Sonoro Gold Corp. (TSXV: SGO, OTCQB: SMOFF, FRA: 23SP): Near-Term Gold Producer, Properties in Mining-Friendly Sonora, Mexico; John Darch, Chairman and Ken Macleod, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/23/2021

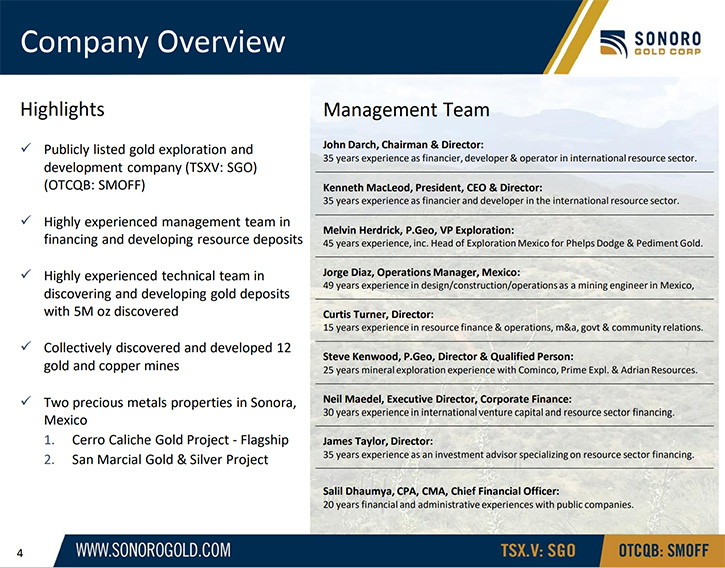

We spoke with John Darch, who is Chairman and Director, and Ken Macleod, who is President and CEO, of Sonoro Gold Corp. (TSXV: SGO, OTCQB: SMOFF, FRA: 23SP) a near-term gold producer, with exploration and development properties in the mining-friendly jurisdiction of Sonora, Mexico. The Company plans to develop a heap leach pilot operation (HLPO) at its flagship property, the Cerro Caliche gold project, and utilize the generated cash flow to fund further exploration and development. According to Mr. Darch, they have a clear business plan and execution strategy to move to production within the year. Sonoro has a highly experienced diverse and complimentary Management Team, highly committed, with a combined 20% stake in the Company.

Sonoro Gold Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Darch, Chairman and Director, and Ken Macleod, President and CEO, of Sonoro Gold Corp. John, could you give us an overview of your Company and what differentiates it from others?

John Darch:

I think what really differentiates Sonoro from the other junior gold mining companies, in this sector, is that we are planning to move to production within the year. We have all the essential components to be a successful mining company; The people, we have a diversified, proven, and complementary team. They are very success oriented, and very complementary in terms of their capabilities and experience; Geology, mining engineers, financing, marketing, et cetera. That is one of the important things.

