Moneta Porcupine Mines Inc. (TSX:ME, OTC: MPUCF, XETRA: MOP): Exploring and Developing One of the Largest Undeveloped Gold Resources in North America; Gary O'Connor, CEO and Chief Geologist Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/31/2021

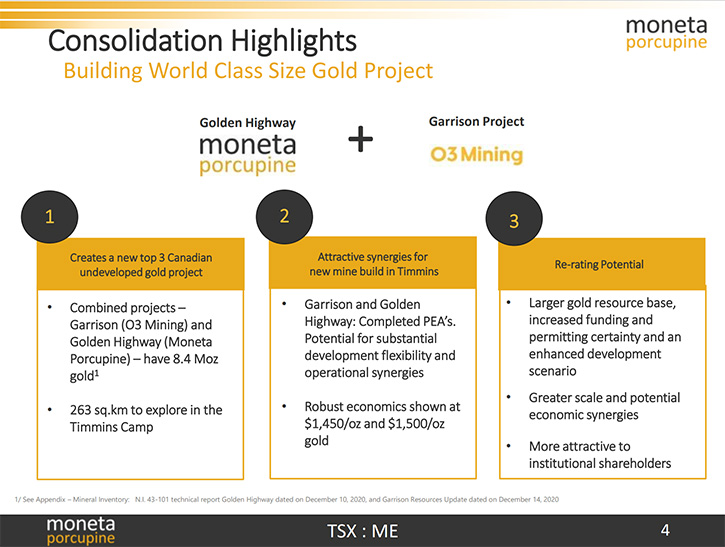

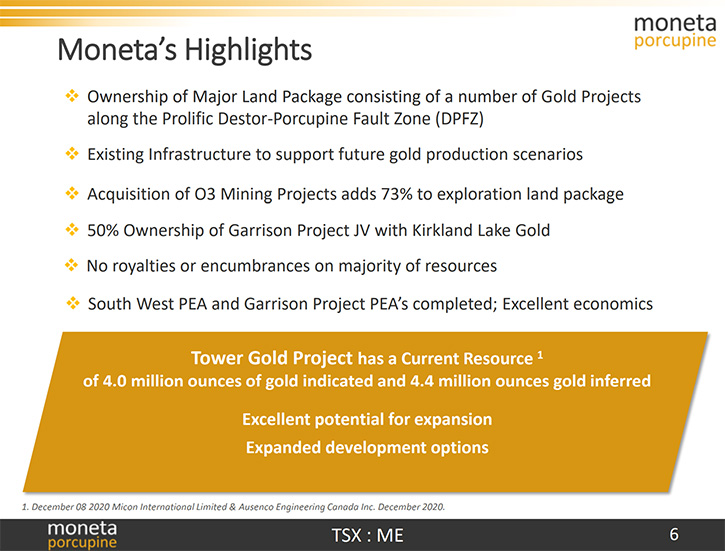

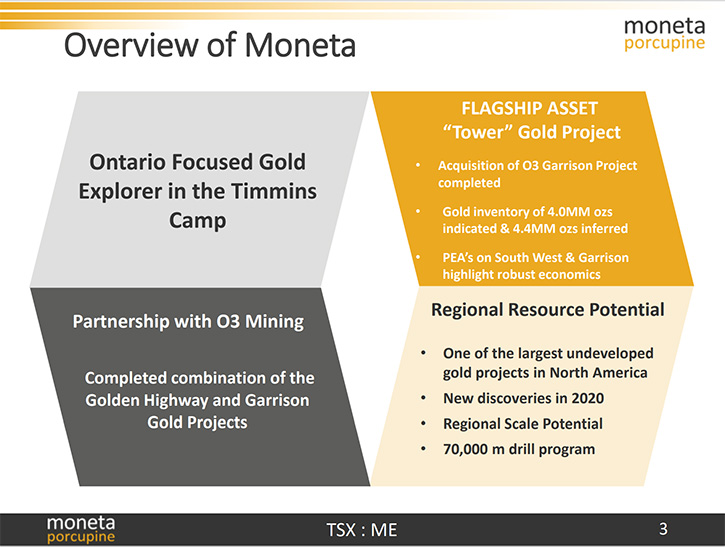

At PDAC2021, we spoke with Gary O'Connor, CEO, Chief Geologist, and Director of Moneta Porcupine Mines Inc. (TSX:ME, OTC: MPUCF, XETRA: MOP), a gold exploration company, which holds a 100% interest in 6 core gold projects and a 50% JV with Kirkland Lake Gold, strategically located in the Prolific Destor-Porcupine Fault Zone, in Ontario, Canada, with excellent infrastructure, including access roads, water, electricity, and mills. Moneta Porcupine put together one of the largest undeveloped gold resources, in North America. In February 2021, the Company completed the acquisition of the Garrison project, from O3 Mining, to create a leading Canadian gold development company, with 4 million ounces indicated and 4.4 million ounces inferred gold ounces.

Moneta Porcupine Mines Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Gary O'Connor, who is CEO and Chief Geologist and Director of Moneta Porcupine Mines. Gary, could you give our readers/investors an overview of your Company? And also, what differentiates your Company from others?

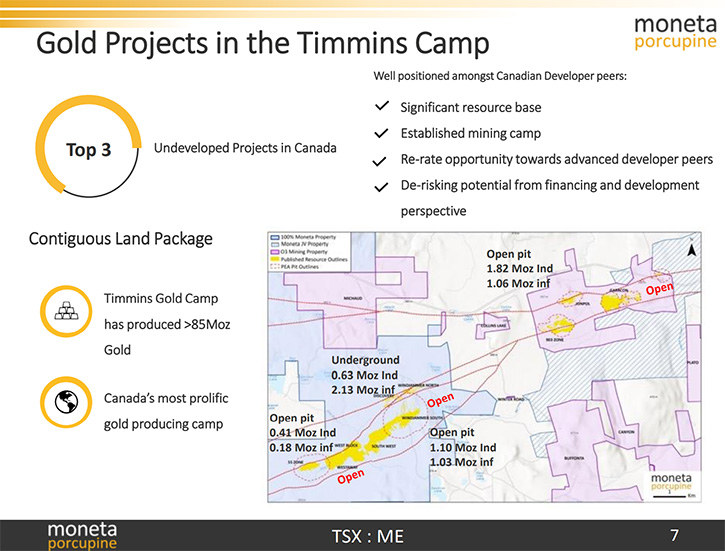

Gary O'Connor: Yes, thank you, Al and thank you for the opportunity to speak. Moneta Porcupine Mines is listed on the main board of the Toronto Stock Exchange under the ticker ME. It is an exploration gold company that is focused on gold in Ontario. Our main focus is the Timmins Camp in Ontario, Canada. Timmins is Canada's largest and most prolific gold mining camp where we have a large strategic land holding and a large, strategic resource. We've just put together what is one of the largest undeveloped gold resources in North America. It consists of 4 million ounces indicated and 4.4 million ounces inferred gold ounces. It consists of both open-pit and higher-grade underground resources. We have 2.8 million ounces in underground resources and 5.6 million ounces in open-pit resources.

