QuestEx Gold & Copper Exploration (TSX-V: QEX): Successful Team Exploring for High-Grade Gold and Copper, in the Golden Triangle and Toodoggone areas of BC; Dr. Tony Barresi, President Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/10/2021

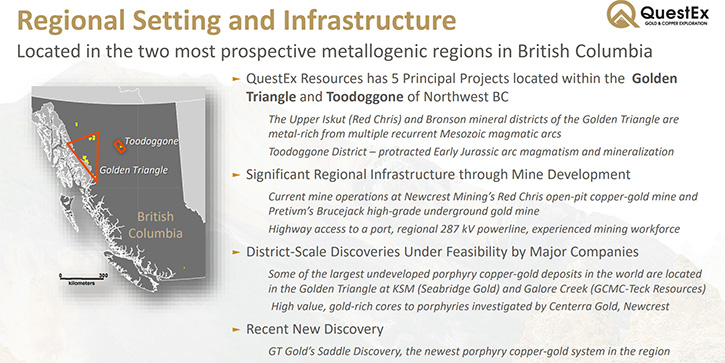

QuestEx Gold & Copper Exploration (TSX-V: QEX) is exploring for high-grade gold and copper, with a focus on the Golden Triangle and Toodoggone areas of British Columbia. We learned from Dr. Tony Barresi, President of QuestEx Gold & Copper Exploration (TSX-V: QEX) that their assets are being advanced by a newly assembled Technical and Management Team, with experience in exploration, permitting and discovery. According to Dr. Barresi, QuestEx is focused on making discoveries and advancing high-potential projects, with the goal of developing a portfolio of assets that are attractive to majors mining companies. QuestEx’s Castle Property is adjacent to GT Gold Tatogga property, which March 10, 2021 was purchased by Newmont for 456M.

QuestEx Gold & Copper Exploration

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Tony Barresi, President of QuestEx Gold & Copper. Tony, could you give our readers/ investors an overview of your Company? And also, what differentiates your Company from others?

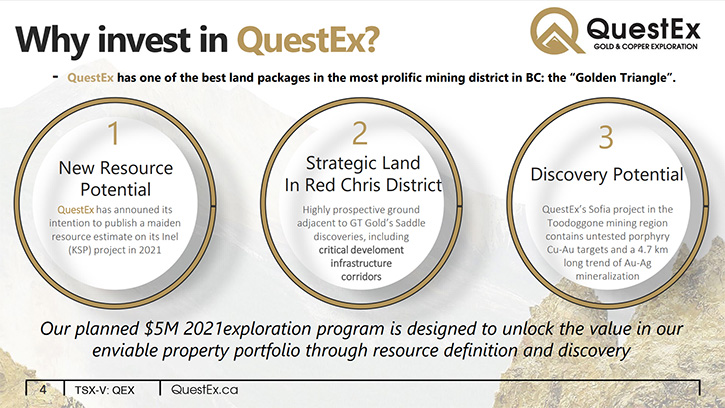

Dr. Tony Barresi: Sure. Thanks a lot for the opportunity to talk with you, Allen. I really appreciate it. QuestEx is a Company, with a large portfolio of gold and copper early-stage exploration properties, focused in British Columbia. We actually have the third largest land package, within British Columbia's prolific Golden Triangle, only behind Seabridge Gold and Pretium Resources. Our business model is to leverage our intellectual capital, so basically our technical team, and our really enviable and large portfolio of properties to make a discovery. We're not miners. We have no intention of developing these discoveries into mines ourselves. Our model is to advance our projects to the stage where they are highly attractive to majors, and then bring them on either as partners or to purchase the properties or potentially even our Company.

Dr. Allen Alper: Sounds great!