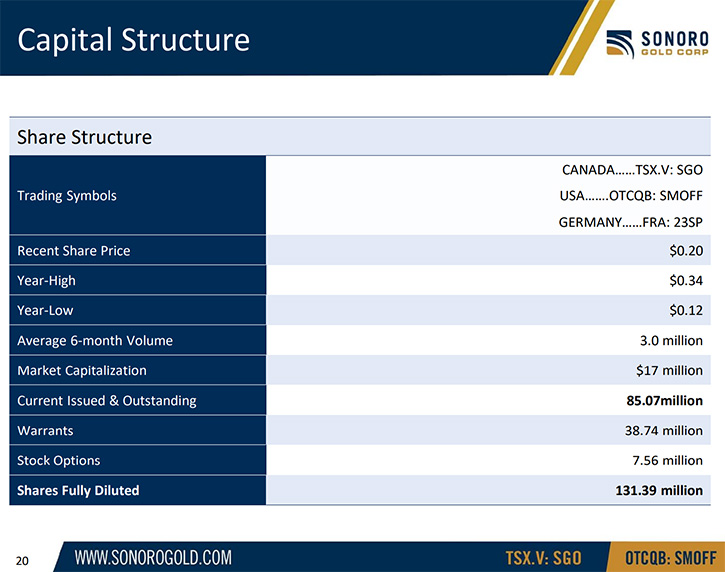

The other part is the project itself, Cerro Caliche, which is one of two projects, and I will leave Ken to talk about Cerro Caliche, our flagship project. The other part, which I think is very important, is the share structure of the Company. The insiders, management and the technical teams are very committed. We have a combined 20% stake at an average cost of 19 cents a share. We participated in the last private placement at about 18% and a new private placement of a similar magnitude.

What I think is probably the most important thing is that we have a very clear business plan and execution strategy. That is to move to production as quickly as possible, as professionally as possible, no shortcuts, but to be able to start generating revenue and all of that will continue the expansion of the Cerro Caliche resource. Those things combined, are what sets Sonoro apart in the junior gold mining sector.

Dr. Allen Alper:

Well, that sounds great, Ken. Could you elaborate on your main flagship project?

Kenneth MacLeod:

The project has been in the drilling phase intermittently for around 15 years. In 2007, Corex Gold acquired the rights to the property, and they drilled approximately 7,700 meters of reverse circulation drilling. During the 2008-9 global financial crisis, the money supply for gold exploration was very limited, so Corex decided to discontinue their involvement in Cerro Caliche and focus their attention on another project they were developing in Mexico.

In 2011, Paget Southern Resources, a private Australian company that wanted to go public on a Canadian exchange, came to Cerro Caliche and drilled over 3,000 meters of core. However, they never went public, and ran out of money. By then both companies combined drilling programs totaled almost 11,000 meters of core and RC drilling, all to National Instrument 43-101 standards.

When we acquired the property in 2018, one of the first things we did was to acquire all the data from the Corex and Paget campaigns, so it enabled us to start off with a good, strong wind at our backs, and that 11,000 meters of drilling enabled us to pinpoint the most promising areas for drilling with great accuracy.

I think its accurate to say that just about every single hole we drilled in 2018 from October until about June of 2019 was productive. And continuing from there, we published our maiden 43-101-resource report in July of 2019. That report estimated a total of 200,000 ounces, with an average grade of 0.545 g/t gold equivalent, with the gold component essentially being 0.5 g/t on average. There is very little silver in the mineralization, which makes it simpler of course from the point of view of processing as well. The important aspect of publishing this resource is that it has established a basis from which we could start assessing the viability of going into production and, as we continued to drill with the intention of expanding our resource it has enabled the Company to fast track its strategy to become a cash-flowing gold producer.

We then proceeded with a financing in September 2020 and raised $8 million to enable us to continue with the drilling program. Part of this drilling program was to test several prospective new targets with limited prior drilling while we continued drilling to define already identified large zones of shallow, potentially bulk mineable gold mineralization. Since that time, we have drilled a grand total of about 25,000 meters from September 2020 through to April 2021. Add that to the 11,000 meters drilled by the prior operators plus the 10,000 meters we drilled in 2018/2019, so now we have a database with over 46,000 meters of drilling.

