Rudi Fronk, Chairman of Seabridge Gold (TSX: SEA; NYSE:SA): Leveraged Play to a Rising Gold Price - more Ounces of Gold in Ground Per-Share

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/12/2017

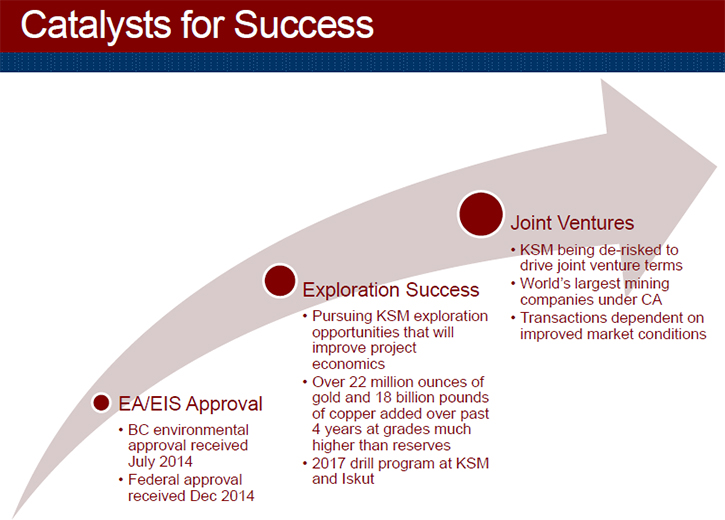

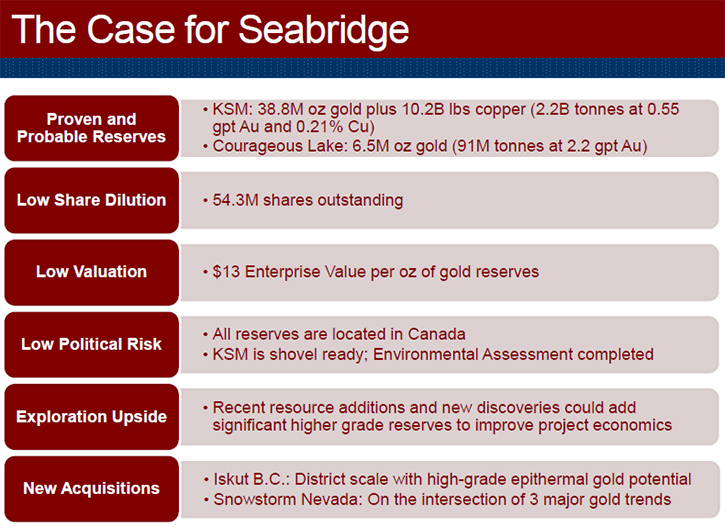

We learned from Rudi Fronk, who's chairman of Seabridge Gold (TSX: SEA; NYSE:SA), that he started Seabridge almost 18 years ago with a contrarian view on gold. Their goal was to create what they thought would be the best leveraged play to a rising gold price. Their concept is driven on the idea of providing more ounces of gold in the ground on a per-share basis than anybody else in the industry and to that end, they've been highly successful. Seabridge holds a 100% interest in several North American gold projects. The Company's principal assets are the KSM Project located near Stewart, British Columbia, Canada and the Courageous Lake gold project located in Canada's Northwest Territories. Plans for 2017 include more exploration drilling at the Iron Cap deposit at KSM project.

Rudi Fronk, Chairman of Seabridge Gold at PDAC 2017.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Rudi Fronk, who's Chairman of Seabrook. Could you give our viewers another overview of your company?