Dr. Tony Barresi: Yeah. We stand out compared to our peers in a number of different ways; first just in the pure size and diversity of our property portfolio. We have properties right from close to the northern border of British Columbia, with Yukon all the way down to Southern British Columbia, where we have a property that's adjacent to Kodiak Copper's MPD property and then, of course, large exposure in the Golden Triangle and the Toodoggone. So that's the diversity and size of our property package, but it's also an incredibly prospective land package. We're situated, with a 640 square kilometer land package, right in the heart of the Golden Triangle, in-between Skeena's Eskay Creek Project and their Snip Project, just to the west of Seabridge's super giant copper-gold porphyries. The geology we have on our properties is extremely prospective, but not well explored, largely because they are in under-explored emerging districts that are benefiting from new and improved infrastructure, accessibility, and exposure due to rapidly retreating glaciers. So, we stand out because of our high potential, highly prospective property portfolio, but also because of the prowess of our technical team, which includes two Ph.D. and three M.Sc., with combined over 200 years of mineral exploration experience. The technical team is key to unlocking the value in our property portfolio. You do not see many junior explorers, who are investing as heavily as we are in technical expertise, but we see it as a critical part of our business model. Without that expertise we can throw exploration money at the ground, but it is far less likely to bring share-holder value, through significant discovery or advancement of projects to economically meaningful stages.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about your properties and what you have found to date?

Dr. Tony Barresi: Just focusing on our Golden Triangle properties, one of our most exciting properties that we're going to be hitting hard in 2021, with an aggressive drill program, is our KSP property. Now, this is a property that's situated between the past-producing Snip and Johnny Mountain mines to the west and Eskay Creek and Brucejack to the east. It's a very large land package, and it's a land package that until recently would have been considered very remote.

Now AltaGas has driven a road onto and through the property and put in a number of hydroelectric projects off that road, so this once remote property now has highly favorable infrastructure. It has essentially the identical geological controls for mineralization as on Seabridge's KSM property, with their super giant Kerr-Sulphurets-Mitchell and Iron Cap deposits. We have the same suite of intrusions and we have a similar fault to the Sulphurets fault. There is a real control on mineralization on the KSM property, and we believe it is on our KSP property as well. So geologically, it has all the right elements, but it hasn't been well explored because it used to be so remote.

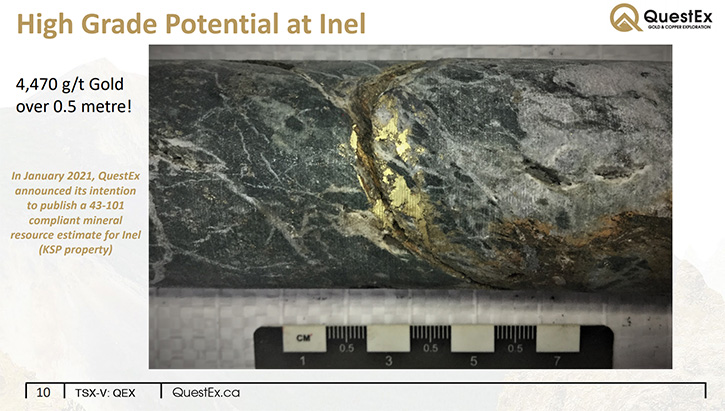

Our Inel showing is the most advanced target on the KSP property. I believe that Inel is the most advanced gold showing in the Golden Triangle that does not already have a resource defined. It has a kilometer and a quarter of underground workings. It has close to 40,000 meters of drilling, and yet there's no resource. When we took over this project, we identified a couple of the things that were holding it back from being able to have a resource.

One of them was that there simply wasn't good topographic control in this area. So we ran a LIDAR survey over it this year, and we now have perfect topographic control. The other was that there was no 3D model of the geology, so we're working hard to build that 3D model right now. And we believe that even if we didn’t do any drilling this year, we would still be able to define a new resource for the Inel showing. I think it's going to be a good one, because there are some pretty incredible intersections from this showing.

For example, in 2016, our predecessor company hit 4,470 grams gold over a half meter there. And there are other fantastic intersections from there as well. For example, seven and a half meters of 41 grams gold, that kind of thing. So, we're going to define a new resource for now, but we're also going to continue to explore at Inel, and Allen, we're developing an approximately 3,000-meter drill program that's going to allow us to increase, we believe, both the grade and the tonnage of our in-house resource before we release it later in the year. So that's our KSP property.

