White Rock Minerals Ltd (ASX: WRM, OTCQX: WRMCF): Very Large District Scale, Land Package with High-Grade Silver/Zinc/Gold in Alaska and Gold/Silver Project in Australia; Matt Gill, Managing Director and CEO Interviewed

|

By Allen Alper Jr., President of Metals News

on 5/23/2021

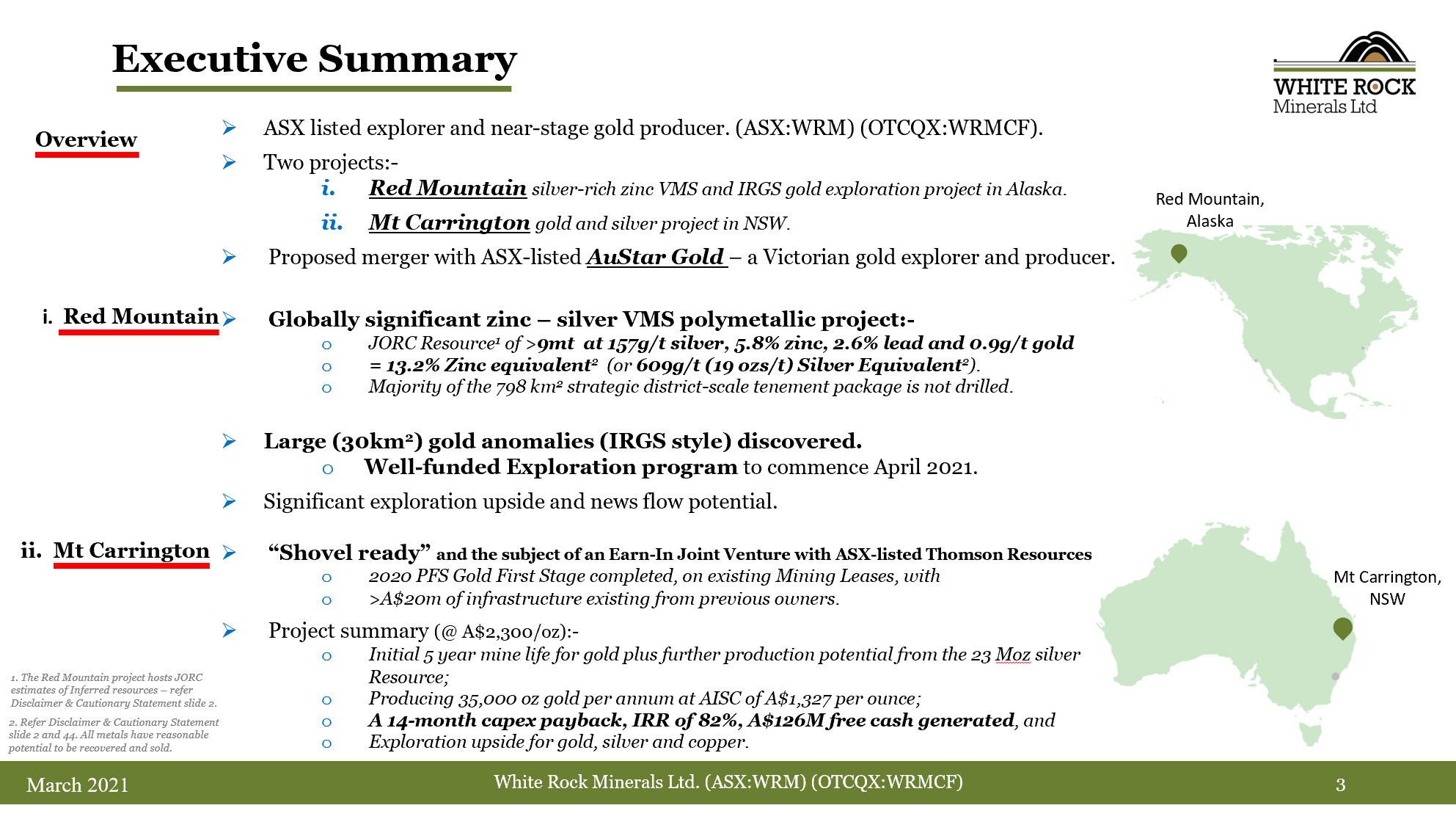

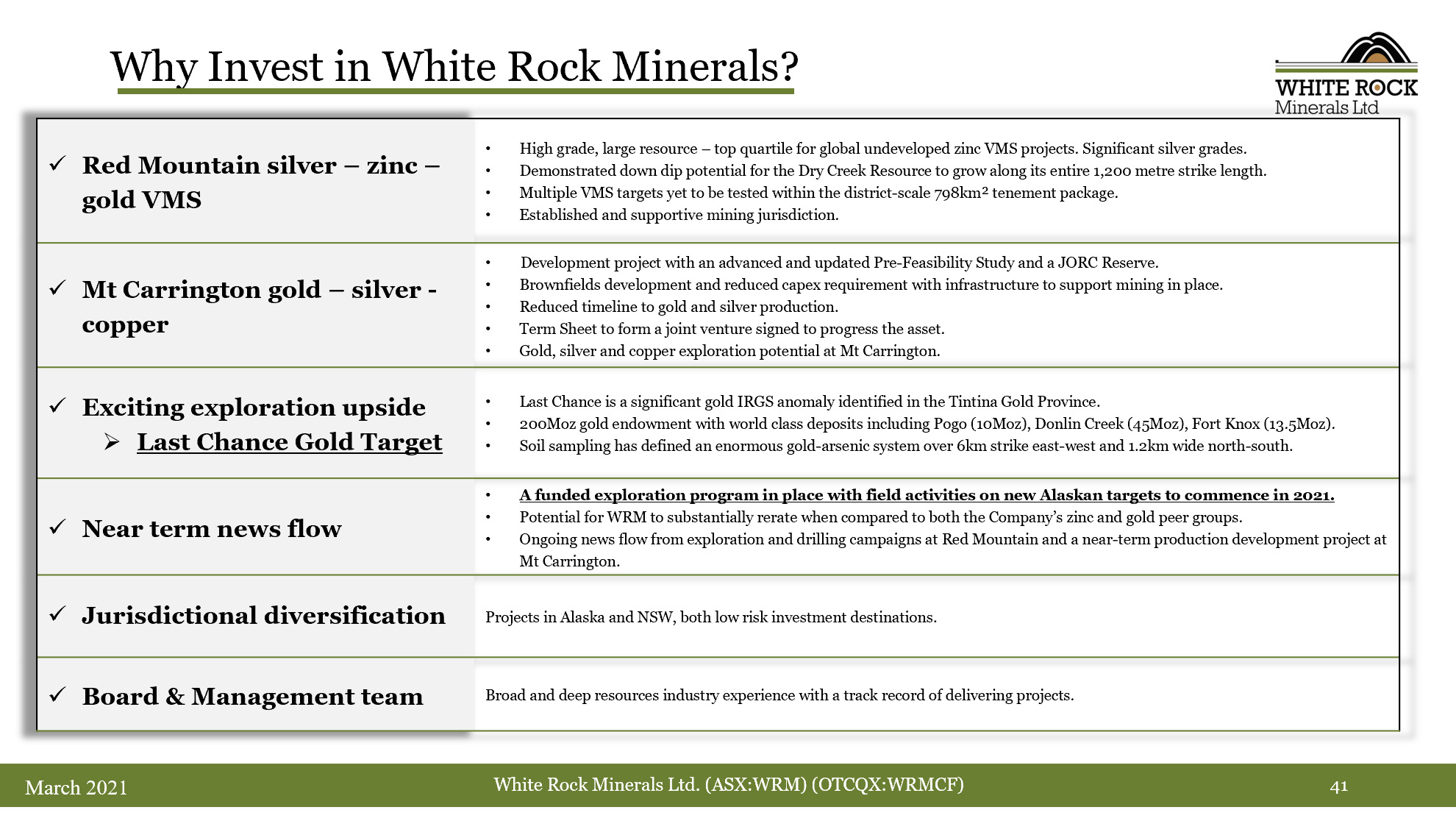

We spoke with Matt Gill, who is the Managing Director and CEO of White Rock Minerals Ltd (ASX: WRM, OTCQX: WRMCF), an Australian minerals exploration and development company, with activities focused on two projects: Red Mountain, located in Alaska, and Mt Carrington, located in northern NSW, Australia. At the 100% owned Red Mountain Project, covering 798km2, White Rock Minerals is blessed with two great geological settings: the high-grade silver, zinc, gold VMS area, and the very large, intrusive gold anomaly called Last Chance, the latter over 15 square kilometers in size. Mt Carrington, a 100% owned, advanced gold-silver epithermal project, with a robust 2020 Pre-Feasibility Study, is currently subject to a 3-stage earn-in agreement, with Thomson