West Red Lake Gold Mines Inc. (CSE: RLG, OTCQB: RLGMF, FSE: HYK): Adding Ounces to Their 1.1-Million-Oz Resource, in the Prolific Red Lake Gold District of Northwest Ontario, Canada; John Kontak, President Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/18/2021

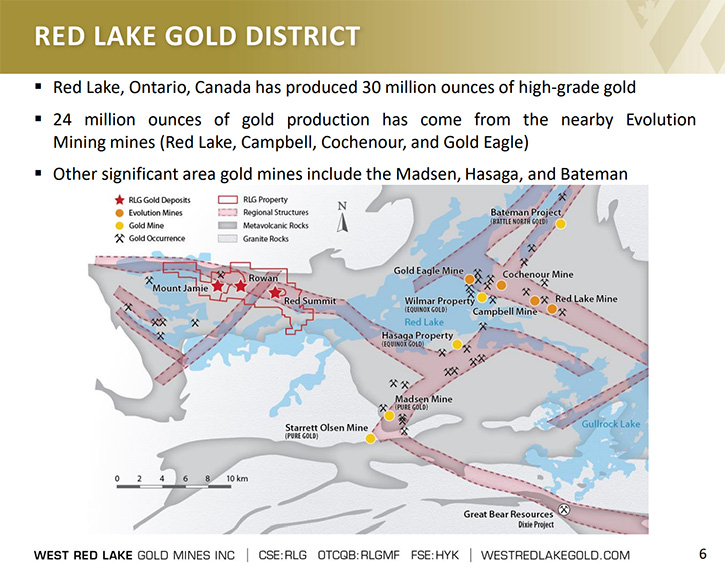

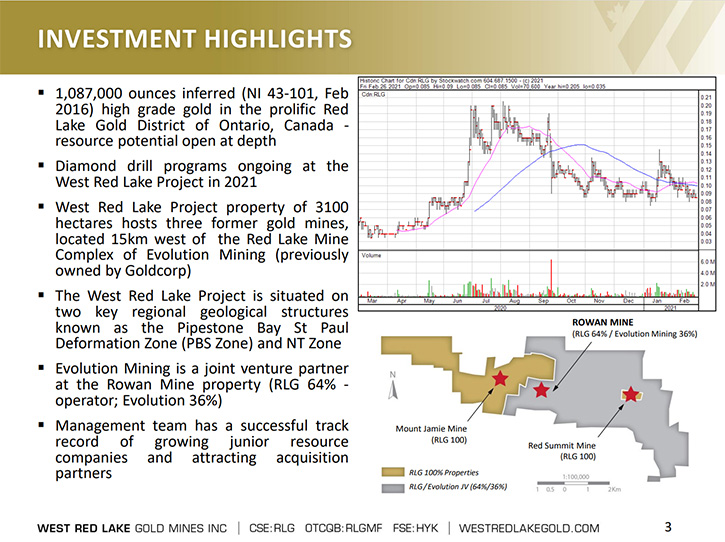

At PDAC2021, we learned from John Kontak, President of West Red Lake Gold Mines Inc. (CSE: RLG, OTCQB: RLGMF, FSE: HYK), that they are focused on their large property in the prolific Red Lake Gold District of Northwest Ontario, Canada, which is host to some of the richest gold deposits in the world and has produced 30 million ounces of gold, from high-grade zones. We learned from Mr. Kontak that the Company is currently focused on expanding their NI 43-101 resource, at the Rowan Mine property, by conducting the drilling program at four different gold targets. Mr. Kontak expects capital to flow into the gold sector, which will force assets to be revalued upward. Meanwhile, West Red Lake's experienced Management Team is busy adding ounces to their already 1.1-million-ounce resource.

West Red Lake Gold Mines Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with John Kontak, who is President and Director of West Red Lake Gold. John, could you give our readers/investors an overview of your Company? What differentiates it from others? Also, tell us some of the highlights of 2020, and what is happening in 2021, and your plans for 2021?

