Dear Subscriber:

In my season’s greeting one

year ago, I stated the five-year commodities bear market was finally over.

However, I warned that an incipient bull market would likely be a two-steps

forward, one-step back process, and indeed that is what occurred in 2017.

Most of the world exchange-traded

hard commodities turned in very good performances with yearly returns of 13%

for gold, 12% for oil, 30% for copper, 28% for lead, and 29% for zinc. Palladium

was the big winner, up a whopping 55% in 2017, while its sister metal platinum

returned less than 3%.

Platinum’s weakness compared

to other precious metals is unprecedented: the current Pt:Au ratio of 0.71 is a

historic low since January1970 while the Pt:Pd ratio of 0.87 is a17-year low.

Based on these highly anomalous ratios, I bought physical platinum at the

market bottom two weeks ago.

Gold rallied from a low of

$1151 at the beginning of 2017 to a high of $1346 on September 8. The last four

and a half months of the year have been marked by a gold price in strong negative

correlation with the US dollar. Gold closed the year at $1303 an ounce on

dollar weakness.

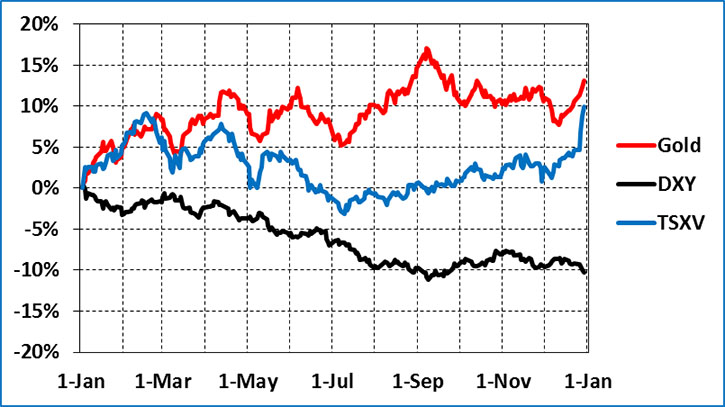

Here is the year-to-date composite

chart of DXY and the gold price:

As savvy speculators are

aware, the Toronto Venture Exchange is often driven by the price of gold and

that relationship ruled in 2017. The TSXV Index closed 2016 at 762, hit 844 in mid-February, and

then drifted to a low of 750 in conjunction with the seasonal low for gold in

mid-July. It then moved slowly upward and underperformed gold until spiking

sharply to close today at a yearly high of 852. More than half of the Index’s

year-over-year gain of 12% occurred during the past four trading days.

This normalized plot of DXY, gold, and the TSXV Index

shows the relative movements of each metric for 2017:

At MercenaryGeologist.com, we are dedicated to producing state-of-the-art

analysis and research on commodities and equities. Our commitment to basic

supply-demand fundamentals and a contrarian outlook allows us to prosper regardless

of market conditions.

Since I launched the brand in

late April 2008, our sponsorship business model has proven to be very stable

compared to paid subscription newsletters. In this span of less than 10 years,

many more writers have left the business than remain on the job. Our opt-in

subscriber base now stands at over 6600 for a 4% gain in 2017.

Once again I chose to proceed

cautiously during 2017 as the junior resource market teetered on the totter for

most of the year. When markets emerge from bear cycles, my speculations tend to

be early stage, start-up exploration companies with advanced projects in a

commodity of interest and in geopolitically stable jurisdictions. I

participated in several private placements in both the public and private

arenas this year. Most were for gold projects with four in the United States

and one each in Canada, Ireland (Zn), and Brazil.

In line with the tepid junior

resource market, my track record of stock picks was a mixed bag in 2017.

Let’s review the performance

of two companies that I selected for coverage in late Q3 of 2016:

Mawson Resources Ltd (MAW.T)

is a Finnish gold explorer that I covered in late

2010 with returns of 273% in seven trading days. My latest Mawson pick was at 40

cents in September 2016. It closed at a 52-week high of 56 cents the following

day but did not exceed that level in the next 12 months. Low liquidity within

its trading range was problematic. Management and I mutually agreed to cease

coverage at the end of nine months. Mawson closed today at 45 cents. I remain a

committed shareholder of MAW with news in 2018 expected to include drill

results and perhaps a strategic partner and a spin-out of new projects.

GoldMining Inc (GOLD.V)

, formerly Brazil Resources Inc, has been an

intermittent sponsor since its IPO in mid-2011. After a six-bagger win from

early 2015 to September 2016, I provided an update last October as it was

correcting from an overbought high of $3.35. With recent tax-loss selling, GOLD

hit a 52-week low of $1.22 in early December and closed today at $1.33. I recently

bought shares using my

seasonal trading methodology

and remain on the bid for more.