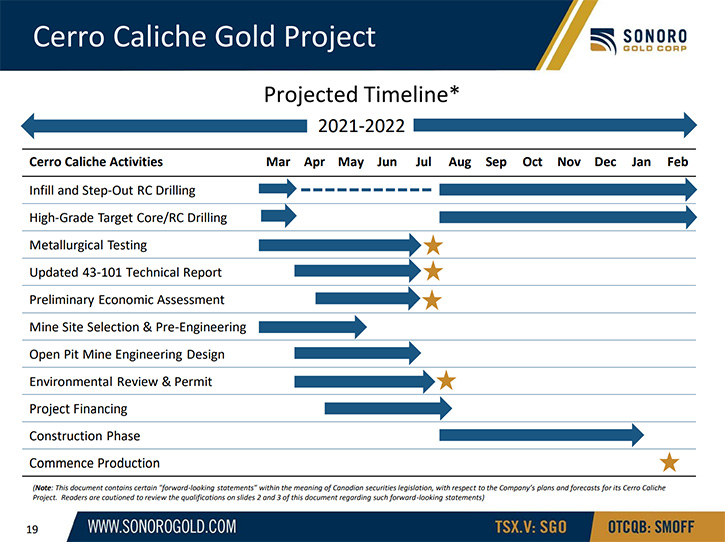

The focus of the drilling, over the past few months, has been to increase the drilling density and expand the established gold zones, while we do some drilling which is related to actual mine development and getting samples for things like rock density and metallurgical testing. Our main goal is to demonstrate a material increase in the resource and of that increase we hope to have a substantial amount in the drill indicated category so that these results are reflected in the next edition of the 43-101 resource report. In my opinion, we have done quite admirably in that we feel very strongly that not only have we increased the size of the resource substantially, and though I cannot tell you exactly what that will be until the 43-101 comes out in three months time, I expect we will also see a substantial upgrade in the classification of the resource. The initial 43-101 was limited to demonstrating an inferred resource because we did not have independent metallurgical testing completed at that time, but this time the necessary metallurgical tests are to be completed in advance of the report.

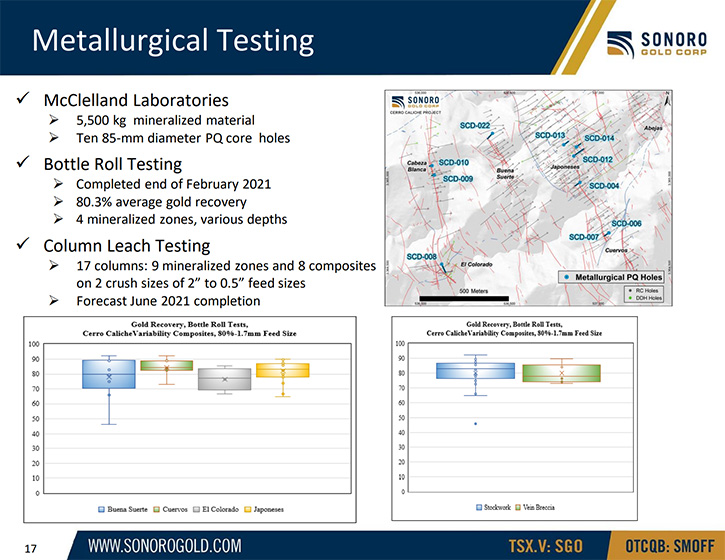

We’ve been conducting metallurgical testing with McClelland Laboratories in Sparks, Nevada, and last December we sent five and a half tonnes of material from PQ cores drilled from five distinct zones within the property and at different depths within each of these holes as well. They have been conducting the metallurgical testing since then. The initial results from the bottle roll testing, showed an average recovery of 80.3%, over all these different zones, ranging from a minimum of 70% to a maximum of 90%. The assumed gold recovery rate for our maiden 43-101 re-port is 72% so these results are encouraging.

We’re very satisfied with the results of the bottle roll testing, and the column leach testing is well advanced now. I would expect, within about 40 days, we should be complete the column tests, which takes us to the end of May. After that I would expect the metallurgical report will come out some time in the month of July.

The completion of the metallurgical testing will enable us to complete our next edition of the 43-101 which is already underway at Micon International’s Toronto office. Micon is very experienced with working on resource evaluations in Northern Mexico, having worked for several companies in Northern Mexico over at least the past decade. They anticipate having their 43-101 report completed shortly after the metallurgical testing is completed.

