Chesapeake Gold Corp. (TSXV: CKG, OTCQX: CHPGF): Discovering, Acquiring and developing Major Gold-Silver Deposits in North and South America; Alan Pangbourne, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/29/2021

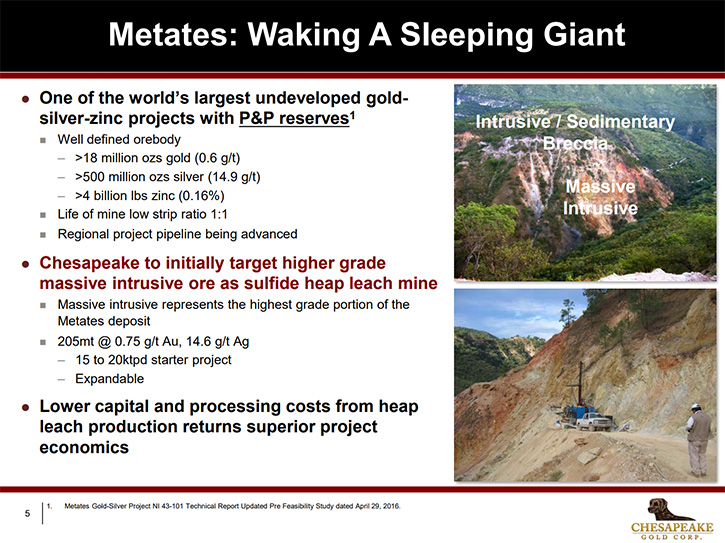

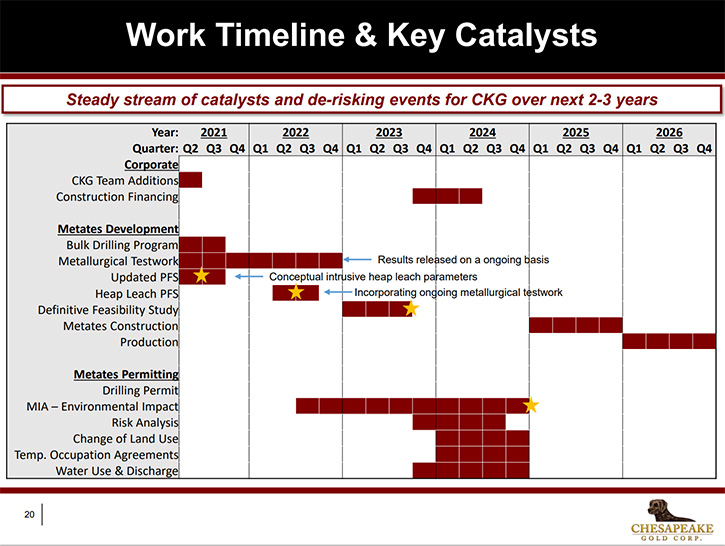

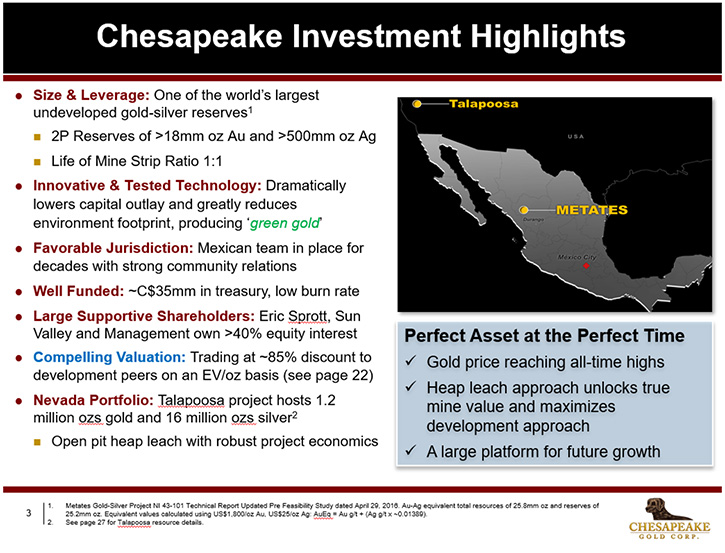

We spoke with Alan Pangbourne, who is CEO and Director of Chesapeake Gold Corp. (TSXV: CKG, OTCQX: CHPGF), the mining development company, focused on the discovery, acquisition and development of major gold-silver deposits in North and South America. Chesapeake’s flagship asset is the Metates gold-silver-zinc project, located in Durango State, Mexico. Metates hosts over 18 million ounces of gold and 500 million ounces of silver and is in the top five undeveloped deposits in the world. According to Mr. Pangbourne, they expect to produce a PFS in the middle of 2022, feasibility permitting, to begin in 2023, to start construction in 2025, operations in 2026, and then they will look at expansion stages.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News. I'm talking with Alan Pangbourne who is CEO and Director of Chesapeake Gold Corp. Alan, I was wondering if you could give our readers /investors an overview of your Company. I know it's an amazing Company, with huge Gold and Silver reserves. I wonder if you could tell our readers/investors what differentiates your Company from others.

