Gold Fields Ltd (JSE, NYSE: GFI): Globally Diversified Gold Producer, Nine Operating Mines in Australia, Peru, South Africa, West Africa, Project in Chile, Annual Gold Equivalent Production of 2.2Mo; Sven Lunsche, VP of Corporate Affairs

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/18/2021

Gold Fields Limited (JSE, NYSE: GFI) is a globally diversified gold producer, with nine operating mines in Australia, Peru, South Africa and West Africa (including the Asanko JV), as well as one project in Chile. Gold Fields has total attributable, annual gold-equivalent production of 2.2Moz, attributable gold-equivalent Mineral Reserves of 51.3Moz and Mineral Resources of 115.7Moz. We learned from Sven Lunsche, who is VP of Corporate Affairs at Gold Fields, that although COVID 19 caused a lot of disruptions, they had a good 2020 as a result of the gold price that hit a record level of just over $2,050 in August. The Company tripled its dividend payment. According to Mr. Lunsche, the $1 billion investment program that started four years ago, came to fruition last year with effectively two new mines, and it's paying healthy dividends. According to Mr. Lunsche, Gold Fields is a stable Company with an experienced operational Management Team that should be on the list of investors, who have confidence in gold.

Gold Fields Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sven Lunsche, who is VP of Corporate Affairs at Gold Fields. Sven, could you give our readers/investors an overview of Gold Fields? And what differentiates Gold Fields from other first-year gold companies?

Sven Lunsche: Thank you, Allen. There are obviously a lot of commonalities, with our peers in the sector. One is that we've all had a good 2020 as a result of the gold price. The gold price hit, as you all know, a record level of just over $2,050 in August last year. The average price Gold Fields received last year was 28% higher than in 2019. So purely from a gold price perspective, we've done extremely well. Our production was stable last year, which is a credit to our mines because COVID 19 caused a lot of disruptions and impacted our South African and Peruvian mines in particular, where the mines had to be shut down for a couple of weeks in both countries. Despite that, we managed to increase production slightly over 2019.

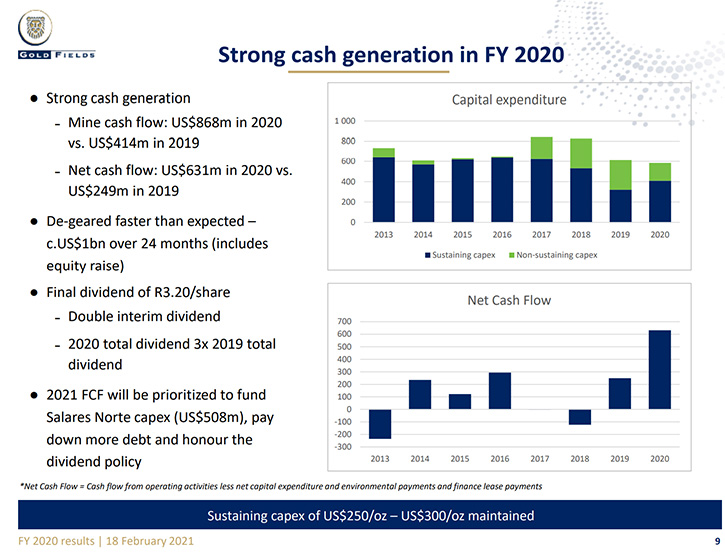

So a combination of stable production and a higher gold price certainly helped us achieve our record earnings. We more than doubled attributable earnings. We tripled our dividend payments. Our mine cash flow was almost three times that of 2019. So on the financial side, we did extremely well; on the operational side, we also did well. I think this is broadly reflective of other gold mining companies. I think where Gold Fields stands out a bit is that three years ago, four years ago now, we embarked on a $1 billion investment program. That was very counter-cyclical at the time. We had a lot of analysts criticizing us for that, but that investment came to fruition last year and it's paying healthy dividends. As part of this program, we effectively built two new mines, Gruyere in Australia, and our Damang mine was completely rebuilt. We bought a stake in an Australia mine and a Ghanaian mine and we continue to invest in near-mine exploration at our mines in Ghana and Australia, thereby extending their life of mine.

