Osino Resources Corp (TSXV: OSI): New Discovery Very Large Gold System Next to Established Producing Gold Mine in Namibia; Interview with Heye Daun, President and CEO

|

By Allen Alper Jr., President, Metals News Inc.

on 3/29/2019

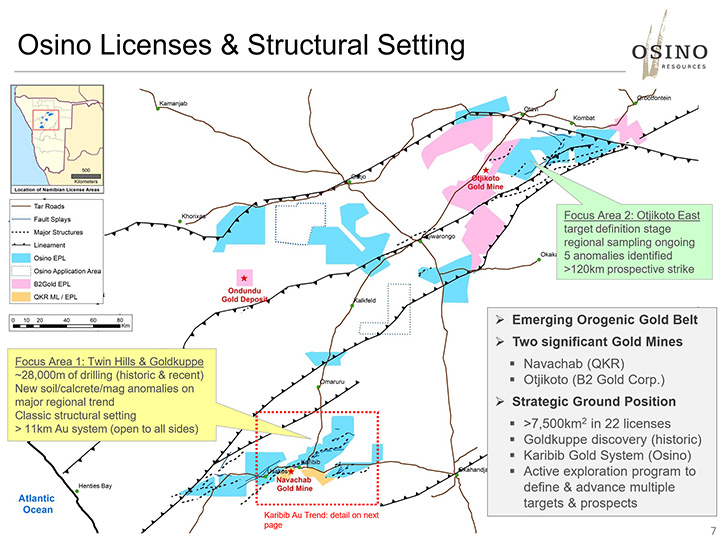

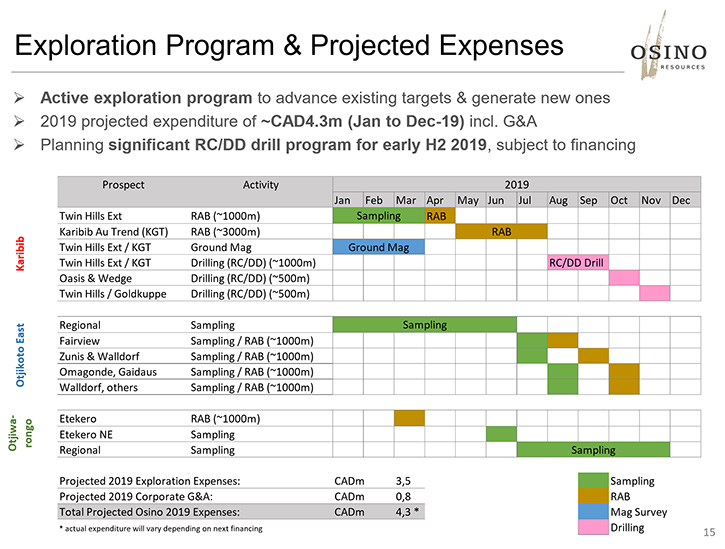

At the PDAC2019, we learned from Heye Daun, President and CEO of Osino Resources Corp. (TSXV: OSI), a gold exploration company, active in Namibia, that they are currently focused on their drill-ready Twin Hills project, which is a new discovery of a very large gold system right next to an established producing gold mine. Plans for 2019 include financing and exploration drilling at Twin Hills, with the goal of turning the discovery of a big gold system into a real economic discovery. Osino's secondary project is an advanced stage Goldkuppe exploration project and a group of target generation stage licenses that are contiguous to B2Gold's Otjikoto Gold Mine. According to Mr. Daun, Osino is in discussions with possible JV partners to develop its non-core projects.

Heye Daun, President and CEO Osino at PDAC 2019

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Heye Daun, who is the President and CEO of Osino Resources, Corp. Could you tell us at Metals News and our readers/investors about your background?

