Adventus Mining Corporation (TSX-V: ADZN; OTCQX: ADVZF): Building a Copper-Gold Business in Ecuador; Kargl-Simard, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/28/2020

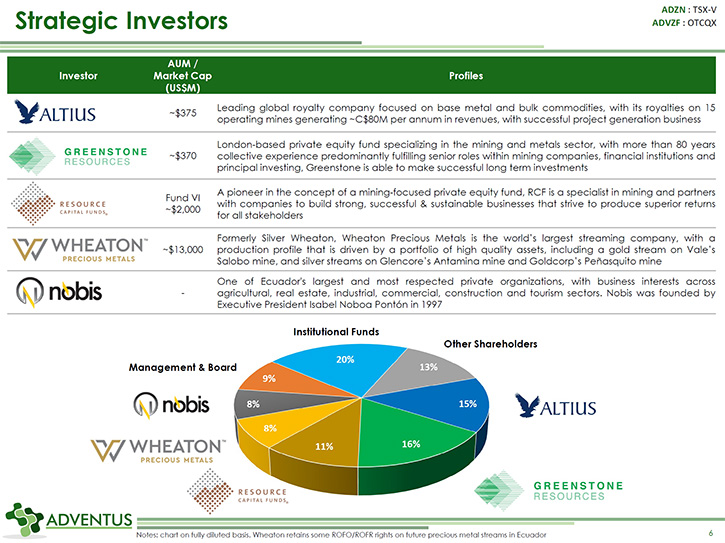

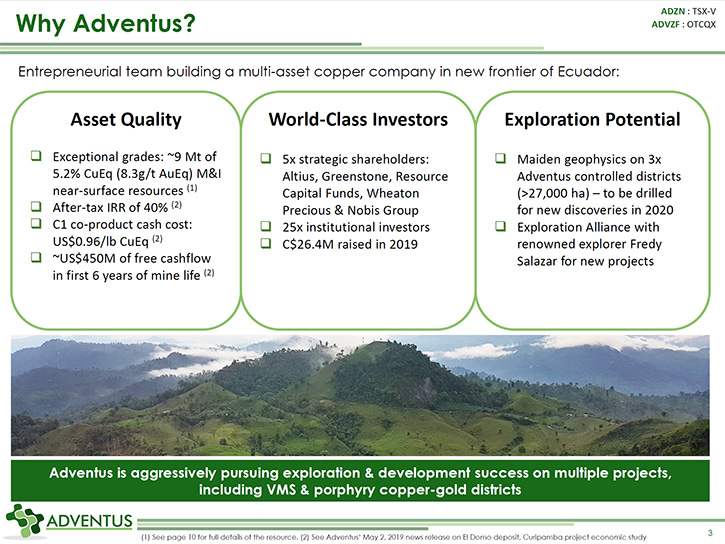

We learned from Interview with Kargl-Simard, President, CEO and Director of Adventus Mining Corporation (TSX-V: ADZN; OTCQX: ADVZF), that they are an exploration and development company, focused on building a copper-gold business in Ecuador. Adventus Mining is run by an all-Ecuadorian team, has one of Ecuador's largest and most respected private organizations - Nobis Group of Ecuador - as one of its strategic shareholders, and has partnered with Salazar Resources, which is the most successful explorer in Ecuador's history. Adventus is leading the exploration and engineering advancement of the Curipamba copper-gold project, in Ecuador, as part of an earn-in agreement to obtain a 75% ownership interest. Near-term plans include finishing the feasibility study on the high-grade El Domo deposit, located on the project, then getting ready to submit a draft of an environmental assessment, to the government, by next year, and ultimately, making a construction decision by early 2022. In addition, two new copper-gold porphyry districts, Pijili and Santiago, are being prepared for drilling in Q3-2020. Adventus Mining is well-financed, and its financially driven strategic investors include Altius Minerals Corporation, Greenstone Resources LP, Resource Capital Funds, and Wheaton Precious Metals Corp.