Alan Pangbourne:

What makes us different? I guess the simple answer to that is it is a massive reserve and resource in Mexico at 25.2 million ounces of gold and silver combined. It is in the top five deposits, around the world that haven't been developed yet. With the recent amalgamation, Chesapeake absorbed Alderley Gold, and we changed the Management Team. We came with a technology that allows us to heap leach gold sulfides. It's actually the pyrite, another iron sulfide, to then be able to recover the gold and silver.

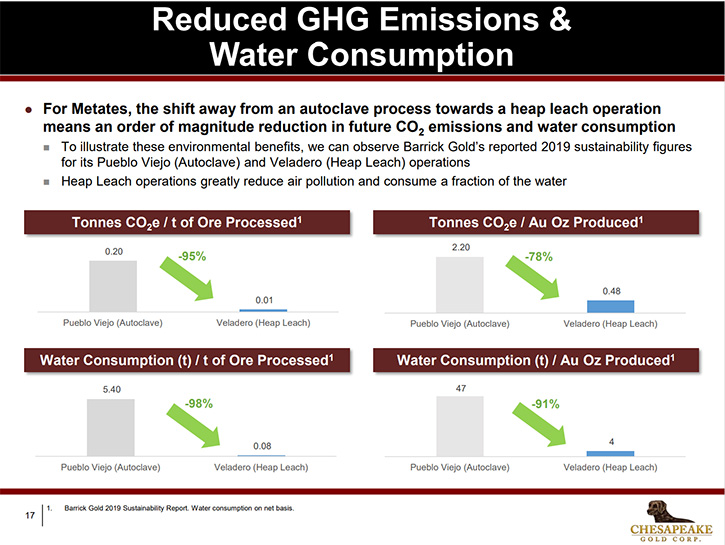

By moving to a heap leach environment, instead of the more complicated and expensive autoclave processes, we can see significant reduction in capital costs, operating costs, simplicity and it is actually also environmentally more friendly because it uses a fraction of the water, a fraction of the power, and there is no tailings dam associated with it. Water and tailings dams are really hot button issues with local communities because everybody's concerned about their water supply. Obviously, given more recent events around tailings dam, nobody wants to live near a tailings dam these days anymore.

That's what makes it different. Our Company is different from others, because with this technology, we will be able to unlock the value in the Metates Project in Mexico that has sat dormant for many, many years now because of a perceived metallurgical problem, which was really an economic issue. With lower capital, lower operating costs, the ability to design and build a financeable, buildable, deliverable, operable and then expandable project is increased significantly. That's what we plan to do over the next few years, is advance this project to the point that we can build that first stage. Then expand multiple times to take advantage of all of the mineral endowment that we already know where it is. We don't have to drill it and find it. This is not an exploration story, it's a development story.

Dr. Allen Alper:

That sounds so exciting. Could you tell our readers/investors a little bit more about your production plans for getting the project into production and what kind of schedule you might be looking at?

Alan Pangbourne:

It takes time to develop a mining project. The one advantage we have is we already know where the ore body is, so there isn't the exploration timeline to be concerned about. When we took over Management the first thing, we did was look at what work program we need to develop to be able to get into production. The first thing we need to do is drill a large diameter core, which we've already started doing. We'll drill about 2,500 meters to give us 10 tons of material to start metallurgical test work. That's the critical phase of the program. That metallurgical test work is going to take us 18 months to two years because heap leaching is not fast and you can't speed it up that much, you have to do the test work correctly. What we are going to do in the meantime and again, we've already started that, we're producing a study, which we hope to get out into the market late June and early July. That study will show what a heap leach version of this technology at Metates at 15 to 20 thousand tons a day will look like, from a capital cost, operating costs and what the development path and timeline looks like going forward. That will be June or July this year.

Once we have the majority of the test work done, in the middle of next year, 2022, we expect to produce a PFS, solely on the heap leach option to be able to show investors the full economic impact and the next steps going forward. The next step after that will be to do a feasibility study and start permitting, that will be in 2023. We currently have enough financing to do all of that work and get us to the end of the FS and then we would start the formal financing efforts to be able to have the funds to build this financeable, scalable project that we want to build at Metates.

We expect between permits and financing that will take up to a year. We would start construction in 2025, operations in 2026, and then look at how many and what size stage expansions we would have on that. Given the size of the reserve and resource, that's why we believe Metates can be the cornerstone asset, and that we can build a new mid teir gold producer.