Resources, whereby Thomson can earn up to 70% of the project. Plans for this season include a fully funded and very aggressive exploration program at the Last Chance gold target as well as numerous VMS prospects in Alaska.

Al Alper, Jr.:

This is Al Alper, Jr. with Metals News. I'm interviewing Matt Gill, who is the Managing Director and CEO of White Rock Minerals. They are listed as ASX:WRM. They have the Red Mountain high-grade zinc and precious metals project in Alaska and the Mt Carrington gold/silver project in New South Wales. Matt, could you give us an overview of White Rock Minerals and what sets you apart?

Matt Gill:

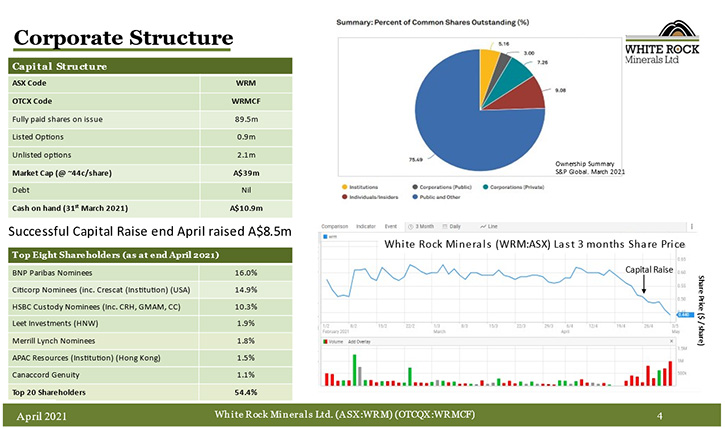

I will just let your readers/investors know that we also have a cross listing on the OTCQX, for our North American and, in particular, our US investors and interested parties. Our ticker is on the OTCQX:WRMCF. We are ASX listed, having listed ten years ago. We're a small junior, we have a market cap, in Australian dollars, of around $40 million. What sets us apart? We have a very large, district scale, land package in central Alaska. Even though we're Australian, that land package is about 800 square kilometers, all state claims, all 100% owned and under management by White Rock.

Within that land package, we're blessed with two great geological settings. We have this high-grade silver, zinc, gold VMS area and in the west we also have this very large, intrusive gold anomaly, called Last Chance, over 15 square kilometers in size. Back here in Australia, we have an advanced gold and silver project at Mt Carrington in northern New South Wales, which has Gold JORC Resources and Silver JORC Resources. It has a feasibility study and the project is on already granted mining lease.

Our two assets – Red Mountain and Mt Carrington - set us apart, the commodity mix – gold, silver and zinc - and jurisdiction diversification – USA and Australia, and thirdly our current cash in bank. We just successfully raised $8 million AUD. We now have something like $18 million AUD in the bank and are fully funded for our exploration season in Alaska this year.

Al Alper, Jr.:

Tell me a little bit more about Red Mountain and what you plan to do for exploration this season?

