Abitibi Royalties Inc. (RZZ-TSX-V, ATBYF-OTC-Nasdaq): Streaming and Royalty Company Owns Royalties at the Canadian Malartic Mine, near Val-d’Or, Québec; Ian Ball is President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/20/2021

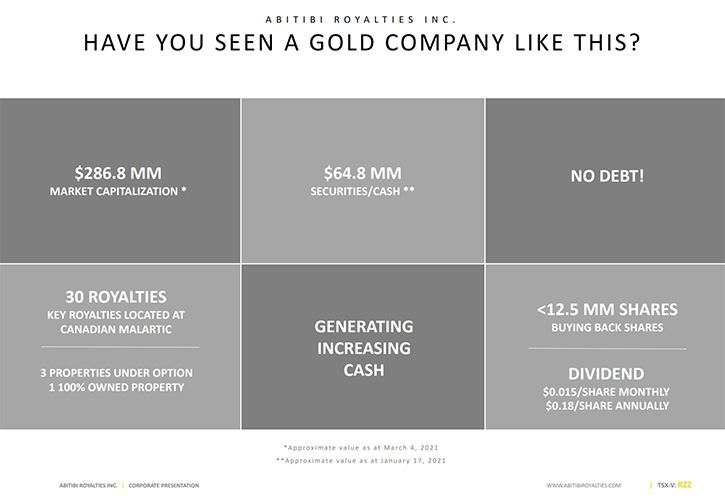

At PDAC2021, we spoke with Ian Ball, who is President and CEO of Abitibi Royalties Inc. (RZZ-TSX-V, ATBYF-OTC-Nasdaq), the streaming and royalty company that owns various royalties at the Canadian Malartic Mine, near Val-d’Or, Québec. In addition, the Company is building a portfolio of royalties on early-stage properties, near producing mines, generating mineral projects for option or sale. In 2021, Canadian Malartic is expected to start the official advancement of the underground. Abitibi Royalties will expand its project generator division, will continue to buy back its shares, and will look into upgrading their listing in the United States. The Company is unique among its peers, due to its strong treasury, no debt, monthly dividend, share buyback program and limited number of shares.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Ian Ball, who is President and CEO of Abitibi Royalties. Ian, I wonder if you could give our readers/investors an overview of your Company and what differentiates it. Also, what are some of the benefits of a royalty company in general?

Ian Ball: Sure. I would be happy to. As the name implies, Abitibi Royalties is in the royalties’ space and our core asset is a royalty on the eastern portion of the Canadian Malartic Mine, which is operated by Agnico Eagle and Yamana Gold, and is the largest gold mine in Canada. What separates Abitibi, is the extreme measures that we go to, in order to respect the shareholder. The royalty model has proven to be very beneficial for investors. But beyond that, we've tried to do everything possible to treat the owners like partners. And that goes from having the fewest number of outstanding shares of any mining company in the world, not having any form of stock options or warrants outstanding, buying back our shares, paying a monthly dividend. On top of that, for the seven years that I have been with the Company, I have used all my after tax compensation to buy shares, to increase my ownership. So, we are trying to combine a good business model, with an exciting discovery and respect the shareholder at the same time.

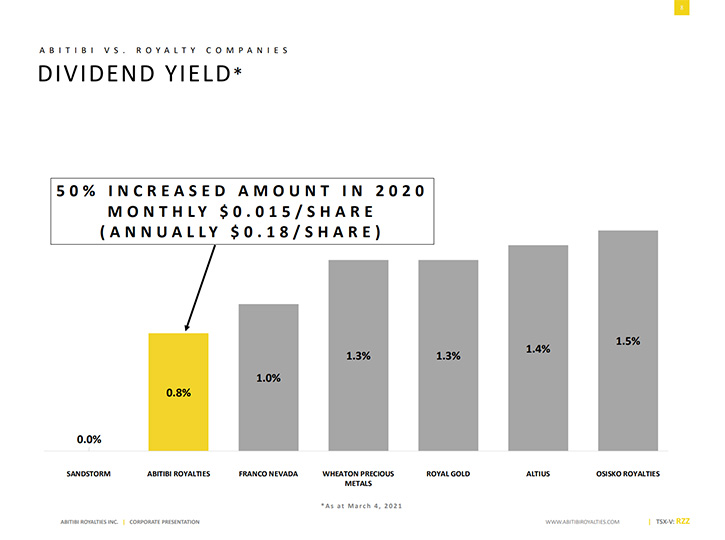

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors about the dividend program that you have put in place?

