Sunrise Energy Metals (ASX: SRL; OTC: SREMF): Sunrise is the owner of the Sunrise Battery Materials Complex in NSW, Australia. The Project is Australia’s largest and most advanced battery materials project and will produce critical metals for Electric Vehicles.; Sam Riggall, Managing Director and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/12/2021

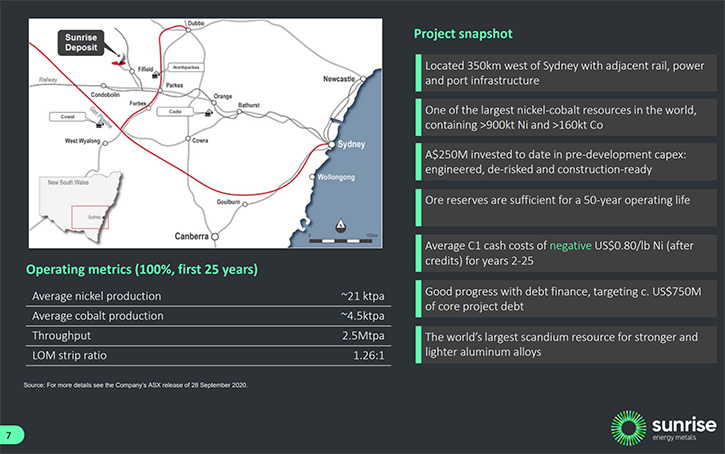

We spoke with Sam Riggall, who is Managing Director and CEO of Sunrise Energy Metals (ASX: SRL; OTC: SREMF). Based in Melbourne, Sunrise Energy Metals is the 100% owner of the Sunrise Project, located in New South Wales, 350km west of Sydney. The Sunrise Project is one of the largest cobalt deposits outside of Africa, and one of the largest and highest-grade accumulations of scandium ever discovered.

Sunrise Energy Metals

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sam Riggall, who is Managing Director and CEO of Sunrise Energy Metals. Sam, I wonder if you could give us an overview of your Company and what differentiates your Company from others?

Sam Riggall:Sunrise Energy Metals has been operating for over 30 years. We're a world leader in hydrometallurgical processing technology, in particular using ion exchange systems to pull metals out of solution, at very high efficiency. We can use this technology in a range of applications - basically, if it’s in solution we can use ionic chemistry to extract it. It's a very versatile technology. As long as you can get metal into solution, you can use ionic resins to extract them, with very high recovery and at low cost.

This is technology that has been proven at scale over many decades. At Sunrise, we have taken this technology platform, scaled it, and designed it to manage solutions containing a high-solids content – what we call cRIP, or continuous resin in pulp. This has enormous relevance for the fast-growing battery industry. cRIP can be used to extract key elements, like nickel and cobalt, out of leached ore pulps to produce a product that can be used in the production of a lithium-ion battery.

Dr. Allen Alper:

That sounds excellent. From my understanding, this is a very low-cost process that will be very competitive.

Sam Riggall:

That's right. What drives the cost structure of processing metal, in this way, is a few things. One is that it has a much smaller footprint than conventional processing systems, which are focused on separating liquids from solids. If you think about the very large decantation circuits you see at mine sites, they take up an enormous footprint and are expensive to build. In our case, we do it with a much smaller footprint and therefore the capital is reduced significantly. Perhaps more importantly, ion exchange can concentrate the metals in a solution to a much higher concentration than you get from conventional processes. Which means that for a given volume of solution entering a refinery, you have a lot more metal that can be pulled in the circuit. You're looking at significant reductions in capital, but also reductions in reagent use because you're just dealing with a much lower volumetric flow.

Dr. Allen Alper:

Sounds very good! My understanding is that Sunrise is a nickel and cobalt laterite deposit. Is that correct? Could you tell us a little bit about that?

Sam Riggall:

That's right, there are a number of districts across Australia that host lateritic nickel-cobalt resources. There are also a couple of operating nickel laterite mines in Australia today. Sunrise is a very unusual laterite, which is what attracted us to it in the first place, in that it has a very high cobalt content. For every unit of nickel you produce at Sunrise, we generally produce somewhere between two to four times more cobalt as that produced at a conventional nickel-cobalt laterite operation. That's just a function of the geology, it has nothing to do with the process we use.

The deposit is large and long life. It will have a mine life of approximately 50 years, and over that time there will be almost a million tons of nickel and over 150,000 tons of cobalt extracted from the resource. That makes it one of the largest cobalt resources in the world outside Africa. There's enough nickel and cobalt in Sunrise to convert about one-third of America's light vehicle passenger fleet to electric today.

