Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF): Produces Over 200,000 oz of Gold a Year, below $800 an oz, Very Profitable, Significant Exploration Growth, Portfolio of Increasing Valuable Assets; Serafino Iacono, Executive Chairman Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/21/2021

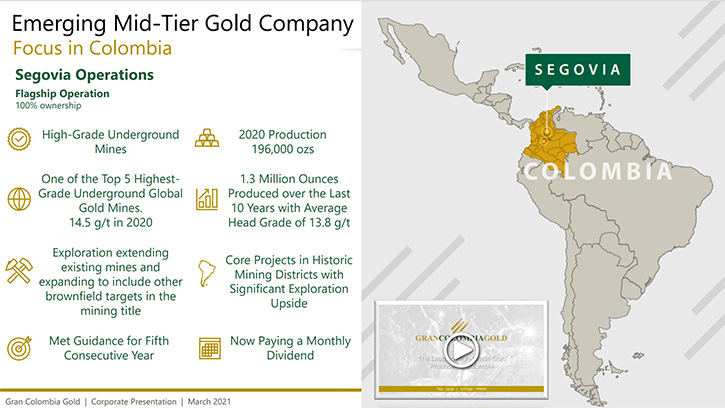

At PDAC2021, we spoke with Serafino Iacono, Director and Executive Chairman of Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF). They are currently the largest underground gold and silver producer in Colombia, with several mines in operation, at its high-grade Segovia Operations. Segovia is one of the top five, highest-grade, underground global gold operations, which still has a significant exploration future in front of it. Last year they spun off a Company called Caldas Gold Corp. (TSX-V: CGC; OTCQX: ALLXF) to advance Marmato Project. Another spinoff, called ESV Resources Ltd. (TSX-V: ESV.H) is aimed at creating value through the Zancudo and other projects. The Company's goals for 2021 include achieving production in the same guidance as last year despite COVID.

br>Gran Colombia Gold Corp. br>Gran Colombia Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Serafino Iacono, who's Director and Executive Chairman of Gran Colombia Gold. Serafino, could you give our readers/investors an overview of Gran Colombia Gold and summarize some of the important developments that have occurred in 2020, and your goals going into 2021?

Serafino Iacono: Sure. Thank you for giving us the opportunity to tell your readers/investors about Gran Colombia, the largest producer of gold in Colombia. We produce over 200,000 ounces of gold a year, below $800 an ounce cash cost. So, a very profitable Company! It is a Company that, in the last seven years, has achieved a complete about-face turnaround, from a Company that was not making too much money to a Company that is now very profitable, well-balanced and well-run.

The highlights of the Segovia property, a private property, where we own the mineral rights, and we own the land. We just pay taxes to the government, but it is private property. Very important, a very unique type of title to own in Colombia! It is rated as one of the top five gold mines in the world, for grade, and we're very proud of that.

It has been in that category for the last seven years. Most importantly, it has been in that category for the last 150 years of its life as a mine. We keep our costs down. Our production is very good. Our social responsibility is well-balanced by creating jobs for small miners, as part of our ESG program that takes care of traditional small miners in our community. It is a town of 70,000 people, where we provide the bulk of the jobs, directly and indirectly. We take care of our community very well, and they take care of us very well.

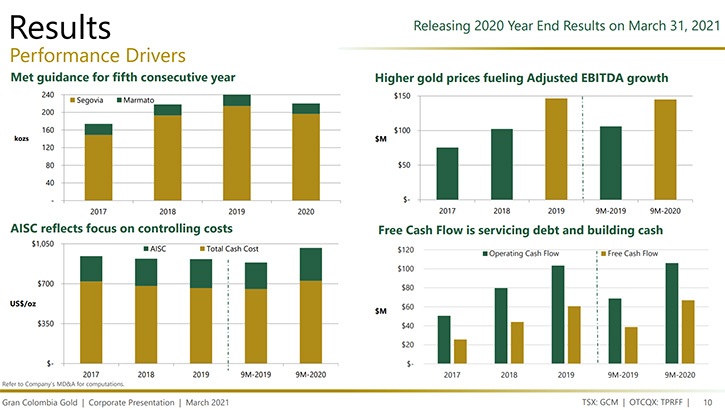

As far as goals for 2021, the Company is on track to achieve production in the same guidance range that we had initially given last year, before the COVID pandemic. Maybe in the beginning of the pandemic, we were a little bit slower. We only had three weeks of a slowdown, but as a Company, we made it up over the rest of 2020. So, in a nutshell, that is who we are.

Dr. Allen Alper: Serafino, what is your vision for Gran Columbia Gold?

