Lucara Diamond Corp. (TSX: LUC, BSE: LUC, Nasdaq Stockholm: LUC): Leading Independent Producer of Large Exceptional Quality Type IIa Diamonds; Eira Thomas, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/26/2021

Lucara Diamond Corp. (TSX: LUC, BSE: LUC, Nasdaq Stockholm: LUC) is a leading independent producer of large exceptional quality Type IIa diamonds, from its 100% owned Karowe Mine, in Botswana and owns a 100% interest in Clara Diamond Solutions, a secure, digital sales platform, positioned to modernize the existing diamond supply chain and ensure diamond provenance from mine to finger. We learned from Eira Thomas, President, CEO and Founder of Lucara Diamond that since 2012 the Company has mined and sold 3.2 million carats of diamonds, generating revenues of $1.7 billion. In 2019, Lucara made a decision to suspend the dividend, in favor of investing that cash in underground expansion, which has the potential to extend the mine life out to at least 2040. In 2020, the COVID pandemic impacted diamond prices, and Lucara entered into a definitive supply agreement with HB Antwerp in respect of all Lucara's diamonds produced in excess of 10.8 carats in size. According to this partnership, Lucara is paid for the rough diamonds, based on the estimated polished outcome, minus a fee and the cost of polishing. Diamond prices have rebounded, demonstrating a V-shaped recovery beginning in the fourth quarter of 2020. According to Ms. Thomas, there was definitely a strong support for diamond jewelry gifting during 2020 and that's continued into 2021.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Eira Thomas, President and CEO of Lucara Diamond. Eira, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Eira Thomas:Lucara Diamond Corp. is a high margin, mid-tier diamond producer, whose primary or flagship asset is a 100% owned diamond mine called Karowe, which is situated in North Central Botswana and has been in production since 2012. We're well known for our production of very large, high-value, white diamonds.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors the size of your sales and the number of carats you mine and your relationship with HB Antwerp?

Eira Thomas:

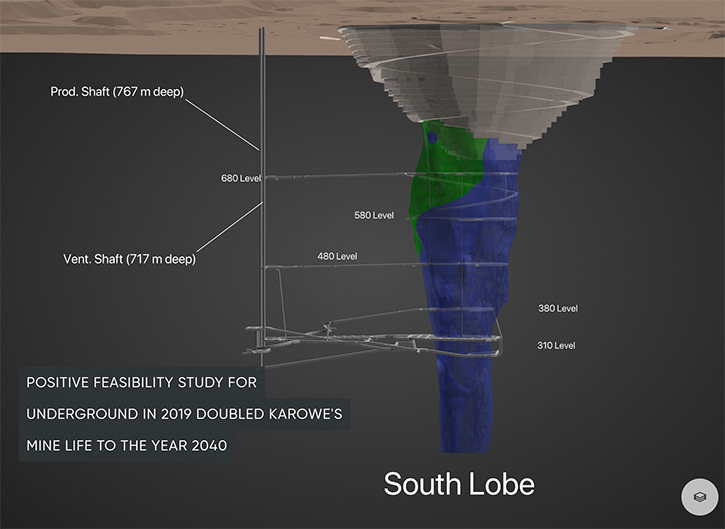

Since 2012 we have mined and sold 3.2 million carats of diamonds generating revenues of $1.7 billion. Between 2014 and 2019 we actually paid out $271 million in dividends, which is well in excess of the capital that we've invested in our project to date. In 2019, we completed an underground bankable feasibility study, which examined the potential for expanding our mine underground, with very encouraging results. We made a decision to suspend the dividend in favor of investing that cash in underground expansion, which has the potential to extend our mine life out to at least 2040.

In 2020, diamond prices were negatively impacted by the COVID pandemic. As a result, we made a deliberate decision after Q1 not to sell any of our large, high value diamonds through traditional sales tenders, which has been our primary sales mechanism for the last eight or nine years. Instead, we negotiated a novel supply agreement with HB Antwerp, a manufacturing company based in Belgium, who agreed to purchase all of our plus 10.8 carat diamonds for the remainder of 2020 and to put those diamonds into manufacturing. This agreement has recently been extended until the end of December 2022.