We just recently acquired the adjacent O3 Mining Garrison Project. The Garrison gold resource numbers are now included in this total. The Garrison Project consists of 2.9 million ounces in an open-pit resource that was the subject of a recent a preliminary economic assessment “PEA” study, which was completed in December last year. Our resources have been subjected to an updated resource estimate, which was also completed in December last year. And our main underground resource, for South West Project, was subjected to a preliminary economic assessment study in September last year. So, we have some recent economic assessments, which show the robust nature of our resources and also underpin the viability and the good value in the resources, which we have defined to date.

Dr. Allen Alper: Oh, that sounds excellent! Could you tell our readers/investors your primary goals for 2021?

Gary O'Connor: For 2021, our primary goal was initially to complete the transaction and the acquisition of the Garrison Gold Project. We have done that. We have completed the closing of that acquisition, two months ahead of schedule. We announced the closing of the acquisition two weeks ago, making Garrison now a part of Moneta Porcupine Mines. We now also have good Board representation from O3 Mining. Moving forward, we are well underway on a 70,000 meter drill program. The drill program is designed to continue to expand the resources. We have a number of areas, both near surface lower grade open-pit targets and higher-grade underground targets, which we are drill testing and modeling. We put a press release out three weeks ago that showed the extensions of one of these zones over 1,600 meters to the east of one of our current resources. We are also targeting the extensions of the new underground discovery from last year at Westaway. It is a high-grade underground resource. We are drilling the extensions of Westaway now, and we will be drilling the extensions of the Garrison open-pits and targeting underground resources of Garrison as well, upon completion of the Golden Highway drill program.

