Desert Mountain Energy Corp. (TSX.V: DME, U.S. OTC: DMEHF, Frankfurt: QM01): Exploring and Developing the World's Potentially Highest-Grade Helium Properties in US Southwest; Don Mosher, Director and VP of Capital Markets Interviewed

|

By Allen Alper Jr., President of Metals News

on 5/14/2021

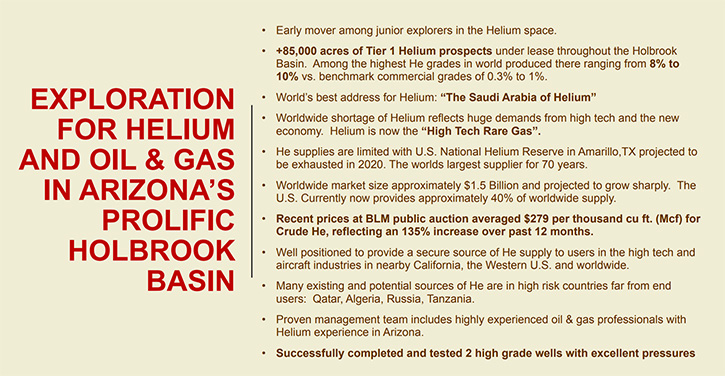

Desert Mountain Energy Corp. (TSX.V: DME, U.S. OTCQX: DMEHF, Frankfurt: QM01) is focused on exploration and development of the world's potentially highest-grade helium properties, and productive rare earth gas properties, in the US southwest. We learned from Don Mosher, a Director and the VP of Capital Markets, for Desert Mountain Energy, that they are building their Holbrook Basin Helium Project in Arizona into a vertically integrated Helium producer, with their own solar facility, to produce their own electricity, and with plans to sell directly to end users, primarily in Arizona. The largest user of helium is the MRI industry, followed by the supercomputer centers for all the cloud-based technologies, fiber optics, space rocket launches, deep sea diving, and even delivering antibiotics into COVID-19 patients' lungs.

Desert Mountain Energy Corp.

Al Alper, Jr.:

This is Al Alper, Jr. with Metals News. I'm here interviewing Don Mosher, a Director and the VP for Capital Markets, for Desert Mountain Energy. Desert Mountain Energy is listed on the TSX-V, also recently listed on the OTCQX and the Frankfurt Exchange. They explore for helium, oil and gas in the Arizona Holbrook's Basin. Don, could you give us an overview of Desert Mountain Energy?

Don Mosher:

We are building a vertically integrated Helium producer in Arizona, in the Holbrook Basin. Our entire focus is on helium exploration, although down the road we're planning on taking a look at some hydrogen helium projects that we have, but that will be a couple of years off. We do have some oil and gas assets that were originally put into the Company, when the old mining shell was reactivated. Mike Gilchrist Oil & Gas assets are being disposed of, so we will be completely focused on helium.

We've kept the "Energy" in the name because we are planning on building a solar facility and producing all our own electricity to do all the finishing on the helium, which will be selling directly to end users, mostly in Arizona. Arizona is a great place because we've identified 27 end users in the state. There are other companies moving there, Taiwan Semiconductor for example. I think Intel's building a $20 billion plant there. I believe Panasonic is going to be putting in an MRI assembly facility there. All those industries have a demand for helium for specific purposes.

When I talk about our project, as a Tier 1 project, I have three reasons for that. Number one, our grades are much higher than what you find, for example, in the natural gas plays in Western Canada. Their percentages are running like .5% to 1.5% Helium in a natural gas environment. Where we are in the Holbrook Basin, the percentages run anywhere from 5% to 12%, with nitrogen being the majority of the gas coming out of the holes. It puts us in the Tier 1 Asset category as grades because our metallurgy is quite simple, with such a large nitrogen percentage.

Our first two holes ran 78% and 90% nitrogen. The nice thing about nitrogen is you can vent it off into the atmosphere, 78% of what you're breathing currently is nitrogen. Finally, jurisdiction, location to end users. Transporting helium is a very tough job. Helium will escape almost any containment known to man. If you're an end user in Arizona and you were buying out of the strategic supply in Texas on a hot summer day, you could lose up to 18% of your helium on a 1,400-mile trip.

Al Alper, Jr.:

Wow, that's a great location! Could you tell us a little bit more about helium and the uses for helium?