Adventus Mining Corporation

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Christian Kargl-Simard, who is President and CEO of Adventus. Christian, could you give our readers/investors an overview of your Company, and also what differentiates it from others?

Christian Kargl-Simard: Two years ago we entered Ecuador to build a copper-gold business. We've created a platform that I think separates us from our peers. Number one is we want Ecuadorians working for Ecuadorians, so our business in Ecuador is run by 100% Ecuadorians. On our shareholder register, we have the Nobis Group, which is Ecuador's largest industrial conglomerate. It's the first time major Ecuadorian money has invested in the Ecuadorian mining sector. So they're a major investor, and an ongoing investor, providing support from a connections point of view. Their foundation helps from a social perspective. They're just a good advisor.

Our partner, on our three projects, is Salazar Resources, which is the most successful explorer in Ecuador's history. So I think we have all the boxes checked in terms of strong influence, strong local teams, knowledge of the Country, an all-Ecuadorian team, and connections with anybody we need to talk to in Ecuador. We've built our shareholder register with all financially-driven investors. With all of that put together, it makes quite a compelling platform for Ecuador and exploration development, reducing risk, hedging our bets. So all of that, put together, is the reason we were able to raise $60 million, over the last three years, for exploration development in Ecuador.

Dr. Allen Alper: Wow, that sounds excellent. Could you tell our readers/investors a little bit more about your copper-gold property, and why it's so significant?