Matt Gill:

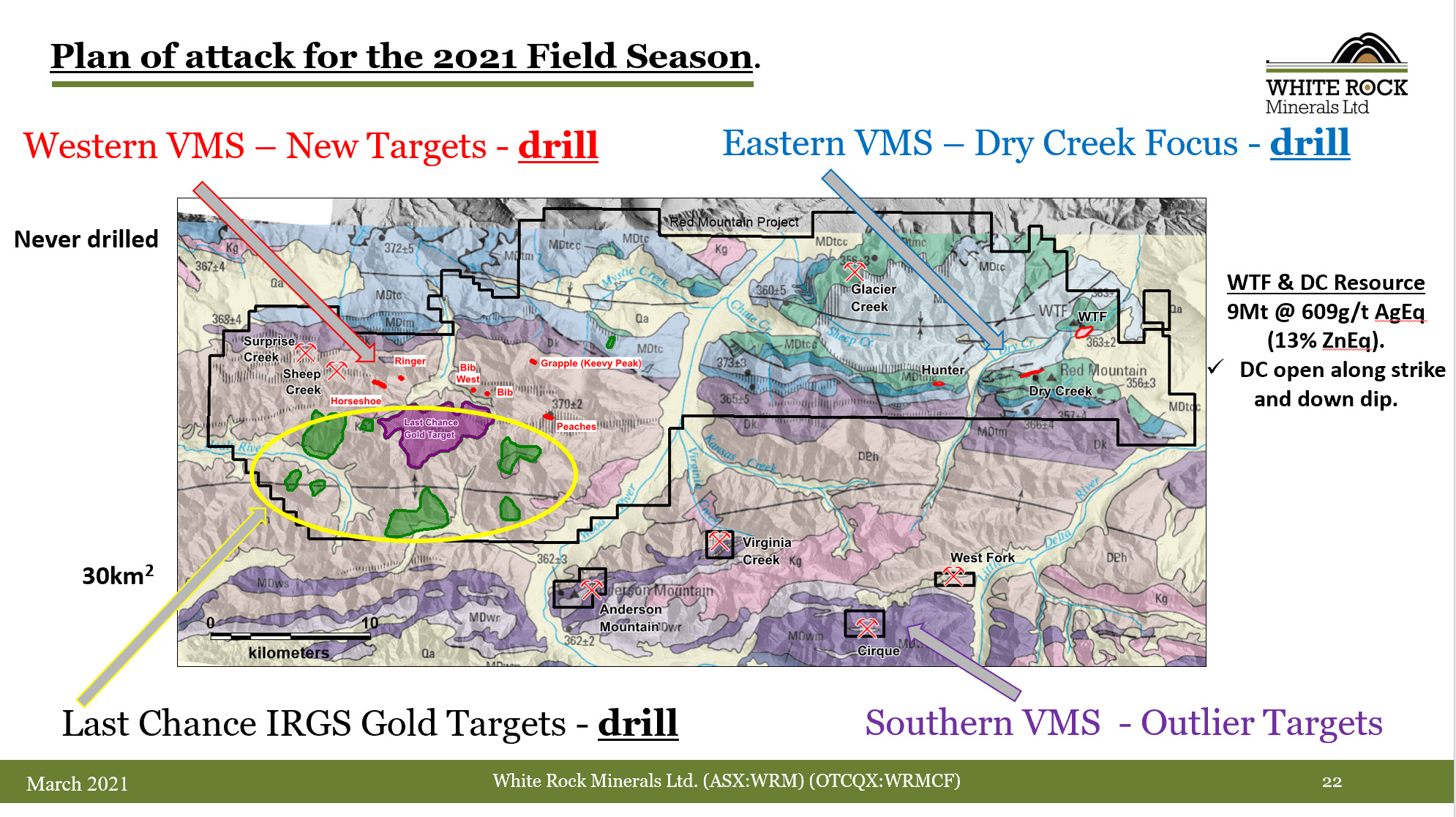

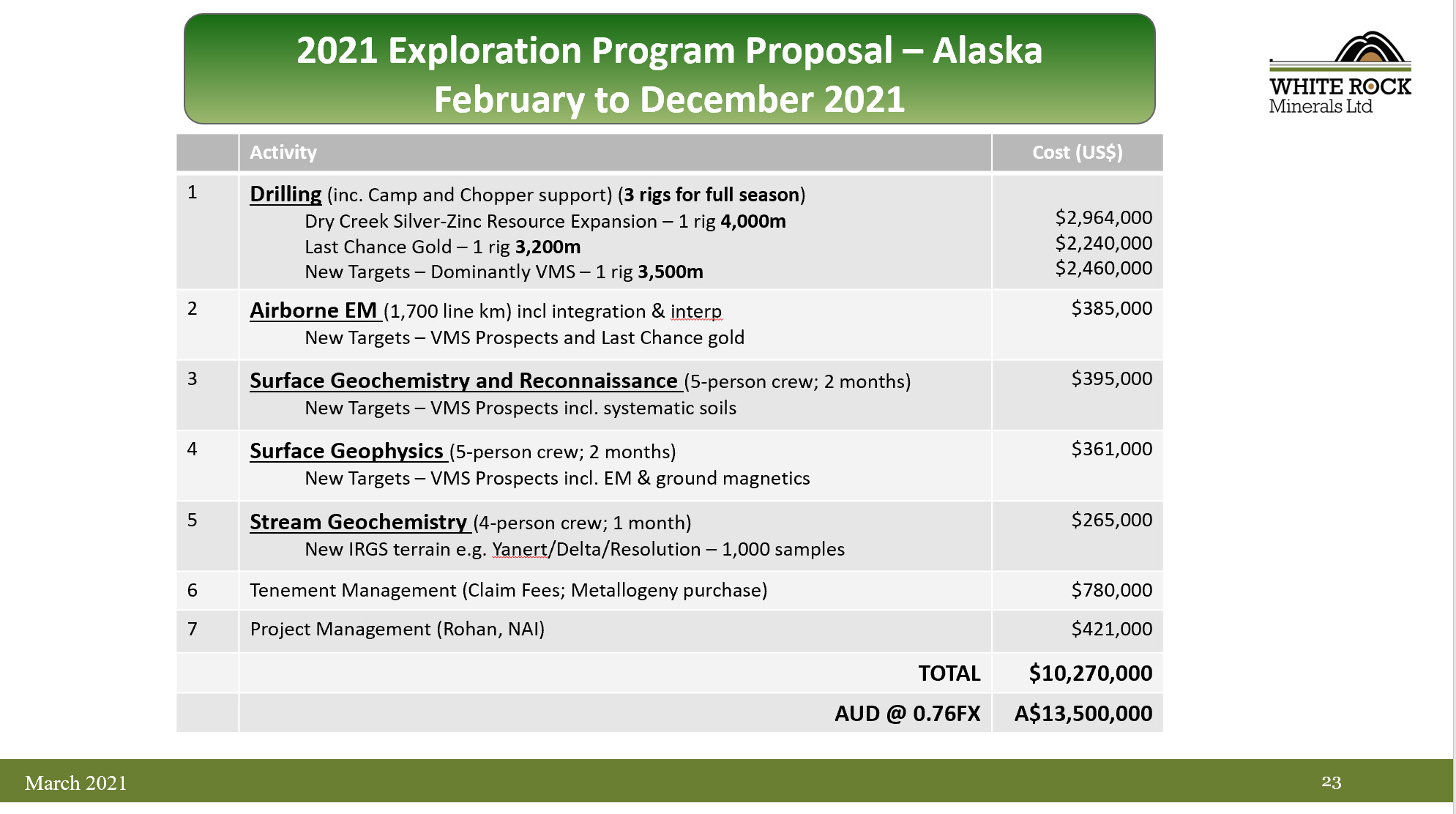

This week is the first step in a quite aggressive exploration program. We are flying airborne geophysics, as we speak, over our Western tenement package that includes the Last Chance Gold Target. It also includes a newly identified outcropping zone of zinc, silver, gold, copper VMSs just to the north of Last Chance. That's a very exciting first step in our program. We already had a 20-man camp, and we have also secured a 30-man camp.

We already had one drill on site, we've secured another two diamond drills, and we have secured two helicopters. We built a great Team in-country; this will be our fourth season in Alaska. We are all systems go. We will be mobilizing the drills during May. Our plan is to have the first drill bit turning by the end of May and all three drills turning by mid-June.

