Bunker Hill Mining Corp. (CSE: BNKR): Most Prolific Silver Region in USA, Targeting Rapid, Low-Cost Production Restart, with Zero Footprint; Richard Williams, Executive Chairman and Sam Ash, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/25/2021

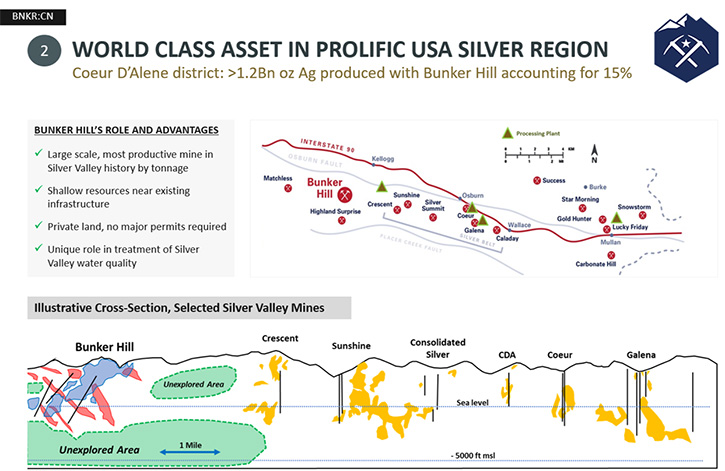

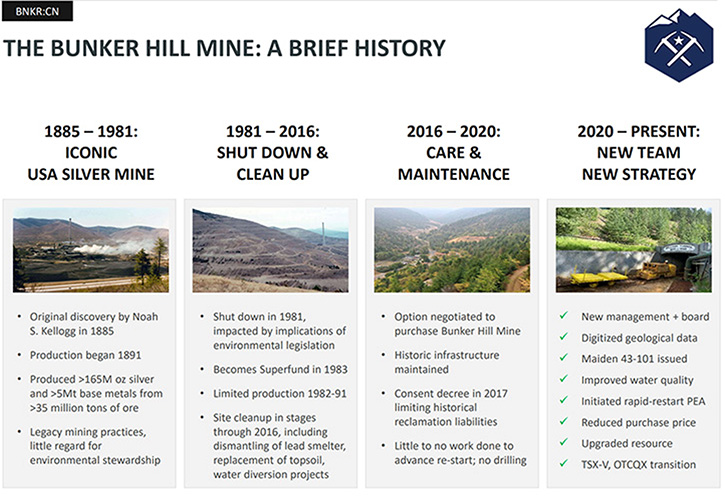

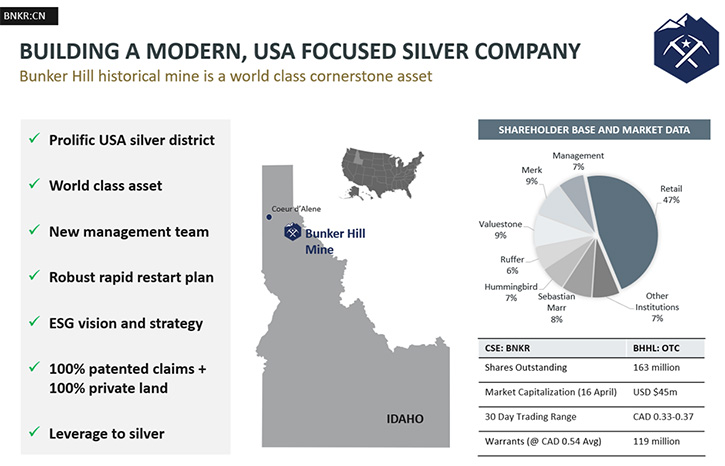

We spoke with Richard Williams, Executive Chairman, and Sam Ash, CEO of Bunker Hill Mining Corp. (CSE: BNKR), a USA-focused silver exploration and development company, located in the most prolific silver region in the Country. Under the new Idaho-based leadership, Bunker Hill Mining Corp. intends to sustainably restart and develop the world-class, high-grade Bunker Hill Mine, that had produced over 165M oz silver and over 5Mt base metals, between 1885 and 1981. The project has the potential for a very long life of mine, with significant exploration upside, and has extensive existing infrastructure. With the focus on sustainability, the Company is targeting rapid, low-cost production restart, with zero footprint. The PEA was recently released on April 20 www.bunkerhillmining.com/news-and-media/news-releases/bunker-hill-announces-robust-restart-pea and the PFS is expected to be published by Q3-2021. Bunker Hill Mining aims to build a modern, zero-emission, zero-footprint operation as a cornerstone asset, that will mine in ways that enhance the quality of the environment.