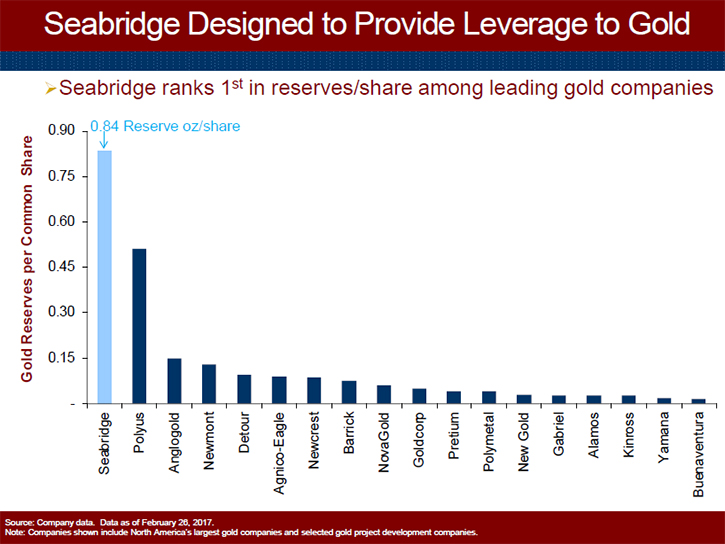

Rudi Fronk: Okay. Thanks, Allen. I started Seabridge almost 18 years ago, with a contrarian view on gold. Our intention, our focus and our goal was to create what we thought would be the best leveraged play to a rising gold price. Back then, gold was trading well below $300 an ounce. We thought it would go substantially higher over time. Our concept was driven by the idea of providing more ounces of gold in the ground on a per-share basis than anybody else in the industry. To that end, we've been highly successful.

Dr. Allen Alper: Could you elaborate a bit on your reserves and your resources?

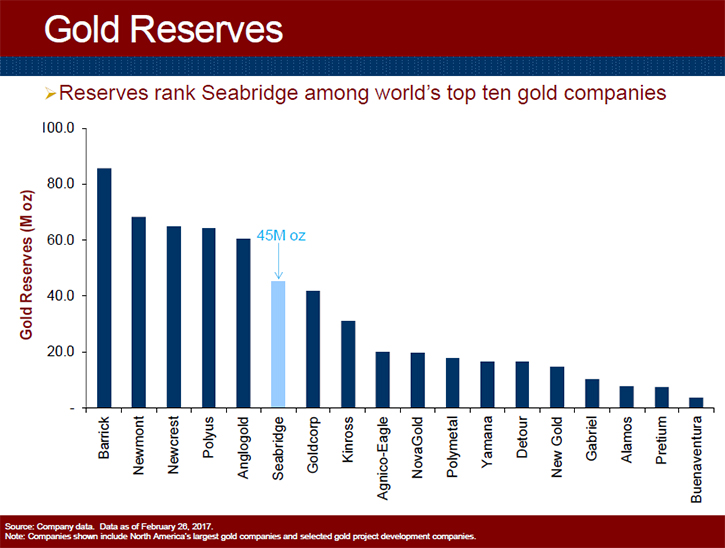

Rudi Fronk: In terms of proven or probable gold reserves, we now have 45 million ounces of gold and 10 billion pounds of copper. That's contained within a much larger resource of 101 million ounces of gold and 34 billion pounds of copper. I think it is important to point out that our reserves and resources are located in Canada, one of the safest mining jurisdictions in the world.

Dr. Allen Alper: That's great. That's a nice place to be, nice and safe. What are your plans for 2017?

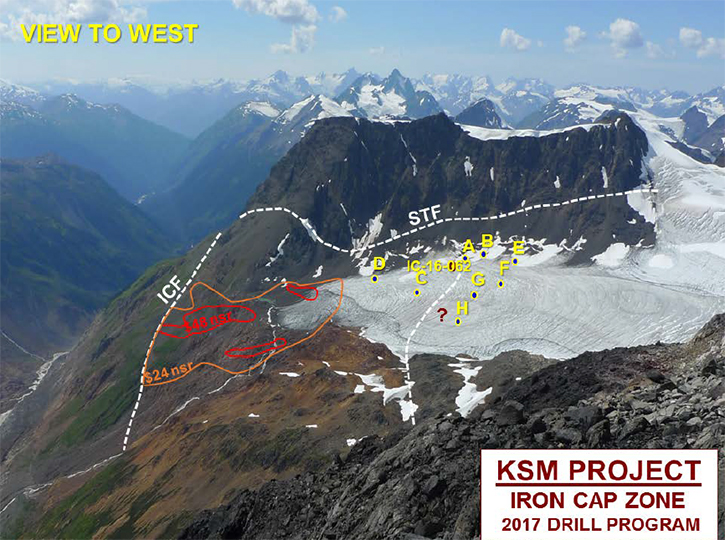

Rudi Fronk: In 2017 we're going to continue to advance on the concept of building more leverage to the gold price. We have exploration programs this year focusing on both KSM and our newly acquired Iskut project. At KSM, we will be extending one of the four deposits we have at KSM, called the Iron Cap. Last year we intersected 555 meters of continuous mineralization of 0.83 grams per tonne gold and 0.24% copper. At the very top of that hole, we hit something that we were not expecting, where we intersected 60 plus meters of 1.2 grams per ton gold and about 1% copper. In 2017 we expect to add meaningful new resources at Iron Cap as well as test the higher-grade zone we found nearer the surface. In 2017 we will also have a meaningful exploration program at Iskut, which is located about 40 kilometers away from KSM. We purchased Iskut in 2017. We believe Iskut, not only hosts porphyry style mineralization like we have a KSM, but also has the potential to yield higher grade epithermal style gold mineralization similar to what Pretium Resources has next door to KSM at its Brucejack Project.