Ian Ball: We started the dividend in September of 2019. Originally it was a quarterly dividend that equaled 12 cents per share, or 1 cent on a monthly basis. We then increased that dividend by 25%. And then in January of this year, we announced a further 20% increase and now it's being paid monthly. So it's one and a half cents a month or 18 cents annually that we pay out.

Dr. Allen Alper: Excellent! Could you tell our readers/investors a little bit about the property in Abitibi?

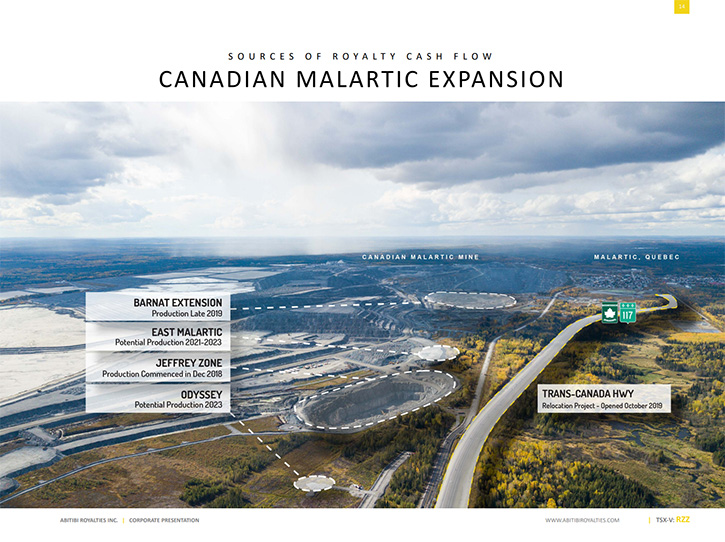

Ian Ball: Our royalty mostly covers the underground portion of Canadian Malartic, which is called the Odyssey Project. We do have royalties on smaller portions of the open pit, but the primary driver is the underground project. Agnico and Yamana, in February, announced the formal construction decision to move ahead with that project. When it's up and going, it's scheduled to be the largest underground gold mine in Canada. Our royalty does not cover all of the underground, but it does cover a good portion. It's a very big project that has an initial mine life of 13 years, with only half of the resource included in that study. If you do some extrapolation, you can see this mine life going much further, based on what we know today. The mineral zones are open for expansion. There is a large land package that our royalty also includes that hasn't really been tested in 10 years, as most of the focus has been on the core zones.

When you look at it from a world-class opportunity and a significant royalty, I believe that we're quite unique among the smaller royalty companies, having a major royalty, on a big project that has a long mine life ahead of it. It has some of the best exploration potential in Canada.

Dr. Allen Alper: Well, that's excellent. That's a great position to be in. Could you tell our readers /investors your goals for 2021?

Ian Ball: Last year, we started a new division, within the Company, called the Project Generator Division. Rather than us buying royalties, it is the Company buying projects and then looking to add value before we proceed to either sell or option that project out and retain a royalty. We're doing that because we think we can make a good return on capital. The plan is to build up that business and the money that we earn from it, pay out to our shareholders, through an increased dividend. So that's certainly part of the business we are looking to build.

Second, we're looking at the official advancement of the underground at Canadian Malartic. The first ramp into that deposit, was started in the middle of summer last year. The work on the shaft began in March of this year, getting the surface foundation in place. And we're looking for underground drilling to commence on that project, which we think would continue to prove up additional resources. So that, combined with continuing to buy back our own shares, is the plan for the Company in 2021.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about your background and some of your Team?

Ian Ball: I would be happy to. So I started my career originally in 2004 with Goldcorp. When Goldcorp merged with Wheaton River, I then started to work for Goldcorp's founder, Rob McEwen, at what became McEwen Mining, working my way up to become President there, mostly focused on operations and exploration before joining Abitibi in 2014.

Beyond that, our Chairman, who was the founder of Abitibi in 2011, Glenn Mullen, was formerly the President of the PDAC. He was also the Founder and CEO of Canadian Royalties, which discovered a nickel mine that is now operating in Raglan, Quebec. The rest of our Board and Management are: Frank Mariage, who is a securities lawyer and ranked as one of the top mining lawyers in Canada; Louis Doyle, who was a part of the TSX Venture Group out of Montreal and headed up their Montreal office. We have Andrew Pepper, who was one of the Founding Directors of the Company and now runs a firm that manages software for pension fund managers to help with their business. We also have Jens Zinke, who has his doctorate in geophysics and his involved with several exploration companies that are operating in Quebec.

On the Management Team, we also have Rico De Vega, who is our CFO. He comes from Sherritt, as well as other gold mining companies. We have a collective group that has been with the Company now for a number of years.