Bunker Hill Mining Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Richard Williams, Executive Chairman, and Sam Ash, CEO of Bunker Hill Mining. Richard, could you give our readers/investors an overview of your Company, your goals, and what differentiates Bunker Hill Mining from others.

Richard Williams, Executive Chairman of Bunker Hill Mining:

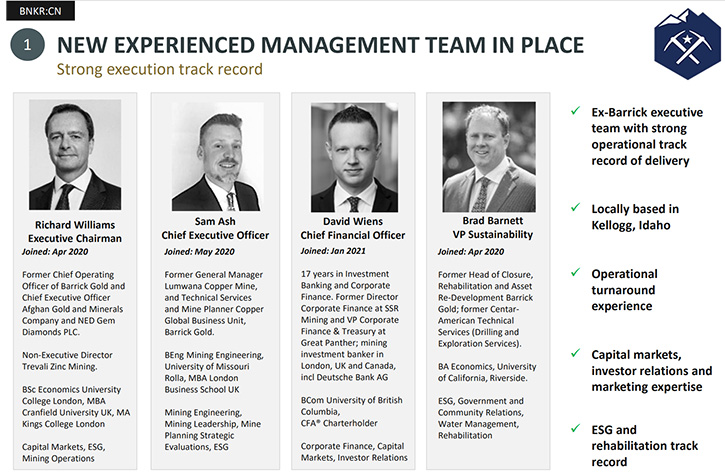

Thank you, Allen. I’ll start with the story of why we came into Bunker. I was a former Chief Operating Officer of Barrick Gold, brought in by, then the new Chairman, John Thornton, back in 2014, to help bring operating efficiencies into the Company. We accomplished that over four years or so, which enabled the deal with Randgold Resources, and the takeover of the leadership by Mark Bristow, very successfully.

Sam Ash, Chief Executive Officer, who is locally based on-site in Kellogg, Idaho, leads the Team. Sam, also formerly from Barrick Gold, has a proven track record of improving efficiencies and he is on this call. I had put him in as the General Manager of the Lumwana copper mine in Zambia, which he successfully turned around over that time. Sam and I had been looking around the world for assets that were distressed, and Bunker Hill fulfilled our criteria – it was a troubled asset that we confidently believed we could turn around and solve. It has the potential to be a cornerstone asset of a new mining company, with potential opportunities for consolidation in the Western United States. The focus is to get the Bunker Hill Mine up and running and used as a springboard for further growth.

When we came across Bunker Hill, on examination, it met the four criteria we were looking for: Firstly, it was in a safe jurisdiction that is a great supporter of mining. Idaho couldn’t be better. Secondly, it had the potential to be very long life, greater than 25, 30 years in our assessment. Thirdly, given the vast infrastructure that was already in place, and the techniques that we could bring to bear, it also had the potential to be run in the lower part of the cost curve, which would allow it to weather any of the future downturns that happen in the commodity cycle.

Then finally, it was a project that we couldn’t just turn into a profitable operation but could be a project that would deliver significant positive social and positive environmental impact. Coming as Bunker does, out of the ashes of the superfund site and the superfund cleanup, that final point is exceedingly important to us, and all our stakeholders.

In March of last year, I took control of the Company as Chairman, and appointed Sam as the CEO, who now lives about a 10-minute walk from the Bunker Hill Mine. It turned out his father used to work on the mine in the 1970s, and established himself in the community there, which is so important. Sam and I started surveying the mine to bring the old data to modern standards, completing a digitization and geologic modelling program, to leverage the historical mine data collected over a period of 95 years, to identify and prioritize high-grade silver targets. This 3D geologic model greatly accelerated our understanding of the deposit and its untapped high grade silver potential. Our strategy and vision is two-pronged; (1) build a modern, sustainable company by focusing on a rapid restart, and (2) including unlocking silver exploration potential, in the lower levels of the mine. Along with the robust, low-cost restart, an important part of the process is the sustainability component of serious water management and community engagement.