In addition to Inel, the KSP property is highly prospective for super-giant porphyry copper gold deposits. One of the things that really stands out about our KSP property, if you zoom out and look at the entire region, is the silt geochemistry, from all the streams that are draining out of the mountains here. Throughout the Golden Triangle there are conspicuous copper, molybdenum and tellurium, silt anomalies surrounding all the known deposits. Specifically, around the Kerr-Sulphurets-Mitchell and Iron Cap deposits, and also at Galore and Shaft Creeks, and even at our North ROK porphyry to the north. But if you look at the region as a whole, the largest, the most intense cluster of the silt anomalies is on our KSP property, yet it has barely been explored for porphyry copper-gold potential because it used to be so remote. So, we are really excited about getting onto the property and doing the grassroots exploration that's necessary to define these targets better.

Dr. Allen Alper: Well, that sounds great, and it sounds like 2021 is going to be a very exciting time for QuestEx.

Dr. Tony Barresi: Thanks, Allen. It really is because the company hasn't done a lot of exploration over the last number of years. The last large campaign that our predecessor company conducted, was back in 2017. So our share price really hasn't appreciated in the same way that our peers’ has, and that's because we simply weren't doing large exploration drill programs over the last number of years. But we've really revitalized this Company. We have a new Management Team, a revitalized Board of Directors. We have a brand new, highly qualified Technical Team. We've been crunching the data and we're going to get out there and do something we haven't done for a number of years, which is an aggressive multi-property exploration campaign. We believe that that's really going to go a long way to building shareholder confidence and bringing our market cap into alignment with our peers.

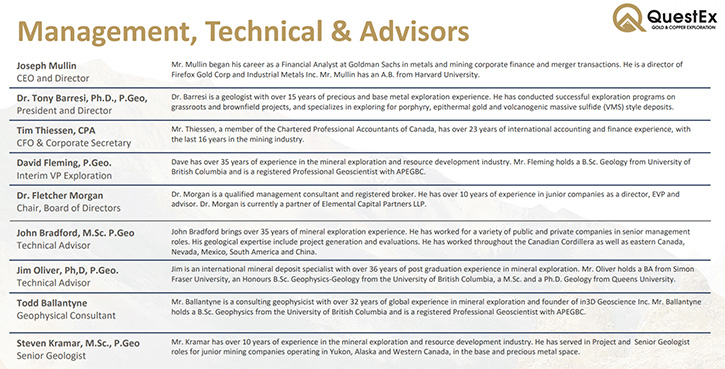

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your background, the Team’s and the Board’s?

Dr. Tony Barresi: I have a Ph.D. in Geology. The subject of my Ph.D. was actually looking at the tectonic and magmatic controls on mineralization in the Golden Triangle, and I did that in conjunction with the BC Geological Survey. So I've basically spent most of my career tromping around in the Golden Triangle, looking at mineral deposits and trying to figure out how to best discover them and explore for them. I also have about 17 years of experience working in the industry.

Dr. Allen Alper: And your Ph.D. was recognized by PDAC. That was very, very great.

Dr. Tony Barresi: That's right. I was honored to be awarded the Mary-Claire Ward Geoscience Award, which is awarded to graduate students, who bring greater understanding of geoscience through mapping as a result of their Doctorate or M.Sc. work. I was actually the second person ever awarded that, so that was a great honor.

Dr. Allen Alper: Well, that was excellent! That was the start of a great career at Triumph and now at QuestEx.

Dr. Tony Barresi: Thanks, Allen. I really enjoyed my time with Triumph Gold. I started with Triumph when they had a share price of about four cents and hadn't done exploration on their property for a number of years. I worked with a team of people to develop new exploration concepts for that property. We came up with some ideas that we were really excited about, and went around and talked to some investors from other companies. That led to an investment by Goldcorp in Triumph. They bought 19.9% of the Company for $6.3 million. And we deployed that money into the ground, testing the exploration concepts and in the end, we had some incredible successes. We made some new discoveries and we made some of the longest, highest-grade greenfields drill intersections, over a couple of successive years.

The share price appreciated from about four cents to a high of over 80 cents, so that's really what we'd like to see happen with QuestEx. I think we're well on our way. At a minimum, we're coming up with some great exploration concepts and we're going to be executing drill tests of those concepts this year.

Dr. Allen Alper: That sounds excellent. That was great! That gives our readers/investors confidence in you and your team.

Dr. Tony Barresi: Yeah. Thanks, Allen. That's really important. I think it is important for investors and shareholders to recognize that we really are a new, completely revitalized team. We're going to go out and hit these properties hard and conduct some really robust exploration this year.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a little bit more about some of the other members of the Team?

