NewPeak Metals Ltd (ASX: NPM): Exploring High-Growth Potential, Exceptional Gold Projects in New Zealand, Finland and Argentina; David Mason, Managing Director & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/11/2021

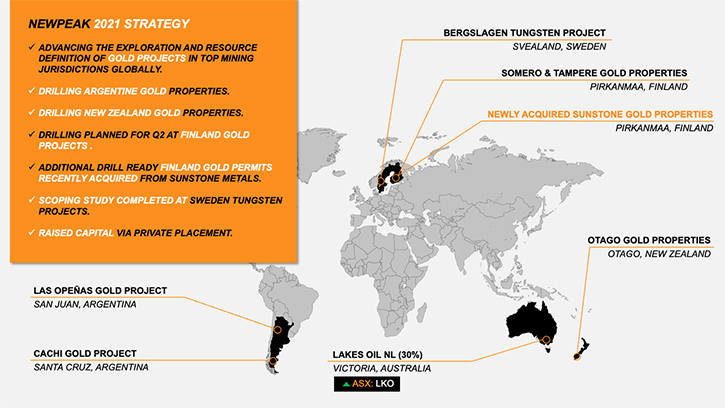

NewPeak Metals Limited (ASX: NPM) is an exploration company, with high-growth potential, focusing on exceptional, results-driven Gold projects, in New Zealand, Finland and Argentina. In 2020 the NewPeak Management Team announced an expansion strategy to acquire additional precious metal properties, in alternative geographic jurisdictions. The Company has successfully implemented this strategy through the acquisition of Gold projects in Finland and New Zealand, complementing the Argentine projects and allowing optionality in its business plans. We learned from David Mason, Managing Director of NewPeak Metals that in 2021 they intend to drill the main projects in each of these jurisdictions.

NewPeak Metals. Image left, Vetas Cachi Gold Drilling in Argentina; Image right, Cap Burn Otago Gold Drilling in New Zealand.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News interviewing David Mason, who's Managing Director of NewPeak Metals. David, could you give our readers/investors an overview of your Company, and what differentiates your Company from others.

David Mason: Certainly Allen, I'm pleased to do so. I'm the Managing Director and CEO of NewPeak. We're an Australian listed resource exploration company. And we have a prime focus on Gold throughout the world. We've been operating in Argentina for a number of years, and we are there drilling a very prominent Gold project at the moment, Cachi, but we've also moved into new jurisdictions in the South Island of New Zealand, in the Otago Goldfields, over the last six months. And over the last 12 months, we've moved into Northern Europe, into Finland and Sweden, into the Gold districts up there. So, we cover some fairly broad, widespread, geographic jurisdictions. They're all excellent jurisdictions, in respect to exploration and mining, particularly Gold. There are a lot of Gold mines in each of those three jurisdictions. There’s several very, very substantial Gold mines nearby our projects and we believe we're going to be successful in making a major discovery on the Gold projects that we hold. That's our main objective at the moment, implementing exploration programs to achieve Discovery. We are targeting Tier-one, world-class new Gold resources in those jurisdictions.

Dr. Allen Alper: Could you tell our readers/investors more about the key projects that you have and the countries they are in, also about your plans for 2021.

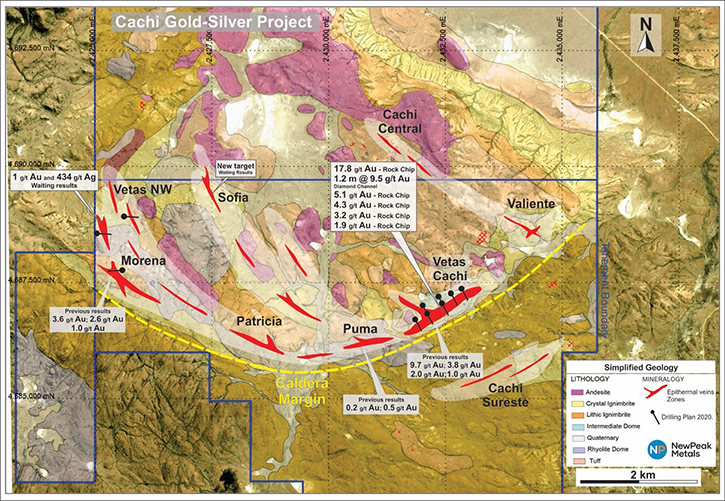

David Mason: Certainly. Let me start in Argentina, where we have been for the last few years. We have two projects, one in the Southern part of Argentina, the Cachi Gold Project. That's the one we're drilling at the moment. And one in the Northwestern part of Argentina, Las Openas Gold, which we intend to drill this year, once we complete some of the first stages of drilling in Cachi. Cachi is a volcanic Caldera-hosted Gold and Silver mineralized resource. It's probably not dissimilar in geology and mineralization type to Yamana's Cerro Moro project, which lies several hundred kilometers to the east of Cachi, where they have discovered some three million plus ounces of Gold.