What's novel about this supply agreement is that Lucara is actually paid for those diamonds using an estimate of polished outcome, less a fee and the cost of polishing. Rather than selling our large, high value diamonds as rough, when rough prices were highly discounted, Lucara was able to partner with HB Antwerp, a leading European diamond manufacturer, to manufacture and sell polished diamonds, helping to protect prices for large, high-value polished diamonds, which were not subjected to the same heavy discounts during the pandemic.

Dr. Allen Alper:

That sounds like an excellent decision, and it sounds like HB Antwerp considers your agreement with them a partnership

Eira Thomas:

Yes, it really is a collaboration. What we like about this arrangement is that we are creating true alignment between the producer and the manufacturer for the first time. Traditionally, in the diamond supply chain, each participant makes its margin on the backs of another participant. Producers are trying to sell their rough diamonds for the maximum achievable rough price and the manufacturers who purchase those diamonds are motivated to purchase them as cheaply as possible to maximize their own down-stream margins. With the HB agreement, we throw that model on its head. Because HB’s commission is fixed and based on the final achieved polished outcome, we are both motivated to maximize the price of each diamond creating a complete alignment of interests.

Dr. Allen Alper:

That sounds great. Could you tell our readers/investors about your background and your Team?

Eira Thomas:

I am a Geologist by training, and I've been in the mineral exploration and mining business for more than 30 years. I started out my career exploring in northern Canada, initially for gold, but then moved into the diamond space when the first diamonds were discovered in the early 1990’s. I was really fortunate to be part of the discovery team at Diavik, Canada’s second diamond mine, and one of the world’s richest.

I spent 16 years working with Aber and after seeing Diavik through to production, I went back to my exploration roots and started my first diamond company with my long-time business partner, Catherine McLeod-Seltzer. That company was called Stornoway and it went on to make a number of discoveries in the Canadian High Artic, before acquiring an asset in Quebec, which went on to become developed as Quebec's first diamond mine.

Thereafter, Catherine and I, together with Lukas Lundin, another colleague and serially successful mining entrepreneur, saw an opportunity to look for diamonds in other parts of the world and we decided to target Botswana, which has one of the greatest geological endowments for diamonds in the world. We became the three founding partners of Lucara Diamond Corp. and about three and half years ago, I stepped in as CEO for Lucara.

Prior to taking on the role of CEO with Lucara, I was CEO of Kaminak Gold Corp., involved in developing an exciting gold project in the Yukon called Coffee, which was ultimately sold to Gold Corp in 2016.

Dr. Allen Alper:

You have a fantastic record of accomplishments and experience. Could you tell our readers/investors a little bit about the geology that created such large diamonds?

Eira Thomas:

With fewer than 25 producing diamond mines in the world today, diamonds are considered a rare commodity. The type of diamonds mined at Karowe are even rarer, dominated by a population of large, high value type II white diamonds, which are thought to originate very deep in the earth, as deep as 800 kilometers below the surface. Those diamonds are brought to surface in volcanic eruptions called Kimberlites. Seventy percent of our revenues at Karowe come from diamonds larger than 10.8 carats in size and we have mined and sold some of the largest, highest value diamonds in the world. In fact, Karowe has produced roughly a quarter of all diamonds greater than 300 carats globally and accounts for 4 of the world’s top 10 diamonds greater than 300 carats since 1893.

Dr. Allen Alper:

That sounds excellent. It sounds like an amazing deposit.