Al Alper, Jr.:

That's very exciting. What are your plans for this exploration?

Matt Gill:

The three drills are on three distinct exploration opportunities, which I think offers great diversity and a good chance for exploration success. One drill will be focusing on our high-grade silver zinc VMS deposit, called Dry Creek, which is in the eastern part of our extensive tenement package. There's already a JORC resource there, grading over 600 grams per tonne silver equivalent. We're going to be drilling 200 meters deeper than the previous drilling and along it’s one kilometer strike length, so that's our first drill target and program.

Our second drill will be drilling deeper holes at our Last Chance Gold anomaly. We only discovered that in January last year. We did a lot of work on ground; we got some holes into it last year. With Last Chance, we actually went from discovery to drilling in seven months, despite COVID and despite four months of winter in Alaska, which I think is a testament to our great team in-country, but also the Alaskan approvals system, working very favorably. That's the second drill target and program.

The third drill will be drilling these outcropping VMS targets, these targets were only announced in January this year. They've never before been drilled.

So, we have a three-pronged approach, with our drilling. I think that offers a lot of news flow and it's really exciting. The biggest disappointment, with COVID, is unfortunately, from Australia, we can't get to go and look. But fortunately, there's Zoom and drones, and we will be making sure that our readers/investors can see what is happening over the course of the next few months.

Al Alper, Jr.:

Excellent, excellent! Tell us a little bit about Mt. Carrington?

Matt Gill:White Rock listed with Mt. Carrington and has had this asset for 10 years. It's very advanced. It's had past mining, you walk onto exposed gold ore, there already exists a tailings dam there, over 100,000 meters of drilling has been done, there are four JORC resources for gold, and four JORC resources for silver. Two of those resources for gold are in JORC Reserve and that's generated an initial five-year mine life, before we add anymore gold or anymore silver. The project generates great financial metrics. Once in production, it generates $30 million Aussie, free cash flow, per year, with a quick capital payback in just 14 months.