Dr. Tony Barresi: Our CEO, Joe Mullin, is a Harvard-educated, former Goldman Sachs banker. About five years ago, he made a shift into the junior exploration sector and he's involved on the Boards of a number of different Companies. He became involved with QuestEx, through a merger with a private company, of which he was the CEO, called Buckingham Copper. Through that, we got Joe, which was fantastic, and we also acquired a couple of the properties that are a part of our portfolio that we're really excited about.

Our CFO is Tim Thiessen. He's also a veteran of the industry. He's been working in the exploration industry for close to 20 years. Our VP Exploration is Dave Fleming, and I think he has close to 40 years' experience in the mineral exploration industry and he's worked for a variety of majors and junior miners. We have a really fantastic slate of technical advisors, including Jim Oliver and John Bradford, both of whom are international mineral deposit experts. So we're really excited to have the team that we have and the expertise that we have, and to take that intellectual capital and leverage it to do some really great exploration this year.

Dr. Allen Alper: Oh, that sounds excellent! It's great to have such an important location and such a strong technical team for exploration! You also have financial people, who could get you money to do the drilling and the exploration. Sounds like you have a very well-balanced team to move forward!

Dr. Tony Barresi: Yeah, and the money side of it is really important. One of the things that Joe brings to the table is something that's really interesting and unique. Because he's spent so long in the banking industry, but outside of the junior exploration space, he actually has a tremendous amount of credibility, and credibility with all of his contacts, who don't typically invest in this space. We have access to a very wide and diverse group of investors that most junior explorers find it hard to get a meeting with, for instance, Wall Street bankers, who are used to doing billion dollar deals or doing real estate and that sort of thing. But Joe is able to open those doors for us, so it's been an interesting experience working with Joe.

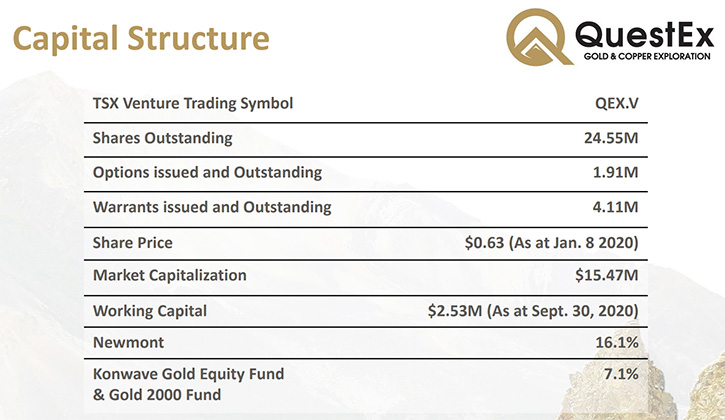

Dr. Allen Alper: Excellent. Could you tell our readers/investors about your share and capital structure?

Dr. Tony Barresi: One of the things we did, as we were trying to revitalize QuestEx, was a share rollback. Back in September, we did a 10 to one share rollback, and I'm pleased to say that when we did that, there was very little erosion of our share price or market cap. When we did the share rollback, our share price was seven cents. When we finished it was 70 cents and it remained 70 cents for quite some time. Before Christmas, most of our peers’ and our share price decreased, but we've been hovering around 65 cents in the new year. We have, post-rollback, only about 24 and a half million shares outstanding, so lots of room to do a future financings to fund these exploration programs. We only have about 4.1 million warrants outstanding and most of them are not in the money at the moment. Our largest shareholder is Newmont and they hold about 16%. We also have a large shareholder in a fund called Gold 2,000 out of Switzerland.

Dr. Allen Alper: Oh, that's great. It's great to have a shareholder like Newmont. They're so well-recognized and, well, the biggest and best gold company in the world, and to have confidence to take 16% of your shares. That's great.