Eira Thomas:

It's an amazing deposit for sure and we have recorded a number of historic diamond recoveries over the 12-year history of the mine, including the 1,109 carat Lesedi la Rona, the third largest diamond in history and the 813 carat Constellation, which sold for $63 million, the highest price ever achieved for a rough diamond. More recently in 2019, Karowe produced the 1,758 carat Sewelô, the largest diamond ever recovered from Botswana. The Sewelô has been put into partnership with HB Antwerp and Louis Vuitton, the world’s leading luxury brand to create a bespoke, exclusive diamond jewelry collection.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors about your share and capital structure and your balance sheet?

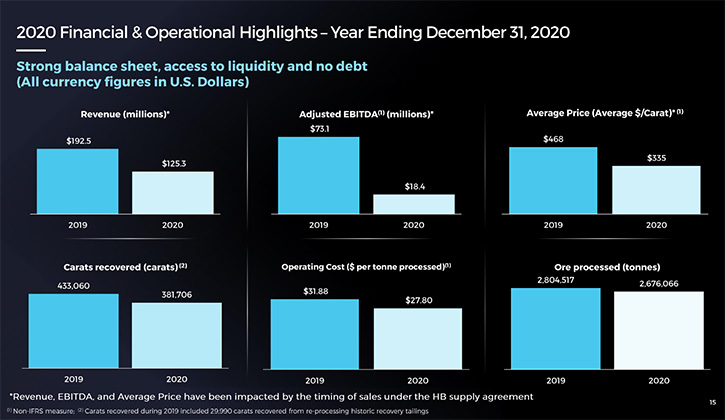

Eira Thomas:Lucara has approximately 409 million shares outstanding and currently trades around $0.76 Cdn. Importantly, we went into the pandemic with a strong balance sheet, with cash on hand, no debt and access to liquidity. After Q1 2020 as rough diamond prices deteriorated in response to the global pandemic, we made a deliberate decision not to sell any diamonds greater than 10.8 carats in favour of entering into a committed supply agreement with HB Antwerp in July for the remainder of the year. We have recently extended that supply agreement for another 24 months.

The decision to defer sales impacted our full year results and makes a year over year comparison difficult. Revenues generated from diamonds recovered and polished in 2020 will continue to be realized in 2021 as polished sales progress. At year end we had about $4.6 million in cash, $25.9 million drawn on our working capital facility, and a further $19.5 million in available liquidity.

Dr. Allen Alper:

That sounds very good. What does the outlook for 2021 look like?

Eira Thomas:

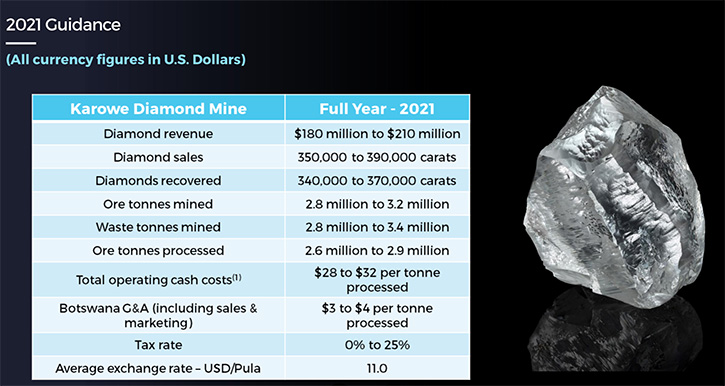

Our outlook for 2021 is cautiously optimistic. Rough diamond prices recovered nicely towards the end of the year and price trends continue to be positive in 2021. Our mine also continues to operate well, and we are forecasting revenues of US$180 to $210 million in 2021. Overall the fundamentals of our business are looking much stronger, in the sense that global supply for rough diamonds is on the decline and demand is stable and strengthening. We expect this trend to continue because some of the world's largest diamond mines are now nearing their natural end of life and global diamond supply is on the decline. We saw the Argyle Mine in Australia close its doors in 2020 and a number of Canadian producers are now also moving into their sunset years.

