Blue Sky Uranium Corp. (TSX-V: BSK, FSE: MAL2; OTC: BKUCF), Grosso Group, Leader in District-Scale Low-Cost Uranium Discovery in Argentina, Interview with Nikolaos Cacos, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/9/2021

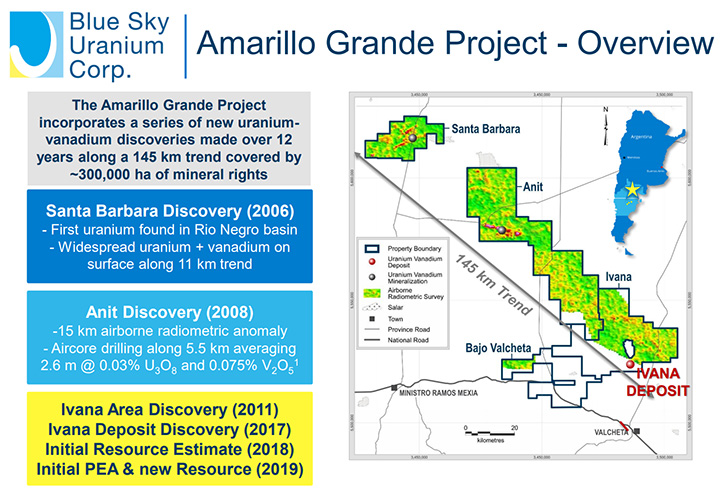

Blue Sky Uranium Corp. (TSX-V: BSK, FSE: MAL2; OTC: BKUCF), a member of the Grosso Group, is a leader in uranium discovery in Argentina, rapidly advancing a portfolio of surficial uranium deposits into low-cost producers. The Company's flagship, district-scale, Amarillo Grande Project has the potential to be both a leading domestic supplier of uranium to the growing Argentine market and a new international market supplier. We learned from Nikolaos Cacos, President and CEO of Blue Sky Uranium, that in 2021, they will be drilling to expand the resource and to advance the project towards a pre-feasibility study that should be completed by the first quarter of 2022.

Blue Sky Uranium Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Nikolaos Cacos, who is President and CEO of Blue Sky Uranium. Niko, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Nikolaos Cacos: I would be very happy to, Allen. Blue Sky Uranium is a uranium exploration company that is focused on making uranium discoveries in Argentina. We have been around for a long time, over 15 years now, and we have made an incredible discovery in Southern Argentina. We have discovered not just a uranium deposit, but we have discovered a brand-new uranium district that is similar to the districts of uranium that we're seeing in Kazakhstan.

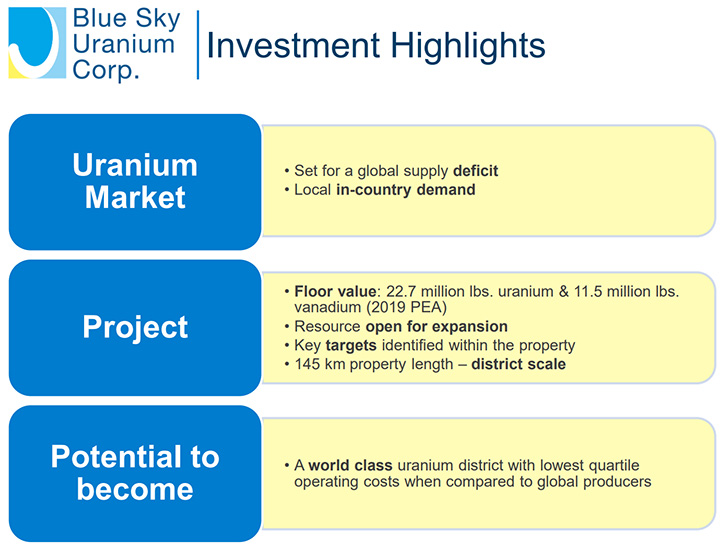

Those districts in Kazakhstan are monstrous. They had contained hundreds of millions of pounds of uranium, and they are able to produce the uranium at a very low cost, supplying upwards of 60% of the world's uranium today. What we have in Argentina is an entire district that spans 300,000 hectares of tenements. It is a corridor 145 kilometers long, and 50 kilometers wide. The deposit size is just under 23 million pounds of uranium - 22.7 million, to be exact. The vanadium is at 11.5 million pounds.