So all this came really to fruition last year. Those investments paid off handsomely for us and most importantly, we also managed to reduce our debt by around US$600 million, from just over $1.7 billion to just over $1 billion. So our net to EBITDA ratio is now 0.6 which is, for us, a really, really healthy margin. In summary, we've done well financially and operationally and our investment strategy has come to fruition.

Another notable feature is that we decided to build a new mine, Salares Norte, in Chile. The Board gave us a go-ahead in February last year and construction is on track. Once it comes into production, which looks to be in early 2023, it will have one of the lowest costs in the industry, just under US$500 per ounce, so it will contribute meaningfully to our bottom line and produce 450,000 profitable and sustainable ounces.

A good year for us, but obviously there are challenges ahead, including a declining gold price. But maybe we can talk about that in answers to your next questions, Allen.

Dr. Allen Alper: I know you are globally diversified. Could you say a little bit about the regions you are in and what is significant about them and the outlook?

Sven Lunsche: Sure, I can. We now operate nine active mines in four countries: South Deep in South Africa, Tarkwa, Damang in Ghana and the Asanko joint venture in Ghana as well. We have four mines in Australia, which produce about 45% of our output. And then we have one mine in Peru. I mentioned the project in Chile, that is our very prospective Salares Norte Project, which will come into fruition in 2023.

Australia is at the heart of our production. It's been a country that has done extremely well for us, very well managed from a regulatory perspective and has not been affected by COVID at all. We had not one positive case there. The Western Australia region, where all our mines are based, had a handful of cases, if at all, over the past year. While our mines there have a relatively short mine life, we invest heavily in near-mine exploration, and we tend to replace our depleted reserves plus some, at all these mines.

Our second biggest region is in Ghana. Once again, both our mines are doing extremely well there. They're both open-pit mines. We have a very skilled workforce there and have a sound development agreement, with the Ghana government, which facilitated investment of over US$500 million in the Damang mines and acquiring 45% of Asanko. Both Tarkwa and Damang in Ghana are highly productive mines that produce high-grade, low-cost gold at the moment.

Cerro Corona was the mine hardest hit by the COVID pandemic, but it's still doing well. It produces copper and gold, and obviously copper is doing very well, so as a by-product, it has done really well for us. But last year production went down, costs went up because of COVID, and severe restrictions placed on the mine by the government. But they have still produced $65 million in cash, so even in hard times, they do well.

Our South Deep mine was our problem child for a very long time. In 2018, we had to retrench about a third of our workforce, unfortunately, but it was absolutely necessary to assure sustainability of the mine, which is now being turned around. It made $35 million in cash last year. It's showing good prospects and has one of the world's largest ore bodies, certainly among the top five. So it will be with us for 70 years and if we can carry on the track that we are on now, it will be a very, very reliable producer for us and a very profitable producer at that. But we are not 100% where we want to be yet. There's a lot of work to be done. It is three kilometers underground. There are a lot of structural issues, with electricity prices in South Africa, with regulatory obstacles that we face. But overall, I think our portfolio of mines is doing well. We have always said, "We want a portfolio of no more than 10 mines. We want to produce between two and two and a half million ounces a year," and we are pretty much there once Salares Norte comes on board. We’ll then have 10 mines and our production will be at the top range, close to 2.5 million ounces. And I am confident they'll be profitable ounces, which means we should be providing good returns to our investors.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors a little bit on your outlook for 2021?

Sven Lunsche: Yes, sure. We've issued guidance to the market in February, which shows that there'll be a slight uptick in costs because of our $500 million investment in Salares Norte this year. I think it's about 5% higher all-in costs. We are predicting a 3% rise in production and obviously, depending on the level of the gold price, our cash flow will not be as high as last year, but we firmly believe that we're on track to produce another good set of results. The investment in Salares Norte, is a long-term investment. Once it comes on board, this will be one of the lowest cost producers in the industry, 450,000 ounces at below US$500 an ounce. That’s on the lower quartile of the cost curve.