Dr. Allen Alper:

That sounds excellent. Sounds like this year and the next few years are going to be exciting times for Chesapeake Gold, as you move forward with your project.

Alan Pangbourne:

Yeah, that's right, we're really excited that we could do the deal with Chesapeake and get involved with the Metates Project. We believe that the technology will unlock the value that's there, and it will also give us an ability to actually look at other opportunities for other mispriced sulfide ore bodies that are currently untreatable. We'll also be looking at some of those in the future as well.

Dr. Allen Alper:

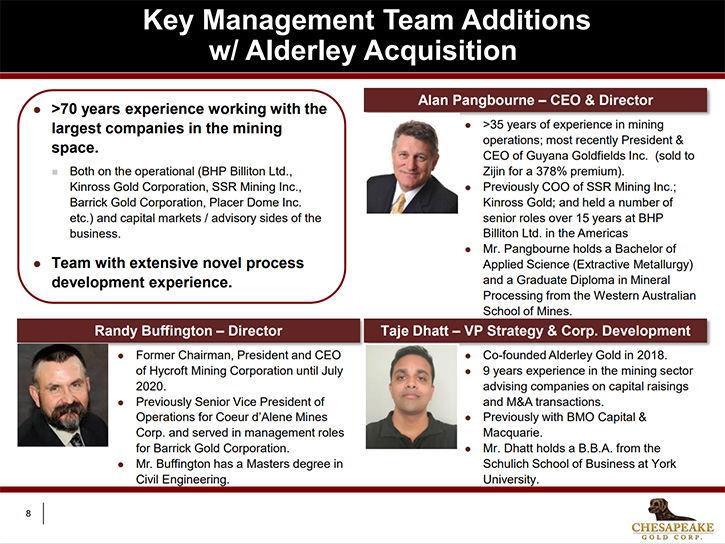

That sounds excellent. Could you tell our readers/investors a little bit about your background, your Team and your Board?

Alan Pangbourne:

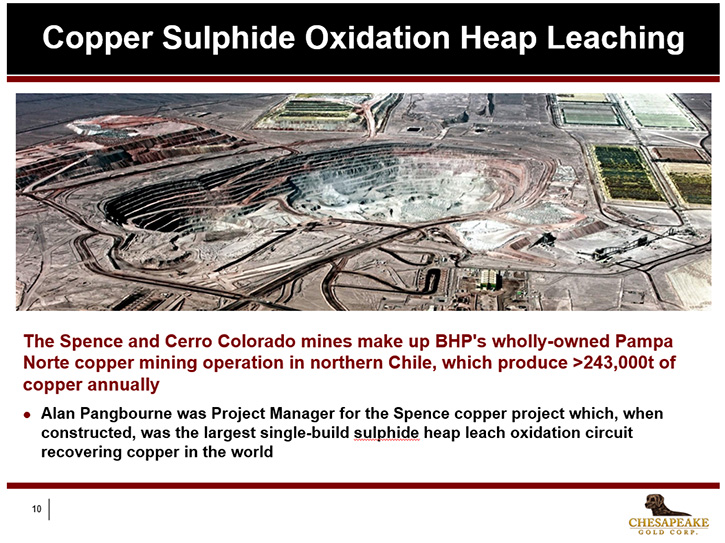

I'm a Metallurgist by profession and I've been in the mining industry my entire career. If you look back at my past, I either build it or fix it. I built some of the larger projects in the world. I built the Spence Project in Chile, which was a copper project for BHP that was a billion-dollar project back in 2002, when you could still buy something for a billion dollars. That was actually the largest single build sulfide heap leach in the copper industry, producing over 200,000 tons a year of copper. That's where a lot of this technology and the concepts come from.

The copper industry has been leaching in a heap leach environment, secondary copper mineralization now for 30 years. About 10% of the world's copper is produced using this technology. It's really a transfer from the copper business to the gold business. Also, while I was at BHP, I was President and COO of Nickel Americas, so I looked off to Colombia, Guatemala and Cuba for BHP, in an operating role and responsible for P&L of an entire part of the business. My most significant recent role, I joined SSR mining in 2013, just after John Smith joined to fix Argentina. They built a mine Pirquitas in Argentina and it wasn't quite working properly. I joined the team to help John fix it. We managed to fix that asset, increase production, lower costs. We then did two more acquisitions, over the next five, six years in Marigold in Nevada and Seabee in northern Saskatchewan and I was the COO through that time period.

We also improved both of those operations and we were able to take the Company from $500 million market cap back in 2013 through to over $2 billion and production from 100,000 ounces, 400,000 ounces over that same time period. We hit guidance every year for seven years. So that gives you an idea of the way I approach things. I'm a builder. I'm a fixer and we do what we say we're going to do and then deliver.

