Harmony Gold Mining Company Limited (JSE: HAR): World-Class Gold Mining and Exploration Company in South Africa and Papua New Guinea; Peter Steenkamp, CEO and Exec. Dir. Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/21/2021

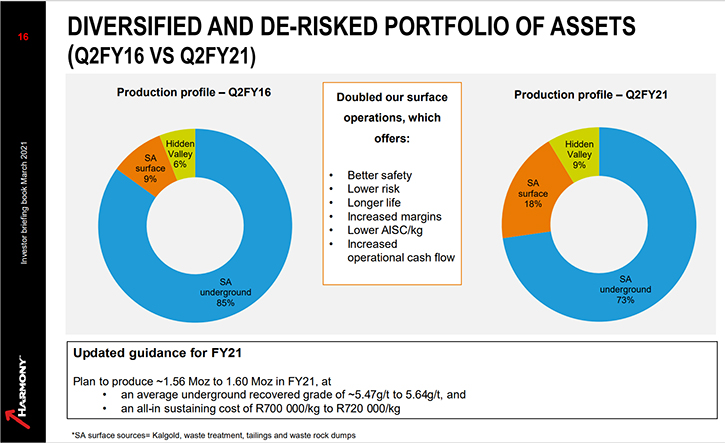

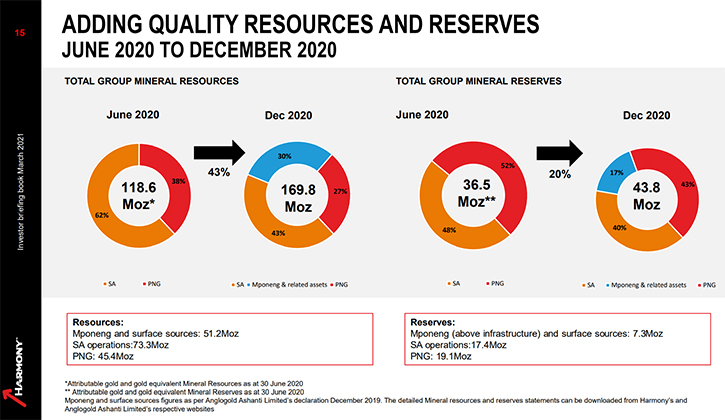

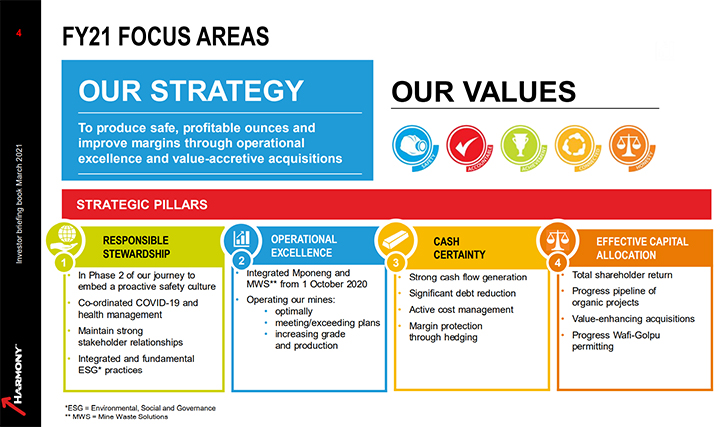

We spoke with Peter Steenkamp, who is CEO and Executive Director of Harmony Gold Mining Company Limited (JSE: HAR) - a world-class gold mining and exploration company, with more than 70 years’ experience in the industry. Harmony Gold has operations and assets in South Africa and Papua New Guinea. These assets include one open pit mine and several exploration tenements, in Papua New Guinea, as well as 9 underground mines and 1 open pit operation and several surface sources in South Africa. In addition, Harmony owns 50% of the significant Wafi-Golpu copper-gold project – a tier 1 asset, in a joint venture, in Papua New Guinea. According to Mr. Steenkamp, the Company was able to turn around and grow dramatically, since 2016, by embarking on a new growth strategy of producing safe, profitable ounces and increasing margins. This started by acquiring Newcrest’s 50% stake in Hidden Valley (previously a 50:50 JV between Harmony and Newcrest) in 2017, and then, acquiring the South African assets from AngloGold Ashanti. The first mine acquired from AngloGold Ashanti was Moab Khotsong in 2018 and then recently, Mponeng and Mine Waste Solutions (MWS). These assets have increased the Harmony resource and reserve base. Plans for 2021, include integrating the newly acquired assets, further optimizing existing operations and taking advantage of a good pipeline of organic projects to secure the future growth prospects for Harmony.

Harmony Gold Mining Company Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Peter Steenkamp, who is CEO and Executive Director of Harmony Gold.

