Mustang Resources Ltd. (ASX: MUS): Developing Premier Ruby, Graphite and Vanadium Projects, Interview with Dr. Bernard Olivier, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 4/19/2018

Mustang Resources Ltd. (ASX: MUS) is a Mozambique-focused emerging multi-commodity developer and explorer, currently fast-tracking the development of its Montepuez Ruby and Caula Graphite and Vanadium projects, located adjacent to each other in northern Mozambique. We learned from Dr. Bernard Olivier, Managing Director of Mustang Resources, that they are focusing on the development of their ruby project in the Montepuez area, as well as the neighboring graphite and vanadium deposit called the Caula Graphite and Vanadium Project. Both projects are located in northern Mozambique, right next to each other, so they can share infrastructure and camp facilities. We learned from Dr. Olivier, that their aim, with the Ruby project, is to take it through exploration phase, and in the process identify the resources and areas that they can take from exploration into production.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Bernard Olivier, Managing Director of Mustang Resources. Could you give our readers/investors an overview of your company, your focus and current activities?

Dr. Bernard Olivier: Mustang Resources is a Mozambican-focused, multi-commodity developer and explorer. We are focusing on the development of our ruby project in the Montepuez area, as well as the neighboring Caula Graphite and Vanadium Project. Both projects are located in northern Mozambique, immediately adjacent to each other and share infrastructure and facilities.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit about the three projects, and their stages of exploration and development?

Dr. Bernard Olivier: Absolutely. First the ruby deposit, which we've been exploring for about a year. The development of a colour gemstone project has two facets; the mining and exploration, and the marketing, branding and sales component.

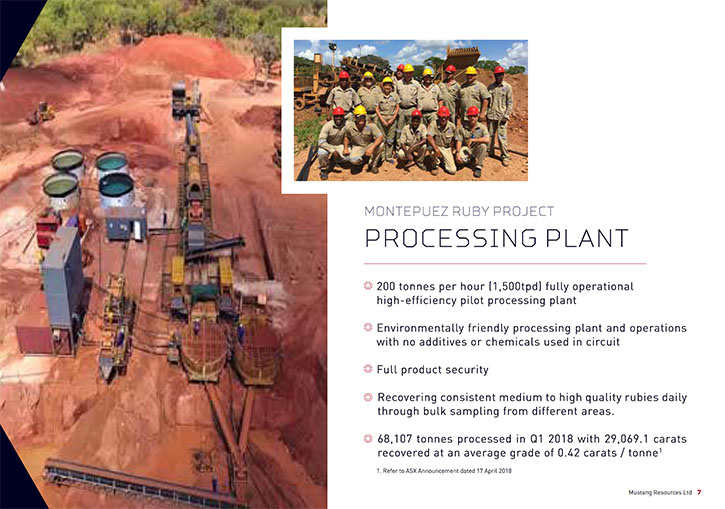

The Montepuez ruby project is currently in its large-scale exploration phase, with the aim of progressing to production as soon as possible. We are making good progress with our exploration activities and had a very successful first quarter of 2018. We have a large tenement packing cover over 140 km3 and our extensive exploration activities have, for example, led to the recent discovery of a new ruby-bearing gravel deposit, called Block D, which returned very positive pitting and exploration results. During the quarter we also recovered 29,069 carats from the processing of approximately 68,107 tonnes of material stockpiled before the onset of the rainy season. Now that the rainy seasons is coming to an end we have started preparation for recommencing our bulk sampling, which will include the newly discovered Block D area.

With regards to the marketing and sales component; despite being in an exploration phase we are still extracting significant quantities of rubies due to the nature and size of our exploration activities. We are extracting rubies from our fully functional 200 tonne per hour processing plant which feeds directly into our integrated sorting facility. Material is sorted and pre-graded before it is exported to our sales and marketing office in Thailand. We recently announced the commencement of sales from our, newly established, office in Thailand, with maiden sales, totaling approximately A$230k, concluded. We are also receiving strong levels of interest form well-known international jewellery brands and groups who would like to source responsible and ethically mined rubies from our Montepuez operation.

Transparency and traceability is extremely important when it comes to coloured gemstones and is an important aspect of our operations. I believe the colour gemstone industry is lagging far behind the diamond industry and we, as an industry, should strive to develop and introduce a similar set of protocols to the Kimberly Process for diamonds.

Dr. Allen Alper: That sounds excellent. I'm glad to see how much progress you are making with your project. Could you tell us a bit more about your graphite and your vanadium projects?

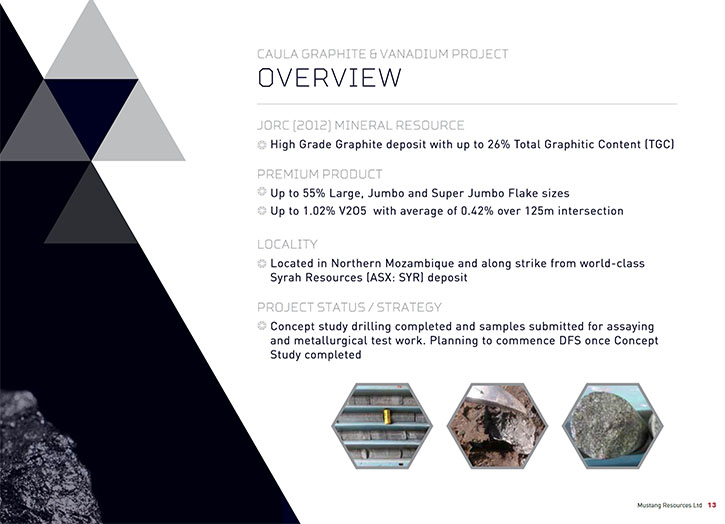

Dr. Bernard Olivier: We are currently in the scoping study phase of our Caula graphite and vanadium project and have completed the drilling associated with the scoping study, which are now starting to be released to the market, as the assay results are coming in. We are very excited with the results we’re already getting back from the scoping study.