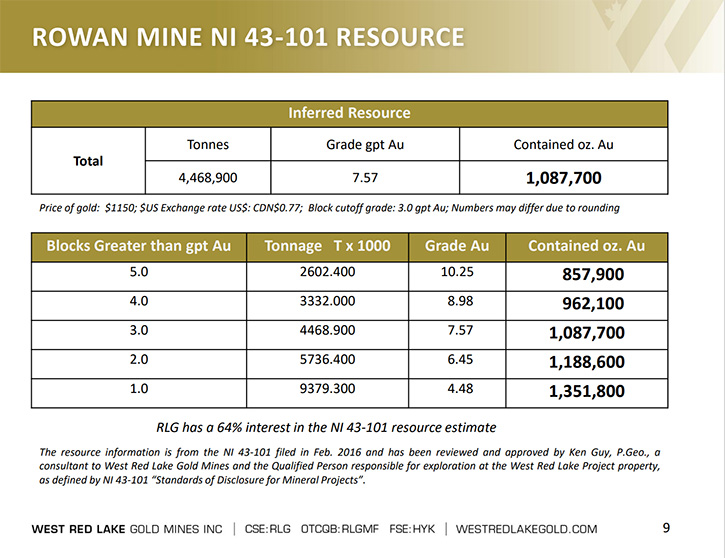

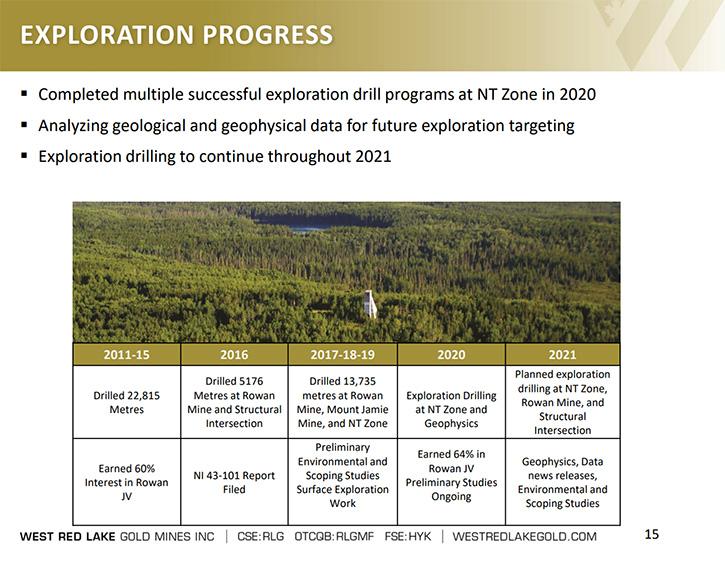

John Kontak: The virtual PDAC started today. That is an indication of the type of world we are all living in right now. What distinguishes West Red Lake Gold Mines are two things very quickly. One, is the excellent experience of the Management Team and their track record. Also, that we have a 43-101 resource in Red Lake, Ontario. The experience of our Management Team is that this will be the third time, as a Management Team, that we monetize gold exploration and development assets in Ontario. Our last two projects were in Timmins and now we are in Red Lake, Ontario. We have a 3,100-hectare property, and there is a 43-101 resource at the former Rowan Mine. We have a 1.1-million-ounce inferred resource, graded at 7.57 grams per ton.