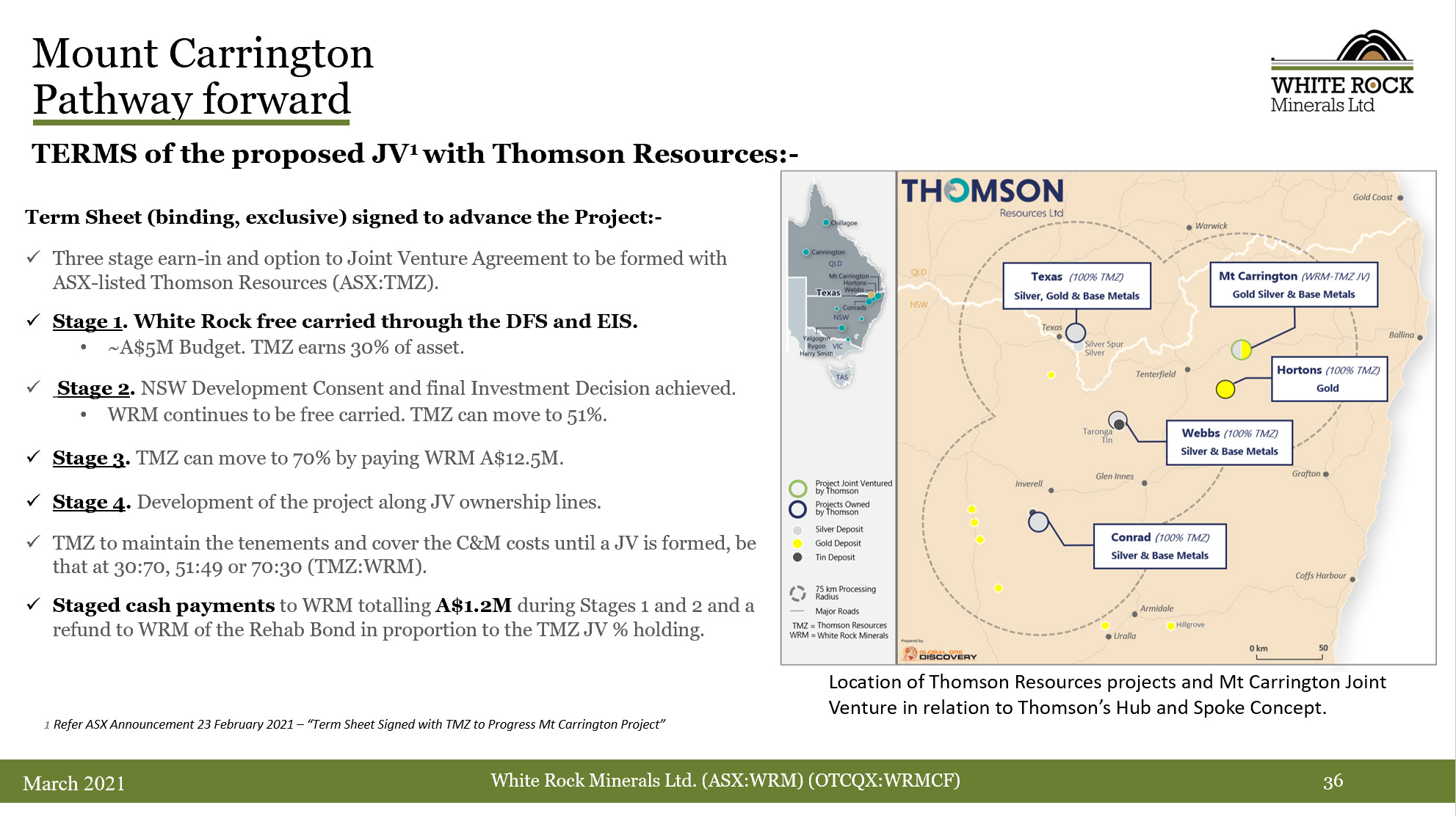

The project’s next step is the Mining Approvals, which is about an 18-month step. It's been a bit of a challenge for White Rock to raise the money for that step. Certainly, given the opportunity in Alaska, Alaska was probably always going to get any available funding. But we've been able to partner up, with another ASX listed company, called Thomson Resources, together we've just signed a joint venture agreement, whereby they will take over the management of the Mt. Carrington assets and take it through the Approvals.

White Rock will be free-carried through that period. Thomson Resources will also take on the care and maintenance costs and obligations, and they will also take the pre-feasibility study through to definitive feasibility study. White Rock will continue to have upside exposure to that asset, with Thomson Resources earning between 30 and 51% and 70% of that asset, depending on where they wish to stop. White Rock is free carried, so the great thing for White Rock and its shareholders is that it allows us to focus on Alaska, but it moves the Mount Carrington Project forward, and the White Rock shareholders still remain with exposure to Mount Carrington, whilst Thomson is earning in and advancing it on both parties' behalf.

Al Alper, Jr.:

Tell our readers/investors a little bit more about yourself and your Management Team.

Matt Gill:

I just need to point out that White Rock is acquiring a third asset, through a merger. We announced earlier this year a merger, by a scheme of arrangement, with ASX listed AuStar Gold. AuStar Gold is a Victorian gold explorer and producer. It has 670 square kilometers of great exploration ground, and it has a small but high-grade producing, underground gold mine and gold processing plant. What is important about this, is that Victoria is going through a second gold renaissance, thanks to the success of the Fosterville Gold Mine owned by TSX-V listed Kirkland Lake. AuStar's land package is southeast of Fosterville, so the geology is great, the opportunity is great. The mine that comes with the AuStar Package has historically produced over 800,000 ounces at 26 grams a tonne and is currently producing small amounts of gold as we speak.

For White Rock, this is a great opportunity to get an asset closer to home here in Victoria as well. With great exploration opportunity, AuStar provides countercyclical news flow to our Alaskan assets and I think that's important for an investor.

In answer to a question about myself, I'm a mining engineer, with over 35 years’ experience, everything from an underground miner all the way through to being a department head, and managing mines. I've been a CEO. I've been a Managing Director. This is my third Managing Director role. I've worked all around the world - Australia, India, Bolivia, Ghana, Papua New Guinea, so broad experiences as a mining engineer.

