Legend Mining Ltd (ASX: LEG): Exploring its Massive Nickel-Copper Project in the Fraser Range, Western Australia, with JV Partners Creasy Group and IGO Limited; Mark Wilson, Managing Director Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/22/2021

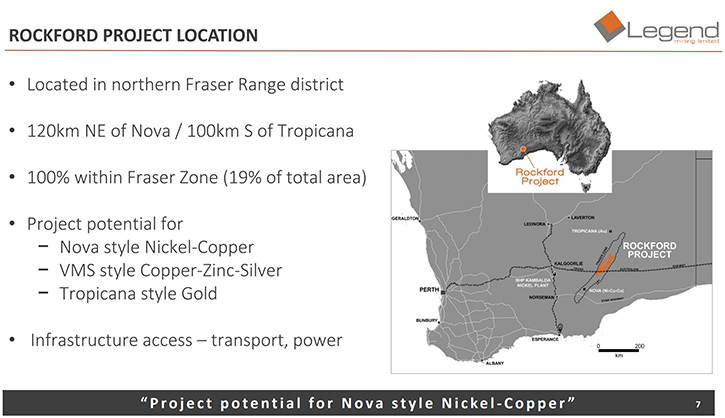

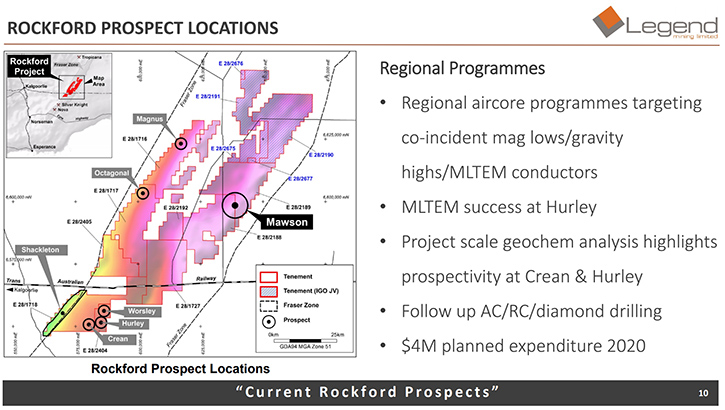

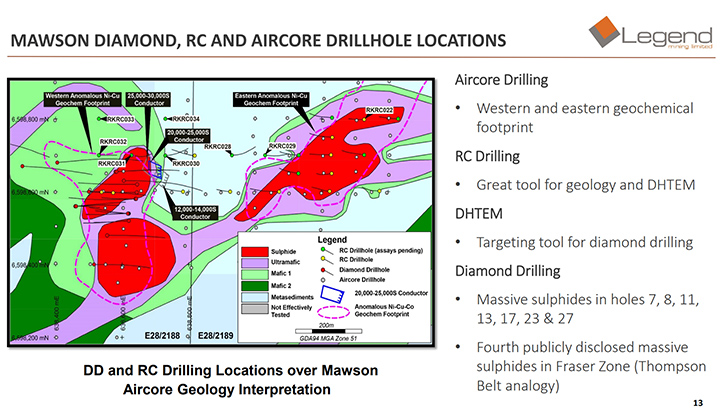

Legend Mining Limited (ASX: LEG) is an Australian exploration company, focused on its nickel-copper Rockford Project in the Fraser Range, Western Australia, with its Joint Venture partners and major shareholders Creasy Group and IGO Limited. We learned from Mark Wilson, Managing Director of Legend Mining, that the exploration results to date have highlighted seven priority prospects, including magmatic nickel-copper-sulphide style targets at Mawson, Octagonal, Magnus, Hurley and Crean and VMS style zinc-copper-silver targets at Shackleton and Worsley. The Mawson target resulted in the discovery of massive nickel-copper sulphides in diamond drillhole RKDD007, which Legend believes is part of a large mineralized system.