Dr. Allen Alper: That sounds great. Could you refresh our readers on your background, your team, and your board?

Rudi Fronk: I'm a mining engineer. I've been in the gold space for over 30 years. I've built mines around the world and I've had mines expropriated. I learned firsthand the concept of political risk. That's why we're in Canada now.

Seabridge’s senior team is mostly made up of engineers, exploration geologists and environmental experts from the major mining companies, like Newmont, Noranda, BHP and Placer Dome. Our board is also made up of seasoned veterans from large companies. They collectively possess all of the technical and financial expertise to oversee our business plan.

Dr. Allen Alper: That sounds very good. What are your thoughts on the gold market?

Rudi Fronk: I think we're just coming out of a very challenging five years when gold went from $1900 per oz in 2011 down to as low as $1050 per oz last year. We remain confident on gold going forward. To us, gold is not a commodity. It never has been. In its simplest form, it's money. It competes against financial assets and it competes against other currencies. Every ounce of gold, ever mined from the beginning of time, is essentially available as supply today. Gold does well when financial assets are out of favour and does not perform well when financial assets are in favour. We believe that the general stock market now is overvalued. In a market correction, we expect to see money coming out of the stock market, and some of that will find its way into gold. In addition, if you look at the level of sovereign debts around the world, coupled with quantitative easing that continues in many of the larger countries, you have to like the backdrop for gold.

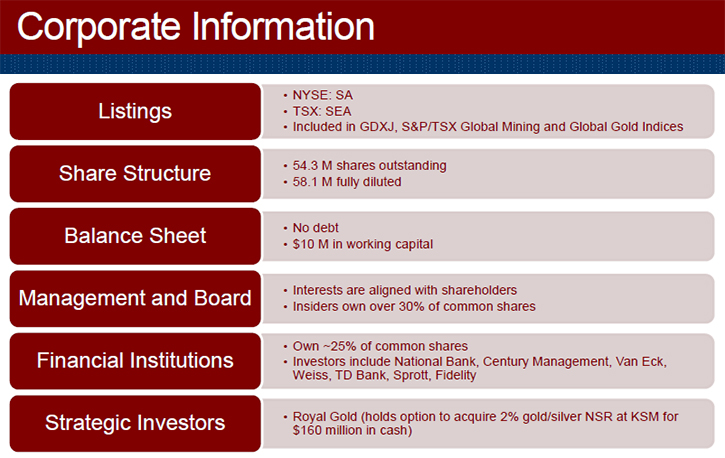

Dr. Allen Alper: That sounds very good. Good analysis. Could you tell me a little bit more about your share structure?

Rudi Fronk: I believe that's where we've done our best job. We have just over 100 million ounces of total gold resources, including measured, indicated, and inferred, of which 45 million ounces are reserves. We only have 54 million shares outstanding today, so we have over 0.8 ounces of gold reserves per common. If you look at it in terms of total resources, there's almost two ounces of gold in the ground per common share. Nobody in the industry comes close to that in terms of ounces per share.