Here are brief synopses of the

five companies that I covered in 2017:

Hannan Metals (HAN.V)

is a new Irish zinc explorer that emerged from a shell

and RTO in early January. I initiated six-months of coverage in late May at 49

cents. Despite the strongly rising zinc price, that turned out to be just a

penny off its high over the life of the contract. Hannan closed today at 23

cents, which is three cents below its two 2017 financings. I am disappointed by

HAN’s poor performance but remain a loyal shareholder because of its quality

management team and high exploration potential of its County Clare project.

Trilogy Metals Inc (TMQ.MKT)

has two world-class copper deposits in northwest

Alaska and presents a compelling call on that metal. Coverage of Trilogy Metals

began in late May at 65 cents and it returned more than a double at $1.35 only eleven

weeks later. I visited the project for the second time in August. Trilogy was

hit hard by tax-loss selling, reaching a low of 69 on December 11 before

rallying on news flow and a rising copper price to $1.19 six days later. It has

since been filling in the gap and closed today at $1.09. I issued an update on

TMQ last week.

Integra Resources Corp (ITR.V)

is a newly founded

Idaho gold explorer and holds the past-producing DeLamar gold-silver mine. I visited

the project and initiated coverage on November 6 in anticipation of its Venture

Exchange listing the following day. Integra’s high was $1.25, its low was 96

cents, and it closed today at $1.10 on light volume. I will follow with a

detailed report on ITR during the first week of January.

Eagle Plains Resources (EPL.V)

is a long-lived prospect generator that has traded

publicly since 1995 and intends to spin-out a Saskatchewan gold explorer in

early Q2 2018 via a 1:2 arrangement. I covered Eagle Plains on December 1 when

it closed at 17.5 cents. Over the past three weeks, EPL has traded as low as 15

and established a 52-week high of 25 cents today.

Allegiant Gold Ltd (AUAU.V)

is a 1:5 spin-out of

Columbus

Gold (CGT.V)

that will hold 14 exploration projects in the Western

US. I wrote up Allegiant on December 8 after a field visit to two of its

precious metals projects in Nevada. Speculators can still receive the spin-out

dividend prior to the share distribution record date, which is expected to be announced

in early January. Allegiant Gold will be listed on the TSXV shortly thereafter,

and I will post an in-depth review of the newco after the stock starts trading.

Now let’s segue to the record

191 products that were posted on our website in 2017.

I wrote

20 musings

on a wide

variety of subjects that are of interest to me and hopefully, are of interest

to you, too.

Our research on the

correlations, ratios, and seasonality of important world-traded commodities and

indices continued with in-depth analyses posted on gold, platinum, the dollar, and

the Toronto Venture Exchange Index.

My other subjects included a

guide to the PDAC, a field tour of the Yukon, a treatise on America’s 90 wars

in 241 years, a report from the New Orleans Investment Conference, five book

reviews, and seven Mercenary Alerts covering stock picks.

I was interviewed

136 times

and made

25 video

appearances in 2017.

We initiated a new bi-weekly

podcast series with Oreninc’s Kai Hoffman from Germany and Paul Harris from

Colombia. Our three regular podcast programs continued: the weekly Metals,

Money, and Markets update is with Rob Goodman of MiningClips.com; the monthly Mercenary

Musings Radio with Rob Graham focuses on commodities, has exclusive syndication

to Kitco.com, and will soon enter its 9th year; and the popular

Monthly Market Review with Kerry Lutz of the Financial Survival Network now has

an audience averaging over 15,000 listeners for each show.

In 2017, we also launched a

new product, the “

CEO

Interview Series with Mickey Fulp

”

in partnership with MiningClips.com. Seven of these high-end,

professional-quality, video productions have been very popular, averaging several

thousand viewers each. We hope to bring you many more of these informative

chats in 2018.

I made

nine public

speaking appearances

throughout

the year, including speeches at the two largest resource investment shows: the

Vancouver Cambridge House in January and the PDAC in Toronto in early March. I presented

at the New Mexico Geological Society Spring Meeting in April and was also an

invited speaker at the International Letter Writers Conference in Vancouver in

May, 121 Mining Investment in New York in June, the Capitalism and Morality

Symposium in Vancouver in late July, and the New Orleans Investment Conference

in October. I made two jaunts south to Socorro to mentor geology and

engineering students at New Mexico Tech.

We continued to grow our

Twitter feed:

@mercenarygeo

now stands

at over 63,200 followers for a gain of 7% for the year with an average of five to

six tweets per day. We are the undisputed industry leaders for this social

media platform. My IT team constantly monitors the Twitter account to attract

quality followers from the business and investing sectors and quickly

eliminates spammers and robots. Our tweets cover a cornucopia of subjects

including business news, commodities, equities, geopolitics, geological

phenomena such as earthquakes and volcanoes, individual rights and freedom,

investing, libertarian ideals, my outdoor hobbies, and American spectator

sports.