In conjunction with that, we are preparing a Preliminary Economic Assessment, or PEA as it is commonly referred to, which will be completed at the same time because all three companies are working together to get the completion of the PEA done as quickly as possible, which we anticipate will be sometime in July. That gives us a snapshot of where we are. Based on all the work and results thus far we are confident that the recommendation will be to go into production. Our focus will then be on raising the construction finance, with a view to getting into production in the first quarter of 2022. We are already in discussions with several parties regarding potential project finance, so we basically have a roster of mine finance professionals who are very aware of what we are doing, and I expect will be ready to react quickly when the results are made public.

We are now planning for a throughput of 15,000 tons per day to start. Should we be able to maintain the 0.5 grams/tonne grade advanced in our maiden 43-101 report, we would anticipate a very successful production outcome which your readers may be able to calculate for themselves, assuming our productions costs are similar to those of our peers in northern Mexico.

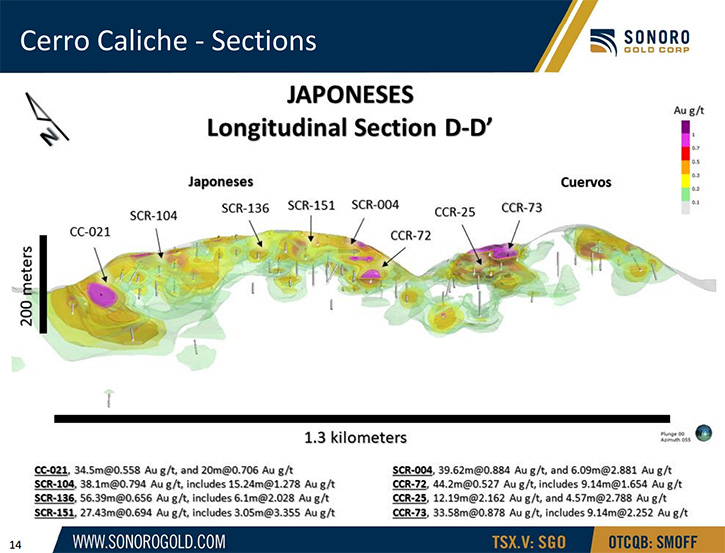

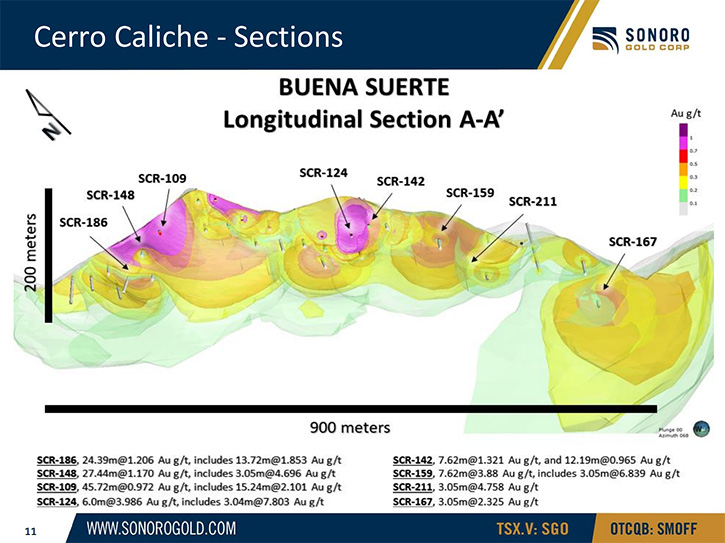

Our goal is to continue with the drilling program to increase the size and classification of the resource. In June of 2020, we published an internal report that quantified the potential for the property’s already identified zones of shallow oxide gold mineralization. We estimated the potential of these known zones to be in a range of between 75 million tonnes and 100 million tonnes, and a grade of between .3 and .5 grams per tonne for the head grade. Reviewing the results from the Buena Suerte, Buena Vista and Japoneses zones, our recent drilling has expanded these zones quite considerably, to the point where they are linking up to form one large continuously mineralized zone, thus potentially reducing the strip ratio.

