Cornish Metals Inc. (TSX-V: CUSN, AIM: CUSN): Associated with Osisko, Exploring Copper and Tin Projects, in the UK and North America; Richard Williams, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/30/2021

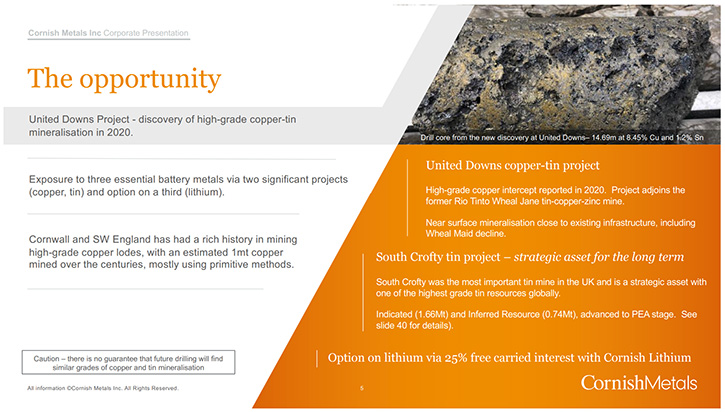

Cornish Metals Inc. (TSX-V: CUSN, AIM: CUSN), is an Associate Company of Osisko, building a portfolio of strategic metals assets in the United Kingdom and North America. Cornish Metal’s near-term strategy is to focus on the United Downs high-grade, near-surface copper and tin project in Cornwall, UK. The Company's past producing South Crofty tin project is one of the highest-grade undeveloped tin resources globally, with an active underground mine permit, valid until 2071. We learned from Richard Williams, President, CEO and Director of Cornish Metals that they expect to begin drilling in early April on the United Downs’ copper-tin discovery. They will also be looking at what they can do with South Cofty if the current tin price environment continues.

Cornish Metals Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Richard Williams, President CEO and Director of Cornish Metals. Richard, could you give our readers\investors an overview of your Company and also what differentiates your Company from others?

Richard Williams: At Cornish Metals’ our principal projects are all located in Cornwall, in the UK. We own the former producing South Crofty tin mine, which I think for all intents and purposes could be described as a world-class tin deposit. It was in production for over 400 years from 1596. I think it was until 1998. We also have what we call the United Downs copper tin project, which is located about 8 Kilometers East of the South Crofty tin mine. United Downs was the scene of a new discovery of high-grade copper and tin mineralization about a year ago. Where we reported a drill intercept that went through 14 and a half meters, grading almost eight and a half percent copper and 1.2% tin. We are one of only 2 companies listed in Toronto that has exposure to tin. The other is Alphamine, which has a mine in the Congo. We recently completed a dual listing on the aim exchange in London, where we raised 8.2 million pounds. We have a dual listing in both Toronto and London.

Dr. Allen Alper: Sounds great! And you have a relationship with Osisko?

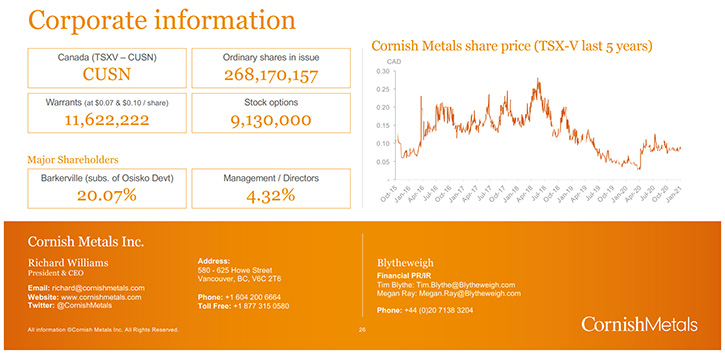

Richard Williams: That's correct. Osisko Development Corporation is our largest shareholder. They own just over 20% of the issued capital. The Company Cornish Metals was originally Osisko’s idea for us to go and look for high-quality tin projects in good jurisdictions that had the potential for a long life. We acquired the Cornish assets and South Crofty clearly meets those criteria from a potential perspective.

Dr. Allen Alper: Could you tell our readers/investors, your primary goals for 2021?