As always, my appreciation goes

to those who actually run this business. I am the voice and face of

MercenaryGeologist.com

but have superb behind-the scenes folks who deliver my

products to you on a timely basis:

·

Webmaster and IT

manager Raffaele Della Peruta has been with me since inception of this business

in April 2010.

·

Kirsty Hogg is now

in her seventh year as our social media and promotions manager.

·

Troy McIntyre, student

research assistant, moved to upstate New York in the late summer but we found

ways to keep him working thru the wonders of the internet.

Troy was retained 15

months ago because of his stated fluency in excel. He is now an expert in that

program and is responsible for our commodity and economic database that continues

to grow (>18 mb) as we add new parameters and develop innovative techniques

for analysis.

Thanks go to my workers, friends,

and neighbors in New Mexico’s South Valley who tend my animals, maintain the

farm, and keep vigilance when I travel.

Finally, my appreciation for

you as a loyal subscriber is constant; we will be successful only if you

continue to have interest in what I write and say. Rest assured that I will be

honest in my opinions, outspoken in my ideas, and consistent in my core values.

As always, we welcome and value your input and comments via

Contact@MercenaryGeologist.com

and respond to all emails unless you are a troll.

We remain fully committed to

profitable speculation in the junior minefield. Our work is anchored by a

long-term, secular view of world commodities demand driven by population

growth.

An unabashed devotion to contrarian

market ideas is what distinguishes us from other junior resource pundits. We

remain mindful that most money is made by early positioning before capital

markets turn bullish. Contrarianism requires diligent research and market

understanding, but most of all, patience and commitment to a well-defined

speculative strategy. Our unique Power of Two trading methodology is the basis

of that strategy (

Mercenary Musing, May 10, 2010

).

I am optimistic that the bull

market in commodities will continue in 2018 and the best junior exploration

companies will follow suit. I remain committed with significant share holdings

in many good companies. That said, I am always seeking and participating in new

ideas, deals, and startup companies in both the public and private venues. Rest

assured that I will bring only the best of these to your attention at the best time

for successful speculation.

Folks, always remember that profit-taking

is never a bad move, and it is an especially sound strategy in the volatile junior

resource market. These are not buy-and-hold stocks. You must sell to make

money!

Finally, my holiday wish for

subscribers in the coming year: May all your trades be to the upside.

Ciao for now,

Mickey Fulp

Mercenary Geologist

The

Mercenary

Geologist Michael S. “Mickey” Fulp

is a Certified Professional

Geologist

with a

B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology

from the University of New Mexico. Mickey has 35 years experience as an

exploration geologist and analyst searching for economic deposits of base and

precious metals, industrial minerals, uranium, coal, oil and gas, and water in

North and South America, Europe, and Asia

.

Mickey worked for junior explorers, major

mining companies, private companies, and investors as a consulting economic

geologist for over 20 years, specializing in geological mapping, property

evaluation, and business development. In

addition to Mickey’s professional credentials and experience, he is

high-altitude proficient, and is bilingual in English and Spanish. From 2003 to

2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British

Columbia.

Mickey is well-known and highly respected throughout

the mining and exploration community due to his ongoing work as an analyst, writer,

and speaker.

Contact

:

Contact@MercenaryGeologist.com

Disclaimer:

I am a shareholder of all the companies

mentioned in this musing. Allegiant Gold Ltd, Eagle Plains Resources, Integra

Resources Corp, and Trilogy Metals Inc currently pay a fee of $4000 per month

to sponsor this website. I am not a certified financial analyst, broker, or

professional qualified to offer investment advice. Nothing in any report,

commentary, this website, interview, and other content constitutes or can be

construed as investment advice or an offer or solicitation or advice to buy or

sell stock or any asset or investment. All of my presentations should be

considered an opinion and my opinions may be based upon information obtained

from research of public documents and content available on the company’s

website, regulatory filings, various stock exchange websites, and stock

information services, through discussions with company representatives, agents,

other professionals and investors, and field visits. My opinions are based upon

information believed to be accurate and reliable, but my opinions are not

guaranteed or implied to be so. The opinions presented may not be complete or

correct; all information is provided without any legal responsibility or

obligation to provide future updates. I accept no responsibility and no

liability, whatsoever, for any direct, indirect, special, punitive, or

consequential damages or loss arising from the use of my opinions or

information. The information contained in a report, commentary, this website,

interview, and other content is subject to change without notice, may become

outdated, and may not be updated. A report, commentary, this website,

interview, and other content reflect my personal opinions and views and nothing

more. All content of this website is subject to international copyright

protection and no part or portion of this website, report, commentary,

interview, and other content may be altered, reproduced, copied, emailed,

faxed, or distributed in any form without the express written consent of

Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.

Copyright © 2017

MercenaryGeologist.com. LLC All Rights Reserved.