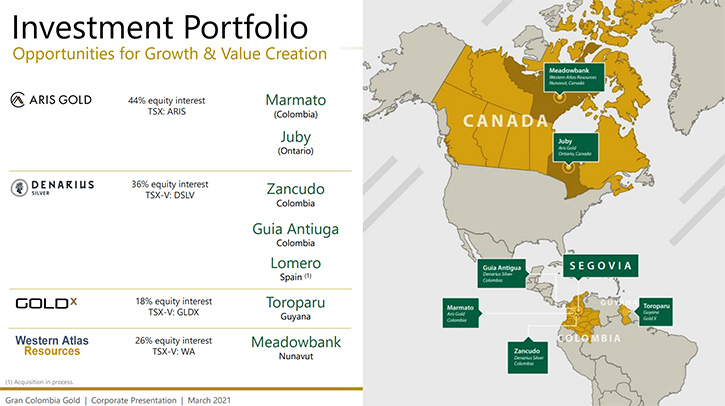

Serafino Iacono: The way Gran Colombia has been structured, it has a main asset (Segovia), and we have some other different assets inside the Company. One of them is our investment in Aris Gold, which is the Marmato project, which was our second mine that we had in operation. We were getting very little value for our assets. Our philosophy has been, always to build up a portfolio of assets. We have a very, very strong Company, with what we have in Segovia as assets. We have 27 known mines in Segovia. We only mine out of three of these 27 mines, inside a title that is almost 3500 hectares, so that's about 35 square kilometers.

Outside of that, I decided to make a conscious decision to create a portfolio of projects that are the next projects to follow, like Aris Gold, that we wanted to take from being a small mine to a fully financed project, where we still own 44%. We turned it over to a dedicated, very experienced Management Team to run the operation.

Our goal is still, to concentrate our efforts on our number one asset, but also develop the satellite assets that we have, like Gold X and now, Denarius, a new Company that is concentrating on polymetallic projects with gold, silver, copper, where we acquired a property in Spain, and we have silver and gold properties in Colombia.

All these assets are the future of the Company. Not only do we want to grow the Company internally, with the 27 known mines in Segovia that we are exploring and developing slowly. These mines are very, very solid, they are all former mines that produced gold and will continue to produce gold for many, many years. We are also developing a portfolio that diversifies us going into Guyana and going into Spain and going into other places where we have the most important thing in the world, which is the know-how and the know-who in those countries.

Dr. Allen Alper: That sounds excellent. Sounds like a great strategy, very focused, and very strategic. Serafino, could you tell our readers/investors about the fantastic improvement and the balance sheet that you have had for the last few years?

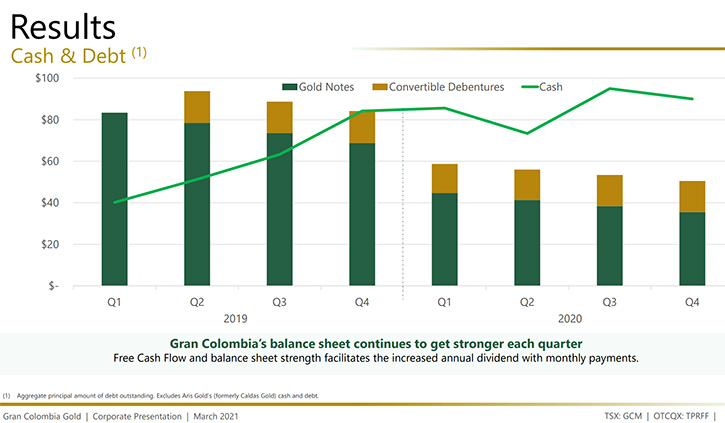

Serafino Iacono: Sure. The Company went from a company that basically was trying to repay its debt, when I started the turnaround of the Company in 2015, Gran Colombia was a Company that had $180 million in debt. It was making decent money, but it was not making enough money to put money aside or to make too many investments. Through the turnaround and luck (prices of gold going up) we took the Company from neutral to a Company that, every year, not only was paying and reducing its debt, which we have done since 2016, our debt has been reduced, and by the end of June this year, there will less than $20 million of debt in the Company.

At the same time, we implemented three important things: building up reserves, having enough money to start doing a serious exploration and drilling program, and developing our high-grade mines at Segovia. This Company, last year, did over $350 million in sales and more than $150 million in EBITDA. So, lots of cash flow, lots of cash in the bank!