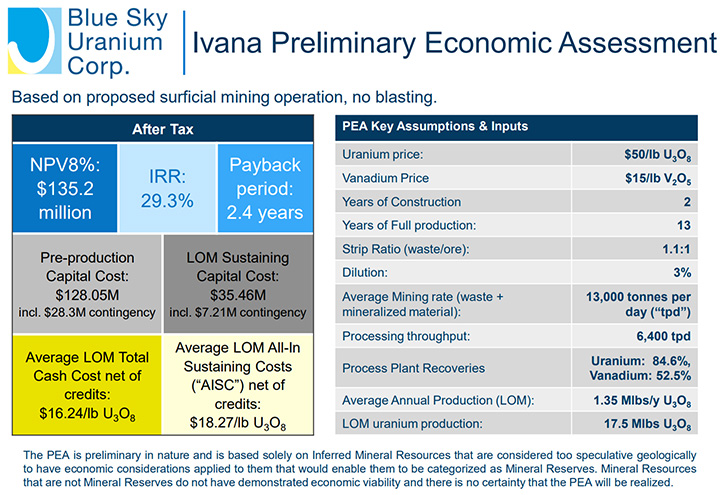

The PEA, (the preliminary economic analysis) that we completed in 2019, indicates that if this deposit were in production today, it would rank amongst the lowest cost producers in the world. So, the caveats here are two-fold. We believe we have a district with the potential to rank amongst the largest uranium districts in the world, and amongst the lowest cost.

Dr. Allen Alper: That's fantastic. Could you tell our readers/investors your plans for 2021?

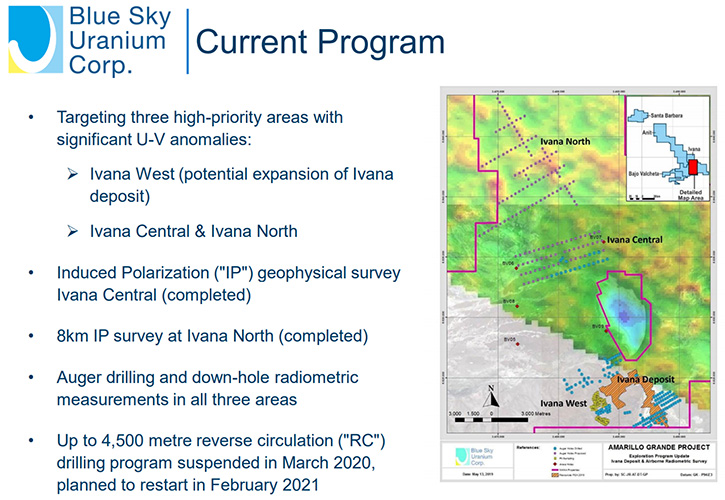

Nikolaos Cacos: I would be happy to. To date, we have demonstrated, with the preliminary economic study that the cost of production potential is extremely low for Amarillo Grande Uranium Discovery. Going forward, the next characteristic that we are aiming to prove up is the scalability of being able to find additional deposits. We feel that Blue Sky Uranium has excellent potential to uncover new deposits that can begin to grow our resource base at Amarillo Grande Uranium Project, in the very short term.

We just commenced a 4,500-meter drill program about a week ago. We expect to wrap it up by the end of April. Following that, we plan to advance the project towards a pre-feasibility study in the second quarter of this year. We hope that study will be completed by the first quarter of 2022.

Dr. Allen Alper: Well, it sounds like 2021 will be an exciting time for Blue Sky Uranium and your investors, stakeholders, and shareholders.

Nikolaos Cacos: Yes, indeed. There is a lot of potential value-adding activity that is ongoing. I think Blue Sky is at an inflection point, in terms of being able to create additional value for our projects. I think investor sentiment for uranium is beginning to be felt in the market, across the board right now. In that backdrop, I think Blue Sky represents an excellent candidate for investors to consider.

Dr. Allen Alper: That sounds excellent! Could you tell our readers/investors what is happening in the uranium market right now, and what the forecast is?