We are very pleased with the drill results obtained since last September. If you analyze the results, I think we are continuing to maintain at least a half gram average as we proceed with the drilling program. Of the project’s 18 zones the main focus has been on the Central Zone including Japoneses, Buena Suerte, Cuervos and Abeyas, and the Western Zone including Cabeza Blanca and El Colorado. The Central Zone currently stands at approximately a kilometer in width across the strike and up to 1.3 kilometers along strike.

The potential for a very large, open pit of those dimensions in the Central Zone is quite real. And all the drilling that has been carried out over the past two months has been geared towards demonstrating the validity of our expectation that this will be one large open pit, thereby minimizing the strip ratio as much as possible. We also envisage at the Western Zone, off to the west by another 500 meters, there will be a secondary pit, which will be about a kilometer in length by about between 100 and 150 meters wide.

We truly believe that we have only scratched the surface of the potential for the project. Because this drilling has been focused on an area of about two square kilometers and so that is probably around 25% of the overall surface area of the project. We know that there is a grand total of 18 gold enriched zones that run in a southeasterly, northwesterly direction on the property. These are parallel zones, mainly, as is quite commonplace in Northwestern Mexico.

We have many, many other targets outside of this Central and Western Zones that we will be drilling over the next two or three years and as we do, we hope to continue to expand the resource and our mining activities. We are confident from the drilling results over the past 8 months, that a material increase will be reported by this July. And then over the next two or three years, we feel the odds are very good that it will continue to grow toward or beyond the projected target of 75 to 100 million tonnes grading around 0.5 grams per tonne.

Dr. Allen Alper:

That sounds excellent. Sounds like you have made great progress, and you have done extensive drilling, and have great knowledge. Could you tell our readers/investors about your great location, surrounded by many other successful mines close to Arizona, and your great infrastructure?

Kenneth MacLeod:

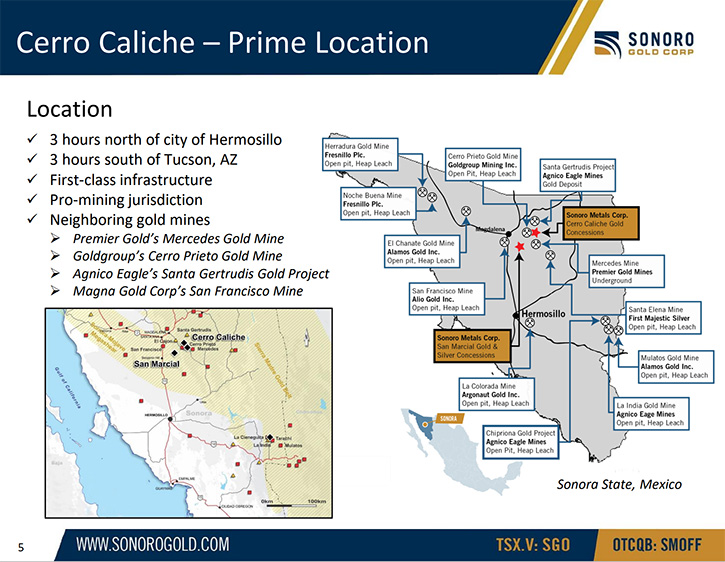

I will start off with Sonora State. I believe the Sonora State is one of the best jurisdictions in the world in which to define a mining resource and be able to get it permitted in a reasonable period of time. I believe that Sonora State is every bit as mining friendly as Nevada, as far as being able to put a mine into production and Sonora is much, much faster in the permitting phase than Nevada. We would be looking at years for permitting in Nevada. Here, in Sonora, we are looking at months. I consider Sonora to be one of the prime jurisdictions in the world now for permitting.

