Campbell: We believe that we are, unequivocally, one of the top, heavy rare earth projects, in particular in dysprosium and terbium deposits, in the world. We have, if not the best, one of the best joint venture partners in JOGMEC that could rapidly accelerate this project through to commercial production, once those economic decisions are made appropriately. I think, because of our tightly-held share structure and the fact that we are not widely known or followed, we are severely undervalued.

The only other project that is similar to us in the world, a xenotime mineralized heavy rare earth project, would be the Browns Range deposit, owned by Northern Minerals, which is an Australian listed Company. We believe that we are very comparable in the size of our resource to Northern Minerals right now, and if you look at their market capitalization, they're sitting at, I think, around 160 million Australian right now, and we're sitting at 72 million, and just popped up to that recently, just in the last few weeks. We still believe there's a lot of growth potential, once our story is disseminated more widely in the investment community. That's one thing we're starting to try to change, by putting more of an emphasis on investor relations and advertising and marketing and getting our story out to the wider public, because most people don't know us.

Dr Allen Alper: Well, those sound like very compelling reasons to invest in Namibia Critical Metals. You have great resources, great backing, with JOGMEC, and you have a great internal partner who knows Namibia so well.

Darrin Campbell: Absolutely. Yeah. And finally, after many years of the rare earth sector being neglected by the capital markets, it's definitely come back into focus, and we see the stars all aligning at the same time for this project. We have the right Technical Team, we now have the right resource, fully established, and the market prices for dysprosium and Terbium, in particular, look very good going forward to 2030. So, we're really excited about the development of this project and our Company over the next 12 months.

Dr Allen Alper: Oh, that sounds excellent. With electric vehicles growing at such a rapid rate, it seems like there'll be a great need for your critical metals.

Darrin Campbell: Absolutely.

Dr Allen Alper: Is there anything else you'd like to add, Darrin?

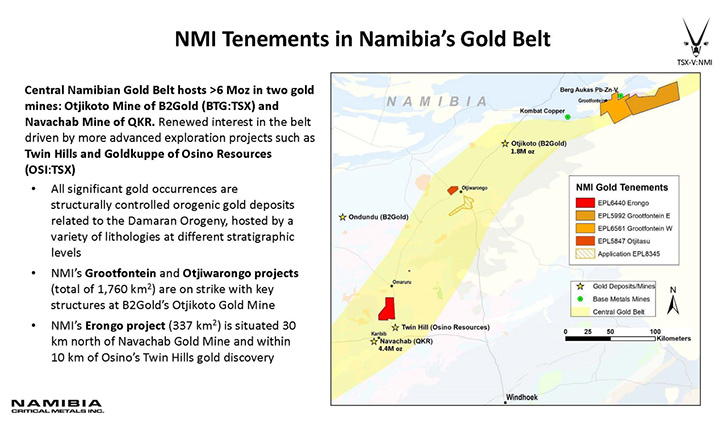

Darrin Campbell: In addition to this exciting, rare earth project, we also have turned our exploration focus back to our gold roots. The rare earth project is fully funded, all the way through to commercial production by our JOGMEC partners, but we also have some really exciting early-stage exploration projects that we're working on now, in this emerging gold district, of central Namibia. B2Gold has an operating mine there, called Otjikoto. There's another privately-owned mine, called Navachab, in this district, and combined, those two projects have about 6 million ounces of gold reserves. There are a couple of other junior mining companies that are now working in that area. One of note is Osino Resources, out of Vancouver. They just put out a maiden resource on their Twin Hill gold discovery.

This area is getting a lot of attention, and we have a land package of about 1700 square kilometers of gold projects that we're just starting to focus on, over the last three or four months, and we expect to be doing a small drill program, on two of the three projects that we have there. We're really excited about that! We're seeing some really nice drill targets developing, out of the groundwork that we've been doing there for the last few months. And so, I see our shareholders really benefiting from a two-pronged continuous news flow, over the next 12 months, mainly being our Lofdal heavy earth project. But we also expect some good news flow coming out of this gold exploration program that is just taking off.

Oh, that's really great news for your investors. It sounds like 2021 will be a truly exciting period for them.

Darrin Campbell: It has been already, and yeah, we're looking forward to the rest of the year as well, for sure.

Dr Allen Alper: That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Namibia Critical Metals Inc.

Darrin Campbell, President

Suite 802,

Sun Tower 1550

Bedford Highway

Halifax, NS B4A 1E6

Phone: +01-902-835-8760

Fax: +01-902-835-8761

https://www.namibiacriticalmetals.com/

Namibia Rare Earths (Pty) Limited

8 Brandberg Street

Windhoek

Namibia

Phone: +264 61 225826

Fax: +264 61 225304

|

|