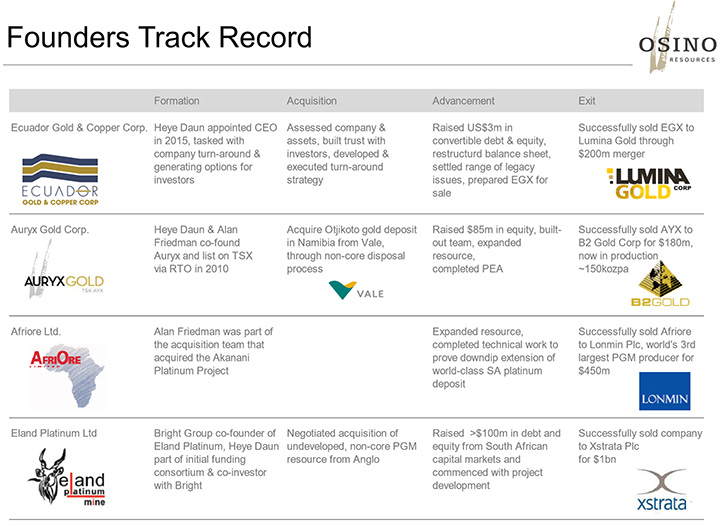

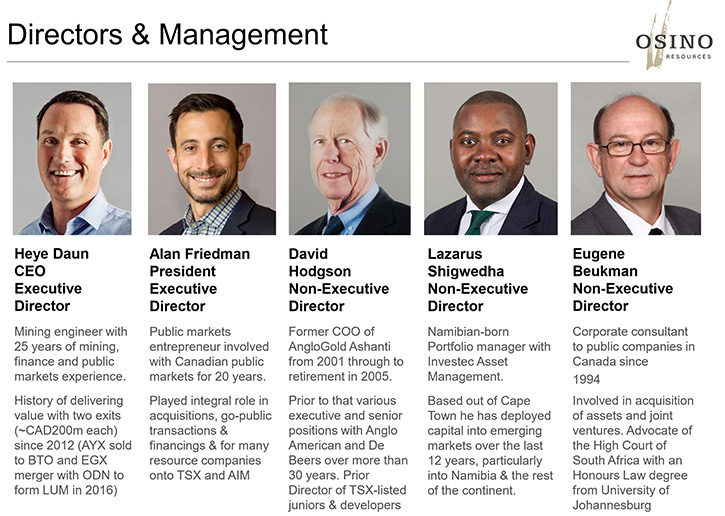

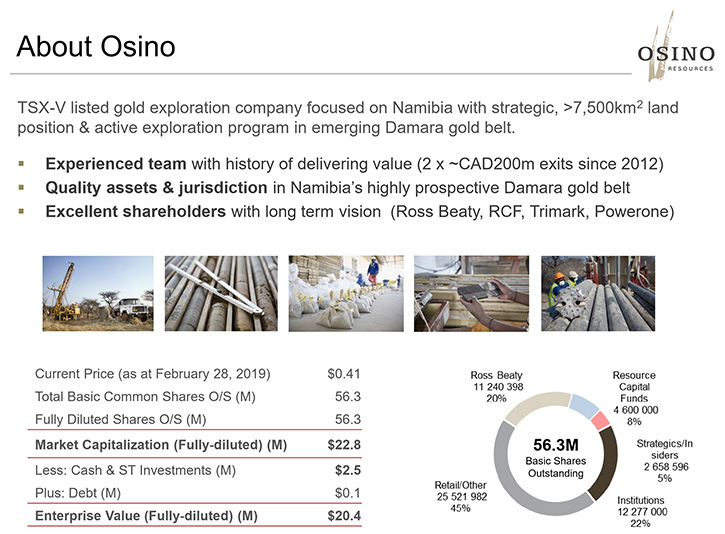

Heye Daun: Thanks, Allen, I appreciate the opportunity. I'm a mining engineer. I’ve been in the industry for about 25 years. Initially, I was building and operating gold mines for Anglo Gold in West Africa and then I spent some time in finance. For the last few years I've been an entrepreneur looking for African assets and marrying them with Canadian capital to create value. That's what we're doing with Osino again. As a born and bred Namibian, it makes sense for me to operating here. We’ve had some good success in the past. We built a company called Auryx Gold Corp., which previously owned the Otjikoto gold project in Namibia.

We ended up selling the project to B2Gold in 2012 for about 200 million dollars. I did another deal a few years later in Ecuador, where we had a similar turn-around and ended up merging with Odin Company. That was very relevant because I got to know Ross Beaty in the process. Ross became the largest investor in Osino and my current deal. He's a big supporter. With Ross, came a lot of the people that follow him. And so Osino is now a gold exploration company, active in Namibia, looking to make another discovery.