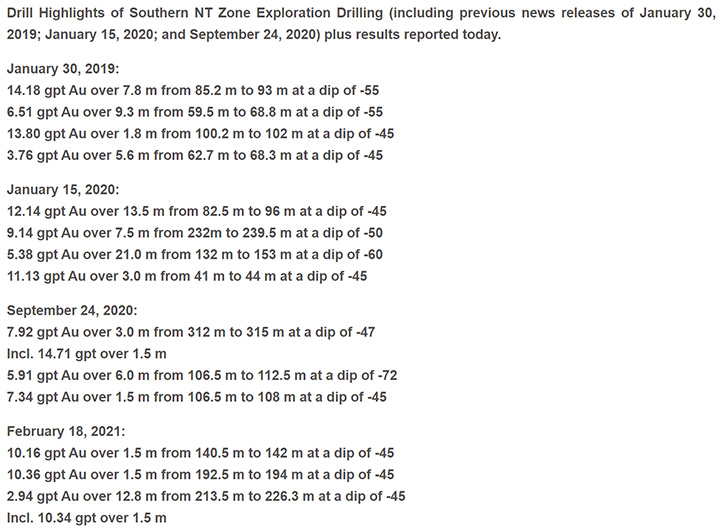

It is all within 500 meters of surface. We put a hole down to 1000 meters, into mineralization that hosts gold deposits. There is a good chance that we would be able to expand the resource as we go to depth at Rowan. On February 18th, we news-released where we have been busy recently, the NT Zone, which is a second gold bearing structure that comes on our property from the Southwest and trends Northeast and intersects the Pipestone Bay, St. Paul Deformation Zone, which is the major East-West gold bearing structure in Red Lake, Ontario. We have 12 kilometers of strike length on the Pipestone Bay St. Paul Deformation Zone. The three former mines on our property are located on the deformation zone, where we have been busy once again on the NT Zone, which comes on our property from the Southwest and trends Northeast.

We announced on February 18th that we now have put in 40 holes, and over 10,000 meters, at the NT Zone. The 40 holes are all within 200 meters of surface, and we have identified four gold zones. This is about 800 meters south of the Rowan Mine, where we have the 1.1 million oz inferred resource. It is very similar geology and we'll develop it as our second deposit on our property, which over time would have the potential to be a second resource.

We are drilling right now on the property, adding ounces to go from the 1.1-million-ounce resource that we have now at Rowan and add ounces by going to depth, and then adding ounces on our property by developing the second resource at the NT Zone. We have identified these four gold zones, so far.

So, the camp is open, we are drilling now, and we're looking forward to having a very good 2021.

We also have news-released at the Rowan, where we have the resource, within the first 200 meters of surface. We are putting in some shallow holes, because the resource really starts below 200 meters from surface, and we think there is potential there for a surface bulk sample in the future. So, we are looking into that as well. We are busy adding ounces, looking at a surface bulk sample at Rowan and looking for capital to flow into the gold sector. You know, gold moved up quickly in 2020 in the second and third quarters, there has been a consolidation in the fourth quarter of 2020, and the first part of 2021, the price of gold is now around $1,700. But we think, for macro-economic reasons that typically result in a positive gold sector, historically low interest rates and negative real interest rates, in addition to liquidity and money supply - QE is now 10 years old and even more so now, than it was in the last 10 years.

It is all being caused by debt. I read this morning that it is expected that the U.S is going to run a $4 trillion budget deficit this year and the same in Canada and the Euro-zone and Japan, et cetera. These things historically result in a positive gold sentiment. So, we think we are going to add ounces on our property. Watch for capital flow into the sector, in which assets get revalued upwards, as they have in the past. So, we were busy in 2020, busy in 2021 and looking to do what we have done in the past, and what we would like to do again, make this asset available to the gold producing community, on a stock for stock, non-taxable transaction, and then sell the asset. But we do not want to be selling the asset now.

We are getting $20 an ounce in the ground for our resource in Red Lake Ontario. When capital flows into the sector, these ounces are revalued upwards, because they are valuable ounces, high-grade, close to surface in Red Lake, a proven prolific mining camp. At the right time of the cycle, we think it is early right now, but at the right time of the cycle, we'll make these assets available for sale. In the past, we have done transactions for as much as $250 million, when we sold our assets to the likes of Rob McEwen and McEwan Mining. Another asset of ours, in Timmins, was owned by Osisko Mining and has since been sold. So, we have done business with some, blue-chip Canadian miners. And would like to do that again for our shareholders.

Dr. Allen Alper: That sounds excellent! Sounds like 2021 is going to be an extremely exciting time for West Red Lake Gold and your shareholders and stakeholders. So that is great! It looks like people are agreeing with what you are saying about the gold cycle. Experts are predicting that in the future gold will become stronger and stronger, with all this money being printed all over the world.