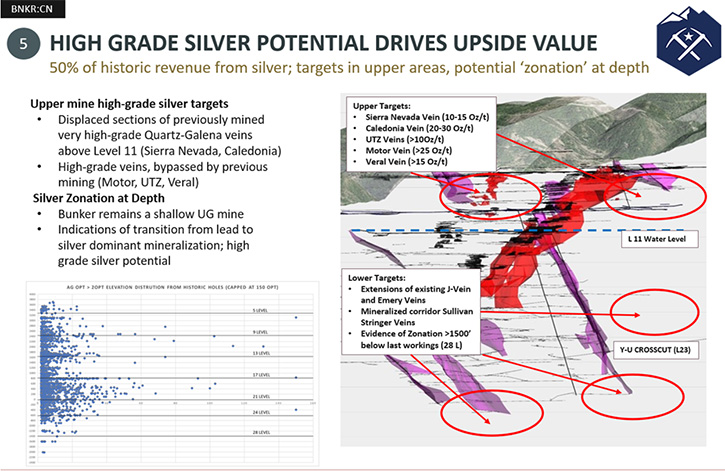

The mine, in the past, produced 165 million ounces of silver, even though it was known as a zinc lead mine. Through our analysis, we could see that the ratio of base metals like zinc and lead, to silver, which is currently sitting around about 75% zinc and lead to 25% silver could be brought back to its historical ratio of 50/50 to 50% silver with some considered exploration.

Over the past year, we raised money in the public markets, changed the Board over, and have worked hard to build a Team that is worthy of the Bunker challenge, with the capacity to run an expanded portfolio of assets from the United States. The Bunker Hill team has worked energetically and precisely, to deliver a robust Preliminary Economic Assessment for a restart of the operation as early as 18 months from now.

For that, Sam’s been able to bring in Brad Barnett, a Californian development economist, Former Head of Closure, Rehabilitation and Asset Development Barrick Gold; managed 100+ employees over 85 sites globally, including 5 Superfund sites in the USA; and David Wiens, whom we were very lucky to get as CFO, after a long search. Although based in Vancouver, he spends half of his time in Idaho. What differentiates us, is having an asset, with all of those qualities, and an exceptional and carefully chosen Team, working with Sam, based on the mine site, with a focus on restarting and generating value by the early generation of cash flow, which we then re-invest for further silver exploration, unlocking further shareholder and stakeholder value.

Dr. Allen Alper:

Well, that sounds like Bunker Hill Mining is in an outstanding position to generate cash flow for their investors.

Richard Williams:

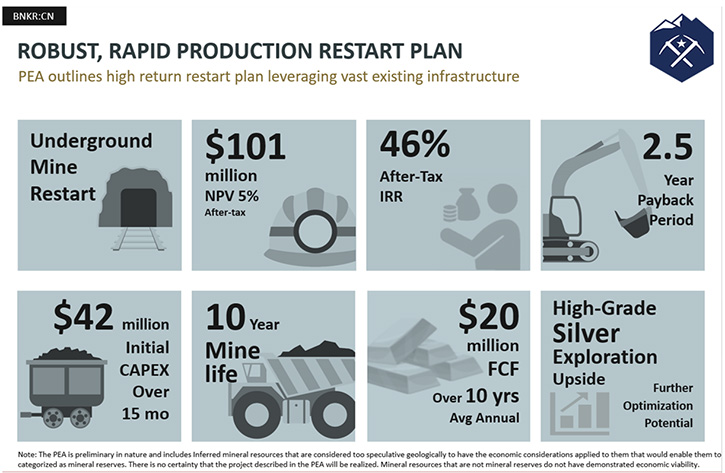

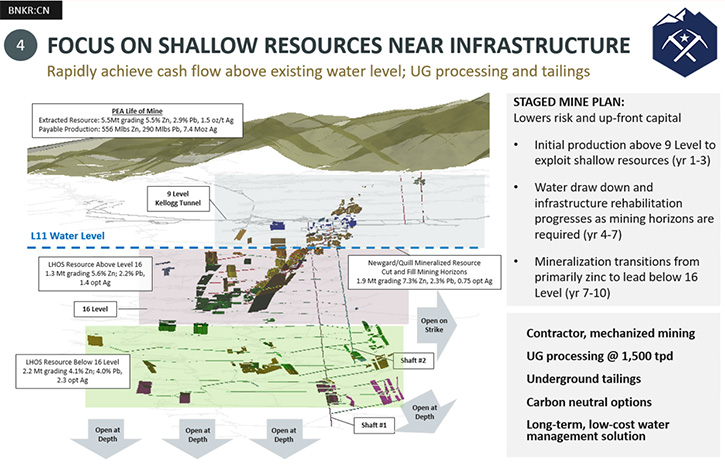

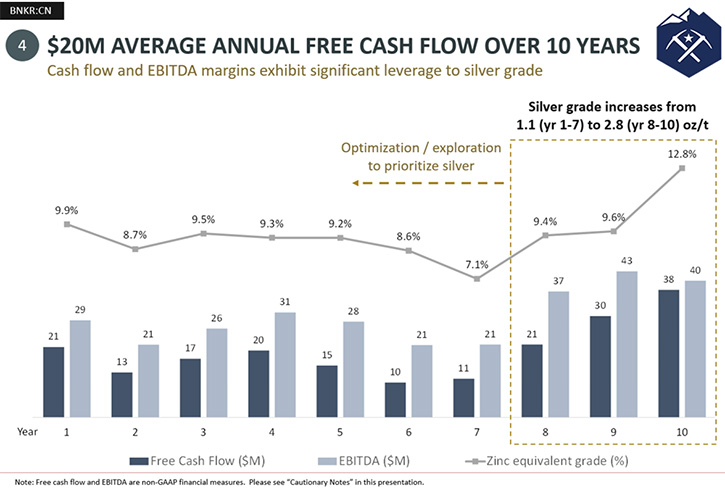

That’s certainly how we see it. Now Sam can talk through the work he’s done, spotlighting the remarkable potential of the mine and the ability to bring it back into production. Noting of course, we have announced a robust restart PEA of $101m NPV, 46% IRR, 2.5-year payback, $42m initial capex, $20m average annual free cash flow over 10 years.

Sam Ash:

Thanks, Richard. It’s great to speak with you, Allen.

When we looked at the mine, we were thinking about laying out the path forward, and the work program that needed to take place. It came down to three legs, for us. One, the technical leg, advancing the project, getting a 43-101 compliant resource, publishing the PEA, and ultimately a restart.

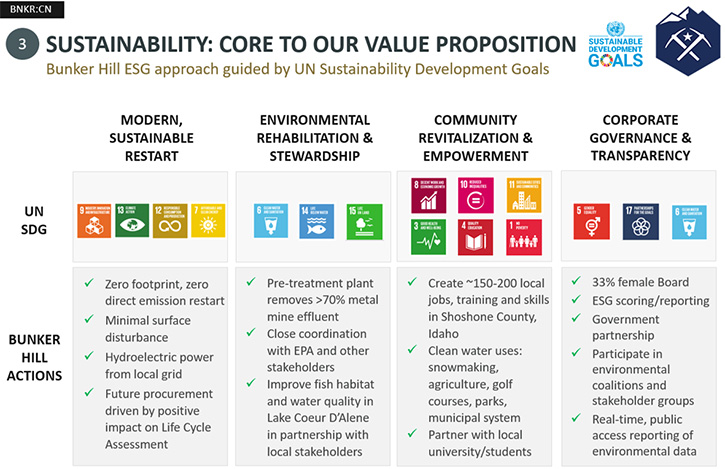

The second leg was cleaning up the organization, taking care of the governance, getting our financial house in order. Then the final leg is the environmental piece. Recognizing, and acknowledging, and embracing the fact that the Bunker Hill Mine site was operated for over a hundred years in a way that was incredibly environmentally damaging and destructive to the local environment.

