GoGold Resources Inc. (TSX: GGD, OTCQX: GLGDF): PEA, Producing 70M AgEq Oz, After-Tax NPV5% of $295M, IRR of 46%, at $21/oz Ag and $1,550/oz Au; Bradley Langille, President & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/17/2021

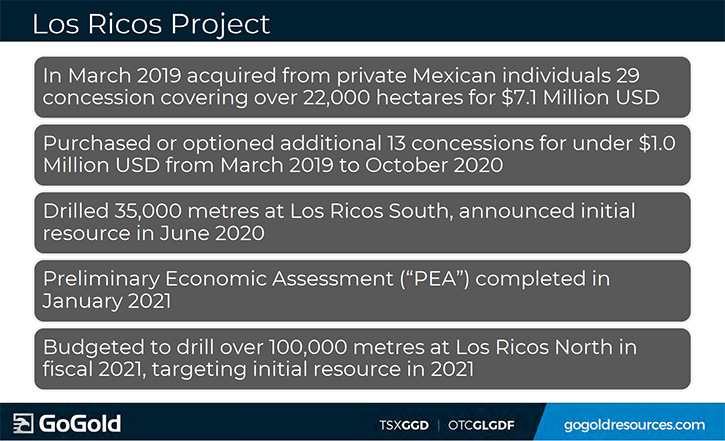

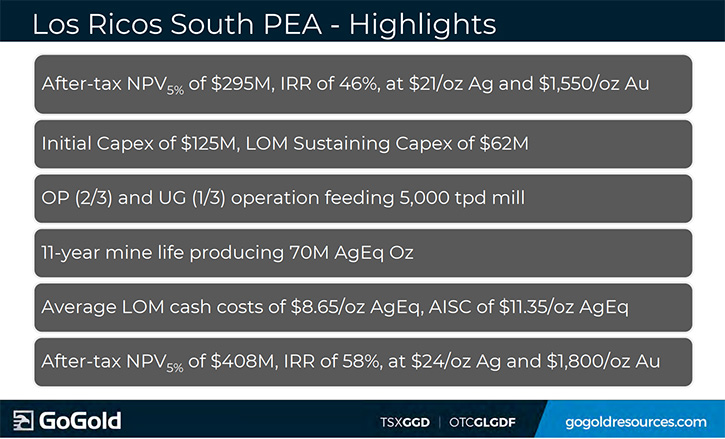

GoGold Resources Inc. (TSX: GGD, OTCQX: GLGDF) is a Canadian-based silver and gold producer, focused on operating, developing, exploring and acquiring high-quality projects in Mexico. The Company operates the Parral Tailings mine, in the state of Chihuahua and has the Los Ricos South and Los Ricos North exploration projects, in the state of Jalisco. We learned from Bradley Langille, President, CEO, and Director of GoGold Resources, that they have advanced the Los Ricos project to the PEA that was completed in January 2021. The PEA features 11-year mine-life, producing 70M Ag Eq Oz, in combined open pit and underground operations, after-tax NPV5% of $295M, IRR of 46%, at $21/oz Ag and $1,550/oz Au. Near term plans, include drilling over 100,000 meters at Los Ricos North, targeting initial resource in 2021.

GoGold Resources Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Bradley Langille, who is President and CEO, and Director of GoGold Resources. Brad, I wonder if you could give our readers/investors an overview of what differentiates your Company, and also give them an update on all the new things that are happening, the PEA, the drill holes, et cetera.

Bradley Langille: Yes. It has been a big year for GoGold. We have advanced our Los Ricos development district a lot in the last couple of months. Since we went into the district only 24 months ago this month. We have drilled about 80,000 meters of core and about 450 drill holes. And we have been able to, in Los Ricos South, define the first 43-101 resource. On an equivalent silver basis, this resource is gold and silver, primarily silver. About 60% plus is silver by value and 63 million ounces of silver equivalent a grade of 199 grams of measured and indicated, and an additional 20 million ounces of inferred in Los Ricos South.