Allen Alper Jr: Excellent! What do you find the most interesting? Do you have any projects and, or properties that are your favorites?

Heye Daun: We started off being very much a consolidation play, because we realized that in order to create value, you need scale. We spent the first year or two putting a large package together. You need to turn the ground over and you need to show that you have advanced projects. Within the ground that we hold, our key flagship asset is the Twin Hills Project. Twin Hills is a new discovery of a very large gold system, right next to an established producing gold mine. It's on a big regional trend that we've identified. It's an orogenic exploration model and Twin Hills is basically at the drill ready stage. 2019 will be the year of actually drilling it and hopefully making an economic discovery. Turning the discovery of a big gold system into a real economic discovery. That's the plan.

So that's Twin Hills. That's our core project. Our second project is called Goldkuppe. It's an historical discovery that we inherited from some licenses that we acquired. It's more advanced in terms of drilling and technical work that's taken place on it. But it appears as if it has less scale potential than Twin Hills and that's why it's secondary to us.

And then thirdly, we have a bunch of licenses that are contiguous to B2Gold's Otjikoto project in Namibia. These licenses are at the target generation stage. So we're doing very good, solid grassroots exploration over here. We've identified about five interesting gold anomalies so far. In 2019, we'll be testing those anomalies. So that's our third project. We have a very large and prospective package for a small junior, which is exciting, because it give us multiple kicks at the can, so to speak.

Allen Alper Jr: That sounds exciting. What are your next steps?

Heye Daun: Right now, we are waiting for results, interpreting results, in a holding mode. As you know, exploration is an iterative game. You gather data, analyze the data, interpret the data, and then you go back and do more work. In order to continue at the same or higher level of activity from 2018, we will need to raise some money at some stage. We have about three million dollars in the bank so it's not like we're desperate. But, as I said earlier, the Twin Hills project is at the stage, where a very significant drill program should be done on it. In order to do that, and not end up being naked, financially-speaking, we need to raise some money later in 2019. That's why we're talking to existing and potentially new shareholders, with a view of doing that. Once we've completed such a financing, which should happen in the next two or three months, we plan to execute a very significant drill program on Twin Hills, in order to make the discovery that I was talking about. I would say the key milestones for us are; firstly conclude the financing. Secondly, execute a very significant drill program, and thirdly continue with ongoing target generation and target advancement of our other projects.

Allen Alper Jr: How are you financing and still minimizing dilution?

Heye Daun: Well, so far, we went public in June last year. The idea of going public was that after having raised just under 10 million dollars in a private company, we realized that we were getting to the end of raising money in a private company. So we went public in order to elevate our corporate profile and to access new investors. The RTO took place in a not very receptive market during the middle of last year, as you know, 2018 wasn't that great. So to answer your question, "How do we raise money?" Well, typically, if we can in the markets, public equity. We have a great bunch of shareholders, who support us. This includes Ross Beaty, of course, then there're Resource Capital Funds and Power One, out of Toronto. We also have Trimark as shareholders, a powerful group out of Dubai, which is associated with Ross Beaty.

About 50% of the Company is held tightly by these groups and they will follow any financing that we do. But we would like to attract some new investors and possibly a strategic technical group. For that purpose, we are currently talking to some of the mid-tier producer type groups. Another option, we are considering, is to JV some of our project because, for a junior, we have a lot on our plate and once the projects are sufficiently advanced we may be able to attract JV partners to lay off some of the exploration risk and expenditure. So we will definitely consider JVs. We've been approached by a number of entities, with whom we're in discussions right now.

Allen Alper Jr: So you're currently looking for some JVs who might help you by putting some money into the ground and meeting your drill targets. Is that what you're talking about?

Heye Daun: Yes. I think we would consider JVs on our non-core projects. Because we have seven and a half thousand square kilometers of prospective ground. We have been exploring all of that acreage ourselves so far. So if we get ongoing interest to JV some of those, we will do that. But our first choice will be to do the exploration ourselves by raising equity and then executing the technical programs ourselves. We've shown so far we're very nimble, very efficient with low overheads and technically competent. I therefore think that we are perfectly positioned to execute these exploration activities ourselves, with the support of our strong shareholders.

