A Special Alert Musing from Mickey the Mercenary Geologist

For Subscribers Only

Contact@MercenaryGeologist.com

October 10, 2016

When an exploration company

that I have covered at various times in both bull and bear market cycles

substantially rewards thousands of subscribers, I tend to cycle back on a

periodic basis.

I first covered

Brazil Resources Inc (BRI.V)

shortly after it went public over five years ago. It

is one stock that I continue to play successfully thru the typical up and downs

of a junior resource company. As with many of my favorite holdings, I maintain

a core position and a trading position.

Since I last wrote about BRI

in early 2015 (

Mercenary Alert, January 23, 2015

), the company has significantly expanded its project portfolio with gold

resource acquisitions in Alaska and Colombia. We will discuss these items

later.

Most importantly for us as

shareholders has been its share price performance from the date of my previous

Alert to present:

With two major all-share acquisitions

in little more than a year that diluted the company less than 10%, Brazil

Resources now has 112 million shares outstanding and 127 million fully diluted,

including 12.0 million in-the-money warrants and 2.9 million options. Cash

position stands at $9.4 million. Management and insider ownership constitute

25% of holdings and institutions control about 30%. Despite these large blocks

that seldom move, liquidity is excellent with daily trading volumes averaging

nearly 1.5 million shares since March.

When my last musing was

posted on January 23 2015, BRI closed at 54 cents. Seven trading days later it

hit 85 cents. As the junior golds tumbled to an all-time low in early 2016, the

company followed suit, reaching its all-time low of 38.5 cents on January 22.

As contrarians we know that

patience with well-run companies is ultimately rewarded and in this case, it

has been. BRI started an uptick at the PDAC in March on strong volumes and with

a few pauses and corrections, continues to make new highs.

We reached our goal of a

double on April 11 when the stock hit $1.14, albeit more than three months

after our self-imposed time frame of one year. Few would quibble with that

delay when it touched $3.35 in mid-September.

Folks, this stock has been among

the top performers in the gold sector this year. For us, it’s been a six bagger

since I last reported and illustrates why we choose to back talented management

teams with promotional savvy. With last week’s 7% correction in the gold price,

BRI has fallen back to the $2.50 -$2.60 range. As traders, we love corrections

within bull markets because they present buying opportunities.

Now on to important Brazil

Resources updates since early 2016:

-

·

After acquisition

of the 170-sq km Whistler gold-copper porphyry project in south-central Alaska in

summer 2015 from Kiska Metals for 3.5 million shares and $150,000 in maintenance

services, the company tabled an updated 43-101 resource estimate. Base case

indicated resources are 79 million tonnes grading 0.51 g/t Au, 1.97 g/t silver,

and 0.17 % copper and inferred resources are 146 million tonnes grading 0.40

g/t gold, 1.75 g/t silver, and 0.15 % copper.

-

·

In March 2016,

BRI closed an oversubscribed private placement of 10 million shares to raise

$4.5 million.

-

·

In April, it

announced completion of a ground geophysical survey on its Rea uranium 75-25

joint-venture with uranium giant Areva in the southwestern Athabasca Basin.

Strong electromagnetic conductors were encountered and drill targets defined.

-

·

In April and May,

it announced 43-101 resource estimates for the Island Mountain and Raintree West

satellite deposits at the Whistler project. With these resource additions to

the, the total Whistler base case indicated resources are 110 million tonnes

grading 0.50 g/t Au, 1.72 g/t Ag, and 0.14 % Cu; inferred resources are 311

million tonnes grading 0.47 g/t Au, 2.26 g/t Ag, and 0.11% Cu.

-

·

This month, BRI

completed 100% acquisition of the Titiribi gold-copper porphyry project in

central Colombia from Trilogy Metals (TMQ.NYSE. MKT). It was an all-equity

transaction for 5.0 million shares and 1.0 million warrants at $3.50. The

company then completed a 43-101 resource estimate with base case indicated

resources at 286 million tonnes grading 0.50 g/t Au and 0.10% Cu and inferred

resources of 208 million tonnes grading 0.49 g/t Au.

With these two acquisitions made

near the bottom of the metals cycle, measured, indicated, and inferred

resources for all BRI projects now total 18.1 million ounces gold-equivalent

ounces. That is an increase of a whopping 14.2 million ounces since my last

report on the company. The company has now

established a significant pipeline of gold projects for development, production,

or disposition.

Its near-term development

project remains Sao Jorge in the Tapajos area of Para state, Brazil. This area

is benefitting from strong regional activity by both major and junior gold

companies. For example, Eldorado Gold

recently announced plans to commence construction on its Tocantinzinho project next

year.

The 100%-owned Sao Jorge

project is an advanced gold project hosting an indicated resource of 14.4

million tonnes grading 1.54 g/t Au for 715,000 oz gold and an inferred resource

of 28.2 million tonnes grading 1.14 g/t Au for 1,035,000 oz gold at a cut-off

grade of 0.3 g/t. Sao Jorge is located 70 km north of the town of Novo

Progresso via mostly paved roads with power and water on site. A mining license

application has been submitted.

The 100%-owned Cachoeira

project in northeastern Brazil contains three gold deposits with a combined

indicated resource of 692,000 ounces gold (17.5 million tonnes grading 1.23 g/t

Au) and 538,000 ounces gold (15.7 million tonnes grading 1.07 g/t Au) in the

inferred category at a 0.35 g/t cutoff. The deposits are open along strike and

at depth with several drill targets to be tested in future programs. An

environmental license application has been submitted.

The company is currently

assessing opportunities to joint ventures its other Para state holdings. They include

the Boa Vista and Surubim projects, both of which have qualified resources, and

three early-stage prospects.

