Interview with A. Paul Gill, CEO of Lomiko Metals Inc. (TSXV: LMR, OTC: LMRMF): Graphite’s Future is Li-Ion Batteries

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/26/2017

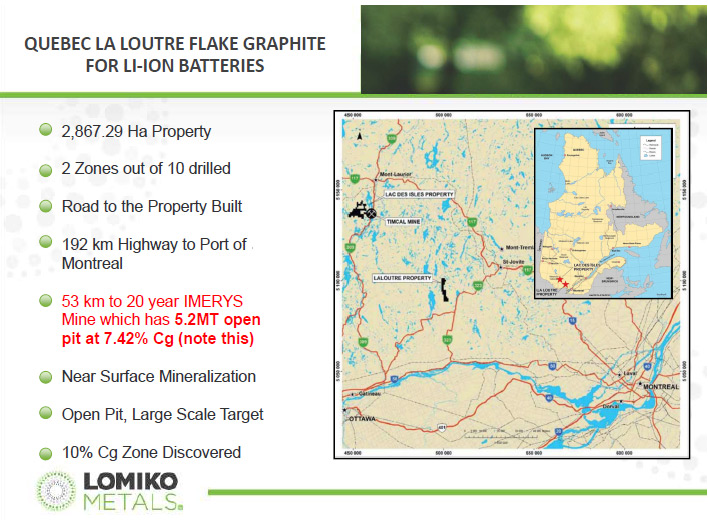

Lomiko Metals Inc. (TSXV: LMR, OTC: LMRMF) is a Canada-based company engaged in the acquisition, exploration

and development of resource properties that contain minerals for the new green economy. Its mineral properties

include La Loutre, Lac Des Iles, Quatre Milles Graphite Properties and Vines Lake property, all of which have

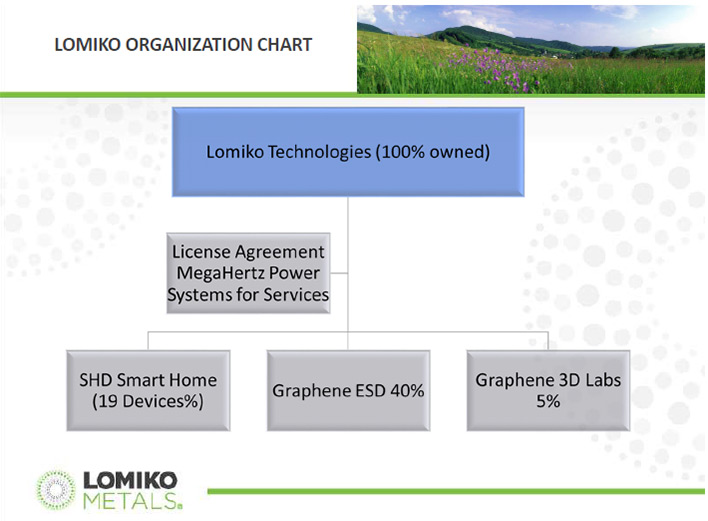

had major mineral discoveries. It's wholly owned subsidiary, Lomiko Technologies Inc., is a shareholder of

Graphene 3D Lab (TSXV: GGG OTCQB: GPHBF), with 40% of Graphene ESD Corp and a 19% owner of SHD Smart Home, a

manufacturer of IoT devices. We learned from A. Paul Gill, CEO of Lomiko Metals, they have made an exceptional

discovery of 110 meters of 14.56% graphite in Quebec. This is the best graphite hole reported from juniors this

year, twice the grade of the nearby Imerys Carbon and Graphite Mine. Plans for 2017 include further drilling,

pre economic assessment and expansion of the new discovery. According to Mr. Gill, Lomiko is vertically

integrated, having a stable supply of graphite that allows them to enter the field of graphene. They've already

been investing in two different technologies in this area, 3D printing and super capacitor technology, both of

which use graphene as a core element.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing A. Paul Gill, CEO

of Lomiko Metals Incorporated and Lomiko Technologies, Inc. Could you update our readers/investors and give us

an overview of Lomiko?

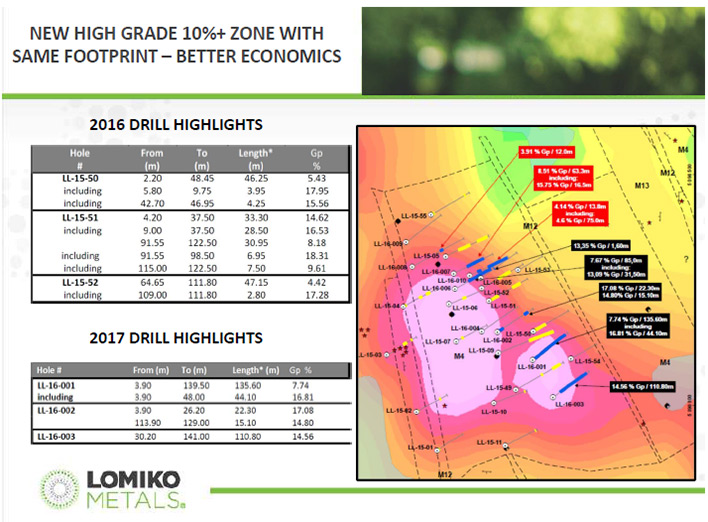

Mr. Paul Gill: Right now, we have been exploring for graphite in Quebec and we've made a major