We've delineated a very large Caldera system at Cachi through surface exploration, over a couple of years, and we now have the opportunity to drill it. We did just a very small first phase drilling program in January. Demand for rigs, unfortunately, in that part of the world, is very tight. And so, we were not able to complete the program, but we have now secured another drilling rig and company. And we're about to start drilling in Cachi again, within the week. And this time the program will enable us to drill probably five or six mineralized targets that we've identified on the surface. Initially, we drilled eight holes into the first one, which was Vetas Cachi. We will continue the drilling at Vetas Cachi, where we've had some very good sniffs, veins and breccias between 20 to 30 meters thick running just under one gram per ton. What we'd like to see there, is two or three grams plus of precious metal grade. We believe we'll find it down dip and along strike.

Vetas Cachi is a swarm of different gold veins, and we've just scratched the surface at the moment. Once we drill Vetas Cachi further, we'll move to some of the other targets that we've identified, including Vetas NW, Patricia, Puma and Valiente, and they all have potential similar Vetas Cachi.

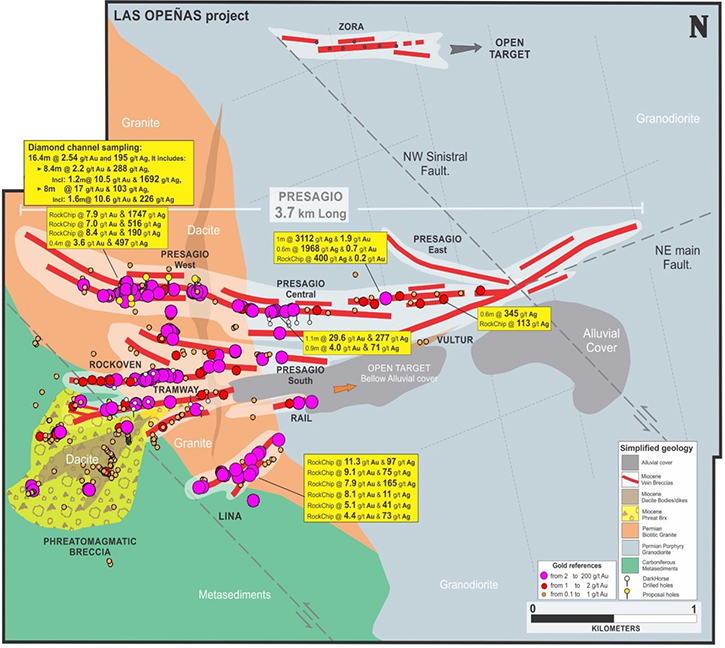

The other project in Argentina, up in the Northwest, is Las Openas. We drilled a small program there about two years ago. We got some very good hits out of it. Subsequently we carried out some more detailed surface geological exploration, and we delineated what we feel is going to be the Bonanza vein system at Las Openas. It's a system that's about two kilometers plus in length. It's a number of different epithermal veins, some up to 7 meters in thickness, over a 70-meter-wide mineralized zone. That's what we've seen at the surface. We have had some incredibly high Gold and Silver results come out of this particular zone, called the Presagio zone. We look forward to drilling that over the next couple of months. We believe that system will prove up a large Gold and Silver system. Those are our two projects in Argentina.

NewPeak, Las Opeñas Gold Project, Argeninta

NewPeak Cachi Gold Project, Argentina

Dr. Allen Alper: They sound like outstanding projects in Argentina. And that this year will be a very exciting time for your investors and stakeholders to stay tuned.

David Mason: We believe so, Allen. Both these projects have huge potential. We think the Cachi project may go similarly to Cerra Moro, where it is a multi-million-ounce deposit. Las Openas might not get quite to that level, but it has very high grades of both Gold and Silver. In its own right, it will be a world-class deposit.

Dr. Allen Alper: That sounds excellent. What about the other countries and the other projects?