Don Mosher:

The largest user of helium is the MRI industry. Thirty to 32% of all production goes into MRIs for cooling magnets. Other applications for helium would be the supercomputer centers for all the cloud-based technologies. You can't manufacture fiber optics without helium. When SpaceX launched that rocket, they used about $12 million worth of helium. They use it to purge the ballistic rocket engines before liftoff. There are new applications coming on. They're using it to deliver antibiotics into COVID-19 patients' lungs. As an inert gas, it's also used in deep sea diving. It's used for leak detection because it's the second smallest atom on the Table of Elements.

If you can contain helium, within a closed system, you're not going to leak anything else out of it. It's used in welding applications, lifting applications with balloons, whether we're talking party balloons or we're talking big commercial dirigibles. There are new applications coming up all the time. The new nuclear reactors, I do believe will be cooled with helium as well. The other aspect of helium is it's very abundant in the universe, but it is very rare on Earth because it does escape the atmosphere unless it's contained. The creation of helium on this planet, unless it was placed here during the creation of the planet, comes from the degradation of Uranium 238 and Thorium, deep in the earth's crust.

As the helium travels up through cracks and crevices within the planetary crust, it needs to find a geological containment unit to hold it. Otherwise, it escapes out of the earth and just disappears back into the universe. The unique thing about the Holbrook Basin and where we're finding the helium, is a geological formation called an anticline. When you get crustal folds, we're looking to drill into the structural highs in anticlines.

The anticlines are composed of salt and anhydrite rocks, which are very dense. It's almost like drilling into the top of the dome, where that earth has folded. If you look at our maps online, you'll notice maps of our leases look like checkerboards. The reason for it is, we are specifically looking for those and anticlines, we Don't care about the synclines on the sides of those pieces of property that we have. If somebody wants to go in there and drill down into the synclines, I wish them luck. They're going to find water, maybe oil and gas, but they're not going to find what we're looking for, which are these helium wells in a nitrogen atmosphere.

Al Alper, Jr.:

Tell us a little bit more about what you're doing at Holbrook and what are your plans?

Don Mosher:

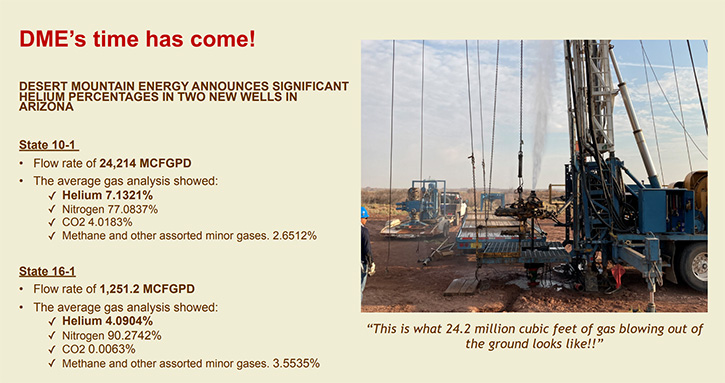

We just received the permit to drill our fourth well today. In about 10 days, we'll be moving a rig on site and we will be drilling the fourth well. Once it's done, we're hoping we'll have the permits for wells five and six. If everything goes according to plan, we'll drill well four, five, and six. Once those wells have cemented casing in them, we will move the completion rig on site, will do the completion and the sampling of those wells. Once those three wells are done, along with wells, one and two, we'll do a reservoir analysis.

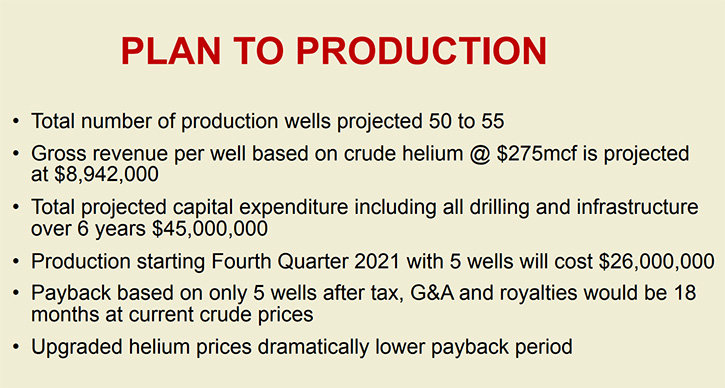

At that point in time, we're going to be able to put a value on how much helium Desert Mountain Energy owns in the ground. From there, we will look to move into the construction phase, where we build our solar facility, along with our finishing and refinery facility. We were looking to go into production in the fourth quarter of this year. We've had some delays getting permits, so it might set the whole program back a month or two and it may not get into production until first or second quarter of 2022. But right now, the plan is still to be in production by the end of the fourth quarter of 2021.

