Carlisle Goldfields (TSX: CGJ) Pursues Development Potential of Lynn Lake Gold Camp Located in Mining Friendly Manitoba with Cooperation of Local First Nations and Joint Venture Partner AuRico.

|

By Dr. Allen Alper

on 3/10/2015

Carlisle Goldfields (TSX: CGJ) is currently working on a feasibility study and exploring their Lynn Lake Gold Camp project in the mining friendly jurisdiction of Manitoba with the cooperation of the local First Nations communities and Joint Venture partner AuRico Gold (TSX: AUQ). AuRico is providing support and substantial funding (CAD$13 million spending in 2015) to the project to assist in the development. Carlisle is being directed by Abraham Drost who has had a very successful track record.

Abraham Drost, the President and CEO of Carlisle Goldfields (TSX: CGJ), spent some time with the team from Metals News at the recently held PDAC 2015 where he updated readers on the progress that is being made at the Lynn Lake Gold Camp in Manitoba.

Drost states, “I started as CEO of Carlisle Goldfields a year ago after leaving as CEO of Premier Royalty after the sale to Sandstorm. I was invited to look at Carlisle by then-CEO Bruce Reid.” After a good deal of due diligence, Drost was impressed enough to not only join the company, but to invest in it as well. Drost said, “What I saw convinced me that there was a significant gold asset here. I became a shareholder before I became an Officer and a Director of the company.”

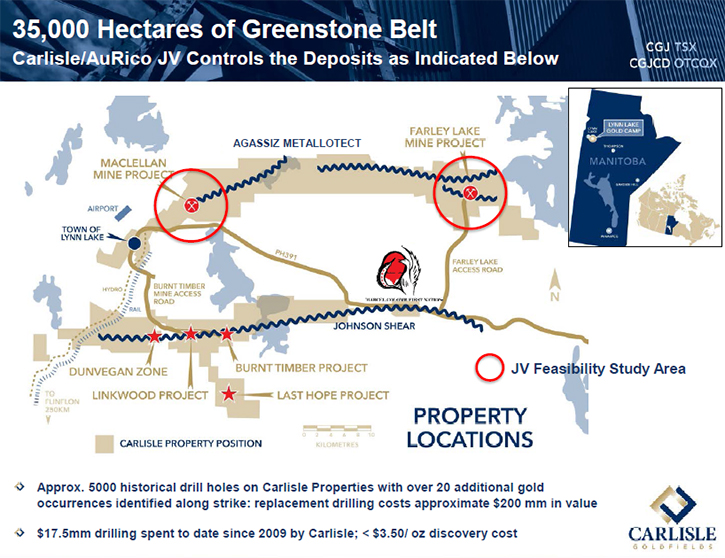

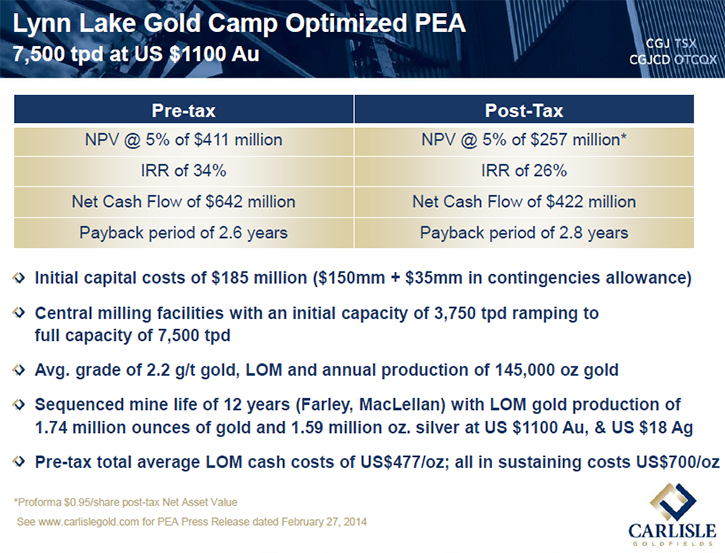

Carlisle Goldfields is currently working on a gold project located in the mining friendly jurisdiction of Manitoba. Said Drost, “We control the Lynn Lake Greenstone Belt in northwest Manitoba. We have five gold deposits with five million ounces of 43-101 compliant gold resources of which 1.6 million are Measured and Indicated open pittable gold resources.” Carlisle’s partner AuRico Gold is providing support and funding to the project to assist in the development. Said Drost, “The MacLellan and Farley Lake deposits are the subject of a Feasibility Study that is being conducted by our partner, AuRico Gold. They are spending $9 million on feasibility this year and $2 million on exploration matched by $2 million from Carlisle for a total of $13 million.”