Richard Williams: Yes. On the back of the capital raise that we just completed in London, we should be starting drilling in early April on the United Downs copper, tin discovery. The use of proceeds from the raise is to test a 1 Km strike section of that new discovery, which is sandwiched between two former producing high- grade copper mines, which we'll call United Mine and Consolidated Mines, which were in production from the early 1700s up until the 1860s 1870s. They produced copper grades in excessive of 7% copper. So the new discovery that we announced last year is in line with those kinds of grades. That will be the main focus for the use of proceeds, but obviously both the copper price and the tin price have seen strong gains in price level in the last couple of months. We'll also be looking at what we can do with South Cofty, as well if the current tin price environment continues.

Dr. Allen Alper: Could you tell our readers/investors a little bit about the market for tin and copper?

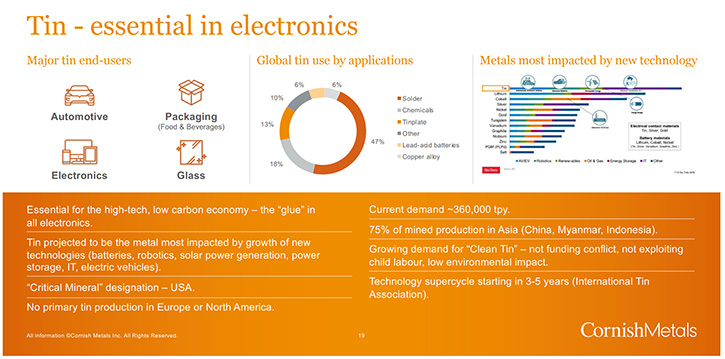

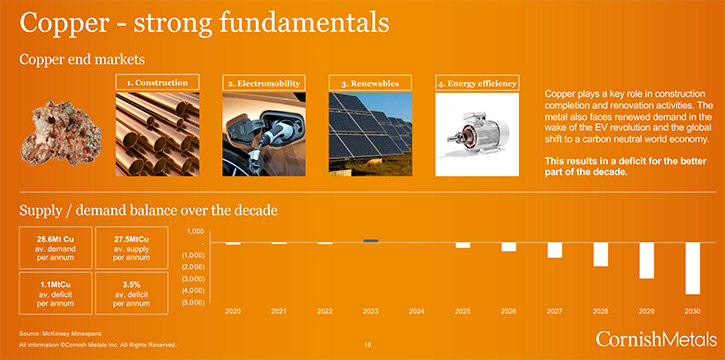

Richard Williams: Yes. I think we've all seen and read this really global push towards electrification and growth in renewable power, electric vehicles and home. All of these require copper and tin. Tin is in fact, for many of the readers, who don't know, essential in the electronics world. Almost 50% of all tin consumed today is used in the form of solar. So, anything, with an electrical connection, has tin in it. So, your TV or computer, your cell phone, your iPad, anything to do with electronics has tin in it.

It's an area that can grow and increase from a demand perspective. I think what you see in the marketplace right now is a bit of supply concern. Obviously there's a coup going on in Myanmar, which is potentially going to disrupt tin supply. About 75% of all the mined tin comes out of Asia, China, Myanmar, and Indonesia. On the back of not only the growing demand and electrification push and push towards carbon-neutral economies, you also have growing concerns over security of supply. Countries look into secure domestic supply. In the UK, you have a government that aspires to grow its own domestic technology industry and batteries industry. Both copper and tin are essential to those sectors. There's an opportunity for Cornish Metals to play a big part in the goal of the UK government to build those industries.

Dr. Allen Alper: That sounds excellent! Could you tell our readers/investors a little bit about your background and your Team?

Richard Williams: Yes. I'm a geologist I've been in the mining industry, since the late 1980s. I've worked throughout Southern Africa, Central South America, and obviously North America where I'm based now and also in the UK in Cornwall, for the last five years. I am the CEO. I look after all the corporate affairs of the Company. Our Chief Operating Officer, Owen Mihalop is based in Cornwall. We have our main office down at the South Cofty mine site. Our Chief Financial Officer, Matthew Hird, has also been in the resource sector for a good 15, 20 years now. He's also based in the UK. We have the Osisko Development Corp, as our biggest shareholder. They've been very supportive, getting the Company to where it is today. Obviously, leading up to the successful AIM listing, from an investment perspective, we recognized earlier on that exposure to the UK investment community was very important for the development of Cornish Metals. We've seen that already, with the take-up on the AIM listing that we did and the money that we raised a couple of weeks ago.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your capital and share structure?