John Kontak: We share that view. We manage our Company on a very conservative basis. Because most of the time when you are managing a junior exploration company, you are in a bear market, that is just the nature of the cycle of the industry. But when there is positive gold sentiment, you can create some shareholder value in a relatively short period of time, 24 to 30 months. You can take a Company like ours, with say a $20 million market cap and you can end up doing a transaction for multiple hundreds of millions of dollars. So, that is what we would like to do again.

Dr. Allen Alper: Well, that sounds like it would be an excellent opportunity for investors, John. Could you tell our readers/investors about yourself and your award winning and well-recognized, successful team?

John Kontak: Yes, Tom Meredith, our Executive Chairman, his family has been doing this in Canada for multiple generations, both mining, finance, and developing mining companies. So, a wealth of experience there! Tom, by way of family background, focuses on the capital markets side of it. And he is very experienced. Ken Guy, our Exploration Manager, was the Exploration Manager at the prior two Companies that we had in Timmins. He developed those assets, taking them from a limited resource of 50,000 ounces and building it up to a couple of million ounces. Ken knows how to find the gold and has been doing it in Northern Ontario for over 30 years. Myself as President, I am a lawyer by training and was involved in developing these other companies that I have mentioned. So, it is a well-rounded Management Team.

John Heslop, who is on our Board, used to be the President of PDAC. He still heads up their charitable foundation. And Michael Dehn is on our Board. He used to be a senior geologist with Goldcorp in Red Lake. Goldcorp was of course founded in Red Lake, Ontario. So, Michael Dehn has great knowledge of the geology of the Red Lake Gold District. When it comes to capital markets, telling the story, marketing and investor relations, technical, et cetera, we have a team that touches the bases you need to touch in this business.

Dr. Allen Alper: Well, you and your Team are very accomplished and successful and well prepared to explore and increase the ounces of West Red Lake Gold.

John Kontak: Absolutely. We are adding ounces and looking forward to capital flowing into the sector, where ounces are revalued upwards. Those are the key. And so, we want to do that in 2021. As you said, the people who follow the gold sector are generally positive on the next 24-to-30-month period. And we are as well. So, we are looking forward to it now.

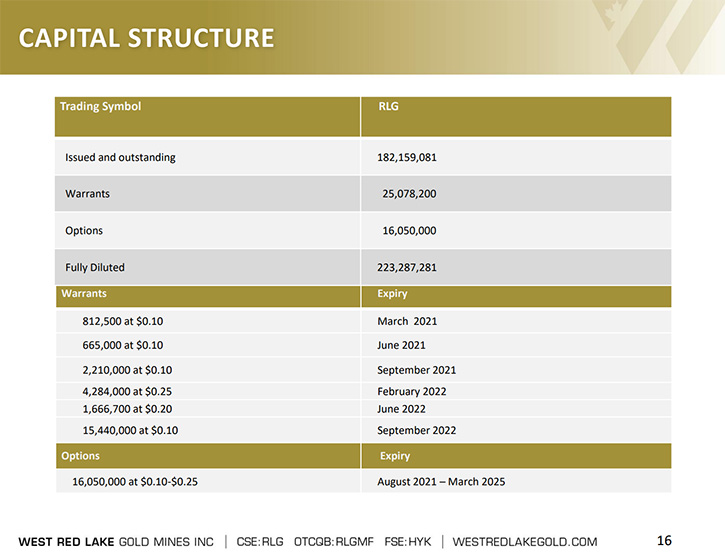

Dr. Allen Alper: That sounds excellent, John. Could you tell our readers/investors a little bit about your share and capital structure?

John Kontak: Yes, we have a 20% shareholder, which is an institutional flow-through fund. They have about 20% of the Company. The Manager of that account is a good friend of ours, and he has been successful in investing, with our prior companies. And now he is a 20% shareholder of this Company. The Management Team, myself and Tom Meredith have large share positions that we bought on the open market and in private placements. So, the common Shareholders are aligned with Management. We do not have options. The Management Team does not have options.