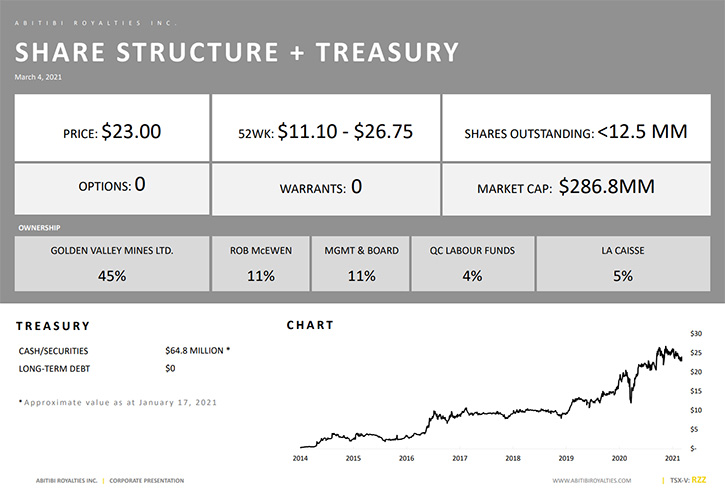

Dr. Allen Alper: Well, you have a diversified and very well-experienced and very well-accomplished Team that you have put together, so that is excellent. Ian, could you tell us a little bit more about your balance sheet and your Share and Capital Structure?

Ian Ball: As we last reported in our news release, about four to six weeks ago, our cash and securities totaled approximately $64 million. We are debt free. We do generate cash through multiple means. One is through our royalty on the open-pit portion at Canadian Malartic. Second is through investment income that we have in various holdings and third, through the Project Generator Division that has already become profitable. We are generating cash each and every day. In terms of the share structure, there are just under 12.5 million shares outstanding. There's never been a rollback in the Company. That share account is going down, because there are no stock options, no warrants, no restricted share units. And the buyback is designed to reduce that share account, so all of our owners can increase their respective ownership in the Company.

Dr. Allen Alper: Well, that's excellent. It's good to see that you have so much confidence in the Company that you're willing to have so much skin in the game.

Ian Ball: I think it does create a very good focus, when the Company you run is also your largest investment. You certainly wake up each day thinking about how you can grow the share price, not necessarily how you can grow the size of the company, because I think that they're very two different metrics. I'm solely focused on the share price, not the size.

Dr. Allen Alper: Well, that sounds like an excellent approach. Ian, could you tell our readers/investors the primary reasons they should consider investing in Abitibi Royalties?

Ian Ball: When you look at the rates of return that we have been able to generate inside of the Company organically, historically they have been quite high, so that's obviously one of the key drivers of any company: What is your internal rates of return? Second, I think you get exposure to what I believe has become and is continuing to be one of the largest discoveries in Canada at the Odyssey underground project at Canadian Malartic. So I think that's quite a unique opportunity. And then third, you certainly have a Management Team and Board of Directors that strives to respect its shareholders and treat them as partners in the business. All those things combined, I think, make the Company unique, and I'm investing right beside all of our investors, almost each and every week.

Dr. Allen Alper: Well, those sound like compelling reasons to consider investing in Abitibi Royalties. Ian, is there anything else you would like to add?

Ian Ball: No, I think that covers it on Abitibi, but just slightly on the gold price, I think when you look at the price today, it's very hard to predict where it's going over the next 12-48 months. But something that caught my attention was that since the US dollar was created, which occurred right around the time of the Civil War, 20% of all US dollars that are in existence today were created in 2020. So when you look at the gold price and it's relatively flat year over year, I think gold today represents a very good value versus the fiat currencies we're seeing around the world. I don't see governments getting off the gas pedal anytime soon.

So although the last couple of months has been down for a lot of gold investors and people are getting frustrated, I would say, "Don't lose faith." Gold has a 7,000 year track record as being money. It can't be diluted by government officials. And I think it's going to continue to play a key role in the financial system and preserving people's wealth. And I think we're entering into a time where that's going to be quite critical.

Dr. Allen Alper: Well, Ian, I really appreciate you sharing your insights on the gold market. That gives a great perspective for our readers/investors.

Ian Ball: Well, thank you for interviewing me for Metals News.

Dr. Allen Alper: You are very welcome, I enjoyed talking with you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.abitibiroyalties.com/

Shanda Kilborn – Director, Corporate Development

2864 chemin Sullivan

Val-d’Or, Québec J9P 0B9

Tel.: 1-888-392-3857

Email: info@abitibiroyalties.com

|

|