So, this year is not as boisterous a year as we had in 2020. I think much of that has to do with the gold price. It has retreated from its lofty highs in mid-2020, but I think overall, we're in a very, very healthy position. This will reflect in continued positive earnings this year and even stronger earnings over the next few years. That will depend on the gold price of course. We've seen the gold price retreat to about $1,700, but our mines are targeted to achieve a margin of 15% at $1,300 an ounce. So even at $1,700, $1,600, $1,500, our mines make good money. So it's not too much of a worry. We have structured our mines to operate at a low level. So even if the gold price falls to $1,000, we still can break even. So, we have a lot of leeway on the gold price and we have deliberately structured our mines to do that.

Dr. Allen Alper: Could you tell our readers/investors about the Management and the Board and yourself?

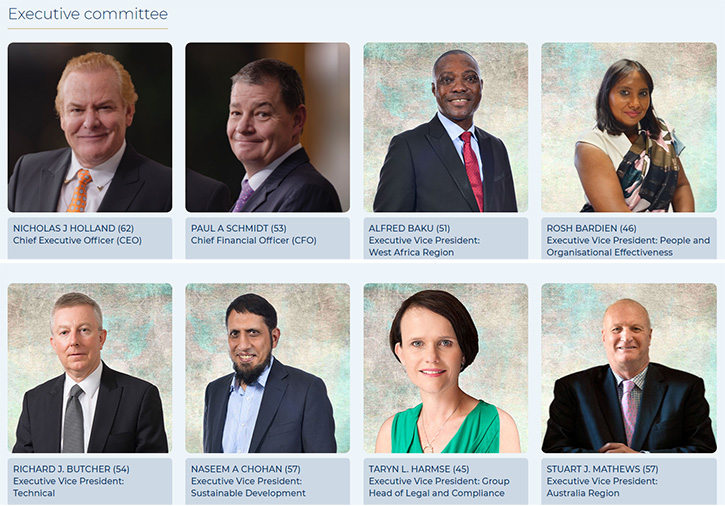

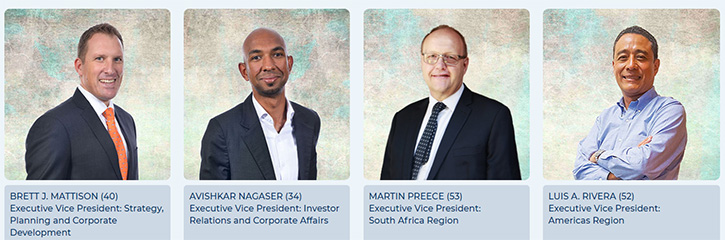

Sven Lunsche: Sure. I won't talk too much about myself. I am the Corporate Affairs officer. We have a stable Board that is reflective of the regions, in which we operate. We have two exec, nine non-exec Directors. We are still, obviously, a South African listed Company, although we have a secondary listing on Wall Street. The Chair and the Deputy Chair are both South Africans. Our Management Team is very stable. There is a big change for us this year though; we announced in January that our CEO of the last 13 years, Nick Holland, is retiring at the end of March. He is being replaced by Chris Griffith, a very well-established mining executive. He was previously CEO of Anglo American Platinum, of Kumba Iron Ore, and he has been part of the Anglo American Management Leadership Team for the last 10 years.

So a very experienced, very well respected mining executive, taking over the CEO-ship at Gold Fields. But as we always point out, this is not a one-man operation. Nick Holland has made it very clear that the success of this Company is based on his broader leadership team and, obviously, all employees of Gold Fields. So, while the transition has raised a lot of media attention, hopefully it will not change our step, our direction, our guidance. But it is good to have a new leader, who will bring new perspective, new visions. In the first few months he will speak to people, he will look around, visit the operations and then decide on the best long-term strategies for the operation. He has already stated that he believes Gold Fields is a very well-run organization. So, I think it is a strong and stable leadership team, which will take the Company forward.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers and/investors about your share and capital structure?