The 2015 project spending commitment is significant. Said Drost, “AuRico’s spending commitment is really a validation of what we saw in Lynn Lake which was a very high quality series of gold assets, in a greenstone belt that is enormously fertile.” Drost is enthusiastic about the addition of AuRico to the project. He said, “With AuRico on board, we recently announced committed budgets of $13 million with the bulk of that going into feasibility work, but also a significant portion of that going into exploration. From my perspective, we will hit several benchmarks in the near to medium term. The expectation is that by Q3 of 2016 we will be in mineable reserves on two of the Carlisle assets.”

The company is being led by a Board of Directors that has a long background in a variety of areas that are critical to the mining industry. Said Drost, “We have a Board of Directors consisting of nine members, two of whom are senior managers at AuRico. They have a varied background from engineering and geology to finance and law.” Drost believes that the Board has the knowledge to move the Lynn Lake Gold Project to the next stage. Said Drost, “with AuRico, we have the experience to get the job done in terms of ultimate mine development in Lynn Lake on a joint venture basis.”

The company is on track to complete up to 100,000 feet of drilling this spring with the hopes of being able to add to their resource and further define the MacLellan and Farley Lake deposits. Drost said, “The feasibility study drilling will start in mid to late March with three drills. The remainder of the exploration drilling will start in April or May.” In addition to drilling, the company has also invested in additional survey work. Drost said, “We are currently flying a detailed high definition airborne survey. We are also cutting survey lines and getting ready for additional geophysical surveys in an area where we have an additional two million ounces of Inferred, potentially open pittable resource material at a grade of about 1.2 grams. That is about 1 gram shy of our mining grade, where the pre-feasibility grade is 2.2 grams, according to our Preliminary Economic Assessment.” To locate additional resources at mining grade, Drost and his team are exploring this high potential area as the exploration part of the Lynn Lake Joint Venture. He said, “We are looking in the southern part of the property for a high grade shoot which could drive the gram per ton level to the point where the area may become mineable.”

Like many junior mining companies, Drost is perplexed with Carlisle’s market valuation. He said, “Fundamentally, there is a disconnect on value at this time. If one backs out our cash on hand of $9 million from our market capitalization of $15 million, one arrives at an enterprise value of $6 million. A $6 million dollar enterprise value with $13 million dollars being spent in exploration this year sounds anomalous to me.” Drost believes that Carlisle’s value will ultimately be considerably higher with the involvement of AuRico and the move to mineable reserves in the feasibility areas of the Lynn Lake Project. “AuRico invested in Carlisle at $0.52 per share for 19.9% of the Company. They initiated the Joint Venture with a cash payment of $5 million to Carlisle. AuRico see the value in Carlisle’s assets and ultimately the market will as well.

Drost believes the project location and Carlisle’s relationship with the local communities should add value as well. He said, “We have a supportive joint venture partner as well as a very supportive First Nation partner. The Chief is here with us at the PDAC today. The area is hot and people want to do business in Manitoba. We have 55 million shares outstanding. Fully diluted we have 67 million shares and it is held 32% by insiders. Besides AuRico with 5.4 million shares, our Chairman Bruce Reid is the largest personal investor at three million shares. I have one million shares bought and paid for. I’d like to point out that Paradigm Capital, Toronto has launched independent research coverage on us with an equivalent $1.75 price target (after the 6.5 to 1 reverse split). Not bad for a $0.25 cent stock.”

http://www.carlislegold.com/

Carlisle Goldfields Limited

401 Bay Street, Suite #2702

Toronto, Ontario

M5H 2Y4

Email: info@carlislegold.com

Website: www.carlislegold.com

Abraham Drost

Cell: 807-252-7800

adrost@carlislegold.com

|

|