discovery at the Refractory zone. This particular discovery is 110 meters of 14.56% graphite, exceptional

numbers. It's double the grade of the [nearby] operating graphite mine called the Imerys Carbon and Graphite

Mine. We think development of this particular area, further drilling, pre-economic assessment is a very good

idea and we think we can get it done.

Dr. Allen Alper: That sounds excellent. Could you tell me a bit more about your plans for 2017?

Mr. Paul Gill: We intend to continue drilling to the southeast, continuing along the lines of discovery

to fully develop the surface exposure of the graphite we have there. Right now, we do have about 150 meters of

the graphite [zone] exposed. We want to expand that. Given that we've already had a resource on the property

that trended exactly in the same way, northwest to southwest. The Graphene-Battery Zone was 400 meters strike

length, we think with more drilling in 2017, we will define the very rich area within the Refractory zone. This

is really exciting because we know the Graphene-Battery Zone had 35 million tons of material, both indicated and

inferred of 3%+ grade, whereas the Refractory zone is grading over 10%, which is very, very good in this

industry.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit about the market for graphite, its

applications and why it's so important?

Mr. Paul Gill: The market for graphite is very, very interesting. We have a number of factors going on

right now. Number one, we know for the last 20 years, China has been the major supplier of graphite to the

market. That production is dropping off. Other jurisdictions, such as Australia, America, Canada and Sweden are

coming on as potential groups that can replace that supply. So that's the scenario. China has been supplying

90,000 tons of the 120,000 tons of flake graphite. China is going to be going down to about 60,000 tons. At the

same time, the demand quoted by the US Geologic Society is going up by 60,000 tons. So we're going to have a

deficit of about 60,000 to 90,000 tons of material that has to come from somewhere. That is going to drive

prices up in the near term.

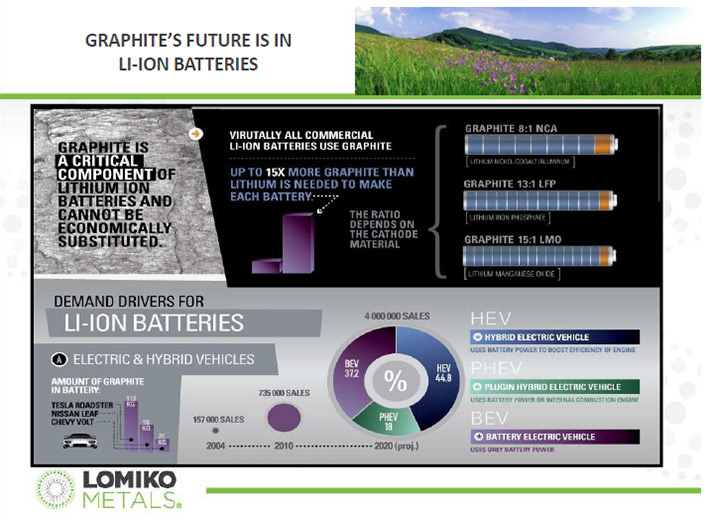

Now, it's already happening because of the Tesla Gigafactory in the lithium space and in the cobalt

space. We think graphite is the next big move and it's going to be the mother of all moves because the

requirement for graphite is 15 times the requirement for lithium in a battery.

Dr. Allen Alper: That sounds great. That sounds very encouraging. Could you elaborate on some of the

applications for graphite?

Mr. Paul Gill: Graphite is used in the steel making industry for refractory bricks. It is essentially

used to make steel. It is used in brakes. It is used in lubrication. And pencil lead of course. But the primary

use of high grade, or large flake, graphite is the creation of spherical graphite for the battery market. That

is something that has been slowly taking more and more of the product that's being produced. We're seeing a

tipping of the scales from an over-supply to a demand that's going to outstrip supply. The target date for that

is around 2018.

Dr. Allen Alper: That sounds good. Besides mining graphite, your company is also somewhat vertically

integrated. Could you tell our readers about that?