Laterite nickel resources have a mixed reputation in the mining industry. There have been some large failures, but there have also been some significant successes. It’s important to recognise that these projects are capital intensive, but once up and running they can operate at very low cost over many decades. That’s why we say that if the world wants electric cars, it will be the laterites that do the heavy-lifting. There just aren’t enough sulfide resources to make a meaningful dent on the projected demand for nickel. And with laterites processed, using hydromet you get the cobalt, another key battery metal, as a by-product.

It is no coincidence that some of the best cathode material manufactured in the lithium ion battery industry is made by companies that are integrated upstream into the mining of nickel laterites. Control over the resource and the way the metal is processed gives them exceptional control over impurities and product quality.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors your timing to develop this project?

Sam Riggall:

The project has secured all key permits. We have completed a bankable study on the project and, in September last year, we released what we call our Project Execution Plan (PEP). The PEP provides the most current update on development costs and the execution plan. The capital cost is US$1.8 billion inclusive of contingency. We are currently putting together the financing package for the project. As I mentioned before the nickel laterite deposits have a high upfront capex. But that is more than offset by the low operating costs of the project, which are anticipated to be negative over the first 25 years of operation.

We've been working very closely with banks, targeting about 50% gearing for the project. We also engage with potential industrial partners who may be interested in offtake from the project. Many of the global auto manufacturers are looking to increase their direct participation in the battery raw material supply chain and Sunrise offers a significant opportunity for them.

From a final investment decision, it is three years to first production.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about your outstanding Board, Management Team and yourself?

Sam Riggall:

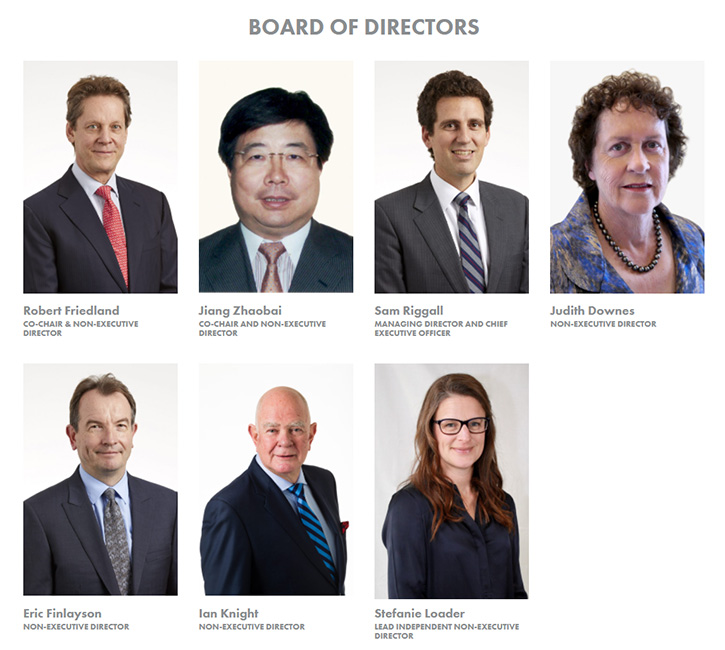

Our Board is co-chaired by Robert Friedland and Jiang Zhaobai, both of whom are also major shareholders in Sunrise Energy Metals.

We also have a very experienced Management Team, who have lived through new project development and delivery.

As I said earlier, laterite development requires more upfront capex than other projects, and one of the key yardsticks for success is ensuring that pre-development activities are well-funded. These projects need to be front-end loaded to ensure the best chance of fit-for-purpose design, smooth construction and rapid commissioning. Approximately A$250M has been invested in Sunrise to date which, in our view, is the entry cost to play this game. This includes an extensive drilling program to understand the resource and multiple piloting campaigns to reduce the risk of any surprises. We were fortunate that we were able to assemble such a large and experienced team of geologists, miners and process engineers, many of whom have extensive nickel laterite experience.

We are also very excited about the further geological potential of the region in which we operate. We recently announced a stunningly high-grade platinum intersection from our first drill hole that went under the nickel-cobalt resource (0.6m from 255.9m at 129g/t Pt, 1.23g/t Pd, 1.79g/t Rh, 4.00g/t Ir, 0.89g/t Os and 0.28g/t Ru). Shortly we'll begin the second phase of that drill program to determine the extent of that platinum mineralization. Our hope is that we can define a large, high value platinum system underneath the laterite.

Dr. Allen Alper:

That's excellent! That's really great! Sam, could you say a few words about your own background? I know you have excellent accomplishments.