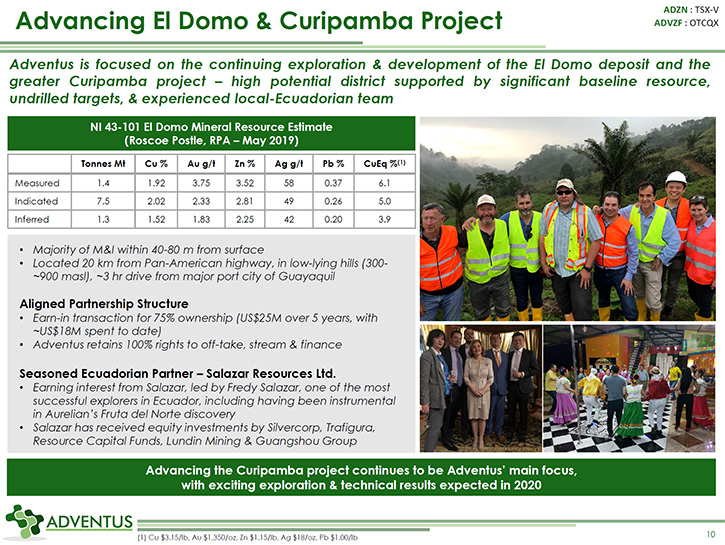

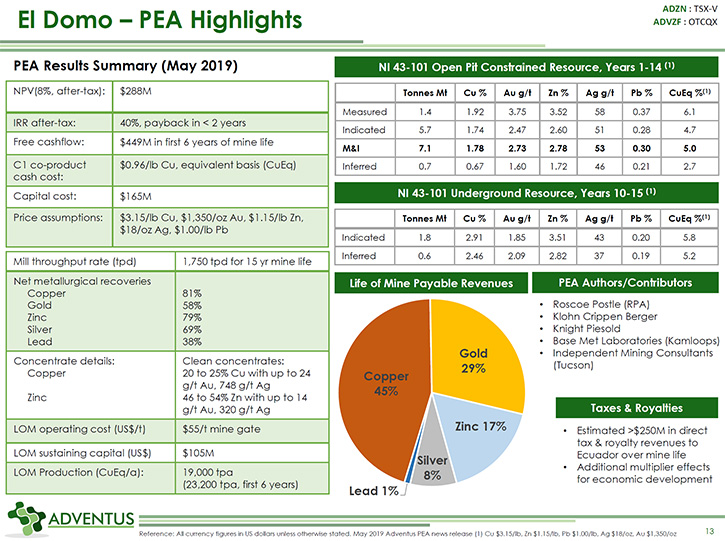

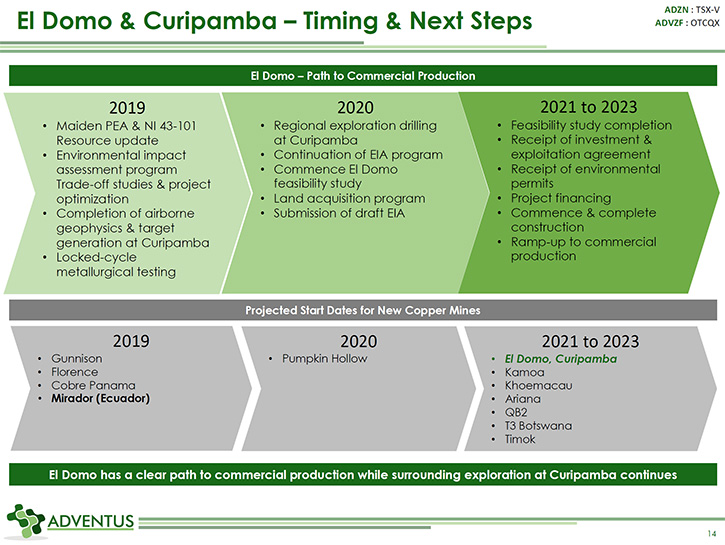

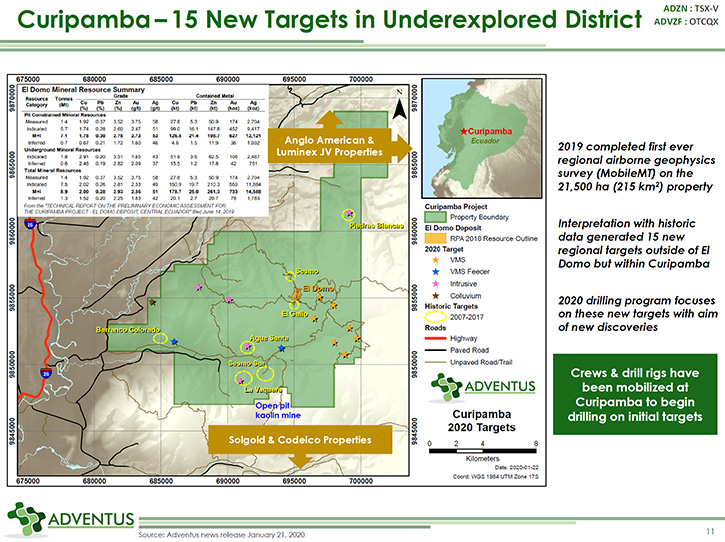

Christian Kargl-Simard: Curipamba is the name of the district where our main project is located. It's 220 square kilometers. But within Curipamba is the El Domo deposit. So this is an advanced-stage development project. We're ramping up our feasibility study throughout the year, and we're hoping to submit our draft environmental assessment to the government over the next year. All of that could lead to a construction decision, likely in the first half of 2022, if all goes well. Because it's 5.2% copper equivalent (or 8.3 g/t gold equivalent) and open-pittable, it's a very high-grade project, very strong economics at any reasonable commodity price deck.

It's about 50% base metals revenue, 50% precious metals. Of course, gold prices and silver prices actually make the project more robust, because it's potentially easier to finance on a gold stream where you have to sell fewer gold ounces to get the same amount of money. Because of the high-grade and its current stage, it's one of the few new copper projects that could be in production by 2023. It is pretty insensitive to commodity price movements because of the equal precious metals and base metals component.

Dr. Allen Alper: Wow that sounds excellent! Could you tell our readers/investors your primary goals for this year?