We are common shareholders like everyone else. There are some senior people in the Canadian mining community that have a history with the Company, who have large share positions as well. So, I could call friends and put my hands on about 40% of the stock. And we trade, our volume is good. We are listed in Toronto; we are listed at the OTC in New York. And we are listed in Frankfort and are busy in the virtual world these days, getting the word out on our positive story, in the three markets, in which we are listed and looking for capital flow into the gold sector.

Dr. Allen Alper: Well, that sounds excellent. It is good to see the team has skin in the game and believes in what you are doing and are willing to share with your shareholders, the success of the Company.

John Kontak: Yes, that is the way we have done it in the past. We think it is the proper way to do it. When the common shareholders have their investments monetized, that is when the Management Team does well for themselves as well. So, common shareholders and Management are aligned in their interests.

Dr. Allen Alper: That's excellent. John, could you tell our readers/investors, the primary reasons they should consider investing in West Red Lake Gold?

John Kontak: Well, we are a very volatile industry, and we think we are at the beginning of a positive gold sentiment cycle, largely for the macro economic reasons that I listed; historically low interest rates and negative real interest rates, money supply, and debt typically result in a positive gold sentiment. And then on top of that, once again, it is about the Management Team and the asset. We have a Management Team that has done it before, has taken these assets, Companies with low market capitalizations of less than $20 million. And have done transactions for as much as $250 million. So, this is the type of Team that can deliver on monetizing the asset. The asset we have is in Red Lake, Ontario. One of the best gold-district addresses to be in, certainly in Canada and perhaps the world.

There is a lot of money being invested in it. Evolution Mining, who is our joint venture partner in Red Lake, Ontario just spent US$350 million, taking over the historical Goldcorp complex in Red Lake. Pure Gold has brought the Madsen mine back into production. Battle North plans to be pouring gold later this year, and there are a lot of exploration dollars being spent in Red Lake, Ontario. (On March 14 it was announced that Battle North Gold would be acquired by Evolution Mining for C$352 million). So, when you have an experienced Management Team that has an asset that we can build on, as we do, then investors can look to perhaps get a handsome return over the next 24, 30 months. So, we are working hard to make that happen for our shareholders.

Dr. Allen Alper: Sounds like excellent reasons for investors to consider investing in West Red Lake Gold! You have a great Team; a proven Team and you are in a great location. You already found one million ounces of gold. You will have, more drilling going on now and even a new deposit that you are exploring.

John Kontak: Exactly. As capital flows into the sector, these assets get revalued upwards. So, if you have over a million ounces in Red Lake, Ontario, historically, you will get as much as $200 an ounce in the ground at the right time in the cycle. But if you have over a million ounces and they are worth even just $100 an ounce, that's $100 million asset, and we are adding ounces. So that is how the arithmetic works for the shareholders and the Management Team as shareholders as well.

Dr. Allen Alper: Well, that sounds excellent. 2021 should be a very exciting time and a very fruitful time for two reasons: the exploration-work you're doing, and also what's happening in the financial world, and what might happen with the valuation of gold.

John Kontak: Yes, exactly. Yes. It is a strange time that we are all in right now, but there has been more talk of inflation in the last six months than I have heard in years. I think a lot of people are confused that we are always in debt and low interest rates and money supply that it has not already taken place. There has been inflation in real estate certainly. There has been inflation in the equity markets, the major indexes. And I think there is a sense amongst the generalist investor, not just the gold bugs, but the generalist investor that when you add all this up, how the world is now, especially the financial world, that there is going to be a rotation. And that gold, as an asset class, will outperform over the next number of years. And we want to take advantage of that.

Dr. Allen Alper: It sounds like there is a consensus that that will probably happen. John, is there anything else you would like to add?

John Kontak: No, that's good. Thank you, Allen, for interviewing West Red Lake Gold Mines Inc. for Metals News.

Dr. Allen Alper: It was very interesting, learning more about your excellent Company! We will

publish your press releases, as they come out, so our readers/investors can follow your progress.

https://www.westredlakegold.com/

John Kontak, President

Phone: 416-203-9181

Email: jkontak@rlgold.ca

|

|