Two other members on our Board; Peter Lester is my Chairman, he's also a Mining Engineer. A lot of experience more in that M&A and business development space, and Jeremy Gray, with more finance and business analysis, based in London. We're ably supported by Rohan Worland, our Exploration Manager, also based here, with me, in Ballarat. He has previously worked for Normandy and Newmont, both overseas and here in Australia. We have a great CFO, Company Secretary, Shane Turner, also based here in Ballarat.

We have a Technical Adviser, formally appointed, and that's Dr. Quinton Hennigh. Many of your readers may have heard of Quinton. He's a busy man. He's on a few Boards. He advises many companies, and he advises us and gives us his views and his wisdom, on our program in Alaska. Quinton opened up the North American market for White Rock, such that our largest shareholder is, in fact, Denver based Crescat Capital. We also have many other North American investors because of that story, predominantly Alaska, but also our exposure here to gold and silver in Australia.

Al Alper, Jr.:

Could you tell me more about your capital structure and primary investors?

Matt Gill:

We are quite North America looking, we have a cross listing on the OTCQX:WRMCF, as well as being primary listed here in Australia. Our shares on issue are about 89. Unlike many Aussies that have billions of bits of paper, we just have 89 million shares on issue. Our share price is currently around 44 cents AUD, so that gives us the market cap of approximately A$40 million. Major shareholders include Crescat Capital out of Denver. Then we have a collection of funds, one out of Hong Kong, two out of Europe, and several out of Australia here. We have several high-net-worths - one in Sydney and one in Singapore. We also have a billion-dollar private equity group out of New York in our top 20. We have quite a broad register, a good mix of institutional and retail for a small junior.

Al Alper, Jr.:

How about Management? Do you have some insider investment in the Company?

Matt Gill:

Yes, two of the three of us on the Board have shares and options in the Company. Unlike North American companies, I don't have as much as I'd like, but obviously I do have some.

Al Alper, Jr.:

Could you tell our readers/investors the primary reasons they should invest in White Rock.

Matt Gill:

I think that White Rock's opportunity right now is our exciting three-pronged drilling program in Alaska, searching for more gold, silver and zinc. We are fully funded with $18 million AUD in our bank. We will have three drills turning by mid-June, on three distinct and promising targets in Alaska and I think that offers a great opportunity, no guarantee, for exploration success. We are asset backed; it's not just drilling in Alaska.

We have an advanced gold and silver project, here in Australia, on mining lease, with a feasibility study done JORC resources and reserves, being progressed under a joint venture and with White Rock shareholders being free carried, and that has a value.

And thirdly, merging with Victorian gold explorer and producer AuStar Gold offers the investor a third asset leg to the White Rock story. Many of your readers/investors may be aware of the great interest in Victorian gold. There are quite a few TSX-V companies now here in Victoria, so White Rock is staking its claim in that space as well.

With that merger, because it's not yet consummated, we would hope that all things being equal and progressing, we'd get the keys to the AuStar asset, and its Victorian exploration potential, by the end of July.

So there are good reasons for an investor to be excited about White Rock; we will be drilling shortly and the great news flow we hope that that will deliver.

Al Alper, Jr.:

That sounds really exciting! You have a lot of upside potential. You have an experienced Team and great locations in mining-friendly areas. Is there anything else you'd like to add?

Matt Gill:

You touched on jurisdiction and I absolutely endorse that. We are into silver, gold and zinc, so commodities are important for the investor to consider. We are in two safe jurisdictions that the investor should also consider and certainly, sovereign risk. Alaska is in the top five of the Fraser Institute, and like Australia, both jurisdictions speak English, and follow the rule of law. I think that's important. There are quite a few places where sovereign risk is a big issue. I'm more than happy that we de-risk that part of the business as much as we can. Australia and Alaska are two great places for White Rock to do business.

Al Alper, Jr.:

Thank you very much for a very interesting, informative interview.

I’m very impressed!

https://www.whiterockminerals.com.au/

Matt Gill

MD&CEO

White Rock Minerals Ltd

mgill@whiterockminerals.com.au

|

|