Peter, could you give our readers/investors an overview of Harmony Gold, and what differentiates Harmony Gold from others?

Peter Steenkamp: Yes, thanks Allen. First of all, Harmony is a South African gold mining Company, operating for over 70 years. We also have assets in Papua New Guinea, north of Australia, however most of our production comes from South Africa.

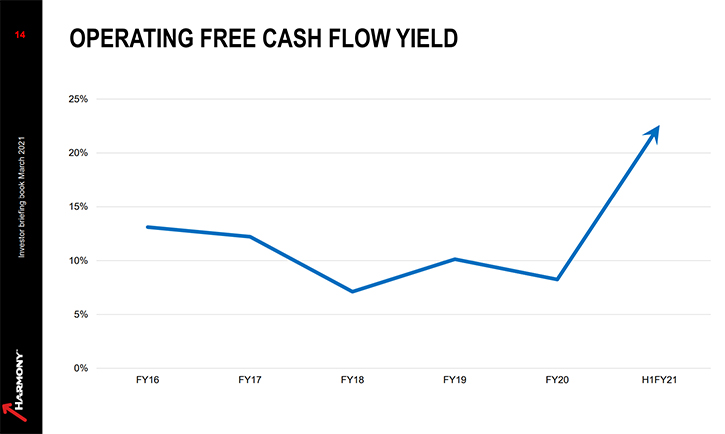

The growth strategy of Harmony really started about five years ago, when I re-joined Harmony as CEO. We looked at Harmony to see how we could take it from a pure South African gold miner to an emerging market gold specialist. Our share price was undervalued as we were perceived as having assets that didn't necessarily have a long life or sufficient margin.

We therefore embarked on a journey to revitalize our current assets by putting in place the infrastructure, maintenance and operational excellence that would deliver a strong and stable production over time. Despite the need to stop some of our operations for a few days to implement these fixes, we have managed to execute our strategy on improving safety, discipline and production.

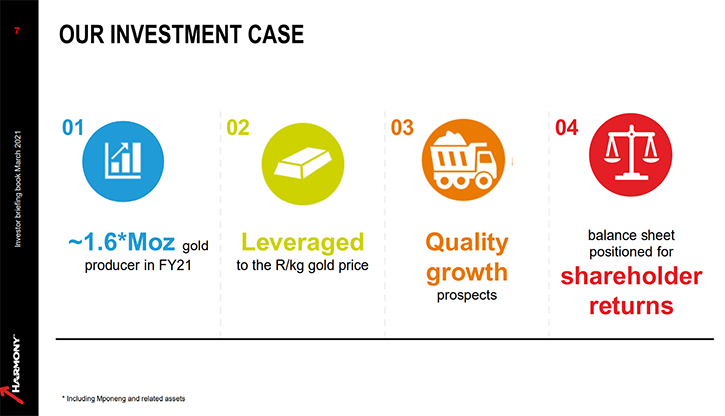

We then embarked on a growth strategy to move ourselves from a 1-million-ounce gold producer to a 1.5-million-ounce producer by 2018. This was achieved through a well-structured and planned M&A strategy and recapitalization program of existing assets.

In Papua New Guinea we bought the remaining 50% stake of Hidden Valley from Newcrest, taking our stake to 100%. We then recapitalized the mine and currently have a 7-year life of mine. In South Africa, we targeted the AngloGold Ashanti South African assets. First of all, we acquired the Moab Khotsong Mine in the western Vaal River area. Then in October last year, we took control of Mponeng and Mine Waste Solutions assets from AngloGold Ashanti.

On the back of these strategic acquisitions, we have been able to expand production to approximately 1.6 million ounces per annum, reduce the risk profile of our business and widen our margins. We thus managed to improve the quality of our ounces while increasing both our reserves and resources. Our share price has subsequently increased by over 400% since 2016.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors your primary goals for 2021?

Peter Steenkamp: It is important that we now integrate the new assets that we bought. We need to think about our growth plan and which of our organic pipeline of projects we will we pursue. We understand the competition for capital and are therefore currently evaluating these projects to determine which will deliver the best return while at the same time meeting our strategic objectives.

We have also had to deal with COVID-19 in South Africa and in Papua New Guinea. The safety of our people comes first, and as such, through the contributions of multiple stakeholders, we have implemented a Standard Operating Procedure and a Covid-19 protocol at all our operations. Our low infection rate is testament to the success of this Standard Operating Procedure and protocols in place. As we speak, only 0.2% of our employees are positive for Covid-19.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors, a little bit about your financial status, your balance sheet, your capital structure?