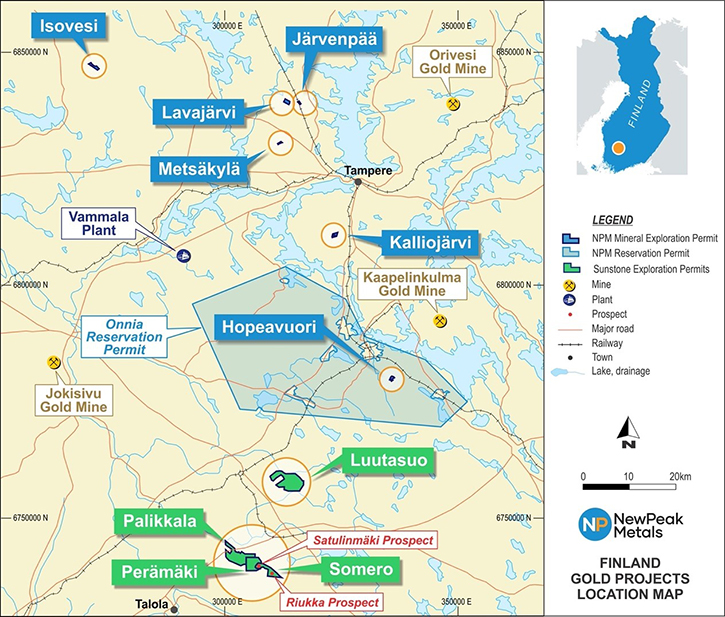

David Mason: At the end of 2019, we decided, as a Company, to expand horizons outside of Argentina as well. Our first port of call was Northern Europe, where we came across some really interesting Gold projects in the Tampere district of Southern Finland, which Finnish company, Sotkamo had in their portfolio. However, they were focused on developing a Silver mine in Finland. These Gold projects, in Southern Finland, were more of a distraction for their Management. So, they were looking for a home and we were fortunate to get in contact with Sotkamo at the right time. We concluded that acquisition in the middle of last year. We've been transferring the permits into NewPeaks’ subsidiaries in Finland and Sweden, and we've concluded that. We're now waiting for drilling permits from the mining authority, and we're also waiting on rig availability. We have a plan to drill in the Southern Finland Gold fields, probably in May this year.

Hopeavuori, one of the main projects in that portfolio, has previous drilling intersections of 10- and 15-meter-thick veins, running 10 and 15 grams per ton Gold. So very thick and high-grade vein systems already discovered. Our plans there are not so much Discovery, as what we're focusing on in Argentina. The discoveries already have been made in this district. So, it is more resource definition and defining the size and the grade of these Gold systems in Southern Finland. That drilling program will be implemented later this year. It will be directed towards defining international standard classified resources. We hope to get, by the end of this year, some classified resources in Southern Finland.

NewPeak, Finland Gold Projects

Dr. Allen Alper: That sounds excellent. Sounds like that'll be an exciting time; when you start finding that resource and seeing how large it is and how extensive, an enjoyable task for you and your geologists, exploration geologists, et cetera.

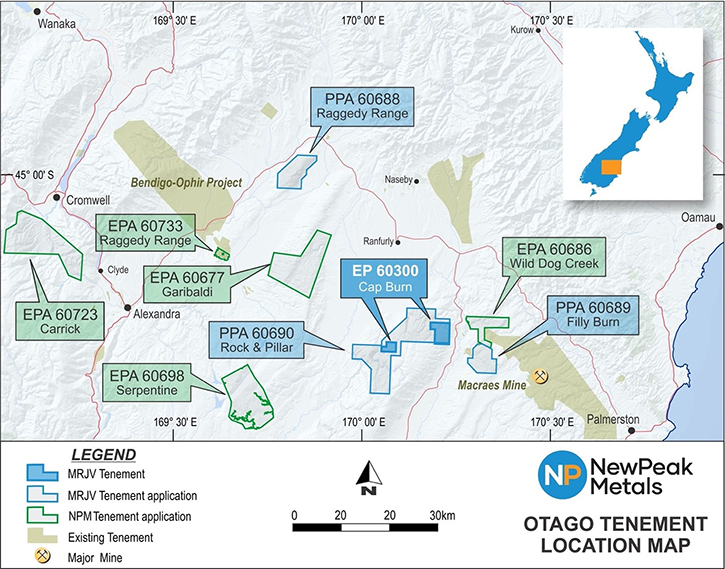

David Mason: Yeah, indeed! We're certainly looking forward to that. The third jurisdiction that we moved into last year is New Zealand. We have had our eyes on New Zealand for some time. An opportunity arose in the Southern Otago Goldfields of New Zealand last year. And we were quick to enter that scene and secure an acquisition of some exploration permits. That main project is called Cap Burn. We have been drilling it now since December, there was a hiatus again because of rig demand availability; it is actually interesting. There's so much work going on in the mineral exploration game, throughout the world at the moment, demand on drilling rigs and laboratories is quite incredible. As a smaller company, which perhaps has less influence than a bigger company, when attempting to put these exploration contracts in place, unfortunately we fall second priority in many respects.