Al Alper, Jr.:

That sounds very exciting! Tell us a little bit more about your capital structure, and would this have an impact on your share prices going into production?

Don Mosher:

Oh, absolutely. We took a look at wells one and two and we determined those two wells will produce on average of about $8.9 million worth of crude helium annually. But with the vertical integration, and us selling helium directly to end users, we would be getting somewhere between $1,400 to $3,000/mcg an MCF, as opposed to just $280 for crude helium. Part of the reason we're doing it is, if we sold to one of the specialty gas players, they would be looking for us to deliver 90% to 95% helium to them at $280 an MCF. Why should we allow them to make three to four times what they're paying us, when by investing another $12 million, we can upgrade that helium and our shareholders benefit from those price increases that we're going to see, depending on whether it's 99.9% pure helium or 99.999% helium. It really is not that big of a capital expenditure when you consider the dollars that are coming through.

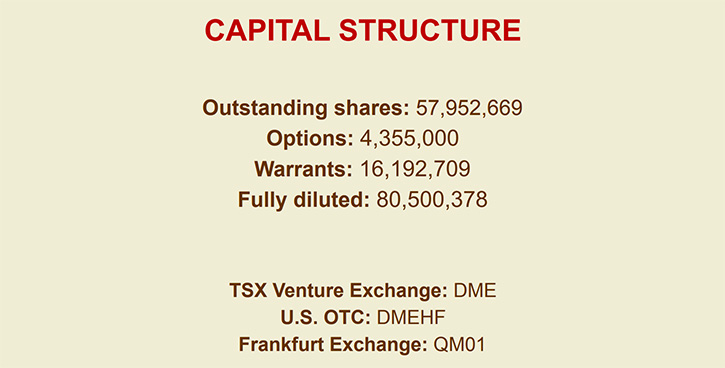

Our plan is to have 60 to 70 wells online, four years from now. The five wells that we're bringing online, we expect will be generating about $50 million US a quarter in revenue, when they've been upgraded and sold to end users. You can do the numbers on what 60 or 70 wells would bring us. Right now, we have enough cash from what's in the Treasury and what we have coming in from a forced work conversion that we triggered last week.

We had raised $13 million at $1.60 CAD back in October. That $1.60 unit was a common share and a $2.00 warrant attached to it. We had negotiated a $3.50 trigger. The stock traded above $3.50 for 10 consecutive trading days, that allowed us to force the warrants. Now we have $16.4 million in additional funding coming in, with no commissions paid, no legal fees paid, nothing else. It's just the owners of those units being forced to convert their $2 warrants. It's generating a little bit of extra liquidity, into the market, because some people can't raise those kinds of checks, they're having to sell the stock, but it's worked out well for us.

Al Alper, Jr.:

That's very good. Tell us a little bit more about your location in Arizona and as a mining jurisdiction.

Don Mosher:

Arizona is one of the main mining states in the US. They have large copper deposits; they're not so much known as an oil and gas location. But when it comes to mining itself, they're a great jurisdiction. People need to realize that we're not looking for hydrocarbons. In fact, the last thing we want in our holes is either hydrocarbons or water. From just a common-sense business aspect, where we drill a well, we're sealing off all aquifers any natural gas formations or oil formations that we encounter. We're only looking for these nitrogen helium environment, dry gas wells.

From an environmental aspect, we're doing the correct thing, because we are going out of our way to protect the aquifers in Arizona. Water is critical in Arizona, we're out in the desert. We Don't do any fracking. We haven't used any acid. If we did need to use some acid, it's not necessarily a bad thing because citric acid is an acid, and we can use citric acid for some applications. But we Don't use any nasty hazardous chemicals. When we need a sudsing agent, for example, we're literally using an industrial dish detergent without the scent and the coloring in it, like you'd find in a Palmolive or Dove or whatever other kind of dish soap that you're using out there. That's what we use for a sudsing agent for drilling. So, we're not using much water to start with.