Christian Kargl-Simard: Yeah, the next 12-18 months will be the most important timeframe in the Company’s history. We have north of a Canadian $20 million budget on our three projects. Starting at Curipamba, the majority of our budget, half will be spent on drilling. We announced in January, we wanted to drill north of 10,000 meters on regional exploration, drilling, testing new targets that have never been tested before, to try to find some regional deposits that could fit into a central milling facility, or maybe the largest deposit found in the project to date. And we also announced a minimum of 3,000 meters of engineering-related drilling, which is required for completion of the feasibility study.

The other half of the spending at Curipamba is for the feasibility study and all the projects related to that, as well as the environmental assessment. $4-$5 million Canadian is for drilling our two copper porphyry districts, Pijili and Santiago. We announced in January, we'll be drilling 5,000-10,000 meters, in exploration programs combined, on both projects. We are targeting very large potential porphyry targets, in excess of one billion tonnes each.

Dr. Allen Alper: Sounds like 2020 will be a very exciting time, an important time for Adventus. So that'll be great! When will news releases be coming out about your drilling results as the year goes on?

Christian Kargl-Simard: We are planning to have a very busy news release program, especially when we're drilling two, perhaps three, but likely two of the projects at the same time. With COVID, the timeframe for drilling has become uncertain. We expect drilling to restart in Q3-2020 at Curipamba on the 13,000-meter minimum program that I just outlined. And at Pijili, we hope to have one drill returning there by the end of June, followed by Santiago in Q3-2020

From 3Q-2020 onwards, throughout the entire year and into next year, we should have releases every three to four weeks on drilling results, on exploration results, such as trenching and rock chip sampling, plus development updates, such as results of tradeoff studies, the hiring of an EPC contractor, etc., on the El Domo feasibility study.

Dr. Allen Alper: Wow, that's great! It's going to be an exciting time for you and your investors and stakeholders. Could you tell our readers/investors a little bit about your background, your Team, and your Board?

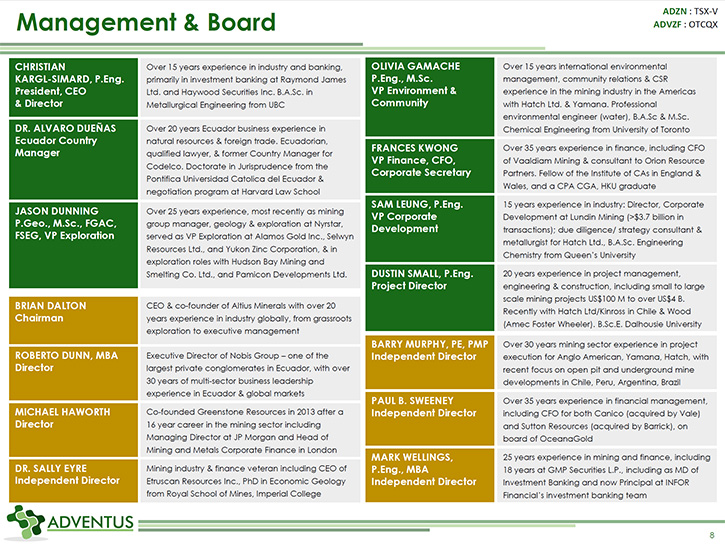

Christian Kargl-Simard: I have a Metallurgical Engineering degree, with a specialty in hydrometallurgy and worked for four years in that sector, primarily for a company called Dynatec Corporation which was sold to Sherritt in 2007. Then I was an investment banker, in the mining sector, here in Toronto, for 10 years at Haywood Securities and Raymond James. I left Raymond James in December of 2016 to start Adventus. The initial investor in Adventus was one of my old clients, Altius Minerals Corporation. Through Altius and my connections, we brought on our initial shareholder base, which included Greenstone Resources and Resource Capital Funds, two of the world's premier private equity groups for mining.