Both of its new acquisitions,

Whistler and Titiribi, are large, low-grade gold-copper porphyries that are not

currently economic but will become more valuable assets as metal prices inevitably

recover. AngloGold-Ashanti is currently working on pre-feasibility studies on three

Colombian porphyry projects in the same belt as Titiribi.

Another asset of significance

in BRI’s portfolio is the aforementioned Rea uranium project in northeastern

Alberta. It will likely remain on the backburner until the uranium market

recovers.

The company remains on the

acquisition hunt for gold assets in other countries in the Americas. With its

recent acquisitions outside of Brazil, I expect a re-branding in the near

future.

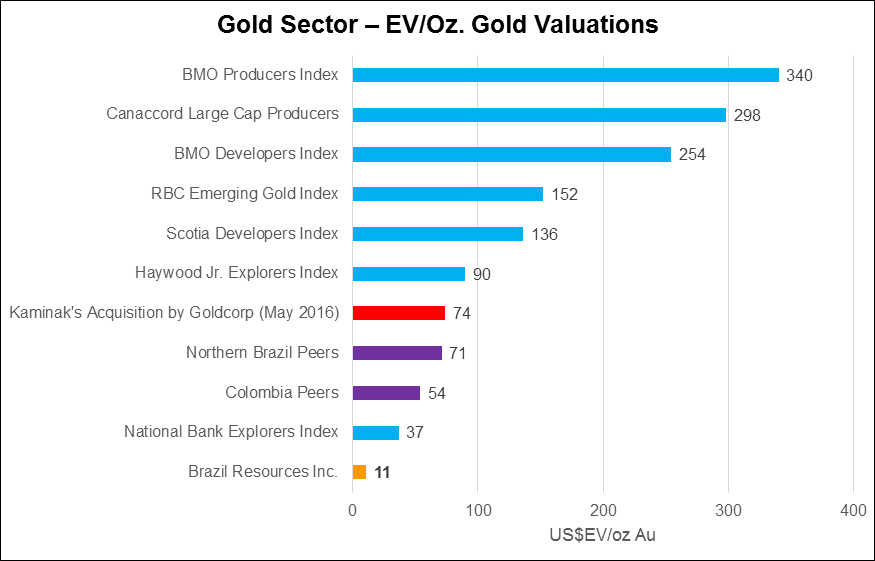

This chart shows that the current

enterprise value of Brazil Resources Inc’s gold portfolio is at the very low end

with respect to its exploration and development peers in both Brazil and

Colombia. It succinctly attests to the company’s upside in market capitalization:

Note that my cost basis in

BRI is now zero because I have taken profits since the spring and may do so

again if the stock continues its rise. That said, I continue to maintain

significant core holdings in Brazil Resources Inc.

My

Power of Two

trading philosophy has worked quite well since I

became a shareholder of the company in 2010. I always encourage you to follow

this method of programmed trading to maximize potential profits in the junior

resource sector.

The company pays fees to

sponsor this website so please factor my biased opinions into your consideration.

As always, proper due

diligence is incumbent before speculating in any financial instrument.

Ciao for now,

Mickey Fulp

Mercenary Geologist

The

Mercenary Geologist Michael

S. “Mickey” Fulp

is a Certified

Professional

Geologist

with a B.Sc. Earth Sciences with honor from the

University of Tulsa, and M.Sc. Geology from the University of New Mexico.

Mickey has 35 years experience as an exploration geologist and analyst

searching for economic deposits of base and precious metals, industrial

minerals, uranium, coal, oil and gas, and water in North and South America,

Europe, and Asia

.

Mickey worked for junior explorers, major

mining companies, private companies, and investors as a consulting economic

geologist for over 20 years, specializing in geological mapping, property

evaluation, and business development. In

addition to Mickey’s professional credentials and experience, he is

high-altitude proficient, and is bilingual in English and Spanish. From 2003 to

2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British

Columbia.

Mickey is well-known and highly respected throughout

the mining and exploration community due to his ongoing work as an analyst, writer,

and speaker.

Contact

:

Contact@MercenaryGeologist.com

Disclaimer

and Notice

: I am a

shareholder of Brazil Resources Inc and it pays a fee of $4000 per month as a

sponsor of this website. I am not a certified financial analyst, broker, or

professional qualified to offer investment advice. Nothing in any report,

commentary, this website, interview, and other content constitutes or can be

construed as investment advice or an offer or solicitation or advice to buy or

sell stock or any asset or investment. All of my presentations should be

considered an opinion and my opinions may be based upon information obtained

from research of public documents and content available on the company’s

website, regulatory filings, various stock exchange websites, and stock

information services, through discussions with company representatives, agents,

other professionals and investors, and field visits. My opinions are based upon

information believed to be accurate and reliable, but my opinions are not

guaranteed or implied to be so. The opinions presented may not be complete or

correct; all information is provided without any legal responsibility or

obligation to provide future updates. I accept no responsibility and no

liability, whatsoever, for any direct, indirect, special, punitive, or

consequential damages or loss arising from the use of my opinions or information.

The information contained in a report, commentary, this website, interview, and

other content is subject to change without notice, may become outdated, and may

not be updated. A report, commentary, this website, interview, and other content

reflect my personal opinions and views and nothing more. All content of this

website is subject to international copyright protection and no part or portion

of this website, report, commentary, interview, and other content may be

altered, reproduced, copied, emailed, faxed, or distributed in any form without

the express written consent of Michael S. (Mickey) Fulp, MercenaryGeologist.com

LLC.

Copyright © 2016

Mercenary Geologist.com, LLC. All Rights Reserved.