When the mine closed, it closed as a result of the Clean Air Act, the Clean Water Act, and the Superfund Act in the United States. The environmental performance of the mine was untenable and left the Silver Valley in a very degraded environmental state. The EPA, in conjunction with the state of Idaho, and the local community, have done a tremendous job of rehabilitating not only the Bunker Hill Mine site, but the Silver Valley.

So now, we find ourselves in a position today, where we are the stewards of an asset and a deposit that has a tremendous mineral endowment, has been cleaned up, and is ready for the right Team and the right Company to come in and revitalize and restart the operation, in a way that’s very much in line with the modern demands that society places on mining and metals extraction. For us, that means having as little environmental impact as possible, ideally zero impact. We have the opportunity to run a mining operation that will be a positive for the environment, which is a core value and Company strategy.

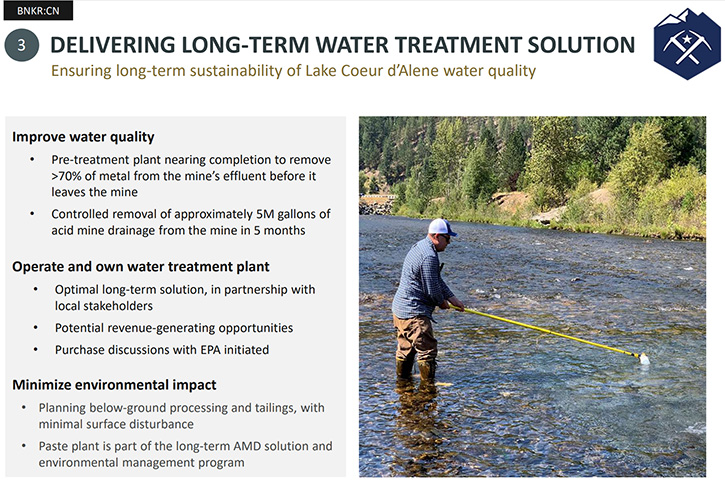

At this time, there is a mine affluent that comes out of the mine, reports to an EPA-owned and operated water treatment plant, where it is treated to an incredibly clean standard, and discharged into the environment. Our job is to take the great work that the EPA has done, and build on that in the mine, and take care of the acid mine drainage challenge, and reduce that environmental commitment for water treatment, over the long-term.

We’ve made some great strides in doing that. Within the first year, we’ve identified that the majority of the problem comes out of a water stream that is only 10% of the total water flow. We’ve isolated that water flow and focused on pre-treatment. We’ve been able to reduce, with our pilot plant, the metals load coming out of the mine by over 70%.

I started with the environmental aspects for a specific reason. It’s because the ESG, and in particular, environmental performance is not only something that we see that is necessary at Bunker Hill, but it’s a part of the Company that we’re building that’s going to be a tremendous source of value. When you look across the western United States, and stepping more broadly around the world, there’s a tremendous amount of outstanding mineral endowments that are distressed because the ways in which they were operated were destructive socially and environmentally.

We believe that a Company, with a Management Team that focuses on the right areas, acknowledges the state of those assets, and tackles those challenges head-on, can create a tremendous amount of value. We see these perceived challenges as opportunities for value creation, where a lot of other players in the mining industry, only see the down-side risk. We made great progress on the environmental and governance side. We believe that governance for us is going to be a tremendous strength, not only for this asset, but for the Company.

I’ll move on to the geology, which, being an engineer and a mining professional, is near and dear as well. When we came into the mine set, the mine operated for over a hundred years, and in that hundred-year period, it always operated at the forefront of technology and mining practice. It had one of the first electric induction hoists that was installed in an underground mine anywhere in the world. The technical work that was done was top notch in every era of the mine.

With that said, the last real technical work was done when the mine went into closure in 1982. Things have since advanced quite a bit. In 1982, all the geologic mapping was still done on Mylars by hand, and we inherited essentially a storeroom full of thousands and thousands of old historic geologic maps meticulously created and maintained over a hundred years of operating life.

There were over 3,500 drill holes that were hand-logged and recorded in leather-bound journals. When Richard and I joined Bunker Hill, one of the first things we did was put together a geologic team to digitize, modernize, take all that wealth of information, that hundred years of geologic understanding, and put it into a format that could be used and leveraged for geologic understanding, and to drive exploration.