We are surrounded by probably around 20, 25 large gold mines in Sonora State. Sonora is the number one jurisdiction, the prime jurisdiction, in Mexico for gold production. With Mexico being number eight in the world for gold production, Sonora produces almost half of the gold production in all of Mexico at about 44%. It is a very important commodity for the economy of Sonora and the economy of Mexico.

When we look at the projects surrounding us, we are sitting on strike with several key projects. Eight kilometers to the southeast of us is the Mercedes Mine, operated by Premier Gold Mines. They have been operating now for eight or nine years. They are generally between 60,000 and 80,000 ounces per year of gold production, from an underground mine, and we are on strike and on the same structure. To the west of us is the adjacent Cerro Prieto Mine, which is an open pit heap leach operation that has been producing for about six years.

To the north of us is a growing project that was acquired by Agnico Eagle in 2017 for US$92 million from a company called GoGold. Agnico has been drilling extensively at Santa Gertrudis now, for the past couple of years and I anticipate a production decision may be made soon.

So, we are in very good company as far as the neighborhood is concerned. From a permitting perspective, this is a disturbed area. We are sharing the entry road into the property from the main highway, 14 kilometers away, with the Cerro Prieto mine next door to us and the Santa Gertrudis project of Agnico Eagle.

There is a transmission line supplying power to the Cerro Prieto Mine, which we in time will be able to extend into the Cerro Caliche property. But for the moment we anticipate, in the first phase of production, the installation of generators and eventually paying for the extension of the transmission line out of cash flow. As far as population centers are concerned, the nearest town or village is the little town of Cucurpe, about 14 kilometers away. The main center of commerce in the region is Magdalena, which is 45 kilometers away.

We do not anticipate any issues with respect to the population in the region, which is heavily dependent on mining anyhow. This is not a tourism region. Also, we are confident that sightlines will not be significantly impaired due to the remoteness of the location and the hilly nature of the terrain, making the mining area mostly hidden from outside view.

I do not see any issues as far as permitting is concerned. And as far as the size of the plant is concerned, we fully anticipate that as we continue with the drilling program, we will be able to increase the size of the resource, and thereby increase the size of the production, starting in the first year. I think it is reasonable to expect that we would first explore the potential to expand to 20,000 tons per day with the drilling program later this year, I would anticipate an even greater expansion in the next couple of years.

Dr. Allen Alper:

That sounds excellent. I think you covered the technical part very well, and you outlined for readers/investors the importance of the drilling work, the metallurgical work, and the plans for 2021. I think they will have an excellent understanding of Sonoro’s plans going forward technically.

Ken, could you tell our readers/investors a little bit about your background, and John, I would like you to talk about your background, and the Team and the Board.

Kenneth MacLeod:

John, do you want to talk about yourself and introduce everybody?

John Darch:

I started off as a commercial banker, with the NatWest Bank and then the Royal Bank. From 1983 to 2006 I cofounded several resource-focused public companies and a geothermal company in which Ken and I were partners. Over these 23 years, I have raised probably over $300 million US for various activities. A well known one is Crew Gold which acquired control of a South African company called Metorex. From there we had multiple producing gold mines in Africa, Greenland, and a major copper mine in Zambia. Another great company was Asia Pacific Resources which discovered and developed to feasibility two deposits, the Udon South and Udon North in Thailand, which are considered to be among the highest-grade potash deposits in the world. The Company was sold to a major Thai Conglomerate for $100 million. Notably, with Ken and myself, was the development of Western GeoPower, which was developing geothermal projects in British Columbia and California.

The other people, Mel Herdrick, our VP Exploration, is a professional geologist, with a great reputation and history that comes with four decades of discovering and developing at least a half a dozen copper or gold deposits. As you know, two of Mel’s discoveries were drilled by him for Pediment Gold, which was subsequently taken over by Argonaut Gold at a substantial premium to its market.