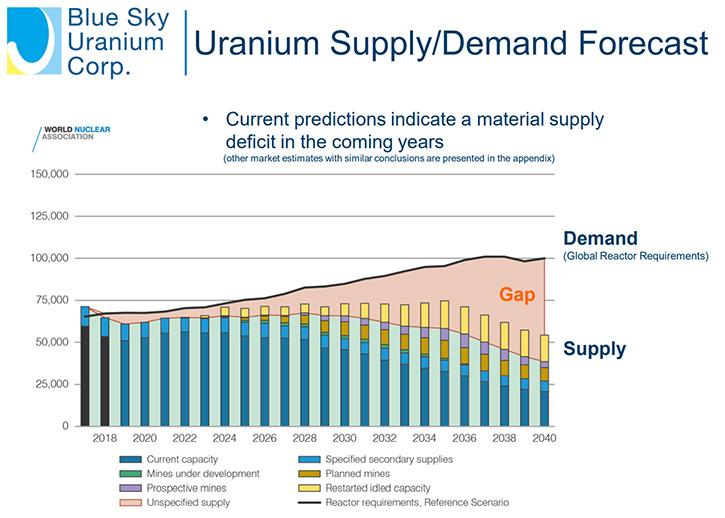

Nikolaos Cacos: Well, the forecast for the uranium market is that the demand for uranium, used as fuel in nuclear reactors, is beginning to outstrip the ability to supply it. We've seen that gap happening, over the last couple of years and that's being exacerbated. Many nuclear reactors or utilities purchase uranium at a premium price. They buy long-term contracts covering five to ten years.

A lot of these contracts have expired or are beginning to expire now. We expect to see a flurry of buying activity that will begin to drive up the price of uranium. Because when you have a multi-billion-dollar nuclear facility, you do not want it to sit idle. Especially not because you have no uranium. So, they are not very responsive to the price of uranium. They just need to have it.

There is an expectation that we are going to see a higher price for uranium because of the utilities. The second thing is, there are a lot more nuclear reactors being built around the world, because of the acceptance of nuclear power as a safe, secure, and reliable source of energy and electricity generation. It is a proven technology. We are seeing a lot of the environmental groups beginning to back it, because of its carbon free footprint. Many things are coming together that make the nuclear and the uranium space an extremely attractive one for investors today.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/and investors what is happening with nuclear reactors in Argentina?

Nikolaos Cacos: Many investors may not be aware that Argentina is indeed a nuclear country. It currently has three nuclear reactors that are in operation right now. And there is a fourth nuclear reactor that is under construction. There are two additional ones in the planning stage, and more being proposed. Argentina is a signatory to the Paris climate accord. It is aiming to reduce its carbon footprint by using nuclear power as a viable component of that energy generation.

But more importantly, Argentina uses nuclear energy, nuclear power for other things. There are atomic centers, they have particle accelerators even in a pilot enrichment plant. All the regulations are in place in Argentina for being active in every aspect of the nuclear life cycle. The only thing Argentina does not have is new production of uranium fuel, and that's where Blue Sky aims to fit in very nicely.

Dr. Allen Alper: Sounds like Blue Sky is in an excellent position! The timing is great! You have a huge operation, with proven results right now, and you are expanding it. Excellent!

Nikolaos Cacos: Operating in Argentina or in any country outside of North America, having the right team and the right people is critical. I am proud to say that our Company is managed by the Grosso Group Management Team, founded and headed by Joe Grosso. The Grosso Group has been awarded as pioneers in Argentina. Joe Grosso has been inducted into Argentina's Mining Hall of Fame. I believe It gives our organization that competitive advantage over other organizations trying to operate in Argentina.

Dr. Allen Alper: That's excellent! I know Joe and have great respect for him. He is a pioneer in Argentina, in the resource sector. He has been there for many, many years and he has been extremely successful, with ground-breaking mineral discovery and development. He is highly respected by everyone!

Nikolaos Cacos: Indeed, very well-respected!

Dr. Allen Alper: Niko, could you tell our readers-investors a little bit more about your background and some of the other members of your Team?