Legend Mining

Dr. Allen Alper: Hi Mark. This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mark Wilson, Managing Director of Legend Mining. I’m very impressed with your presentation. It looks like you have an outstanding company with great potential.

Mark Wilson: Thank you for that. Yes, it's been a very exciting year for us, which all started around a drill hole in December 2019.

Dr. Allen Alper: Could you give our readers/investors an overview of your Company and what differentiates Legend Mining from others?

Mark Wilson: Are you a geologist or finance person?

Dr. Allen Alper: I’m an economic geologist and petrologist.

Mark Wilson: I'm an engineer, so you have to excuse some of my loose language from a technical point of view, but your readers will certainly understand it.

We're, an exploration Company. We've made a discovery of massive nickel copper sulfide. We've been working in this project for five years. The general area is known as the Fraser zone. And what's important, especially for your North American readers, is that this area was identified by the Canadian geological society back in the 1960s, as having geological similarities to the Thompson nickel belt in Canada. That's so important because the Thompson nickel belt is characterized by clusters of economic nickel copper deposits. It has an endowment of 2.7 million tons of nickel. This area has the same geographic footprint as Thompson and to date only 300,000 tons of nickel has been discovered.

From the 1960s, when Newmont came out in joint venture with local company Western Mining, to do the original exploration, it took until 2012, when the first economic discovery of nickel copper was made by a small company called Sirius Resources. What's so exciting to me and to other true believers in this belt, is that Sirius went from $10 million to 1.8 billion Australian dollars, in the space of three years. IGO, the Company, which took them over at the 1.8 billion, is currently producing nickel at $1.60 US per pound, selling into a $7 a pound Nickel market, it was an enormous win for the Sirius’s shareholders, and it's a great cash generator for IGO.

Dr. Allen Alper: Interesting.

Mark Wilson: And we think we're in the same geological setting, which puts us in the game for a repeat of that story. In the belt to date, there are only four occurrences that have been publicly disclosed of massive nickel copper sulfide. And two of those are on Legend’s ground, one of which is Mawson prospect, which is what most of our current news flows is about. When we first acquired this project, we basically had some good air mag and good gravity data. And we started looking for coincident mag lows and gravity highs, which are characteristic of the Nova Mine down to the South. All this area is soil covered. The average is 80 meters of transported soil cover, but it ranges from 30 to 150 meters, before you get to fresh rock. So, the traditional methods of soil geochemistry sampling, or geological mapping, are a waste of time and money.

So, the only techniques that we're aware of that have any validity is ground EM, looking for conductive bodies, and that has its limitations because the conductive cover in these transported soils definitely messes with the ability of the technique to see through the cover and get a meaningful message back. The other technique is air core drilling, which as you know, can't penetrate the fresh rock, but it'll go through the cover and at least give you a couple of key bits of information. One is the depth of that cover. The second is the geochemistry in the lithology on the way down. And thirdly, it gives you the geology and geochemistry of the top of the fresh rock. And the most effective in discovery, has been an example of both of those techniques, the ground EM and the Aircore working in tandem. What the moving loop ground EM gave us, was a lot of conductors, which when we've drilled them have turned out to be graphitic schists, which is not what we're looking for.