Our VP of Operations, Jorge Diaz, is a mining engineer, and he is both a Colorado School of mines Alumni and he is one of the original Glamis Gold mine developers. He is highly professional and very successful. He has developed similar projects with great success. A notable achievement by Jorge was the design and construction of Alamos Gold’s Mulatos Mine which is a highly successful operation. So, he has a lot of credibility and is a real and trusted part of the local community where we operate. We also have Curtis Turner as a Director. He brings a wealth of experience, involving the practical side of mining and on the corporate side as he was part of the acquisitions team for Argonaut Gold in Mexico.

We also have Neil Maedel, who has been very prominent in his past involvement with public companies. He is experienced with raising capital, coordinating with analysis, and ran a highly successful Switzerland-based newsletter he authored in the 1990s, and later as an executive of both oil and gas and mining companies with activities globally. He has a very good understanding of corporate strategy and the financial markets. We also have director Steve Kenwood, a professional geologist. He adds a lot of value because of his expertise regarding our regulatory compliance and his wealth of knowledge regarding managing and operating small resource companies in the Canadian arena.

Kenneth MacLeod:

My business background started with my six-year experience as a mechanical engineer until 1981, when I changed my focus to managing and financing companies and projects in the resource sector. I have been involved in oil and gas development in the US and the Philippines. I entered the mining sector with a project in the Congo. The first time I met you, Al, was when I was developing a large copper and cobalt tailings and hard rock deposit in the Congo. That was in the late 90s. We were one of the first foreign mining companies to enter into an agreement with Gecamines, the state mining company, to develop projects in Katanga State. Following that, John and I got together in 2001, and we developed a geothermal energy company, Western GeoPower, which was taken over in 2009. Then I set up a private company developing renewable energy projects in the Philippines, one of which was a 600 MW dam. I sold the Philippines projects in 2014 to the subsidiary of a large Philippine conglomerate.

In 2014, I became President and CEO of Sonoro. The gold sector was suffering for many years and raising capital was difficult, but we prevailed through to 2018. Part of the reason we are successful now was that we distinguished ourselves early on as an acquirer of several exceptional mineral properties, with Cerro Caliche being one of them. Another property called Chipriona was sold to Agnico Eagle for USD $4 million, leaving Sonoro with a 1% NSR, which we later solid to Agnico for another $875,000. The ability to raise money by selling a non-core asset really came in handy.

Then in 2018, we identified and optioned the mining claims which form the Cerro Caliche Project. John joined us in 2018 and since then we have raised enough money to carry out a very robust drilling program, which has been successful beyond measure. We believe that we will be able to declare a very substantial increase in the size of the Cerro Caliche resource once the next edition of the 43-101 is completed this summer.

Our success in raising capital, despite the downturn in the market right now, has been astonishing. Many people have moved over to crypto currency and other flavors of the month as far as investments are concerned and yet we have exceeded our expectations in terms of raising capital. We have really put the money raised to good use and this should be clear with the amount of drilling we have accomplished and the consequent results which justified increasing the proposed mining operations size by about 400%. The PEA and resource update is due this July and immediately following that we expect to finance and build the proposed mine. When this happens, I expect the news that I will continue to report to you will just keep getting better.

Dr. Allen Alper:

Well, that sounds excellent. I think you all have accomplished a great deal and in a great location. You have very impressive teams, excellent backgrounds, and a great record of success. I am also very happy to hear that the Management Team has skin in the game and is aligned with the investors.

John Darch:

What you said is hugely important. I think it attributes to our success in raising money. Recently, we announced we were going to do a private placement of $2 million and the response was significant. Within days, we increased the size of that placement from $2 million to $2.6 million. (it was ultimately increased to over $3 million) Talking about Management having skin in the game, Ken and I each contributed $150,000 to the placement to maintain our positions and commitment to the Company. The average cost for the insiders is right up at 19 cents. I think two things are very important, one is that the public recognizes the value in what we are doing, which is why there is this considerable investor interest. Secondly, what our investment in the Company demonstrates is that we are absolutely involved and motivated, and that we are commercially driven, it is not a promotion. It is also important that we continue to invest at the same cost as the outside investors.