NewPeak New Zealand Gold Projects

So, we must use our nuances to ensure that we do get availability. We are drilling again on this Cap Burn project and we're looking forward to being able to release to the market some interesting results on that project, over the next month or so. When we go into a new jurisdiction, we like to put together a portfolio of mineral assets. So, we have applied for some new mineral exploration permits in this area. We have now seven applications in with the New Zealand mining authorities. We expect those to be granted soon and we'll be able to commence, first of all, surface exploration on those projects, which if we have some interesting results, will lead to drilling. So, we are working in these areas. We have large portfolios of leases and we're in a fairly early stage of our mineral exploration and development plans, which we expect to lead to the discovery of a new mineral deposit and new gold deposit, which really creates interest and excitement and value in the market; and that's the part of the game that we're very keen on.

Dr. Allen Alper: That does sound exciting! It sounds like you are working in Tier one regions, with some perfect deposits that have huge potential. So, I think 2021 will be a very interesting and valuable time for your investors.

David Mason: That's correct Allen. Of course, there are challenges that come with what NewPeak is doing at the moment; working in different jurisdictions throughout the world, operating during this pandemic era, competing against other gold exploration companies for funding, for investors. But, certainly from the project perspective and raising capital, the project’s qualities speak for themselves. If it's a good project, you can raise capital in pretty much any jurisdiction you are in. And in terms of operations, that's a management skill. In NewPeak, we have some high-quality Managers, who were able to implement these programs remotely. We're all restricted in our travel throughout the world, but we've overcome those challenges in the last 12 months or more. We've successfully implemented exploration programs, particularly drilling programs in these various countries around the world. And we're starting to get some of the results from that work.

Dr. Allen Alper: That sounds excellent, David. Could you tell our readers/investors about your background and your Team?

David Mason: Certainly, I am a geologist originally and then moved into management and business. I’ve worked in many countries and most continents around the world. In energy, precious and strategic metals. I started my career in the energy business, in coal. I've had phases of work in mineral exploration, gold and other metals. I find myself now principally in gold, over the last five or six years. We have another entrepreneurial geologist on the Board, my Chairman, Nick Mather. He’s founder of DGR Global, our largest shareholder and CEO of SolGold. Of the other Board Members, one is a legal counsel. The other is in the financing commercial brokering side of the mineral business. I'm also surrounded by an exceptional exploration team, in terms of technical and engineering abilities, and it's a team effort for a company to be able to succeed in this business.

So I find myself, in the last number of years, working in the gold field, and it's an incredibly exciting area. Gold, precious metals are quite a trend in the market today. Gold prices are very high and look as if they are staying there. The price has come off a little in the last few months, but when you compare it to a number of years ago, the Gold prices are very strong, and it could well remain that way. Certainly, when you're developing and mining a Gold project, the price of Gold at the moment allows one to make good margins.

People need to have the perseverance and patience and tenacity. The exploration and mining businesses is a long-term business; it's a marathon, it's not a sprint. You can explore tens of different projects before you get the right project. Most of us have a lot of history behind us. We get to a point when we can almost smell success in a project. It's an instinct, that a project is going to be ultimately successful. You do need that tenacity, and you do need the funding to ensure that you get that discovery and then you define those resources and then you build that mine. We have a great team!

I believe our leadership is very strong and capable and NewPeak will really be making a statement for itself this year, 2021. I believe all the hard work we've been putting in over the last few years is really going to pay off. I think for those that are watching us, certainly those investors and shareholders and stakeholders that are already with us are going to be quite satisfied with NewPeak by the end of this year.

Dr. Allen Alper: Well, it sounds like 2021 will be an outstanding time for investors of NewPeak Metals.

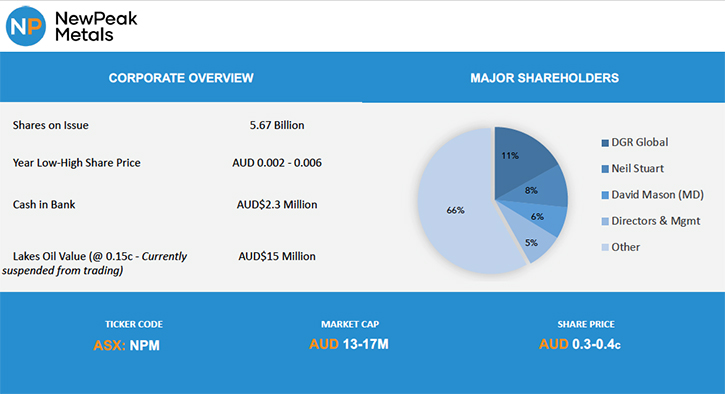

David Mason: Yes. That's definitely correct. I think everything's going to culminate throughout this year, and we're going to be a completely different Company and well on the way. We're a 15 plus or minus market cap company at the moment, Allen. And my objective as the Managing Director and CEO is to get it to 50 million and then a hundred million and then half a billion; that's my target. I've been with the Company now about six years, leading the Company. I believe it's going to be paying off this year. And I really look forward to presenting those results to the Company and its shareholders this year.