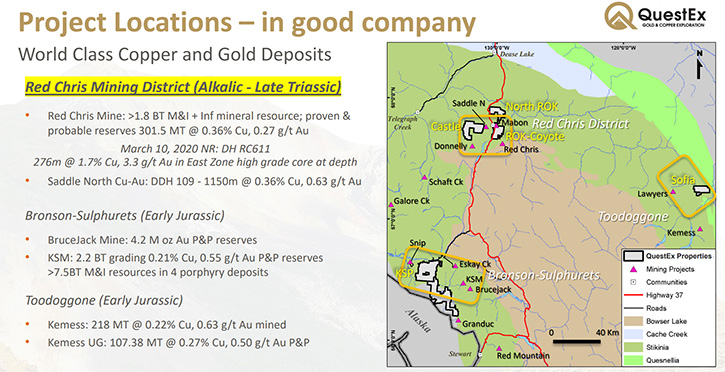

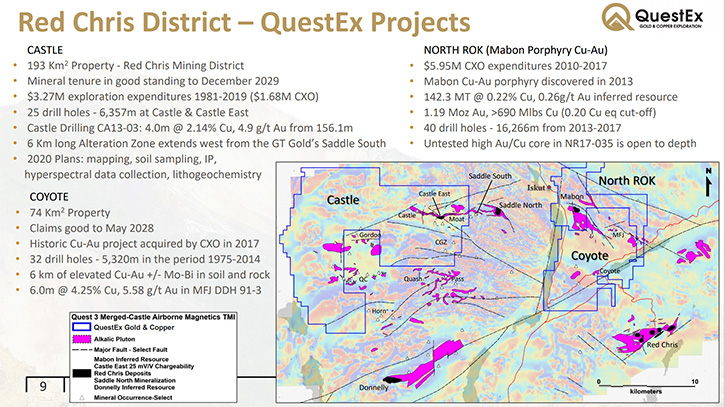

Dr. Tony Barresi: It really lends us a lot of credibility that Newmont wants to have exposure to the upside of the exploration we're doing. One of the properties we have that they're really excited about is our Castle property. Our Castle property is in the Red Chris District and it's directly adjacent to GT Gold's Tatogga property, where they've made their Saddle North and their Saddle South discoveries. Saddle North, in particular, is an incredible discovery. They only put their first drill hole into it in 2017 and they already have a defined nearly 9-million-ounce resource. That's pretty amazing and that's just right across the claim boundary from our property. The mineralized trend that both Saddle North and Saddle South are on is a 10-kilometer-long trend, six and a half kilometers of which is on our property. And our property has barely been explored along that trend, so that's something that we're really excited about. We think Newmont's excited about it too.

But we also have an important piece of physical real estate right there, because if you want to put an open pit on top of Saddle South, chances are that open pit would extend across the claim boundary. If you want to do an open pit at Saddle North, probably you're going to need part of the valley that's on our claim block for a tailings facility. So it's not just great for exploration, it's great for infrastructure. And I think that's part of what Newmont is excited about with that property.

Dr. Allen Alper: That sounds excellent. Tony, could you summarize the primary reasons our readers/investors should consider investing in QuestEx?

Dr. Tony Barresi: Sure. Right now it's a gold bull market and gold exploration companies are flying high. There's not a lot of opportunity to invest in a gold explorer, where there's a huge amount of growth that's not directly tied either to the price of gold going up or the chance that they make a big discovery. But with QuestEx, there really is a great growth potential that's not specifically tied to either of those opportunities. And that's because our share price, our market cap has not appreciated along with our peers, because we simply haven't been exploring our properties over the last number of years.

Now we are set to relaunch. We have brand new Management, a brand-new technical team. We have two PhDs, three MScs that are devouring the data from this really enviable portfolio of properties. And we are going to get out there and, for the first time in a number of years, do an aggressive multi-property exploration campaign. On the back of that, Allen, I think we're going to be able to bring our market cap into alignment with our peers. And then, on top of that, there is whatever investment opportunity or whatever might happen as a result of the price of gold or copper going up, the commodities market or the discoveries that we make. And those are just going to be gravy on top of bringing our share price into alignment, with our peers. We're ready to go and the market hasn't realized it yet, so this is the ground floor.

Dr. Allen Alper: Well, those sound like very strong reasons for our readers/investors to consider investing in QuestEx. Tony, is there anything else you'd like to add?

Dr. Tony Barresi: I'm just really glad for the opportunity to have spoken with you, Allen. Thanks very much.

Dr. Allen Alper: Great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://questex.ca/

Tony Barresi

President and Director

For more information:

T: (250) 768-1511

TF: (855) 768-1511

|

|