IronRidge Resources Limited (AIM: IRR): Large Lithium Pegmatite Discovery in Ghana, Extensive Grassroots Gold Portfolio in Côte d'Ivoire and Potential New Gold Province in Chad; Vincent Mascolo, Managing Director and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/20/2021

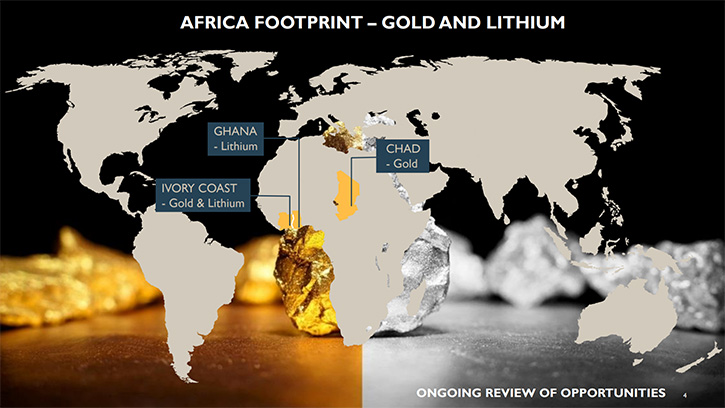

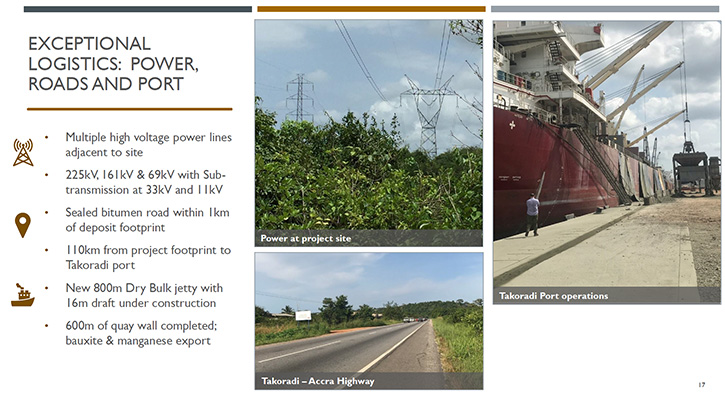

IronRidge Resources Limited (AIM: IRR) is an African focused, minerals exploration company, with a lithium pegmatite discovery in Ghana, an extensive grassroots gold portfolio in Côte d'Ivoire and a potential new gold province discovery in Chad. The Company holds legacy iron ore assets in Gabon and a bauxite resource in Australia. We learned from Vincent Mascolo, Managing Director and CEO of IronRidge, that in January 2020, the Company delivered an exceptional maiden mineral resource estimate on its lithium project in Ghana; in the order of about 14.5 million tons at 1.3% lithium oxide, with an indicated category of 4.5 million tons of 1.39% lithium oxide. The project has unique metallurgy, exceptional geology, and is located in close proximity to operational infrastructure, being only 110km, by road, from the deep-sea port of Takoradi.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Vincent Mascolo, Managing Director and CEO of IronRidge Resources Ltd. Vincent, could you give our readers/ investors an overview of your Company and what differentiates your Company from others?

Vincent Mascolo:IronRidge is a diversified explorer and developer, focused on Africa. We are domiciled in Australia and listed on London's AIM Market. Our key focus, being a diversified explorer across multiple jurisdictions, is lithium and gold; two great commodities to be involved in. Our lithium project is rather spectacular, due to its proximity to operational infrastructure, its unique metallurgy, and our exceptional geology. Basically, our deposit is predominantly outcropping. To hedge our bets, for the downside risk for investors, we also have significant gold portfolios in Côte d'Ivoire and, to a lesser extent, Chad, which we think will come into play later in the year, when financial economics prevail across global economies.

Dr. Allen Alper:

Could you tell us more about your projects?