Richard Williams: Yes. We have around 260 million shares issued, currently trading in Canada. We've been trading in Canada at 18 to 22 cents range. Osisko owns just over around 20% of the capital, Management and Directors are in the 5% range. More recently, we issued around 110 million shares on the capital raised in the UK.

Dr. Allen Alper: Well, it's good to see that Management and Directors have skin in the game and are committed to the project.

Richard Williams: Yeah, I think if you look at the Board of Directors of the Company, it's a very well recognized, accomplished and successful slate of Directors. We have Patrick Anderson as our Chairman. Patrick obviously had great success with former Company Aurelian, with the discovery of the Fruta del Norte, a gold project in Ecuador, which was acquired by Kinross. More recently, he's been the CEO of Dalradian gold, which is developing the multi multimillion ounce, Curraghinalt gold project, in Northern Ireland. Grenville Thomas is a Director. Grenville is very well known for his role in his discovery of the Diavik diamond mine in Northern Canada, amongst various other successes in his career. John McGloin recently joined the Board. He is our UK base non-executive Director. John was formally Chairman of Amara mine, which operated a gold mine in West Africa.

Prior to that, he was a very successful mining analyst for groups like Arbuthnot Bank and Collins Stewart in London. We have Don Njegovan on the Board, as the representative from the Osisko group. Don is the Chief Operating Officer of Osisko mining, which is developing multi-million Windfall lake deposit in Quebec. Prior to Osisko, Don was a banker with Scotia bank in Toronto. He has very valuable experience on both the bank and the corporate and project development side of things. Then we have Ken Armstrong, who was formerly the CEO of Strongbow Exploration (now Cornish Metals). Now he is the CEO of North Arrow minerals, which was exploring for diamonds in Northern Canada.

Dr. Allen Alper: Well, you have a very accomplished and successful Team and Board. Very impressive! Could you tell our readers/investors, the primary reasons they should consider investing in Cornish Metals?

Richard Williams: If you want exposure to tin between Canada and UK listings, you have us, Alphamin, listed in Canada and one other Company in London called Afritin that has a tin project in Namibia. There have been a lot of media coverage recently about the uses of tin, the growing demand for tin and its importance to this green economy to which we are aspiring. There are not many high-quality tin projects ready to move towards production. South Cofty is one of them. It's one of the highest-grade tin resources globally. Probably the highest tin resource that's not currently in production and operating in the UK.

You're in a very good jurisdiction. We've seen very good support from local communities, local council, right up to central government to see Cornwall come back onto the mining map. It was historically a very prolific tin and copper producer. Certainly, copper in the 1700s and early 1800s and tin from the mid-1800s up until the late 1990s. There are about 2000 documented mines throughout Cornwall. It's very much a heavily mineralized region. It has all of the infrastructure you would need to put mines into production, but more importantly, it has a very supportive local community, to see mining return to that part of the world.

Dr. Allen Alper: Well, those are very compelling reasons for our readers/investors to consider investing in Cornish Metals. It will have a great property with great potential for a very long life. And you will have two very important metals that will supply the electric vehicle market, copper and tin. And you have very strong backing from Osisko. Sounds like you have everything going for you.

Richard Williams: Yes, it's quite amazing how quickly things can change in the market. I think towards the end of last year, we started seeing the signs of various countries around the world, looking at stimulus spending and where that spending is going. We saw that pick up, with the increase in the copper price and increase from investors into the base metal market toward the end of last year. That's just continued into this year now with the rise in the tin price and people becoming more aware of the importance of both matters. But certainly, tin from a lot of people's perspective and what role it plays going forward.

Dr. Allen Alper: Well, that sounds excellent. Richard is there anything else you'd like to add?

Richard Williams: No. I think the main thing, from a newsletter perspective, is we are gearing up for drilling and we should be drilling, within early April. We expect to have a lot of news flow throughout the balance of this year. And if you want exposure to tin, this is where you need to be.

Dr. Allen Alper: That sounds excellent! It sounds like 2021 will be an exciting time for Cornish Metals, as you drill and discover and release data and have news releases.

Richard Williams: Yes!

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.cornishmetals.com/

Richard D. Williams, P.Geo

Irene Dorsman (604) 210 8752

irene@cornishmetals.com

|

|