Al Alper, Jr.:

Would you characterize the Desert Mountain Energy then, as having a focus on ethically sourcing helium?

Don Mosher:

Absolutely. We're an equal opportunity employer. We have a six-man Board and two of the Board members are women, so we're over 30% represented by females on the Board. We're looking at doing the same as we did when we built our Team. Right now, the Company has a two-man team, which is Rob Rohlfing as CEO, President, Chairman and I am working on the Capital Market side. On our Board, we have Dr. Kelli Ward, who's the Head of the Arizona Republican Party.

We have Jenaya Rohlfing, Robb's daughter, who's a Senior VP for ConocoPhillips and ran all the Alaskan drill operations, so she's extremely qualified. In addition to that, we have Dr. Jim Cronoble, Professor at the University of Oklahoma. We have Dr. Ed Schiller out of Alberta. And Soren Christiansen. Both Ed and Soren have been on the Board since it was reactivated and renamed as Desert Mountain Energy. We had the full Board and Management change take place last August, as we move this project forward.

Al Alper, Jr.:

Can you tell us more about your capital structure?

Don Mosher:

Currently, we have 61 million shares out. Fully diluted, we have 80 million shares out. With the eight million and change in warrants that are being converted right now, we'll end up with 70 million shares outstanding, 80 million shares fully diluted. We have no plans to do any financings, providing our budgets hold together on building the finishing facility and doing all our drilling. The drill costs that we realize are, in the world of drilling, extremely inexpensive. We're drilling wells that are costing us anywhere from $425,000 to $475,000 a well, we're not drilling multimillion dollar wells.

They are simple vertical wells, drilled into the structural high in the anticlines. We had planned on a Capex of $30 million. It's been reduced to $23 million because the end users have told us we don't need to buy a fleet of trucks to deliver the helium. They'll come pick it up themselves. There aren't any pipelines involved in this, it's simply separating the nitrogen out of the rest of the gas at the well head, venting it off into the atmosphere and just dealing with the remaining 20% to 25% of the gas, which will be trucked to the finishing facility. With the combination of cryogenics, temperature, pressure changes and some membrane technology, producing anywhere from 99.9% to 99.9999% helium to sell to end users.

Al Alper, Jr.:

That sounds great. It's a perfect location, and they're just going to come over and pick the helium up themselves.

Don Mosher:

Correct. They're happy to do it. Because the proximity to production means that they can move their helium, without losing much of it. If you're looking at paying $3,000 an MCF for helium and you lose 18% of it while you're trucking it over a one-day period, that has a significant impact on how much it costs you. All MRI’s boil off helium during the year. They need to be topped up again annually. There is a lot of demand for helium and we're not even talking government demand. The military uses it for rail guns and infrared lighting and barcode readers. I Don't think people really understand how many uses there are for helium and the fact now that consumption exceeds production.

Al Alper, Jr.:

Yeah, so great find! Could you tell our readers/investors the primary reasons they should invest in Desert Mountain Energy?

Don Mosher:

I think it is because of the demand and the price of helium, compared to natural gas. Natural gas sells for about $3.50/MCF, crude helium, sells for $280/MCF. We're 35 miles from the richest commercial seal to ever produce. It was called the Pinta Dome. It produced back between 1962 and 1975. They were getting $6.50 an MCF for helium, back then, and they made money. With the kind of grades that we're demonstrating, this should be an extremely profitable endeavor and we're very early into the build on this right now. We've only drilled three wells and we're moving the whole thing forward, as fast as we can, to become an actual producer and generate cash flow and profit for our shareholders.

Al Alper Jr.:

Well, that sounds excellent. You've checked off all the boxes; you have a great project, you're in an excellent location, and a mining friendly district. Helium is a great resource. Do you have anything else you'd like to add?

Don Mosher:

No. If people are looking for green investments, they need to realize, if you truly believe that we're going to electrify and all drive electric vehicles down the road, a Tesla has 17 computers on board and they use liquid hard drives. Because a liquid hard drive uses about 40% less energy than a normal hard drive. You cannot manufacture a liquid hard drive, without a helium environment to manufacture the hard drives. If you're looking at a green future, you need to be aware how important helium is to your plans.

Al Alper Jr.:

That's sounds really exciting! Thank you very much for your insight. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://desertmountainenergy.com/

Don Mosher, Vice President of Finance

(604) 617-5448

E-mail: Don@desertmountainenergy.com

|

|