Moneta Porcupine Mines Inc.

Dr. Allen Alper: That's excellent!

Gary O'Connor: Upon completion of the drill program, we will update the resources. We are looking at another significant resource update, which we will subject to an updated preliminary economic assessment study, currently planned for the end of the year. That study will review a much larger project, with a much higher throughput, much greater production profile and significantly larger valuation. We will be looking to have that started by the end of this year.

Dr. Allen Alper: Well, that is really great! Could you tell our readers/investors a little bit about the region you are in, some of the other mines and why it's such an exciting region?

Gary O'Connor: The Timmins Camp is Canada's most prolific gold mining camp. Over 85 million ounces have been produced in the camp over the last 100 years. Many of the big gold mining companies are currently active and producing gold in the camp. Newmont has a large operation, as do Pan American Silver, Kirkland Lake Gold and McEwen Mining. There are a number of operating underground and open pit operations, within a very prolific gold mining camp that has great infrastructure. Our project occurs immediately adjacent to a major regional highway. We have electricity, water, roads, a skilled workforce and all the infrastructure required. Hence the capital costs and exploration costs for any development are significantly lower than the average costs in North America. We see this as a major saving and advantage when we go to develop our resources.

Dr. Allen Alper: Well, that sounds great. Could you tell our readers/investors about your background and your Team and Board?

Gary O'Connor: I am a geologist. I have 38 years’ experience in the industry. I have worked on a number of major resource drill-outs. I've discovered a number of major deposits. I started with BP Minerals, in the Southwest Pacific. I have worked for over 10 years for Freeport-McMoRan in Indonesia, discovered the Wabu gold deposit with over 12 million ounces, discovered four porphyry copper-gold deposits, completed the due diligence on a Company called Bre-X. We had an option to acquire the Busang Project at the time. We found no gold. I was the VP exploration in Eastern Europe for Gabriel Resources, drilled out the Rosia Montana Project, took that to 16 and a half million ounces, discovered Rodu-Frasin, 2 million ounces. We drilled out Certej, 3 million ounces and drilled two other large copper-gold porphyries and then I spent 10 years on Bay Street, on the buy side. I have completed technical due diligence and financial evaluation of hundreds of projects worldwide and have now been with Moneta for the last three years.

Dr. Allen Alper: Well, you have a fantastic background. Could you mention the background of some of the other members of your Team?

Gary O'Connor: We have Jason Macintosh, the CFO. He's previously worked for contract mining groups in the industry, as well as being the cost controller for operating mines and developing exploration companies within Canada. Linda Armstrong has extensive experience and runs our IR program. Kevin Montgomery, our senior geologist has 30 plus years’ experience. We have a good team of project geologists with 20 years in the camp and a number of young, more recent graduates bringing us new, keen and energetic ideas on our projects.

Our Board has an excellent wide skill set. They have worked on a number of projects, development, operating and exploration. We just welcomed Jose Vizquerra and Blair Zaritsky to our Board. They both have extensive experience with the Osisko Group. We are very happy with the Board and the breadth of skills, within the Board.

Dr. Allen Alper: Well, that sounds like you have a very experienced, accomplished Team and Board, so that's excellent! Gary, could you tell our readers/investors a little bit about your share and capital structure?