So, we were able to advance that further. All this happening in the first 24 months, we advanced that to a preliminary economic assessment. So, the first look at the economics of that resource, on our target in Los Ricos South. And that's just the one of many targets that we have in the district. We have over 100 targets, but that first target, we are able to identify that and define it as being something at a PEA level, with a net present value at a 5% discount, after tax, of $295 million and internal rate of return of 46%. That was calculated at $21 silver and $1,550 gold. We envision building a mill down there at 5,000 tons a day. The initial CapEx for that is $125 million. Two thirds of that potential ore would come from an open pit. One third from underground, and that'd be a bulk, underground, long haul, mining operation, essentially the same waste that we mine in the pit and the 11-year mine-life.

We project an average life of mine, all in sustaining costs of $11.35. So, an exceptionally good success in Los Ricos South.

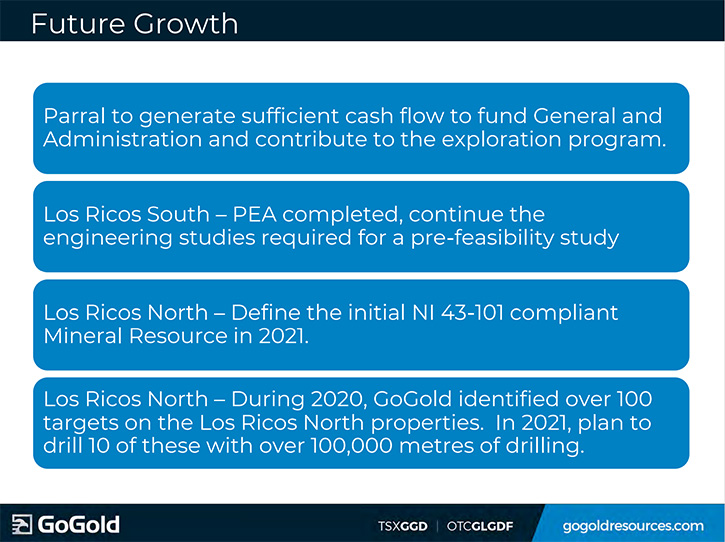

We will be looking at what do we do next with that target, over the coming 12 months. We are targeting having a pre-feasibility study, by the end of the year. We will also be doing some extra, additional resource drilling, in Los Ricos South as well, to grow even further that resource to be included in further economic studies. We've advanced in Los Ricos North, since last summer. We have now drilled both 40,000 meters in just over 200 holes. We have 196 that we have results back, and up there we're defining four areas for an upcoming resource, that we're targeting September, October to have that out. Those are the El Favor area, the El Orito area, the Casados area, and the La Trini area. Those areas we are drilling now, with nine drill rigs, and we're looking to define that first resource of Los Ricos North.

Talking around that in terms of exploration potential, let me define that exploration potential would be what we see as a volume, basically your strike length or your length of the zone and what we think the width and depth of the zone could be. We would estimate potentially how many tons of mineralized material is there. Then as we drill and we start to see the grades coming in, we can apply those drill holes, in those data points, in those grades and come up with a resource study. Our general feeling, talking about exploration potential, is that we have a lot more volume in Los Ricos North than we see in Los Ricos South. We think there is a high probability that, with the initial good results we are seeing, there's an opportunity here to define that first resource that may be even substantially larger than what we've drilled in Los Ricos South. So that is what we are working towards. And we hope to have a Go ahead by September, October.

Dr. Allen Alper: This is an exciting year for GoGold's investors and stakeholders. With all that drilling, you'll be generating great information as the year goes on and it should be a great year of discovering. So, it will be a very exciting time for GoGold and your stakeholders and shareholders.