Allen Alper Jr: Tell us a little bit more about your share structure and how much have insiders invested in the Company.

Heye Daun: We have a very clean share structure, 56 million shares, no warrants, and a standard option plan. There are no funnies, no special rights or other hidden instruments I'm very proud to say that. About 50% of the Company is tightly held by the groups that I mentioned earlier, which is Ross Beaty at just under 20%, RCF at about 9%, Power One here in Toronto at around 8%, and Trimark group, which is Dubai-based. And then there is management, myself. We own about 15%. So that speaks for about 55-60% of the company. And that's it. That's the share structure. What was your second question?

Allen Alper Jr: How much skin does Management have in the game?

Heye Daun: Oh! Thank you very much. Thank you for that question. So these 60% that I just counted up for you, put in about 10 million dollars in three financings. Of that 10 million dollars, 1.3 more or less comes from Management itself. My own money and my family’s money, which I have invested in the company. We have participated in every financing. So just to give you the full picture, we raised the initial seed money at 20 cents. That was about two and a half to three years ago. Then, one and a half years ago, we raised another four million dollars at 38 cents. And then RCF and a few others came in in May last year, pre-IPO at 48 cents. We're currently trading between 35 and 40 cents. Management participated in each of those financings. So it's very clean. So, yes. We have lots of skin in the game.

Allen Alper Jr: Excellent! We feel very secure knowing that Management has its own money in. It shows confidence in the Company.

What do you think the biggest challenge is that you're facing at the moment? And what are you doing to address it?

Heye Daun: Speaking in general, as a junior, I would say the biggest challenge or threat or risk to me is always running out of money. How do you prevent that? Well, firstly, by being judicious and conservative with your treasury, which we are. So we pay modest salaries. We fly economy class. We do all the right things in that respect. But, at the same time, it's important to build a strong group of shareholders that are behind you. That's why I mention 50% of the Company is owned by professionals, with deep pockets, who stand behind us. And I don't take that lightly because we don't rely on those guys because we are very conscious of constantly trying to diversify our shareholder base. So that's what we do to address the financing risk.

The other risk for juniors is to lose your licenses or run into political problems. Being in Namibia is, of course, very good for us because Namibia has a history of being very stable socially. It has a great regulatory regime. You can enforce contracts. So I would say that largely mitigates that risk.

The rest is geological. Are we going to have geological success? And some of that we can control. I mean, the geological endowment, itself, is what it is. The earth was created the way it is. We can't control it. But what we can control is how we work the ground. So, for example, by being active and having a high volume exploration program. The more you look the more you find. And that's certainly the case with us. For a small junior, we have a very, very active program and we are having good success. So far the results that we've achieved in the last two years demonstrate that.

Allen Alper Jr: Right now, what do you think are the main reasons investors should be interested in Osino?

Heye Daun: So, to me, there are three factors. Firstly, we're a team of people that has a track record. We've delivered value before. So our shareholders have made money in the past. We've built companies before and we've sold companies before and we know what it takes to build and advance and exit from a junior. So therefore, firstly, we have a competent team of people.

Secondly, we're in a great country, Namibia. It's geologically very interesting, but it's also safe and the regulatory regime is good, and it is a great place in which to operate.

And thirdly, we have an excellent group of shareholders behind us. I think that sums it up. Those are the three key takeaways investors should consider when looking at Osino.

Allen Alper Jr: Do you have anything else you'd like to add?

Heye Daun: I appreciate your interest. Thank you for interviewing Osino Resources for Metals News. I learned lately the importance of retail shareholders, of course, generally. But, also, very much the importance of alternative means of accessing those shareholders. The new media enables us to reach a new generation of shareholders, of which I'm very appreciative. We need those people because our industry is old and we need young people, young investors to come into this industry and for that reason I appreciate every opportunity to promote our company through social media, newsletters or any other alternative media forms.

Allen Alper Jr: Absolutely. Thank you very much. I admire what you are doing and what you have accomplished. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://osinoresources.com/

Osino Resources Corp.

Heye Daun, CEO

Tel: +27 21 418 2525

hdaun@osinoresources.com

|

|