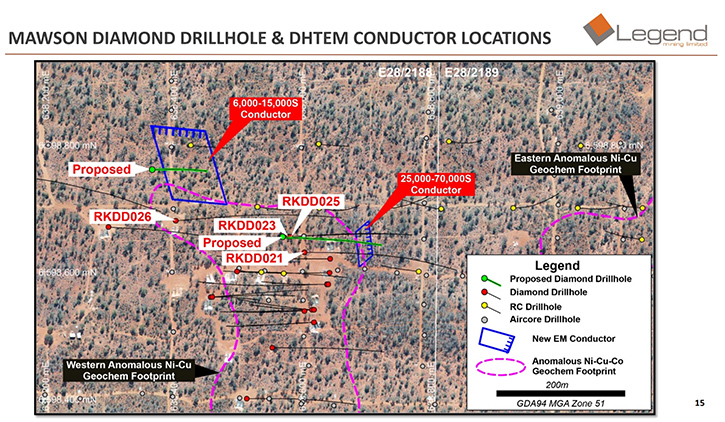

The moving loop conductors mapped out the architecture of Mawson, an intrusive complex, which is 16 kilometers long, and about six kilometers wide, in quite a discernible elliptical shape from the aero-mag. But within that 16 by 6, there are what's interpreted as a cluster of intrusions and the Mawson intrusion is the central one. This is the one where we've established these coherent geochemical anomalous footprints, which we've diamond drilled. Backing up a little bit, December 2017 was the first time we got an anomalous Aircore hole at Mawson, which put us in the ballpark. And then it wasn't until December 2019, when we drilled the discovery diamond hole, which was the third diamond hole in that program, that intersected massive nickel copper sulfides. And the story since then has been one of more diamond drilling, using down hole EM, which as you and your readers would know, has a limit of about 50m-120m radius around the hole that it can see.

And then, stepping out and putting more diamond holes into these off-hole conductors and building our story. But we don't believe the massive that we've intersected today is the source. A lot of the geological indicators point to the fact that what we've been drilling, has been remobilized, but it is close. We've yet to properly interrogate the Eastern chemical footprint, which will be a focus of our work in 2021. I'm hoping, once we get a handle on the structure and the geology of the Western and Eastern geochemical footprints that will give us the clues as to where we want to put our deeper holes in the 3d gravity inversion model, which was a part of that presentation, in the video clip.

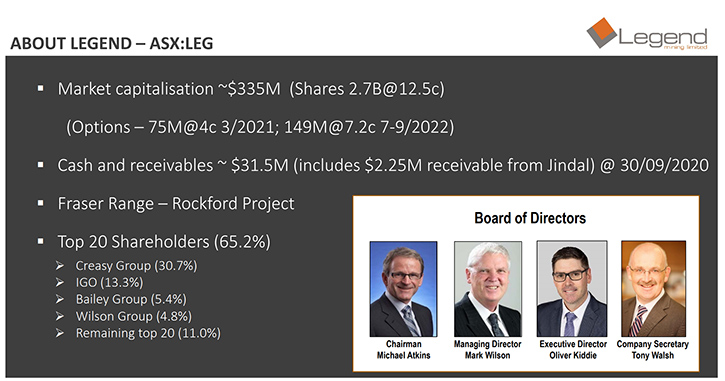

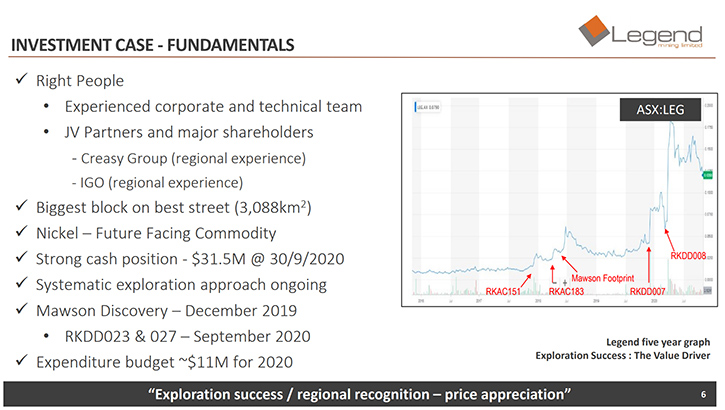

From a financial point of view, we have gone from a market cap of $20m, when we first took this project on in 2015, to a $330 million market cap today. We have $30 million in cash and receivables. We spend at the rate of about 12 million a year. So, we have more than two years of money in our treasury and some outstanding warrants that are deep in the money, which should contribute another $13 million over the next two years. The story is of a very well-funded company and if I might say so myself, well managed. We're in a great terrain, with a great project, and a team of really good people and supportive joint venture partners and shareholders helping us along the way.