As far as the rest of the Team, interestingly with SSR merging with Alacer recently, many of the team members in Vancouver have become available. Carl Edmunds has already agreed to come and help us on the geology side. We're talking to some of the others as well or other people I've worked with in the past, to come and do it again. Our aim is to try and build the next SSR, in one way.

We've changed a few people on the Board. I've joined the Board. Randy Buffington joined the Board. I have a supportive Board for this new, next stage of the Company, looking at how we can turn it from an exploration story into a true developer and then a mid tier producer.

Dr. Allen Alper:

Wow, it looks like your Company is in great hands. You have an excellent background, excellent experience. You've done it before, and it looks like you and your Team will be able to do it again and maybe even bigger and better.

Alan Pangbourne:

That's certainly the hope and the plan. Just stay tuned and we'll keep delivering what we say we're going to do in the time we say we're going to do it and march the project forward.

Dr. Allen Alper:

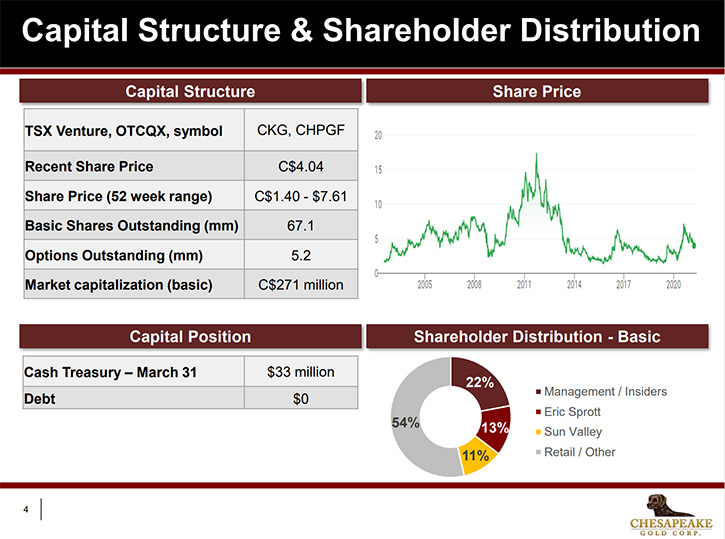

That sounds excellent. Could you tell our readers/investors about your capital and share structure? I know you have some very strong notable backing.

Alan Pangbourne:

Currently outstanding are 67 million shares. Our two largest non- management shareholders are Eric Sprott, who has, I think, about 8.4 million shares of that 66 million. He recently put more money in, back in August last year. Then Peter Palmedo, from Sun Valley, also has 7.4 million shares and then management controls about 13 million shares as a block. I think that qualifies as skin in the game, as far as our interests being aligned with the other shareholders. The rest is retail predominantly. Eric has an interesting view on the project. You'll often hear and say, give me a dollar an ounce for the silver, I'll give you the gold for free and we're still undervalued by a factor of two.

If you look at our peers, as a development company, we're actually undervalued by a factor of seven. We're quite excited about the potential upside beyond it just being an option play on the metal price. That's the capital structure. We have $35 million in the bank at the moment, which is enough to get us through all the way to the end of the feasibility study, which is when we would start looking for project financing, to actually build the project.

Dr. Allen Alper:

That sounds excellent, that's really outstanding. Could you tell our readers/investors the primary reasons they should consider investing in Chesapeake Gold Corp.?

Alan Pangbourne:

I'd say, as a downside case, it's the option play on metal. If you believe that gold and silver are going to move forward, as the world keeps printing money and you look for solid, hard assets. Chesapeake is one of the largest reserves and resources of gold and silver in the world that hasn't been developed. As a base case, if you're into investing in the option, play on metals we are a good bet. When you layer on top of that the potential future of development and the technology, you have multiple points beyond that. We prove that technology, develop the project and your P/NAV starts to improve, you'll see further upgrading in the price.

It really depends on what you're looking for in your investment. But, I believe the option play is the base case and then it's all additive from there. When we become an operator and then we're a producer of 125 to 150,000 ounces a year, expandable, looking for other projects to apply the technology. We have a fundamental market advantage, over others, because of that technology that allows us to look at sulfides from a significantly different view of the economics on the project.

Dr. Allen Alper:

Well, those sound like extremely compelling reasons for our readers/ investors to consider investing and Chesapeake Gold Corp. Alan, is there anything else you'd like to add?

Alan Pangbourne:

Just keep watching, keep listening, and if you want to invest in a Company, we would love to have you on the share register. We're going to build the next mid-tier Gold Mining Company. That's what I've done before, and that's what I plan to do, with the team, again.

Dr. Allen Alper:

That sounds excellent. It sounds like Management and key investors have great confidence in the project, have skin in the game and share the same goals as other investors. Sounds great!

We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.chesapeakegold.com/

Alan Pangbourne

invest@chesapeakegold.com

|

|