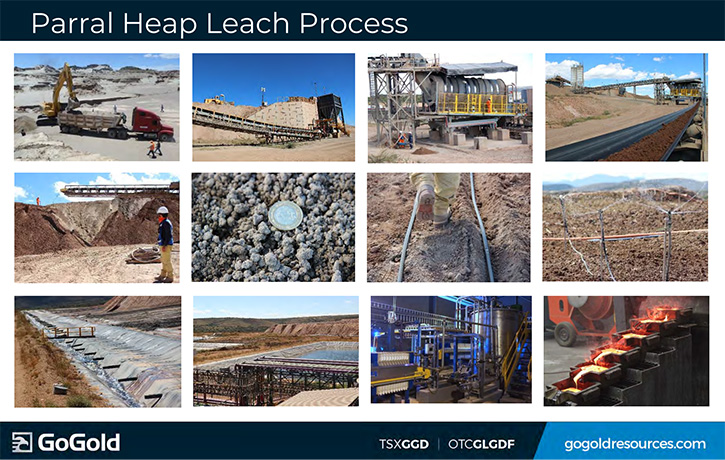

Bradley Langille: Yeah, for sure. Because if you think about the Company right now, probably most of our value would be on the $295 million that we have defined and a PEA in Los Ricos South. We have also an operating mine, the Parral project, where we are producing between 2.2 and 2.4 million silver equivalent ounces per year, under $15 an ounce. Now that project last quarter, a normal quarter, we generated at mine site $6.7 million of pre cashflow.

And last quarter, the bottom line for the Company, we had $4.2 million profit for the quarter. As a corporation, after G&A, we generated about $5.4 million of free cashflow. What that means is, last quarter we spent $3.5 million on drilling Los Ricos, but we covered it all with our cashflow and paid all the general administration in the Company. So last quarter, not only did we cover all that exploration and our G&A, we actually added money to our bank account. We increased our bank account!

Dr. Allen Alper: That is fantastic, a fantastic position for a junior mining company to be in.

Bradley Langille: Yes. It is a very strong position. We have a very strong balance sheet. We have $56 million cash in the bank. We are generating those kinds of cash flows and we have no debt. We're in a very strong position!

Dr. Allen Alper: That's an enviable position to be in. That is great! Most juniors need to go to the market to raise funds to keep on going. It is great to be in a position where you have funding, and you have your extensive drilling program.

Bradley Langille: Yes. We are planning on around a $20 million exploration program in Los Ricos South. So, people often ask, "What's your burn rate? " And I tell them we don't have a burn rate. We have an accretion rate, adding to our bank account rate. So far that's where we are. We are a very strong, capitalized Company, with what I believe, and my technical team believes is, if we are not the best exploration development asset in Mexico, we are certainly one of the very best, in the top of the exploration assets in Mexico. We think that Los Ricos, as a new pre-feasibility study comes out, is going to be one of the very, very important silver assets in the business. We think that the limelight's going to be on it here in 2021, and we think that we are going to solidify our belief that this is a really important silver asset in the silver space.

Dr. Allen Alper: That sound excellent. Could you tell our readers/investors about your background, your Team and Board?