Sven Lunsche: Our primary listing is on the Johannesburg Stock Exchange; our secondary listing is in New York. Our shareholder base is about 20% South African. The rest are all overseas shareholders, particular US shareholders. BlackRock, Van Eck, the South African government Public Investment Corporation, are among our three largest shareholders. I think only one of our shareholders has more than 10% shareholding, but barely so. We are seeing more and more ESG (environment, social, governance) investor interest in mining in general, which we welcome. I think mining companies, in their nature, have long lives. They make a big impact where they operate. So it is important that we address environmental, social and governance issues as rigorously as we address operational and financial issues. Our shareholders are increasingly demanding it. We all know that BlackRock CEO Larry Fink, takes these issues very seriously and demands that the companies, in which they invest, including us, operate responsibly. We now report according to the TCFD regulations on climate. We are in the process of setting long-term targets for climate change, for diversity, for host community procurement involvement. We have very strict environmental protocols that guide us.

So, Allen, I know a lot of hard-nosed investors still think these are soft issues. But they are not for us. ESG issues are part and parcel of how we do business, how we have to do business. Still, we have a lot to learn. We still get things badly wrong as mining companies, but I think we take the issue very, very seriously. We report very transparently about our EFG performance. And in answer to your questions, more and more investors are expecting that and should expect that, as should governments. Governments should know exactly how much we contribute to the economy. For example, Governments and the communities should know exactly how we treat the water in our operations, for example, because it affects them.

So, it's a bit of a divergence from your original question, but yes the share structure is stable, we have a diversified shareholding base, and attract increasing interest among both traditional investors and ESG investors.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Gold Fields?

Sven Lunsche: Oh, that's a tricky one. Allen, I think, as many of your readers, particularly your investors, will know, a lot of the share price performance of gold mining companies is determined by the gold price. Within that parameter, obviously, you have different gold mining companies, doing different things. So let me talk about what the overall investment approach has to be, if you have confidence in gold, I think we should be one of your targets. We are a very well-run Company; very stable Management, with good earnings and dividend prospects ahead. But the share price, I'm afraid, depends mostly on how the gold price is performing, as the correlation between the gold price and gold share prices is significant. I think it's well over 90%. So, if you're confident in the gold price, I would hope we would be one of the gold mines, where you would see as a good investment option.

If you have no confidence in the gold price, I think you won't look at the gold sector in any case. But we believe gold always has a future. I think just about 1% of all global assets are in gold. That is nothing. So even a 0.1% increase in gold plays out in a very positive way, in returns on gold shares and the gold price itself. So certainly, we have confidence in gold. We believe that it has a long-term future as an investment alternative and an investment safeguard. Clearly, the more volatile times are the better for gold and we're returning hopefully to more stable times with COVID being abated, with the economies returning to normal and with a United States government that is more open to international cooperation than the previous one was. Less disruptive, may I say? But overall, I think we are returning to a more stable economic and political environment, which might put some pressure on the gold price in the future, but not in the long-term. We believe gold is at stable levels and will remain at stable levels.

You also have to consider the fact that we believe gold mine supply has hit its peak. Unless there's a huge investment in new exploration, we believe gold supply will slow down gradually, which we believe provides a fundamental basis for an upturn in gold. But we all know gold is driven by more than just fundamentals. It's driven by sentiment. So a long answer to your question. If you believe in gold, I think we are a good investment opportunity for you.

Dr. Allen Alper: I think that's very good insight for our readers/investors, giving them an overall picture of the gold market as well as Gold Fields itself. Sven, is there anything else you'd like to add?

Sven Lunsche: Just that I appreciate the opportunity to talk with you. I did mention the focus on ESG, and I think most responsible gold mining companies realize now that it's a third pillar for your strategy. Apart from the operational and your financial performance, you have to pay equal attention to your ESG issues. And I think Gold Fields and other responsible mining companies in the industry are doing that. So if you're a long-term investor, you want to look at our operational performance, but you also want to make sure that we do the right things, that we operate correctly, that we operate responsibly and that we operate in a way that gives confidence, not just to shareholders, but also to our communities and to our governments.

Dr. Allen Alper: Well, that sounds very good, to know that Gold Fields has responsibility to the Community and the Nation.

Sven Lunsche: Thank you.

Dr. Allen Alper: I enjoyed talking with you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.goldfields.com/

Sven Lunsche

Tel: +27 11 562-9763

Mobile: +27 83 260 9279

Email: Sven.Lunsche@goldfields.com

|

|