Dr. Allen Alper: That sounds excellent, David! Could you tell our readers/investors a little bit about your share and capital structure?

David Mason: Certainly. The Directors and the senior executives hold a significant stake in the Company. So, we ourselves are very much invested in NewPeak. Together we would hold 35 to 40% of the stock of NewPeak. I'm approximately a 7% shareholder. I have grown that stake in the Company by sacrificing my cash remuneration and taking stock in NewPeak. So, it has had both the effect of increasing my shareholding, but also allowing NewPeak to be very conscious of its cash management. The other Directors and some executives, I'm pleased to say, have followed me in that direction. We principally only take remuneration out of the Company through stock and not cash, hence preserving our cash position.

Cash is not easy to get in the world at certain times, and so one has to be very careful and conscious of it. I think that philosophy and that strategy is very prudent. Also, we don't have large overheads. So pretty much, everything we raise in the marketplace goes operations and exploration programs and developments, which I'm very pleased to say. One of my former directors, Neil Stuart, who joined me in the beginning some five, six years ago, he's an eight, 9% shareholder. DGR Global who managed NewPeak some six years ago, they're at around 10% equity.

We have a lot of shares out in the market. We have around 5 billion plus shares. That sounds like a lot of shares, but it's not uncommon on the Australian stock exchange these days for companies to have such a large amount of stock. We will look at consolidating that at some stage in the future when it's the right time. You do have to get that timing correct. We are looking also at a dual listing now in Europe, because of the European presence we have in Northern Europe. So, we are about to press the button on a dual listing. We've chosen the Frankfurt stock exchange. The reason for that is that an ASX listed company can immediately and cheaply dual list itself on the Frankfurt exchange. And the Frankfurt exchange is a really interesting and a very high value stock exchange, and more exploration and mining companies are making a presence there.

In the marketing and promoting that I've done in the UK, in Europe over the last few years, I've had a lot of interested parties, who would like to come and join the NewPeak story, but many of them have been insistent on having some form of listing in Europe, closer to where they live, subsequently they can trade the shares on their own local exchange. So that's driven us to look at that option, and we're now implementing it.

Dr. Allen Alper: It's excellent to see the Management have so much investment in the Company, so much skin in the game and believe in what the Company is doing and be willing to be compensated with stock and confident in the future of the Company.

David Mason: Yes, indeed. And thank you very much for that Allen. It's definitely the first thought on our minds, every day, to bring all that hard work into realization, crystallized, good value for the Company.

Dr. Allen Alper: That sounds excellent. Could you summarize the primary reasons our readers/ investors should consider investing in NewPeak Metals?

David Mason: Certainly. We have some excellent Gold projects in different countries in the world. We're at a fairly early stage of our development, but a very exciting stage, on the verge of what we consider to be some significant Gold discoveries. Our share price is quite low. It's a low and relatively cheap entry point for current investors and also new investors to come into NewPeak. And we believe that an investment in NewPeak is going to allow that investment to grow. We believe that will occur during this year, and that's what we're working very hard to do. My message to investors is watch very closely what we're doing. Think about your investment timing, because we believe that we're getting very close to moving the Company forward very quickly.

Dr. Allen Alper: Well, those sound like very compelling reasons. And the time sounds excellent to consider investing in NewPeak Metals. Is there anything you'd like to add David?

David Mason: Just to say thank you very much for your support of myself and NewPeak over the couple of years that we've known each other. We highly prize your input in our industry. Metals News is a very valuable publication for us. And we really greatly appreciate the efforts you put into covering companies like NewPeak in the market, because it gives us the opportunity to get out there, allows us to promote ourselves. One of the things that many people in our industry don't realize is that nobody really knows about us. You really have to be out there promoting yourself, your product and your services and your Company. And Allen, we think you do an exceptional job for us in that. And we thank you very much.

Dr. Allen Alper: Thank you. I appreciate that. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://newpeak.com.au/

Mr David Mason

Managing Director

Ph: +61 400 707 329

Email: dmason@newpeak.com.au

|

|