Kenneth MacLeod:

One think I would like to add to that, is that the Management Team is well-seasoned. We have over 200 years of collective experience in the resource sector by taking projects through from exploration, financing them, developing them and even into operations. Our Operations Team, headed by Jorge Diaz, has been instrumental in the design and construction and operation of 10 open pit and underground mines in Northern Mexico. Mel Herdrick has been the leading geologist in the discovery of over 5 million ounces of gold over the past 20 years. We have a Team that has so much expertise and that is willing and able to bring this project through to production. The intention for us, as Management, is to maximize the value of each ounce in the ground. The more we define the resource and the greater we increase the density of the drilling to upgrade the resource classification, the greater the value each ounce will be. When we go into production, we will be able to achieve the maximum value for each ounce in the ground at that point.

Dr. Allen Alper:

That sounds excellent. That sounds very good. I wonder if you could just highlight and summarize the primary reason our readers/investors should consider investing in Sonoro Gold.

John Darch:

I think the reason that people should look at Sonoro and why we stay this distinctive in the junior mine sector is that fact that over the last eight months, we have transformed from high-risk exploration into a near term producer. Also, the capital cost is very likely to be exceptionally low with a very short timeline from construction to gold production and cash flow. This is exceptional for a junior company. They normally take years to develop a mine. In Sonoro’s case it is likely to be a matter of months. We can do this because of the location, the people involved, and the type of mining being planned. An added attraction for investors is insiders are willing to invest at the same level as them if they buy now. There are no cheap shares, there are no freebies, everybody pays to get into the Company by way of private placements and market participation.

When we publish our new resource report and the PEA, they should support what we believe will be a substantial increase in the resource and show sound economics. It is not difficult to see a substantially higher share price. If we calculate by using Sonoro’s stated 15,000 tonnes a day, and a grade of 0.5 grams per tonne with a recovery of say 72%, both figures, which were used in the NI 43-101, we get a base case figure of over 50,000 net ounces of gold per year.

I think it is important to keep in mind that we are talking about Sonoro having a very real potential to generate a strong cash flow next year, which should positively impact its current CAD $20 million market capitalization.

I think we have a situation now where we are almost hiding in plain sight. We are putting out news releases, but until we can issue the 43-101 and the PEA, the average investor may find it difficult to do the right calculations that a geologist or professional could do. So, it is Sonoro’s current deeply discounted valuation, together with its highly credible growth and cash flow potential which are why it should be of great interest to investors.

Between the Sonoro shares potential upside and factoring in what I said were the essential components of a successful company: The people, the property, how easily it can be mined, the share structure and the fact that we have a clear business plan that we have never deviated from, it is not surprising that our most recent private placement financing was heavily oversubscribed. It really is a great indication that many investors believe in the Company, its strategy and ability to execute, basically what its management is saying as our words are also confirmed by the share buying that we as insiders are doing.

Dr. Allen Alper:

Those are compelling reasons for our readers/investors to consider investing in Sonoro Gold. John, Ken is there anything else you would like to add?

Kenneth MacLeod:

No, I do not have anything else to add at this time.

Dr. Allen Alper:

We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://sonorogold.com/

Kenneth MacLeod

President & CEO

Sonoro Gold Corp.

Tel: (604) 632-1764

Email: ken@sonorogold.com

General Email: info@sonorogold.com

Twitter: https://twitter.com/SonoroMetals

Linkedin: https://ca.linkedin.com/company/sonoro-metals-corp

Facebook: https://www.facebook.com/sonorogold/

YouTube: https://www.youtube.com/channel/UC_yosp0_k2pG0MxpK7JgNTQ/

|

|