Vincent Mascolo:

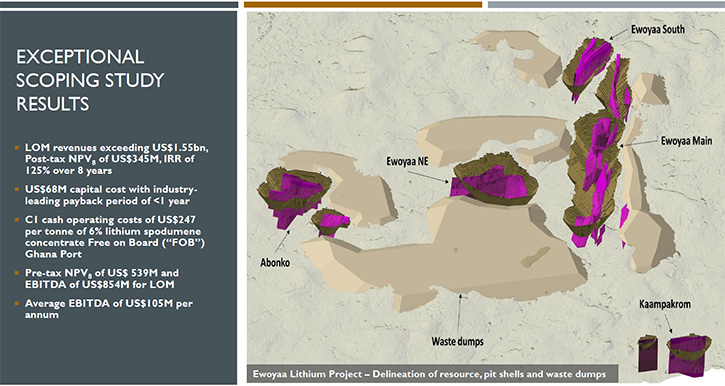

At our lithium project in Ghana, we have delivered an amazing mineral resource estimate; in the order of about 14.5 million tons, at 1.31% lithium oxide, with an indicated category of 4.5 million tons of 1.39% lithium oxide. It is an amazing project, with exceptional geology and the deposit is predominantly outcropping along hill topography. The metallurgy is second to none globally and so is the project’s surrounding infrastructure. We are less than 1 km from the national highway and just 110 km away from the deep seaport of Takoradi, with multiple high-voltage power lines running adjacent outside. This bodes well for a low Capex, low Opex operation and a low carbon footprint is envisioned.

On the project itself, we recently announced exceptional scoping study results, with very robust economics and a mine life, which currently stands at eight years, with ongoing efforts to expand the resource to bring that to a plus 10-year mine life. It stands to reason that we will deliver amazing numbers by virtue of the key characteristics of the projects, which, as previously mentioned, include the exceptional proximity to operational infrastructure. The project ticks the boxes in the narrative of most of the European and American lithium producers and is certainly generating a lot of interest at this time.

Dr. Allen Alper:

Well, that's excellent! You have robust economics, an excellent IRR and a very fast payback. Could you tell our readers/investors more about that?

Vincent Mascolo:

As the metallurgy is exceptional and so unique, given that it is predominantly coarse grain, we only need to carry out a coarse crush, requiring a simple DMS processing flow sheet, which has subsequently generated incredibly robust numbers. We have an operating cost of around $247 per ton and our Capex is US$68 million, which in turn will generate revenues, in the order of around $1.5 billion, with an average annual EBITA of just shy of US$100 million per annum. The business case, however, supports a two million ton per annum run of mine operation, producing nearly 300,000 tons per annum of 6% spodumene concentrate (“SC6”).

Furthermore, the product we will be producing is a premium product. Having tested it, with bench scale testing, through to pilot and industrial scale, we are confident that we are going to be able to produce a product that will be in high demand from the marketplace. The rate of return is impressive at 125% and that is by virtue of the low Capex, low Opex and proximity to operational infrastructure. It all bodes well for an amazing project that is now very achievable and keenly sought after by industry players.

Dr. Allen Alper:

Really fantastic economics! That's really excellent! Could you tell our readers/investors a little bit more about your capital structure and some of your major, impressive shareholders?

Vincent Mascolo:

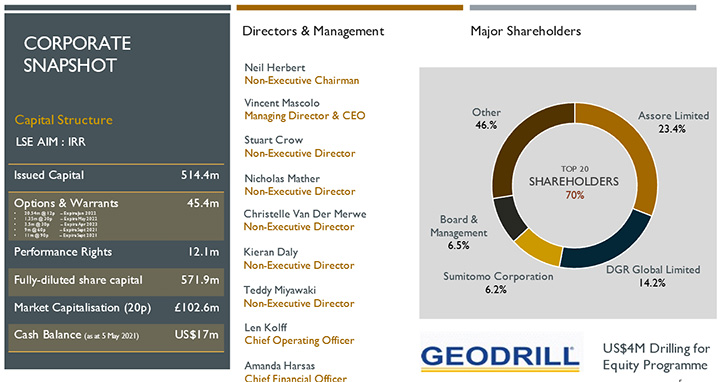

We have a very tight sheet capital structure, by virtue of the business model. Our exploration business model is designed to protect ourselves against commodity risk. Elaborating on that, IronRidge was previously an iron ore exploring Company, with one project and acted as one company. Unfortunately, the iron ore price tanked rather dramatically in 2015, but we still had a healthy treasury and were able to use that money to curate the suite of assets we now have in the Company. As a result, we are now multi-commodity focused, effectively acting as five Companies in one diversified group, with an emphasis on gold and lithium; two assets we believe are poised to perform well in the years to come, due to gold’s consideration as a safe haven investment and lithium’s increasing role in decarbonisation and electric vehicles.