Nikolaos Cacos: I would be happy to. My background; I have nearly 30 years of experience in the mining industry. I have worked alongside Joe Grosso since the inception of the Grosso Group back in 1993. While Joe was in Argentina pioneering the opening of the mining industry there, I was at the head office, running the corporation there. The other Director on our Board is Dr. David Terry. He is a professional geologist. He also has more than 30 years of experience in the mining resource sector. He is absolutely brilliante in terms of giving us advice and helping us steer the Company in the right direction.

Some of our other key players are: our Vice President of Exploration, our key geologist, Guillermo Pensado. He is an Argentinian with an expertise in uranium, who has also worked with chemicals. He was named, Exploration Geologist of the year, just over a year ago. Also, advising us, is Mr. Chuck Edwards, he advises us in metallurgical and process engineering. Chuck was the Chief Metallurgist for chemicals for decades. He is probably one of the world's foremost processing engineers. We are very honored to have Chuck and very honored to have an exemplary team behind Blue Sky, helping us steer in the development of this very exciting project.

Dr. Allen Alper: Well, that sounds like you have an excellent, very strong, diversified team, backed by the Gross approach. So, it sounds like you are very well positioned to move your project forward.

Nikolaos Cacos: Very much so indeed.

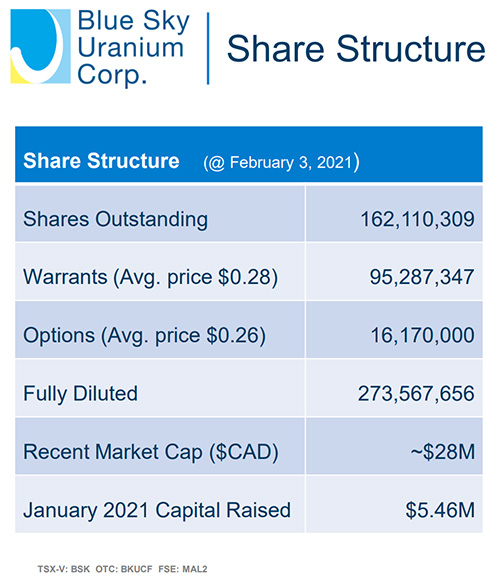

Dr. Allen Alper: Niko, could you tell our readers/investors about your share and capital structure?

Nikolaos Cacos: The Company right now, has just over 160 million shares outstanding. 60% to 65% of these shares are held by Management, insiders, business associates, and our family. It is a very, very tightly held Company. As President of the Company, I have a good position, with the stock that I purchased, so my interests and the Company's interests are very much aligned with our other shareholders. We keep our overhead costs extremely low. Our main focus is to see success in growth or discovery, finding additional discoveries so that we can get higher and higher market capitalizations, recognized by the market.

Dr. Allen Alper: Well, that sounds excellent. It is good to see that Management and the Team have committed to the Company and have skin in the game. Niko, could you tell our readers/investors the primary reasons they should consider investing in Blue Sky Uranium?

Nikolaos Cacos:Blue Sky Uranium represents an exceptional discovery opportunity in uranium. It is not just one deposit; it is an entire district. It is not common to discover entire new districts that have incredible upward potential like Blue Sky has. The timing is key, because we are seeing excitement in the uranium market right now and across the board. All uranium equities from the smallest stuff to the largest, like AMICOR, have had significant depreciation in their market caps and share prices.

Blue Sky has just announced the drilling of the expansion targets that I talked about previously. We are funded, with over five and a half million dollars that we raised last month to carry out our exploration work. With some success in the results that come back, I think our next conversation could be talking about Blue Sky at a very different market cap, and a different corporate complexion.

Dr. Allen Alper: Well, those sound like very compelling reasons for our readers/investors to consider investing at Blue Sky Uranium. Niko, is there anything else you would like to add?

Nikolaos Cacos: No. I just want to thank you for this opportunity to have this discussion. I am going to endeavor to make sure to keep you up to date with our developments. Because I am really excited about this. This is a very exciting time for Blue Sky, and our investors.

Dr. Allen Alper: That sounds great. We will publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.blueskyuranium.com/

Nikolaos Cacos, President, CEO and Director

Tel: 1-604-687-1828

Toll-Free: 1-800-901-0058

Email: info@blueskyuranium.com

|

|