Sam Riggall:

I started my career in the mining industry with the Rio Tinto Group. I was there for over a decade, working in a number of roles across exploration, new project development, investment evaluation and capital market transactions. For a number of years, I was the mining executive for Rio’s industrial minerals group, which was, personally, a terrific experience. More than any other business, it was market-facing, focused on collaborative R&D with customers and required a technical capability that was absent in many commodity markets. My last major assignment for Rio Tinto was to lead negotiations in Mongolia for the 50-year Oyu Tolgoi Investment Agreement with the Mongolian Government and Parliament. After Oyu Tolgoi I left Rio Tinto and joined Ivanhoe Mines as head of business development and strategic planning. When Rio Tinto acquired control of Ivanhoe Mines, I decided to do something a bit leftfield, which became Sunrise Energy Metals.

Bear in mind there was almost no enthusiasm, and even less investment, for electric cars or batteries back then. But Robert and I believed that it would happen and that a combination of Sunrise’s technology and a quality mineral resource could be an interesting opportunity. That’s what’s kept me motivated – a belief that there is a better way to do things than currently exists; that we can do it far more sustainably and responsibly than other suppliers; and that at its core is a very effective technology that will become the template for these supply chains in future. At Sunrise we will continue to back ourselves. Being a pioneer is a painful and lonely existence, but that’s how the world moves forward.

Dr. Allen Alper:

Well, that's great! Amazing Board and Team! That's fantastic! Could you tell our readers/investors a little bit about your capital and share structure?

Sam Riggall:

Sure. Our largest shareholders, Robert Friedland and Shanghai Pengxin Mining, between them own approximately 25% of the Company. We have several large institutional investors based in the US also on the register. Our market cap is circa A$200M, with over A$50M in cash in the bank. There is no debt in the business. Bear in mind that $250m has been invested in pre-development capex for the Sunrise project.

At the moment, we are going through a de-merger process to spin-out our water treatment business. It’s a small, but fast-growing business which has made good progress in recent years delivering our ion exchange technology around the world. This includes plants in Australia, the Middle East and Africa.

Subject to shareholder approval the demerger should be completed around the middle of this year, with the water division becoming its own, separately listed, ASX Company, called Clean TeQ Water. At that stage, Sunrise Energy Metals will become a single-asset Company focused on the Sunrise Battery Materials Project in New South Wales.

Dr. Allen Alper:

That sounds excellent. Sam, could you tell us, the primary reasons our readers/investors should consider investing in Sunrise Energy Metals?

Sam Riggall:

I would like to think that for a new investor, it is its compelling value at today’s share price. We have an NPV8 on Sunrise of US$1.2 billion, based on the PEP. Sunrise is forecast to have a first quartile cost position, delivering a negative nickel cash cost (after credits) over the first 25 years of operation. It is a multi-generational asset designed to specifically integrate with the auto supply chain. So, with an enterprise value of about A$150m, for a project that is permitted, engineered and construction-ready, there is a lot of upside. The biggest catalyst, of course, is funding. That’s where we are focusing our attention.

The other key motivator for investors should be impact. If the world wants to decarbonize, mining becomes an incredibly important part of that equation, and we need to do it better. We need to bring a new toolkit. It is projects like Sunrise that will do that. The viability of raw material supply chains, hinges on a number of factors - cost, the sustainability of the operating practices employed and geopolitics. If you believe in a world, where new technologies are needed to provide sustainable energy storage solutions, the world needs more than one Sunrise. All we can do is provide a template for how we think things can be done better.

Dr. Allen Alper:

Well, that's excellent. Those are very compelling reasons our readers/ investors should consider investing in Sunrise Energy Metals. Sam, is there anything else you'd like to add?

Sam Riggall:

The scale of expansion in mining activity that is required to deliver the world’s decarbonization objectives is not well understood. It will require a level of capital investment that the industry has not seen before, and it will require an enormous amount of management capability and experience to bring the projects on that are needed.

We see the next few decades as being a period of extreme expansionary activity in mining. Perhaps not for every metal, but those that are required for decarbonization will be key. Products like nickel, cobalt, lithium, graphite, copper – they will all be critically important.

It’s exciting, but the most important thing to remember is that we have to do this responsibly and sustainably. We need to bring a different mindset to how we build and operate mines and process metals; how we manage waste; how we conserve water; opportunities for recycling; and how we improve rates of discovery across the industry.

Dr. Allen Alper:

I appreciate you sharing those insights with our readers/investors. That's great! Is there anything else you'd like to say?

Sam Riggall:

No, that's all. Thank you.

Dr. Allen Alper:

Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.sunriseem.com/

Ben Stockdale

CFO and Investor Relations

+61 3 9797 6700

|

|