The team has been built throughout the three years, as the Company and the responsibilities have grown. All of our officers are professionals, who have come from major organizations. Our key officers come out of Nyrstar, Lundin Mining, Yamana Gold, Kinross Gold, and Orion Mine Finance. Our Country Manager is a Harvard law degree Ecuadorian, who built Codelco's copper business from zero to ten projects in Ecuador, over the last 10 years. Our Board has eight individuals, four independent, four non-independent, quite well-known in the mining space. And we have representation from Greenstone, Nobis, and our Chairman is the founder and CEO of Altius.

Dr. Allen Alper: Wow, you have a very strong Team and Board, very experienced, very accomplished. That's excellent! That's probably one of the reasons for the strong backing you're getting from investors. That's great! Could you tell us a little bit about your capital structure?

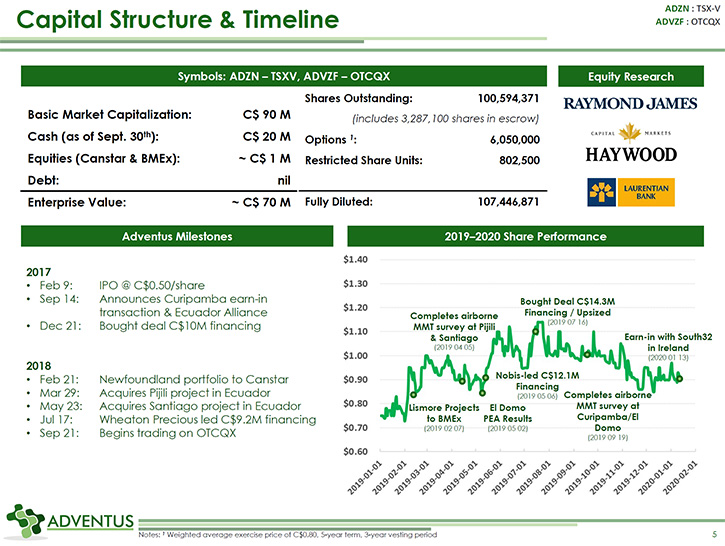

Christian Kargl-Simard: Yes. We have 100 million shares outstanding. We've raised 60 million Canadian, over the last three years. $49 million of that equity has been raised between 88 cents and a dollar, we've never done unit financing, so all of our financings have been in common shares. So it's a very clean capital structure. We entered into 2020 with about $13 million in the bank, which should carry us into the fourth quarter of this year, which gives us multiple opportunities to make new discoveries on the brand new targets that we'll be drilling. The expectation is that, through discovery, we'll be raising capital much higher-priced than last time, which was a dollar a share.

Dr. Allen Alper: Wow, that sounds excellent! Could you tell our readers/investors the primary reasons they should consider investing in Adventus?

Christian Kargl-Simard: Well, number one is Ecuador. Ecuador is an underexplored country. It's one of the last frontiers for copper exploration. It's why it's attracting such significant investment, from all over the world and we're a major player. We think we have first-mover advantage there. We'll be drilling our three projects for new discoveries this year. So I think we have well above average opportunities and a chance to make significant discoveries this year. When I say significant, Ecuador has the potential for billion-tonne discoveries at above average grades, compared to elsewhere.

Secondly, we have a very supportive long term shareholder base that is betting on us over a two to five year period. So investors do not need to be worried about how we continue to finance our activities. Thirdly, if the exploration angle is a dud, or not as exciting as people expected, we still have a copper mining project that should be built within the next three years, which backstops our value. On that basis we're trading around 0.3 times our net asset value.

Dr. Allen Alper: Well, those sound like very strong reasons for readers/investors to consider investing in Adventus Mining Corp. Is there anything else you'd like to add, Christian?

Christian Kargl-Simard: Just to thank you for interviewing Adventus Mining for Metals News.

Dr. Allen Alper: You are very welcome. It’s all very exciting. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

http://adventusmining.com/

Christian Kargl-Simard, P.Eng.

President, CEO & Director

christian@adventusmining.com

|

|