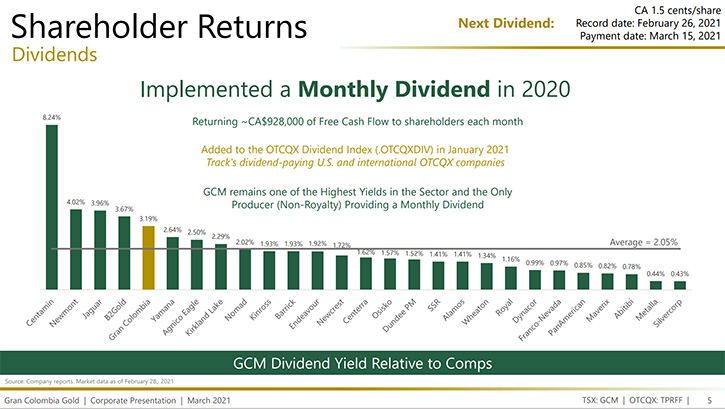

Right now, we sit with about $90 million in cash, which gives us a solid base for exploration and development. So, lots of cash in the balance sheet, very solid exploration program in 2021, and a portfolio of companies, every single one of which has a portfolio value! Between cash and these equity investments, that is close to $300 million of value, excluding Segovia. A Company that has a very bright future! We are putting together new projects and creating wealth for our shareholders. We felt so comfortable with the Company that last year we implemented a dividend policy. We started with a very small amount, but we're up to 3% now, which is very decent. We are on the top of the scale of dividend paying companies in our industry and one of the very few who pay monthly.

Dr. Allen Alper: Oh, that is excellent! You have done an outstanding job with the Company. Very, very commendable and really amazing! Something, for you and your Team, to be very proud of!

Serafino Iacono: Thank you very much. We are proud of our people, and Lombardo Paredes, our CEO, who has done an incredible job, in running the day-to-day at this Company.

Dr. Allen Alper: Well, that sounds excellent. Could you tell us a little bit more about your background and your Team?

Serafino Iacono: My first mine that I was involved in was in 1984, so I have been around a long time. I have been in the natural resource business since the 1980s. I have developed over seven mines in South America. I have been involved in and developed some of the most famous mines. In Venezuela, I developed three mines, Loma de Niquel, Ven Gold, we started Venezuelan Goldfields, and Boulevard Gold, which we sold to Goldfields for $500 million in 2005. I have been involved in the oil business. I started one of the largest oil companies in South America, Pacific Rubiales Energy, which we took from a $35 million investment to a $14 billion Company.

Dr. Allen Alper: Well, you have had a very impressive career, with great accomplishments. Could you tell us more about some of the other Members?

Serafino Iacono: Sure. The Members of the Company; my partner for the last 35 years, the Vice Chairman of the Company, Miguel de la Campa, same kind of career in the mining industry and oil industry. Lombardo Paredes, one of the top executives. I took him out of the PDVSA, which was the Venezuelan national oil company. He is an industrial engineer who understands discipline and building things and running them properly. He is the CEO.

We have a Board of Directors that comprises very strong industry and local leaders in Colombia. We are hands on. I live in Colombia. Most of the people that work with me live in Colombia and work out of Colombia. We are a group that likes to be hands-on in a Company and in the country.

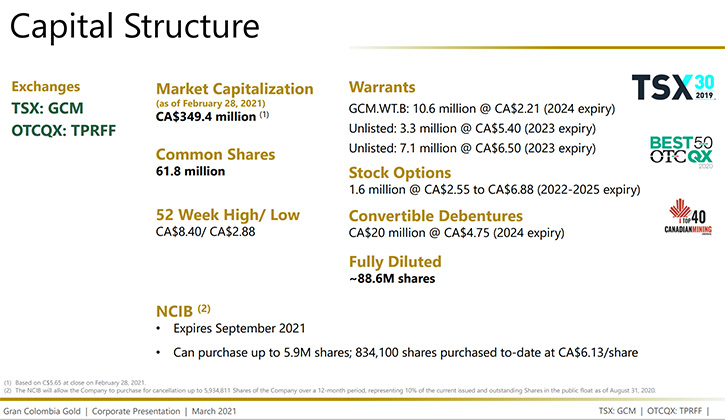

Dr. Allen Alper: Well, a very impressive team. Could you tell our readers/investors a little bit about your capital structure?

Serafino Iacono: The capital structure of the Company is 62 million shares, on an outstanding basis. It is 89 million fully diluted. I would say 45% to 55% is owned by institutional investors. 5% of the Company is owned by Management, mostly myself as an investor. The rest, I think there are lots of retail and small investors that buy into the stock. Especially now, since it is a dividend paying Company, we've seen that there are a lot more institutionals coming in. They like the coupon and they like the potential growth for the Company.