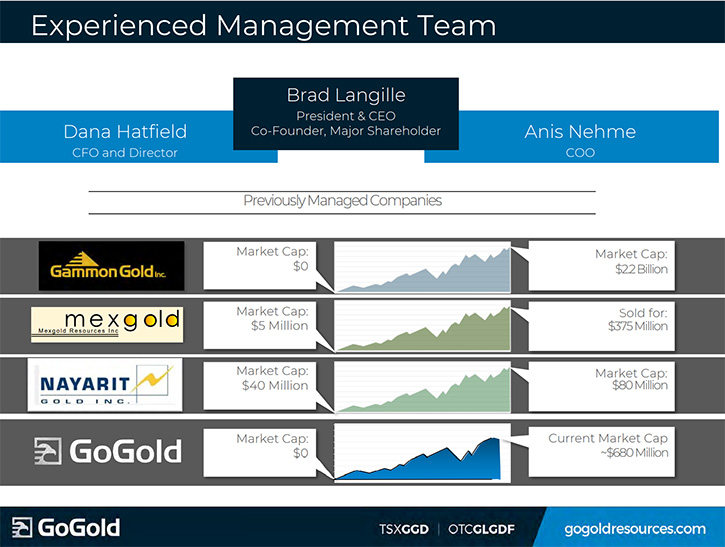

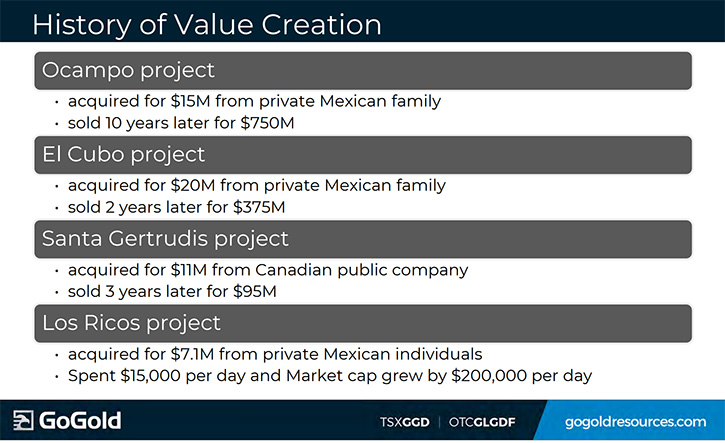

Bradley Langille: Yes. For sure. We are not new to this business. I have been doing this now for 28 years. I am a geologist by education. A lot of what I have done is I have led companies, for over the last 28 years, GoGold for the last 10 years. It has been the Company that I have solely focused on for the last 10 years. But those four companies that I built, along with my Team, within those we built three mines and we made or refurbished a fourth old mine that had operated for 60 years, went in and doubled the production in that mine. After two years, we had bought it for $20 million, invested $45 million and we sold it for $375 million. The first property we ever did, the Ocampo project, during my 12 years as CEO, along with my team, we built two mines there. We took the market capitalization, and trading in New York and trading in Toronto, up over $2 billion.

One of the mines in the Company was sold for $715 million, at that point, having produced over million ounces of gold. And the other asset in the Company was sold for $250 million. So, we've had some very good successes, all in Mexico. We have a great network in Mexico. We tend to be able to find things that are off the radar for a lot of people, and we bring the capital to them. Our group, over the last 15, 20 years, has raised over $1 billion of equity for our projects, and we've done a couple $100 million of debt deals. So, beyond the technical background, I have such a strong technical team, and many of us have been working together for 10 to 20 years. We definitely have the abilities, in the capital markets, to finance our projects and we have a lot of experience under our belts.

Dr. Allen Alper: Well, you and your team have an excellent record of accomplishment. That's really outstanding!

Bradley Langille: Well, thank you. Yeah. We are not resting on our laurels. We're charging ahead. If you look at Los Ricos and how fast we are advancing that project, in 24 months, we went from stark first drill hole to having over 500 drill holes, now over 80,000 meters of drilling resource at all categories of 83 million silver equivalent ounces and a PEA at almost $300 million, in net present value. And in Los Ricos North, we are on the doorstep of putting out what we think will be another very, very large resource. So, we're targeting that to come in during the next six months.

Dr. Allen Alper: Oh, that's outstanding! Really something that you and your Team can be proud of. Those are really great results and a great program. That's a great position to be in. Could you tell our readers/investors about your capital structure?

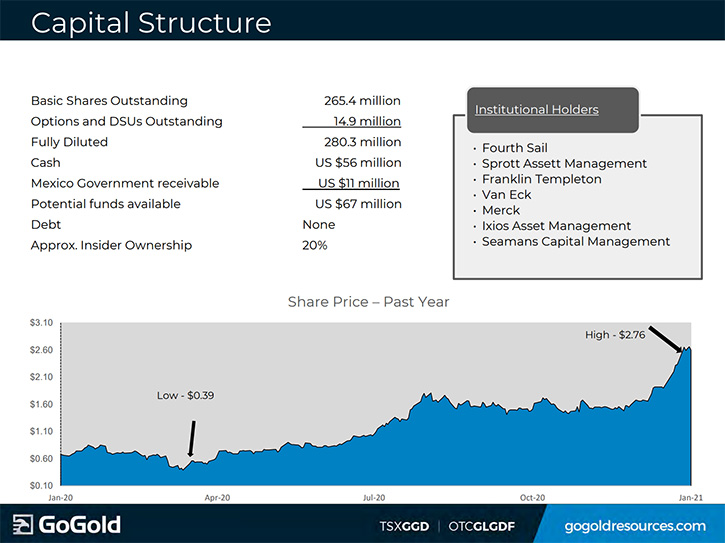

Bradley Langille: Yes. We have 265 million shares outstanding. On a fully diluted basis, we would be at 200 PD and $56 million cash in the bank, the end of the last quarter, no debt and we are probably about 50% institutionally held by some of the larger institutions out there, who are in the precious metals space. Management and Board hold about 20% of the Company. As CEO, I am the second largest shareholder in the Company, I think around six and a half percent. So, I feel that Management and my interests are very well aligned, with our shareholders.