There were a couple of unique, interesting, and we believe, incredibly important insights that have come out of that. Probably the most important is that, for much of the hundred-year mine life, the mineralization was assumed to be associated with faults. Now that was disproven just before the mine went into closure in the late ‘70s, and the insight is that the faulting that occurs at site is all post-mineralization.

With a 3D geologic model and the ability to visualize the geology and the ore body, we’re able to unfault that ore body, identify and recognize where the mineralization was deposited, pre-faulting. We then went through a process of re-faulting it to identify highly perspective exploration targets that were overlooked previously because they were not located in close proximity to the major faults. These discoveries were incredibly important and insightful.

With a solid geologic model in place, our next step was to take the historic reserve, which was actively being mined in 1982, and bring that up to modern standards and publish a modern 43-101 compliant inferred resource. We went through a process of data verification and validation, which included drilling, channel sampling, and re-assaying of historic assay pulps. We were able to complete that in September 2020 and in March press-released the upgrade of our maiden inferred resource to an indicated resource of 4.4Mt containing 3.03Moz of silver, 487M lb of zinc, and 176M lb of lead and an inferred resource of 5.6Mt containing 8.3Moz of silver, 548M lb of zinc, and 312M lb of lead, while also identifying new silver exploration targets.

Immediately on the back of that, we published the PEA last week to support a rapid restart, as we continue the drill program that is focused, in parallel streams, on silver exploration to further expand and upgrade that resource. The robust PEA supports a rapid restart, post-financing, which will have us in operation in 18 to 24 months post-financing. Importantly, we’ll then be in a position where the carrying costs of the operation will be covered out of cash flow. In addition, we’ll be able to self-fund the exploration for silver, largely out of cash flow.

Over time, we see the cash flow, which in the PEA is predominantly zinc focused, transitioning to silver dominant, from a revenue perspective, over time with exploration success. We’re also doing a couple of really interesting things operationally that support our vision of being an environmentally responsible, forward-looking mining company. If you think of the mining industry in general, one of the things that brought us together, as a team, is a common belief that the mining industry is going to change. There’s a voracious demand for metal in the world, particularly as we’re going through a transition to a green economy.

But at the same time, societies demand that those metals are procured in environmentally and socially responsible ways, is increasing and will continue to increase, and rightly so. When you look at the mining industry, we believe that the days of a multi-billion-dollar capital investment in risky jurisdictions that result in an outsized environmental and social impact are coming to an end, and I believe rightly so. Those days will be behind us in the very near future.

That means the future of mining is going to be exactly what we’re doing here at Bunker Hill: Going into mines in an underground fashion that minimizes the environmental impact and still maintain high margin, long life, and supplies metals in a sustainable way to the world economy.

Dr. Allen Alper:

That sounds excellent. It’s great to see Management so interested in preserving the environment and having a great stewardship responsibility.

Sam Ash:

Thank you.

Dr. Allen Alper:

I wonder if Richard could summarize and highlight the primary reasons our readers/investors should consider investing in Bunker Hill Mining.

Richard Williams:

That’s a great question. The primary reason is we have an extraordinarily long growth profile, in terms of our ability to generate early cash and then expand that over a very long period of time. Secondly, we have a Team that has a proven track record of operating mines in a bear market, not a bull market. And then thirdly, in addition to the obvious potential that we have, with all that we can see in front of us, is we have significant upside, with respect to the future of silver.

If you’re looking at Bunker Hill, just like you’d be looking at any mining company investment, the question is, do they have a resource that would generate significant margin and cash flow? The answer is yes. Do they have the ability, within the Team and within the asset, to grow that over time organically? The answer is yes. And then underpin all of that with the fact that our focus, our value creation, is driven clearly by the generation of cash flow through margin, but also to deliver significant positive social and positive environmental impact, in an area of the United States that really needs it. It gives you a much broader view of value than just the essential profit. I’d say those are my high-level points.

Dr. Allen Alper:

Well, I would say those are very compelling reasons to consider investing in Bunker Hill Mining. Is there anything else, Richard, that you or Sam would like to add?