Mr. Paul Gill: Yes, we're interested in the applications of graphite and its derivative, graphene. We

feel that having a stable supply of graphite will allow us to enter the field of graphene. We've already been

investing in two different technologies, 3D printing and the super capacitor technology, both of which use

graphene as a core element. Those two industries should expand in the next little while. The company we've

invested in, Graphene 3D Lab, is public and is making $1.2 million a year and has 12,000 customers going to its

website at graphenesupermarket.com. We're very bullish on the future of graphene. That will draw down on the

kind of supply required, so we will need more and more material to supply those customers once they establish

themselves. Even one particular use, such as the filtration of seawater into freshwater by Lockheed Martin,

could take tens of thousands of tons of graphite to convert to graphene to use as filters for that process.

That's only one use. And there are 14,000 patents for graphene, all of which will require a stable supply. We

think that converting Canadian graphite to graphene will supply that market. This new industry needs a stable,

reasonably-priced supply.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a little bit about your

background and your team?

Mr. Paul Gill: My background has been in mining and materials for the last 15 years. I started with

Norsemont Mining, a copper play in Peru, which was bought by HudBay Mining. It is now an operating mine of

30,000 tons per day with Silver Wheaton investing $ 750 million in the property to complete the build. It’s

located in the Alto Plano region of Peru and is now worth about $20 billion. That company, Norsemont, went from

5 cents to $4 and was ultimately sold for a valuation of $512 million. I then went on to make further

investments in Peru through Grenville Gold and Epic Mining. I spearheaded Lomiko’s entry into technology,

investing through Graphene 3D Lab, which earns $ 1.2 million a year from graphene sales. So we feel we have a

good track record and will continue to develop companies in the future that have tremendous upside potential.

My CFO, Jacqueline Michael, was involved in the software side and developed Conac Software, which sold

to a Hong Kong company, and has been involved in numerous other ventures. Some of my directors are also public

company directors for other groups that have raised millions of dollars. We feel we have a very strong team.

Dr. Allen Alper: That's excellent. Could you tell me a little bit about your capital structure?

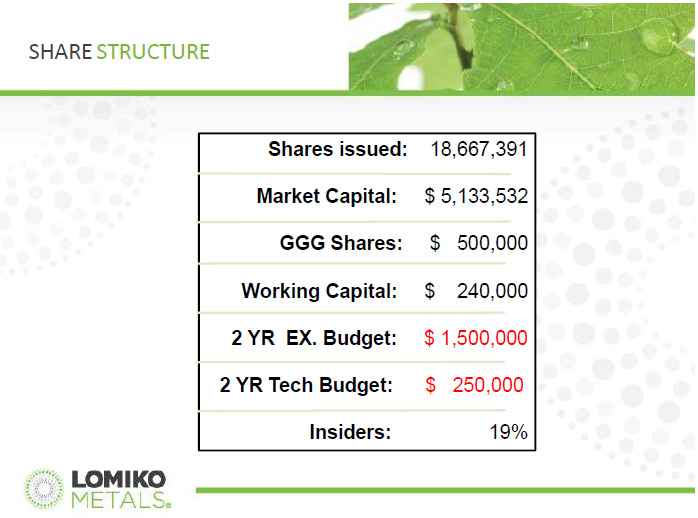

Mr. Paul Gill: Lomiko has 18.6 million shares out, trades between .22 and 27 cents Cdn at a valuation

of about CAD$4.5 million. 22% of that is owned directly by insiders and associated parties, such as Canada

Strategic Metals, who was our joint venture partner on the La Loutre property and Smart Home Devices, which is

one of our subsidiary companies.

Dr. Allen Alper: That sounds good. What are the primary reasons our high-net-worth readers/investors

should consider investing in your company?

Mr. Paul Gill: Great question. Number one, we know that electric vehicle sales are increasing year

after year. Tesla is now worth more than Ford. At $350 a share, it is going to continue those sales. And that's

not all. There's the Nissan Leaf. There are numerous other electric vehicle groups, all of which are increasing

sales and will increase penetration to about 25 to 30% in the next 10 years. All of those electric vehicles will

require lithium, cobalt and graphite. We're well aware that lithium has more than doubled, and in fact, at the

top of the market, was quadruple the price it was in 2015, when it topped out in 2016. Cobalt has now moved and

doubled. The price of graphite has not moved yet and that's the opportunity as Jim Dines says, to get in before

the herd, before the big move happens, before the supply is all bought up and the price spikes. So the

opportunity is right now.

Dr. Allen Alper: Sounds like excellent reasons our high-net-worth readers/investors should consider

investing in your company. Is there anything else you'd like to add, Paul?

Mr. Paul Gill: Thank you for the opportunity to share our information with your readers. My style

rewards patient long-term investors. Too many companies focus on stock price and not the business of the

company. We have worked for 5 years so we are ready to become an overnight success!

Dr. Allen Alper: Thank you for talking with us.

https://www.lomiko.com/

A. Paul Gill

604-729-5312

info@lomiko.com

|

|