We have very supportive, like-minded and visionary shareholders. We have Assore Limited, out of South Africa, Johannesburg, a mid-tier mining house, specializing in iron ore, ferro- chrome and manganese, and DGR Global, which is a resource company generator. DGR Global is the founding forefather of IronRidge and has spawned multiple success stories. The first one being Orbis Gold, which was taken over by SEMAFO in 2015 for its Natougou Project, and SolGold, which is a household name nowadays, with its Cascabel Alpala Project and other suite of assets in Ecuador. The next rising star to emanate, out of the DGR stable, is IronRidge Resources. To further complement the share register, we also have Sumitomo Corporation, which needs no introduction as a global conglomerate, with over sixty-six offices world-wide.

Board and Management also have significant skin in the game, at around 6.5%, which means we are very much aligned, with our shareholders’ best interests. 70 per cent of the share register is held by the top 20 shareholders and, if we include family and friends and Board and Management, skin in the game is around 15% to 16% of the business.

Dr. Allen Alper:

That sounds excellent! It's good to see that Management and the Board have skin in the game and are reliant on the success of the Company to do well. Could you tell us a little bit about yourself, your Directors and Management?

Vincent Mascolo:

I'm a Mining Engineer by degree. I worked predominantly in the construction industry in my younger years, focusing on infrastructure projects for the government of Australia, and in particular, the State Government of New South Wales and Queensland. My engineering background has been in public/private partnerships, environmental studies, and in areas which require extreme delicacy around environmental sensitivities. I have built roads, dams, bridges, hospitals, power sub-stations and water plants; pretty much covering the whole gamut through my family's construction company, which we sold in 2005 to a multinational.

IronRidge benefits from a very well-heeled and highly decorated Team, with a wealth of experience, across financial markets and the mining industry on the Board and Senior Management team, which includes representation from our major shareholders, Assore and Sumitomo. We believe we have already demonstrated a compelling track record, of making discoveries and of adding value to the projects, within our portfolio. Further to this, we are exceptionally proud of the Teams that we have on the ground, in-country, which have been paramount to our success.

Dr. Allen Alper:

It sounds like you have very strong Management, strong Directors and a very strong balanced Board. So that sounds excellent!

Vincent Mascolo:

Yes, we feel we are exceptionally well-placed, with our breadth of experience across our Board and Management Team, to continue to grow the business rapidly and bring further value to our investors.

Dr. Allen Alper:

That's absolutely correct! It's great to have the backing you have, of those Companies that you mentioned. Could you say a few words about Ghana? It's a great mining country, but could you tell our readers/investors a little more about it.

Vincent Mascolo:

Ghana is a great mining jurisdiction. It has a 100-year history, predominantly focused on gold. It used to be called the Gold Coast. Lithium is a potential new industry in Ghana, which they are very keen to embrace and, as such, are endorsing an accelerated approach to developing projects within the Country. As we are the first lithium discovery in Ghana, we have the full support of the government, which has a 100-year mining history behind it. With full support from the highest levels of government, we are proactively assessing the fastest route to production for our lithium project.

Dr. Allen Alper:

Sounds excellent! Could you tell our readers/investors the primary reasons they should consider investing in IronRidge Resources Ltd.?

Vincent Mascolo:IronRidge is a quality investment opportunity. We have effectively derisked the investment by being multi-commodity and multi-jurisdictional, throughout Africa. We have a significant portfolio of assets, effectively acting as five companies in one diversified group. In the last three years, we have delivered three discoveries, in three jurisdictions, thanks to the extensive suite of assets we hold in both lithium and gold. Two and a half years ago, we were a lithium company. Last year, we were a gold company, and today we are back to being a lithium company. With a portfolio of assets, we are able to shift focus, where needed, and advance projects in line with the market’s favour. The downside is low and the upside is very significant, as we start to advance our three discoveries concurrently. That is what makes IronRidge a very compelling investment opportunity.

Dr. Allen Alper:

Sounds like excellent reasons for our readers/investors to consider investing in IronRidge.

Vincent Mascolo:

We also have a Board and Management Team, significantly invested in the business model. We are all keen to make sure that we deliver robust projects and not just blowing hot air into the atmosphere to attract investment dollars. We actually want to make money ourselves.

Dr. Allen Alper:

Sounds wonderful. It's great that the Management Team shares the same goals as investors. Is there anything else you'd like to add?

Vincent Mascolo:

No. I think we've covered it all. You've asked all the right questions.

Dr. Allen Alper:

You did a great job giving our readers/investors a very strong idea of what your Company is all about, what resources you have, your Team, your location and the backing you have. You've done well! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.ironridgeresources.com.au/

Vincent Mascolo (Chief Executive Officer)

Tel: +61 2 8072 0640

|

|