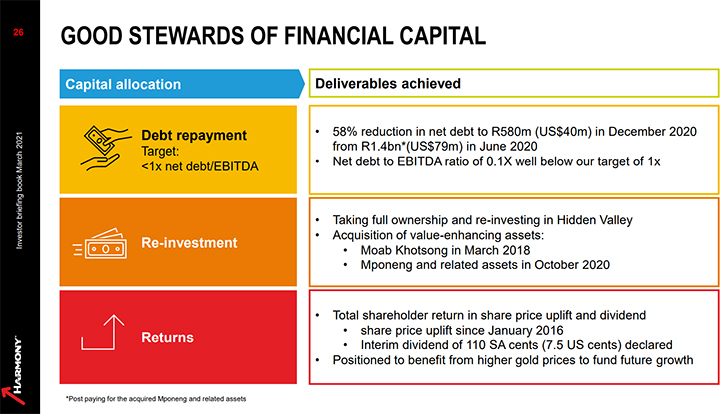

Peter Steenkamp: Yes, certainly. We're very lucky that we have very little debt at this point in time. Our Debt versus Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) ratio is now 0.1 times. Throughout our growth cycle over the last five years, we only exceeded our target of 1.0 times a few times thus exercising a fair amount of financial discipline as far as our debt is concerned.

Our current focus remains on pursuing the organic pipeline of projects at our disposal. We believe that these will create value for our shareholders over the long term. An example of an exciting potential project on which we have to decide is the Zaaiplaats project. This project involves the deepening of the Moab Khotsong Mine through declines which will allow us to mine a very rich ore body yielding around 10g/t. In addition, the life of mine will be extended by a further 23 years sustaining both our employees and the host communities.

Harmony has also reviewed its existing dividend policy and is pleased to confirm a more definitive policy aimed at paying a return of 20% of net free cash generated to shareholders. The new dividend policy is aimed at being more predictable, meaningful and sustainable. While the dividend policy is reviewed every two years, the payment of a dividend will be at the discretion of the board and will be decided on every six months.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors your thoughts on what's happening with the gold market now and in the future?

Peter Steenkamp: As a Company, we cannot control commodity prices or exchange rates. The best we can do is to prepare ourselves to go through the cycles.

I think, with the change of guard in the US, things will be a little more stable. However, global economies need to be recharged and restarted. For that to happen, many of the stimulus packages currently in place will need to be expanded or extended. While there has been some concern around the recent uptick in long dated US interest rates, I do believe that rates will remain lower for a while and the gold price will be stable. I doubt gold will be as strong as it was in 2020 but if the global stimulus and uncertainty persists, it should be supportive for the gold price and in turn positive for gold miners.

We believe that our recent acquisitions will allow us to be in a position to weather these cycles and create long term value for our shareholders.

Dr. Allen Alper: Well, thanks for sharing your insights. Peter, could you tell our readers, investors, the primary reasons they should consider investing in Harmony Gold?

Peter Steenkamp: We have de-risked our portfolio, optimized our operations and acquired excellent assets which have resulted in Harmony being able to produce about 1.6 million ounces of gold per annum. We have an exciting pipeline of projects, a robust balance sheet and a deployable and meaningful war chest which will add future quality ounces to our production. I also believe that over time we have shown that we are responsible with our capital allocation and have been able to deliver on our strategy. We remain a reputable operator that continues meet and exceed guidance.

The leveraged exposure to the Rand per kilogram gold price provides us with a hedge against any downside risk for the Rand, while our hands on management style ensures we are in tune and connected with what is happening at each and every operation at all times.

ESG remains core to our strategic outlook and we remain good corporate citizens.

What you now see is company which is well positioned to take advantage of the current gold prices while delivering positive shareholder returns throughout the cycle.

Dr. Allen Alper: Well that sounds like excellent reasons for our readers/investors to consider investing in Harmony Gold.

Peter, is there anything else you'd like to add?

Peter Steenkamp: We are extremely excited about the future. We have been operating here for over 70 years and remain committed to our stakeholders and our operations in South Africa. We see a bright future for mining in South Africa and we believe we will continue to add an enormous amount of value, not only to our shareholders, but also to the communities and countries in which we operate. We have successfully acquired assets that our peers no longer deemed a strategic fit and believe we can extract significant value from these assets. We will continue to add value to all our stakeholders including shareholders, communities, and our employees by doing what we know best, and that is mining.

Dr. Allen Alper: Well, thank you for all of your insights. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

Website: https://www.harmony.co.za/

Facebook: Harmony gold mining company limited

LinkedIn: Harmony Gold

Twitter: @Harmonygoldnews

Jared Coetzer

Head: Investor Relations

+27(0) 82 746 4120

Max Manoeli

Investor Relations Manager

+27 (0) 82 759 1775

|

|