Dr. Allen Alper: It's great to see that. It's great to see Management and the Board, having skin in the game and being committed to the success of the Company.

Bradley Langille: Yes. Mining is a risky business and here are a few ways you mitigate risk. One is strong technical experience. This is not our first time. And the other thing is, it's a business that requires a lot of investment capital. So, a strong balance sheet and good abilities in the capital markets, are definitely requirements. The other thing is, we understand that this is a risky business, especially exploration. Now we are onto a fabulous exploration project. I really believe it is the best I have had in my career. And I and my team have had some great ones. Our philosophy is you can never be sure, especially early stage. But I would not describe us as early stage. We are beyond that now.

Especially in early stage, we can never guarantee that an exploration project is going to work. But our philosophy is, the Company has to work. So, we stick with it until we have success in that Company. So, we either build mines or we do deals and sell the company, so that all of us, along with our shareholders, make a good return on our risk capital.

Dr. Allen Alper: Well, it's great to be in a position where you have a strong team that could do the geology work, the exploration and fun projects. So that's a great enviable position to be in.

Bradley Langille: Yeah. And an operations team, because we are a producer, and a good solid, good margins production. We're producing silver equivalent ounces at our mines, all in sustaining. That's everything, capital, GSA and everything, at under $15 per ounce.

Dr. Allen Alper: That sounds excellent. Could you summarize and highlight the primary reasons our readers/investors should consider investing in GoGold Resources, Brad?

Bradley Langille: One reason is our track record and experience. As a team, we are in the capital markets. We're very good in the capital markets, we're very successful at raising capital, but it's not, this month we're doing a marijuana company and next month a blockchain company. We say our timing is perfect. If you are there all the time, eventually it is perfect. We are in the resource sector. That's all we do. That's what we know. And we focus to be successful in that. That is one reason investors should invest with us, because we have an experienced team, who are very focused on the resource sector.

The other reason is, we are strongly capitalized. Also, we believe we have, if not the best, one of the very best exploration development opportunities in the Country of Mexico, a great Country to work in. I have spent all my career there and most of the Team are Mexican nationals. They have a long history of mining in that Country. They are such great geologists and engineers in the Country. And they don't all work for us, but we have some of the very best of them.

The other reason is because I think, although in the last week or two, the metal prices have pulled back a bit, after being through several cycles and looking at the world today and the risk out there in the financial markets, that there has been so much new money created and so much new debt created, we think longer term, the precious metals are going to have some pretty good upside, especially in the silver space.

Despite our name, which was put on the Company 10 years ago, GoGold is really a silver company. More than 60% of our revenue is from silver. Silver is one of those metals, as the world becomes more green, more solar panels, more electric cars, you need lots of silver. So that's the reason I believe that GoGold is an exceptional investment. We have exposure to silver, we have a team that's very technically savvy and has great successes, is strongly capitalized and focused. And we will bring in other successes.

Dr. Allen Alper: Well Brad, those are very compelling reasons to consider investing in GoGold. You have a great Team. You're operating and producing and have a great opportunity for expansion of your resources. So, that all sounds excellent. And you know how to raise money to do everything.

Bradley Langille: Yeah. You raised a point that I neglected to say. One of the key reasons people should invest is we are one of the very few self-funding juniors out there. And that's a strong advantage.

Dr. Allen Alper: Oh. That's excellent! Is there anything else you'd like to add Brad?

Bradley Langille: I think we have covered pretty much everything. We are doing so much drilling. We are carrying out, over the next 12 months, a 100,000-meter drill program at Los Ricos. The milestones are going to be pretty much every week results of great drilling. At the same time, we are also advancing Los Ricos South, where we have the preliminary economic assessment, to a pre-feasibility. So, lots of news flow will be coming out of the Company in 2021. I think we are going to move up to be one of the top companies, with the attention of the market, in the silver space.

Dr. Allen Alper: That sounds excellent! Very exciting! 2021 will be a very exciting year for your investors.

Bradley Langille: Yes.

Dr. Allen Alper: I enjoyed talking with you, Brad and Steve. I’m very impressed with what you are doing! We will publish your press releases, as they come out, so our readers/investors can follow your progress.

https://gogoldresources.com/

Steve Low

Corporate Development

GoGold Resources

T: 416 855 0435

E: steve@gogoldresources.com

|

|