There are two components of the Caula project, with regards to the graphite. It stands out from other projects due to its unique combination of being both high grade and containing a high quantity of coarse flakes. Usually you either have high TGC values, or you have coarse flake size. With Caula we have TGC values of up to 26% TGC and more than 50% of our graphite is larger than 180 microns, therefore falling into the large, jumbo, and super jumbo categories.

Our graphite has a high correlation of roscoelite mica in the same ore and the mica is the source of our vanadium. The vanadium assay results from the first scoping study bore hole, received back so far, shows vanadium pentoxide grades of over 1%. The bore hole retuned average vanadium pentoxide grades of 0.42% over a 125m intersection, which it very exciting, and we are eagerly awaiting further assay results for both the graphite and vanadium. Due to the correlation and similar nature of graphite and the vanadium bearing mica minerals, we are planning a dual extraction and processing method. For the start we are designing the processing plant to be able to extract both graphite and vanadium.

Dr. Allen Alper: That sounds excellent. That sounds like a very unusual project and deposit. Could you tell us a little bit about the geology of that deposit?

Dr. Bernard Olivier: The graphite and vanadium are both located in the same rock units, namely comprised of sequences of metamorphosed carbonaceous pelitic and psammitic sediments within the Proterozoic Mozambique Belt. Structural deformation resulted in further fluid migration, resulting in high grade enrichment of both vanadium and graphite as well as the increased flake sizes. The structural deformation created a large antiformal fold structure and we are currently, predominantly focussing on the fold hinge of the antiform, however our EM data and drilling shows that the deposit extends approximately 18km in strike length. We currently have a JORC resource of 5.4Mt at 13% TGC at a 6% cut-off for our graphite but we are in the process of upgrading the graphite resource and establishing our maiden vanadium resources as part of the current scoping study work.

Dr. Allen Alper: Sounds excellent! It's great to have leadership with a PhD in economic geology running the show, excellent. Could you tell me a little bit more about your background, your team and your board?

Dr. Bernard Olivier: I have a PhD in economic geology and I’ve been working as a geologist for 20 years now, of which the last 11 years have been as a listed company director and Executive. I was involved in the development of the Tanzanite One mining operation in Tanzania, since its start in 1999. Similar to what we have at Mustang, the deposit consists of a combination of graphite and coloured gemstones. In the beginning of the operation, we converted a historic graphite mine to extract and process tanzanite. Later on, when graphite prices started to recover, we also restarted the graphite side of the operation. Tanzanite One listed on AIM in 2004 and the Company and mine have been very successful and profitable and I believe one of the largest dividend payers on AIM as well. I have been involved with various other companies and commodities over the last 20 years including being CEO of Bezant Resources Plc, also on AIM.

We have a wealth of experience on the board with Christiaan Jordaan and Cobus van Wyk both having about 15 years’ experience operating in Mozambique. They, together with the operational team on the ground, have a lot of knowledge and experience operating in Mozambique and have already shown this by the rapid development of the ruby project, including constructing the 200 tonne per hour processing plant and all associated services and infrastructure on site.

Dr. Evan Kirby is a metallurgist with over 40 years’ experience in extraction, processing, plant design and plant commissioning. Importantly, he also has significant experience, with both graphite and vanadium. He used to work for the world’s highest grade vanadium mining operation.

Last but not least is our Chairman, Ian Daymond, who is very well known and respected in the mining and resource sector. He practiced as a solicitor for over 41 years as an external or in-house mining and resources lawyer. He also has significant independent director experience.

Dr. Allen Alper: Sounds like they're a very strong, experienced team. Excellent! Could you tell our readers/investors a bit about your share and capital structure?

Dr. Bernard Olivier: We currently have around 880 million shares on issue and our Market Capitalisation is around A$22 million. We have recently completed a rights issues to shareholders and together with our available finance facilities are well financed to conduct our exploration and development work, over the next 12months. Our Montepuez ruby project is already revenue producing and we have recently announced our strategy to fast track the Caula graphite and vanadium into first production by H1 2019.

Dr. Allen Alper: That sounds outstanding. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Dr. Bernard Olivier: I think it's a combination of the right team with the skill and experience needed to develop successful mining operations in Mozambique as well as having exceptional and world-class assets, like our Montepuez ruby project and our Caula graphite and vanadium project. We are already producing revenue from our ruby exploration and bulk sampling activities and are fast tracking the Caula project into production, through the construction of our pilot plant. The production of both graphite and vanadium from our pilot plant will also enable us to secure binding offtake agreements to fund the construction of a larger graphite and vanadium processing plant. We are applying shareholders' money in a very sensible way, with the money going in the ground to develop projects that are revenue generating.

Dr. Allen Alper: Well, I think you have a great approach, getting some production going and generating cash flow, while you are doing exploration and development, an excellent approach and plan.

Dr. Bernard Olivier: Correct, our approach is very much production and revenue generating orientated and developing our projects in a sensible way to unlock value for shareholders.

Dr. Allen Alper: I think that's an excellent approach, an excellent way of moving forward. Very few companies do that. Is there anything else you'd like to add?

Dr. Bernard Olivier: I think we covered it all. There will be significant and exciting news coming out as the assay results of the graphite and vanadium scoping study is released and as the ruby project continues to develop and progress further on both the exploration and bulk sample side, but also on the sales and marketing side.

Dr. Allen Alper: That sounds excellent!

http://www.mustangresources.com.au

Managing Director: Bernard Olivier

bernard@mustangresources.com.au

+61 (0) 4 08948 182

+27 (66) 4702 979

|

|