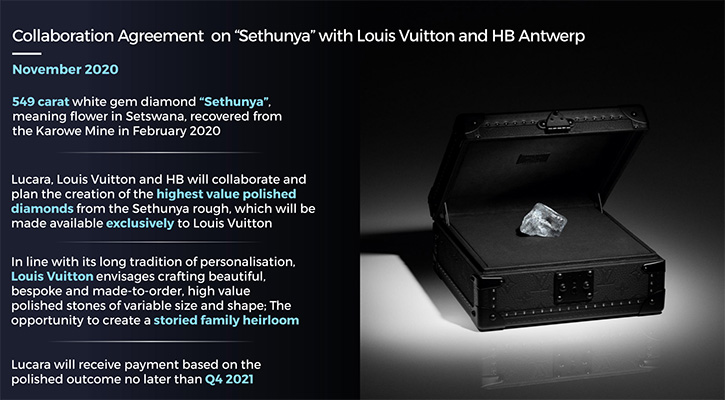

Another positive development for Lucara in 2020 involves two unique collaboration agreements with Louis Vuitton, the world’s leading luxury brand in respect of two of Lucara’s exceptional diamond recoveries. The first, which was launched in January 2020, involves the 1,758 carat Sewelô, the largest diamond recovered in Botswana ever. The second, involves a 549-carat top white rough gem referred to as Sethunya (Setswana for Flower) that was recovered in early 2020 and is one of the highest quality diamonds recovered from Karowe to date. Louis Vuitton's interest in diamonds and their recent decision to launch a high jewelry line stems from the fact that diamond jewelry, in general, has underperformed other luxury products in recent years and they view this as a huge opportunity. The acquisition of Tiffany, announced later in 2020, provides further corroboration of their commitment to the space longer term.

Our optimism about the market and belief that the fundamentals will continue to improve underpins our commitment to moving forward with an ambitious underground expansion plan at Karowe, extending our mine-life from 2025 to at least 2040. While most of the capital required for underground expansion is anticipated to be generated from cash flows from continued operations of our open pit, we are also working to finalize a supplemental debt financing package of up to US $220 million in the coming weeks.

Dr. Allen Alper:

That sounds excellent! It sounds like Lucara Diamond is in an excellent position, with a bright long-term future.

Eira Thomas:

We are very excited! In general, it has been a challenging few years for the diamond business, but as a high margin producer, Karowe continues to perform well. All signs are pointing to a stronger, more stabilized marketplace going forward. With the development of our underground project, Lucara remains highly leveraged to improving diamond prices in the future.

Dr. Allen Alper:

That sounds excellent. Eira, could you tell us the primary reasons our readers/investors should consider investing in Lucara Diamond?

Eira Thomas:

The diamond equities continue to trade at significant discounts, despite the fact that the fundamentals of the diamond business are looking much stronger. We see this as a huge opportunity for value investors. Lucara has maintained a strong balance sheet over 8 years of continuous operations and with the expansion of our mine underground, we will extend our mine-life by more than 15 years and add another approximately $4 billion in revenues using conservative assumptions. We are also very excited about this new relationship with HB and Louis Vuitton which we believe has the potential to create more demand for our large, high-value diamonds. Finally, we have asset diversification through Clara, our 100% owned, proprietary, secure, web based digital sales platform for diamonds less than 10.8 carats in size. Clara remains another important growth opportunity for Lucara, which tripled its customer base during the pandemic, eliminating the need for travel to buy rough diamonds.

In 2021 our main objective with Clara is to increase supply by inviting and opening up the platform to other producers to sell their diamonds. Not only are we a high-margin diamond producer, with a strong future in mining diamonds in Botswana, we also have this web based digital sales platform, which is unique in the world, that has the potential to generate significant cash flows for Lucara, in the future, with very low overhead and cost.

Dr. Allen Alper:

Those sound like compelling reasons to consider investing in Lucara Diamond.

https://www.lucaradiamond.com/

Eira Thomas

President and Chief Executive Officer

info@lucaradiamond.com

|

|