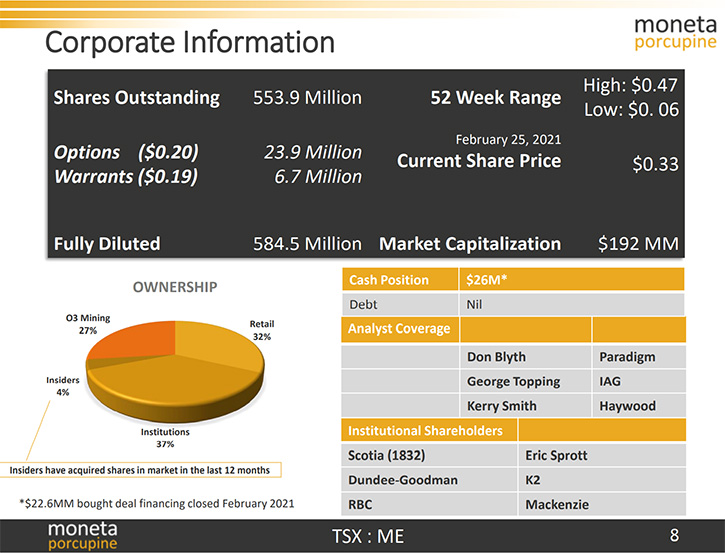

Gary O'Connor: We currently have 554 million shares outstanding. We are trading at about 35 cents a share. We are currently valued at less than US$16 an ounce. Our peer group currently has an average valuation of $77 to $80 an ounce, so we're significantly undervalued. We see a lot of upside. Remember, this is a new story. We only completed the resource update in December, announced the O3 Mining deal in January, so the market is still catching up. We have had good performance over the last three months, but we have a lot more to go. We have $26 million in cash. We completed a $22.6 million bought deal financing recently concurrent with the transaction. We have a budget this year of $10 million, for the 70,000-meter program resource update and PEA, and we are able to fund our large programs as well as a similar sized program next year, rolling into the pre-feasibility phase. We are cashed up and well-funded with resource expansion underway, with significant ounces to be added and currently undervalued ounces, in a very safe jurisdiction in an area with great infrastructure!

Dr. Allen Alper: Well, it is excellent to have the funds to go forward with your exploration and your feasibility studies.

Gary O'Connor: Exactly. We are well-funded to deliver our program and it is going to be a large program, over the next two years. We see the ability to continue to add ounces and to develop what is going to be a significantly larger project in scope and production base. So, there is going to be significant value-add here for our shareholders, over the next year and more as we move forward.

Dr. Allen Alper: Oh, that is excellent. Gary, could you tell our readers/investors the primary reasons they should consider investing Moneta Porcupine Mines?

Gary O'Connor: The main reason investors should invest in us is due to the fact that we are a growing and under-valued gold exploration company. Gold is a great place to be in these times of economic uncertainty, low interest rates and, of course, printing of money, quantitative easing by governments, who are in dire financial states. We provide a sound backing to valuations. We will have a very large resource, one of North America's largest underdeveloped projects. We have already shown it is economic and will have great return on capital. It is a growing gold resource, so any investment anyone makes will be at a low valuation point and they will benefit from the growing resource and value addition. We will be de-risking the projects. Our ounces are currently significantly undervalued, compared to peer groups, remembering we are in Timmins with great infrastructure, in the safe jurisdiction of Ontario. So, there is a lot of value addition be to be delivered here, and we think shareholders will be able to benefit from that moving forward.

Dr. Allen Alper: Sounds like extremely strong reasons from our readers/investors to consider investing in Moneta Porcupine Mines. Gary, is there anything else you'd like to add?

Gary O'Connor: We are growing substantially. Additional value is going to be added, with the pending economic studies and resource updates. We are currently undervalued at our current level of resource size, which is growing. So there's going to be great upside here for potential investors. And the cash costs are low at less than $700 per ounce and will go down from there due to the synergies to be realized in the projects combined and the increasing gold resources.

Dr. Allen Alper: That sounds like you have excellent potential. You are in a great area, with a great team, and you are positioned to do some extensive exploration work. So, it sounds like our readers/investors should pay close attention to what you are doing and the results you will be getting this year, expanding the resource.

Gary O'Connor: Yes! Exactly! There will be a good flow of news coming out over the year with drill results, followed up by a resource update, and then rolling into an updated economic study. So yes, lots of value addition here, over the coming months and years!

Moneta Porcupine Mines Inc.

Dr. Allen Alper: Oh, that sounds excellent! Thank you for your time today Gary and we’ll be watching for all of the progress throughout 2021.

https://www.monetaporcupine.com/

Gary O'Connor, CEO

larmstrong@monetaporcupine.com

|

|