Richard Williams:

I’ll hand it over to Sam. What’s so important for us, with respect to how we run things, is we’ve worked in big companies and small companies. We’ve known each other very well. To get the most out of a mine and its potential is all about the people. You can bring new technology and new techniques to bear, all of which we intend to do. But if you haven’t built a partnership, a genuine partnership, within all levels of the organization from the Board to the Executive Management, to the workers, to the contractors, to the community, to the supply chain, et cetera, you end up having a combination of risk and underperformance that means you never quite deliver on all your promises.

When we left Barrick, we were very keen to take the best of what we knew, and leverage our relationships, our teamwork, and bring it to bear in the Silver Valley that is full of the most superb people, with the most amazing capabilities. Part of what you’ll see at Bunker, over time, is the building, from the ground up, of an exceptional Team that is founded, with its roots in the Silver Valley in Idaho, in the United States. And once we’ve done that and proven that, we’ll have the ability to grow from there because we’ll have the capacity to do so. I’ll hand it over to Sam to talk a little bit about the Team, the community, and who we’re reaching out to, and how we’re operating, because that’s really important to us. Sam?

Sam Ash:

Thank you, Richard. Our success starts with me, as the CEO, being right outside the front gate. We’re in Kellogg, Idaho, and the interest in the mine is right on the edge of town. I have a house right downtown that we purchased and moved into, and I’m able to walk through the community to the mine office every day. I think that’s incredibly important to understand. We are not tangentially part of a community where our employees live and work. We are integrated in it, both geographically and through our workforce. That really drives us to have a very open and collaborative dialogue with the local community, keeping them informed, and working hand in hand with them as we move forward.

Moving on to some of the other stakeholders that we engage with, and work closely with. I have open communication with the environmental regulatory agencies. Each week we have an ongoing conversation and dialogue with the EPA (Environmental Protection Agency), and with the IDEQ, which is the Idaho Environmental Equality Department. We talk and work in collaboration about the activities that we have ongoing in the mine. We make sure our plans and our operation are done in coordination and in alignment with their ongoing activities of environmental remediation.

Then it goes to the employees that work here at the mine. We are blessed to be an area that has a tremendous history and wealth of talent in the mining industry. For the restart of the mine, we are looking to the local community where we will create ~150-200 local jobs, trained and skilled in Shoshone County, Idaho. We are looking to build a mine that’s on the forefront of available technology, with all that means, fully electrified, digitally enabled, and largely reliant on technology.

Our plan, through an effort of coordinated training and skills development, is to blend the wealth of mining knowledge, know-how and skills, which exists in the Silver Valley, with an upscaling of technology and technological applications to generate a workforce that is in alignment and forward-looking to support the mining operations. I think that it’s really exciting, what we will be doing here. When the Bunker Hill Mine shut down in the 1980s, the economic and social repercussions of that are still being felt today, and it’s really exciting to be a part of a project that can help reverse and improve the socio-economic impact that the mine’s closure had all those years ago.

Richard Williams:

Thank you for showing an interest in Bunker. I hope we’ve both demonstrated our enthusiasm and our belief in Bunker and its remarkable potential.

Dr. Allen Alper:

Well, I enjoyed talking with you, Richard, and I’m glad to see such a responsible Management where the CEO lives in the community, as part of the community, and is working not only for the shareholders, but also the stakeholders in the community. So that’s excellent!

Richard Williams:

Thank you very much indeed. It’s a real honor to have the chance to speak with you.

Dr. Allen Alper:

Thank you. I’m very impressed with the approach that Bunker Hill Mining is taking, how careful you are with the environment, and with the community, and how responsible the Company is going forward, with their mining project. That’s excellent. It’s a great example for other mining companies.

Sam Ash:

I think the only thing I would like to add is just to reiterate that Bunker Hill has a world class mineral endowment. We’re advancing the project rapidly, but at the same pace, we are advancing it on the back of solid technical work and robust PEA results. We see, in Bunker Hill, a deposit that has the ability to be long life, multi-generational, high margin, low cost, and be operated in a way that can have a net positive impact on both the environment and the community.

Dr. Allen Alper:

Well, that’s excellent! That’s excellent for the community and for your shareholders. I’m very impressed! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.bunkerhillmining.com/

Sam Ash, President and Chief Executive Officer

+1 208 786 6999

sa@bunkerhillmining.com

|

|