A Musing on the Seasonality of Gold

|

By Mickey Fulp the Mercenary Geologist

on 10/28/2015

The usual suspects in the gold bug and perma-bull camps got their panties all wet last week when the yellow metal briefly set a four-month high of $1184 per ounce. The usual suspects in the gold bug and perma-bull camps got their panties all wet last week when the yellow metal briefly set a four-month high of $1184 per ounce.

Of course when the price backed off a bit, the conspiracy theorists immediately played their trump card, a bastardized version of the EMH (acronym for the widely recognized “efficient market hypothesis”). This gang’s “eternal manipulation hyperbole” is routinely called upon to rationalize a depressed gold price, negate the metals’ inability to punch thru market resistance, or counter solid technical analysis.

My counter-argument to these gold slipper-wearing lock steppers was a think-piece showing why gold is likely to be range-bound in the short term. In a series of charts, I pointed out gold’s correlation with the US dollar index over the past 15 months and commented briefly on its price seasonality (Mercenary Musing, October 19, 2015).

In today’s musing, I once again cool off the gold hotties and GATA groupies with another series of charts that shows the 4% rise in the price of gold so far in October is simply its normal seasonality.

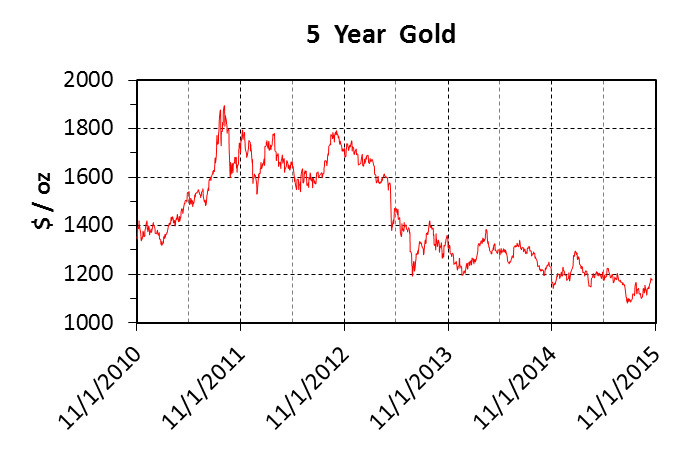

But before we go there, let’s review a five-year chart of gold in US$:

Note that since gold closed at an all-time high of $1895 in September 2011, it has continued to make lower lows and lower highs over the one-, two-, three-, and four-year time frames. Technical analysts regard that as a significant bear market trend.

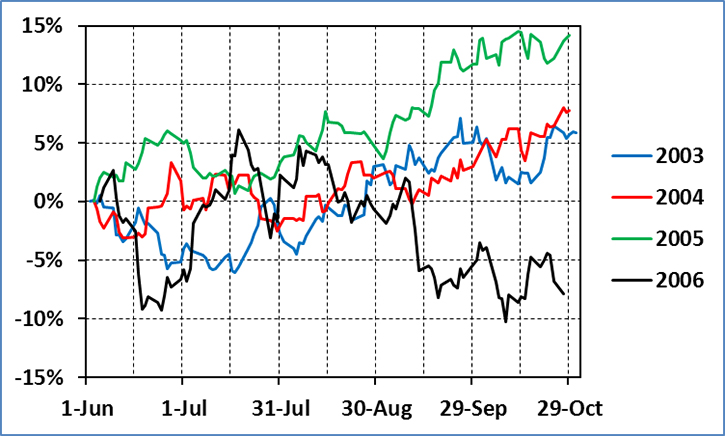

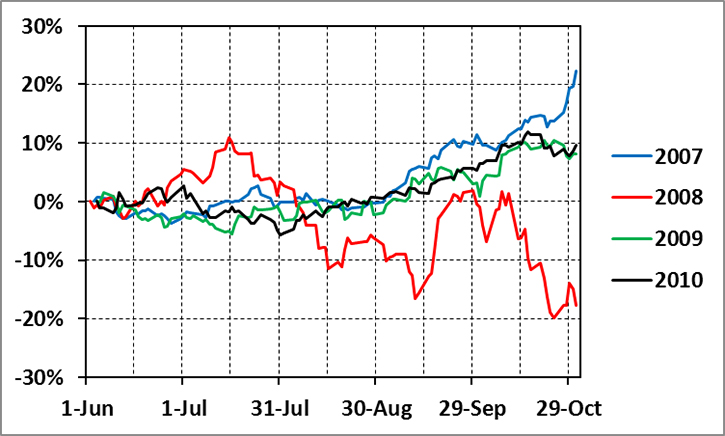

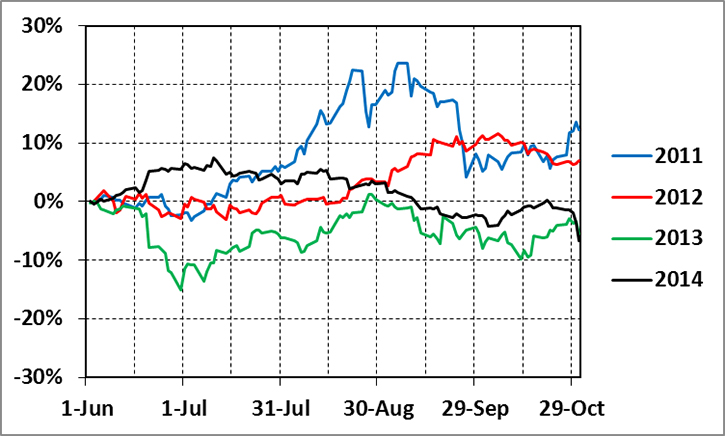

Now let’s look at a series of gold charts covering a five-month period from June 1 to October 31 for every year from 2003 to 2014. Each yearly interval shows the percentage rise or fall from the first trading day in June:

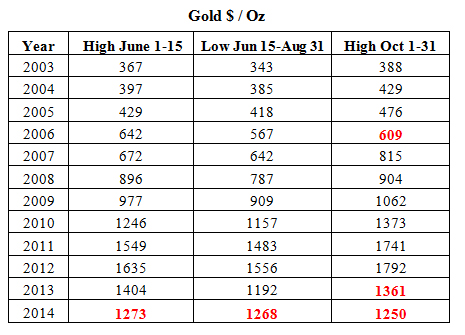

Here is a table showing high and low prices over the pertinent time periods:

These charts and the table show:

• In 11 of the 12 years, gold hit a significant seasonal low during the summer months. The exception occurred in 2014 when gold rose from early June to mid-July, was range-bound until Labor Day, and then dropped drastically in late October (shown in red above).

• For 9 of the 12 years, gold’s high from June 1 to 15 was less than its high from October 1 to 31 (anomalies again shown in red).

• In 2008, gold hit a significant five-month low in October during the global financial crisis. When stocks and commodities crashed, speculators were forced to liquidate gold holdings to cover margin calls.

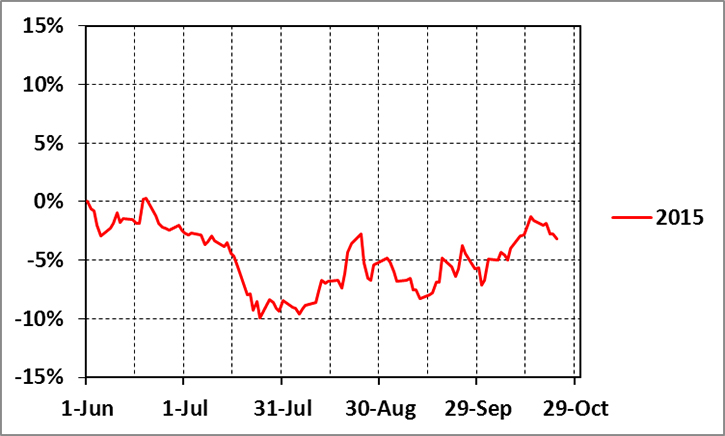

This is the current gold chart, June 1 thru October 23, 2015:

Gold closed at $1200 on June 1, hit its summertime and a 5½ year low of $1085 on August 5, and ended today at $1164.

The 2015 chart mimics the status quo for gold price seasonality in 11 of the last 12 years; i.e., an early to mid-June high, a significant mid-summer low, and followed by a rally in October.

We still have a week to go before Halloween and end of our 2015 five-month period. However, given today’s close at $1164, it appears unlikely that gold will close higher at month’s end than its June 1-15 high of $1200, thus marking the third anomalous October in a row.

If so, this will be further evidence of the ongoing bear market for gold with lower highs being established year over year over year.

Let’s review what I briefly mentioned last week and illustrated in the charts and table today:

The behavior of the gold price since early summer can be attributed to seasonal supply and demand fundamentals. We are witnessing the usual June to October price paradigm: A decline from early June highs with lows established during the summer doldrums followed by a rise during the Indian festival and wedding seasons.

I can also forecast higher prices thru mid-December then a drop during the holiday season in the West as year-end approaches. I will have more on this idea in a subsequent musing.

I reiterate that gold ain’t goin’ anywhere anytime soon. It will remain range-bound within year-to-date highs and lows for the short-term.

This is no trick or treat, folks. As per usual, I will put my mercenary money where my mouth is:

I stand ready and willing to entertain over/under bets on gold’s end-of-year spot price from any of the aforementioned gold bugs, perma-bulls, and yellow metal disciples. If you foresee a break-out of gold to the upside in the next couple of months, contact me for a friendly wager: $100 bottle of wine, loser buys, and we drink it together.

Any takers?

Ciao for now,

Mickey Fulp

Acknowledgment: Gwen Preston is the editor and Steve Sweeney is the research assistant for MercenaryGeologist.com.

The Mercenary Geologist Michael S. “Mickey” Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 35 years experience as an exploration geologist and analyst searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for over 20 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia.

Mickey is well-known and highly respected throughout the mining and exploration community due to his ongoing work as an analyst, writer, and speaker.

Contact: Contact@MercenaryGeologist.com

Disclaimer and Notice: I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in any report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation or advice to buy or sell stock or any asset or investment. All of my presentations should be considered an opinion and my opinions may be based upon information obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. My opinions are based upon information believed to be accurate and reliable, but my opinions are not guaranteed or implied to be so. The opinions presented may not be complete or correct; all information is provided without any legal responsibility or obligation to provide future updates. I accept no responsibility and no liability, whatsoever, for any direct, indirect, special, punitive, or consequential damages or loss arising from the use of my opinions or information. The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and may not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.

Copyright © 2015 Mercenary Geologist.com, LLC. All Rights Reserved.

|

|