Dr. Allen Alper: That sounds excellent. That is great that you are able to pay a dividend. Looking at how you compare to other companies, it is quite substantial compared to most companies that do pay dividends.

Serafino Iacono: Well, we wanted to feel comfortable. It took us a while. But I am one of those believers that paying a special dividend once in a while is not the way to run a company. You must be solid, and you have to be confident that you can pay the dividends for a long time.

Dr. Allen Alper: Excellent. Serafino, could you tell our readers/investors the primary reasons they should consider investing in Gran Colombia Gold?

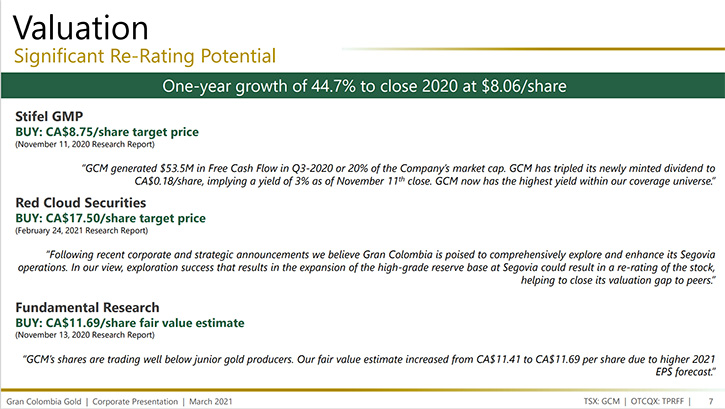

Serafino Iacono: Well, I'll give you the most important reason. I know everybody says that we are undervalued. We are undervalued because we have deals, which are undervalued as a Company. We trade in the $6 range. When you look at it, last year, with over $150 million in EBITDA, we trade right now at about two times EBITDA, which very few companies of our caliber, if you compare us with other companies, not even a company that is an exploration company has a better rating than that.

We are a Company that has a diversified portfolio. Our Company has investments that are worth over $300 million. But the market cap of this Company is in the $400 million range, which would lead you to believe that there is something wrong in this Company, but the reality is there is not. It is just that the market has not caught up to the Company yet, but eventually, it will. So, there is a tremendous upside in this Company.

When you look at the peers that produce the same amount of gold, have the kind of investment that has the kind of cash in the bank that we do, this is a Company that should be trading, as the analysts say, somewhere in the range of $11 to $15 a share, especially for the few shares that we have outstanding as a Company. We have fewer than 70 million shares outstanding.

Dr. Allen Alper: Well, those are very compelling reasons for readers/investors to consider investing in Gran Colombia Gold. Serafino, is there anything else you would like to add?

Serafino Iacono: No. I think everybody should look at this Company and analyze the assets, where we are majority shareholders. Aris Gold is going to be an incredible Company. We own 4% of Aris Gold. Right now, Aris Gold is like the tail that wags the dog. It has a $450 million market cap in a company, of which we own 44%, but it is not reflected in our share price. Same thing with Denarius.

Denarius is going to be a great Company, with some great assets. They need to be developed, but still in the very short-term future, we have brownfield areas that we'll put into development. We own 36% of Denarius. People should look at that as an asset that once they buy Gran Colombia, they are buying that, and they're buying a company like Gold X, where there are 6 million ounces of gold in Guyana, ready to be developed. So fantastic, not only a project we have with growth potential, with high grade gold, one of the top five mines in the world, with high-grade, but you will also buy a portfolio of projects that are going to be near production or near development.

Dr. Allen Alper: Well, those are really outstanding reasons for our readers/investors to consider investing in Gran Colombia Gold. In fact, my family and I invest, and I think we will strongly take a look at investing in your Company.

Serafino Iacono: We're very happy to have you as a shareholder. Remember, I am aligned with shareholders 100% because I am one of them.

Dr. Allen Alper: Well, that is great. It is good to see that Management has skin in the game, has confidence in their Company, and is investing in the Company, and committed like the other shareholders.

Serafino Iacono: Well, we thank you very much for the confidence, and we will try not to disappoint.

Dr. Allen Alper: Well, thank you. I am sure you are not going to disappoint, because you haven't in the last six years, you keep on getting better and better. So very impressive what you and your team are doing!

Serafino Iacono: Thank you very much for your time and thank you so much for the interview. We ought to have another one soon where I can give you some more updates.

Dr. Allen Alper: Very good! I enjoyed talking with you. Wonderful Company!

Serafino Iacono: Thank you.

Dr. Allen Alper: We will publish your press releases as they come out, so our readers/investors can follow your progress.

http://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|