Dr. Allen Alper: Well, that sounds excellent. Sounds like a great project and with great potential. Could you tell our readers/investors a little bit more about your background and your team?

Mark Wilson: I am a civil engineer, who has spent the last 20 years in mining, both in my own projects and in senior management roles, in public companies. I am really well supported from a professional point of view by the Board that I have around me. We're very conservative by nature and very experienced. There is enormous attention to the ESG credentials of public companies these days, (environmental, social, and governance) and we pay great attention to this detail. We've had a new addition to our Board in the last three months, a geologist by the name of Oliver Kiddie, who has spent the last 10 years of his life, working as Exploration Manager for Mark Creasy, who's our joint venture partner, a major shareholder. As such, he's had his feet under the table of every transaction that Creasy has been involved in, in this area over the last 10 years. Creasy was the largest shareholder in Sirius, the company which discovered Nova and had a 30% joint venture interest in the project, which is the same profile he has with us.

Dr. Allen Alper: A very impressive team! Great backgrounds and breath! It prepares you well for moving forward with exploration into development. I have one other question. Could you elaborate a little bit more on your share and capital structure?

Mark Wilson: We have 2.7 billion shares on issue, which is why, with a share price of 12.5 cents, we still have a market capitalization of $335 million. Our top 20 have 65% of that stock and the top four have 54%. And those top four, Mark Creasy with a 30%, IGO (the operator of the Nova nickel mine) with 13%, the Bailey group, who's a high-net-worth here in Perth, with 5.4%. And I'm the fourth largest shareholder with 4.5%.

I point out to listeners that all my shares have been bought on market. I've been involved in this Company for 15 years. When I started, it had $350,000 cash, $11 million of debt and a very uncertain future. It's been 15 years of my life that I've dedicated to turning around the Company to what it is today. And I've spent six years of my total salary acquiring that stake in on-market purchases none of it gained through soft performance transactions.

Dr. Allen Alper: Oh, that's fantastic. That's great to see someone who has skin in the game and believes in what he's doing and has devoted so much time and effort to his Company.

Mark Wilson: Yeah. Thank you for that.

Dr. Allen Alper: Mark. I wonder if you could tell our readers/investors, the primary reasons they should consider investing in Legend Mining.

Mark Wilson: The upside is the Sirius success analogy, $10 million to $1.8 billion in three years, from a 46 square kilometer land package. We have 3000 square kilometers, and the Mawson discovery in the bag. If readers go to slide nine, in my presentation, there's a gravity map on the left-hand side of that slide. And if you look at the landholders, which is the central map of that slide, they can see that Legend controls, just about that entire central gravity high. And many of us who've been in this area for a long time, believe that that gravity ridge is the key to where the mineralization that we're looking for is likely to be found. And they will see that both Octagonal and Mawson are in those locations. So, if you look at us at 335 million today, I still see enormous upside in the growth of that.

The nickel that we're looking for is battery compatible and the battery market in five years’ time ticks all the boxes as a green metal. All the socially and environmentally conscious investors, find that nickel is something that if it's mined in a country like Australia, with the environmental, social and governance considerations, it ticks the boxes of green mining upside. With that ground position, the team we have at the moment, and the money we have. I think that makes a very compelling case for why you should look at Legend.

Dr. Allen Alper: That definitely sounds like an outstanding opportunity for our readers/investors to consider.

Mark Wilson: Even if you're a chartist, the chart shows that we were as high as 20 cents a couple of months ago, and at 12 cents now with the trend line upwards, it points quite strongly to the fact that Legend has a buy written all over it.

Dr. Allen Alper: Well, that sounds great, Mark. Is there anything else you'd like to add?

Mark Wilson: No, I think your questions have all been to the point. Thank you.

Dr. Allen Alper: Well, thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://legendmining.com.au/

Mr. Mark Wilson

Managing Director

Ph: +61 8 9212 0600

|

|