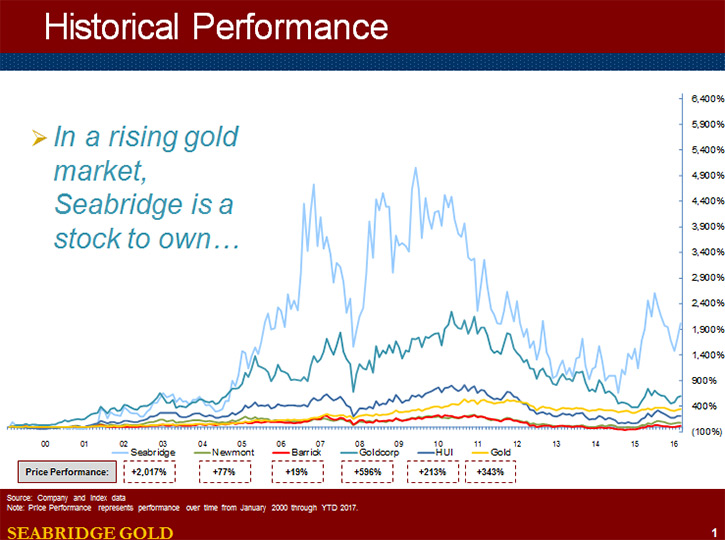

What that means is, if you look at Seabridge's relative share price performance in a rising gold market, we significantly outperform not only the price of gold, which we have now for 18 years, but also most of the other gold stocks. Our view is that people buy gold stocks with the expectation that the price of that stock will rise faster than the gold price. For the most part, if you look at the past 18 years, the major gold companies have underperformed the price of gold. We have outperformed the price of gold by about a factor of six. For every 100% increase in the price of gold, we're up 600%. Unfortunately, leverage works both ways. The last five years have been challenging to all gold companies. Our share price went from the high $30s in 2010 to single digits in 2015. We're now starting to see ourselves once again outperform gold and other gold equities as the gold market goes higher.

Dr. Allen Alper: That sounds great. What are the primary reasons our high-net-worth readers/investors should consider investing in Seabridge?

Rudi Fronk: I think in its simplest form, Seabridge common shares provide a great insurance policy as part of a balanced portfolio. You own insurance and you expect it to pay out when bad stuff happens. In the case of owning Seabridge common shares, we have demonstrated now for 18 years how we outperform other gold stocks and the price of gold itself in a rising gold market. If you want a balanced portfolio with a portion in gold, in my view there's no better stock to own than Seabridge for that gold component. In fact, I have over 90% of my net worth in Seabridge common shares, so as my wife likes to say, "We're all in."

Dr. Allen Alper: That shows you have faith in what you're doing and faith in your company, and that's great. I've done a lot of interviews with Rob McEwen, and he always points out that he owns 25% of the company, so he has his money invested, and his income or his reward will come from the stock doing well.

Rudi Fronk: I agree with that 100%, which is why I have my investments in Seabridge common shares.

Dr. Allen Alper: Great. Is there anything else you'd like to add, Rudi?

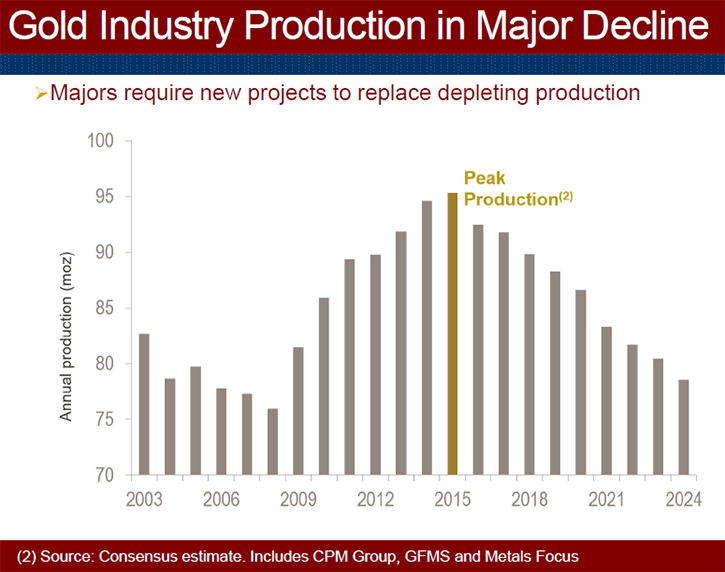

Rudi Fronk: I think if you look at our track record over the past 18 years, the gold industry in general, especially the majors, have done things backwards in a lot of ways. History shows, they always tend to buy assets at the top of the market, and then when the market turns against them, they're out selling assets to try and pay for the sins of their past. In the past five years, the entire focus of the major gold companies has been to pay down debt, mostly by selling assets, because of how they overpaid at the top of the market.

The major gold companies are turning gold into cash which in our view is converting the best form of money in the world, gold, into an inferior form of money, US dollars. Our focus is to turn cash into gold. We raise dollars through equity financings or selling non-core assets, and we take those dollars and re-invest them back into acquisitions or into exploration, essentially turning those dollars into gold in the ground. That's what we're about, that's what we provide, and that's how we'll continue to run the company over the next several years.

Dr. Allen Alper: That sounds excellent. I enjoyed talking with you. You have a great company, and you've done a great job.

Rudi Fronk: Thank you. It's been fun. The past 18 years have gone by quickly. I started Seabridge when I was 40! Now I have gray hair, grown kids. It's been fun, though.

Dr. Allen Alper: That's great. Nice talking to you.

Rudi Fronk: You as well.

http://seabridgegold.net/

Rudi P. Fronk, Chairman and CEO

Tel: (416) 367-9292 Fax: (416) 367-2711

Email: info@seabridgegold.net

|

|