NioGold Mining Corporation (TSX: NOX), Advancing the Marban Gold Project in Abitibi Gold Belt

|

By Dr. Allen Alper

on 2/22/2015

Robert Wares, the President and CEO of NioGold Mining Corporation (TSX: NOX), took time to speak with Metals News about the newest developments at the Company’s Marban gold project located in the Abitibi gold belt. Mr. Wares said, “I am a geologist by training, and I was a co-founder of Osisko Mining. I joined up with my new partners in 2003, and Osisko made a great discovery at Canadian Malartic. Osisko was subject to a takeover offer last year by Goldcorp - which we fought - and eventually we made a deal with Agnico Eagle Mines and Yamana Gold that allowed us to sell them the Canadian Malartic mine, and to spin-out Osisko Gold Royalties Ltd.” Robert Wares, the President and CEO of NioGold Mining Corporation (TSX: NOX), took time to speak with Metals News about the newest developments at the Company’s Marban gold project located in the Abitibi gold belt. Mr. Wares said, “I am a geologist by training, and I was a co-founder of Osisko Mining. I joined up with my new partners in 2003, and Osisko made a great discovery at Canadian Malartic. Osisko was subject to a takeover offer last year by Goldcorp - which we fought - and eventually we made a deal with Agnico Eagle Mines and Yamana Gold that allowed us to sell them the Canadian Malartic mine, and to spin-out Osisko Gold Royalties Ltd.”

“For our business model at Osisko Gold Royalties,” Mr. Wares said, “we decided to add to our existing royalties by working with junior companies, taking an equity position and supplying financial, technical and marketing experience to get their projects across the line into production. We retain a royalty as part of their production. NioGold is part of that business plan.”

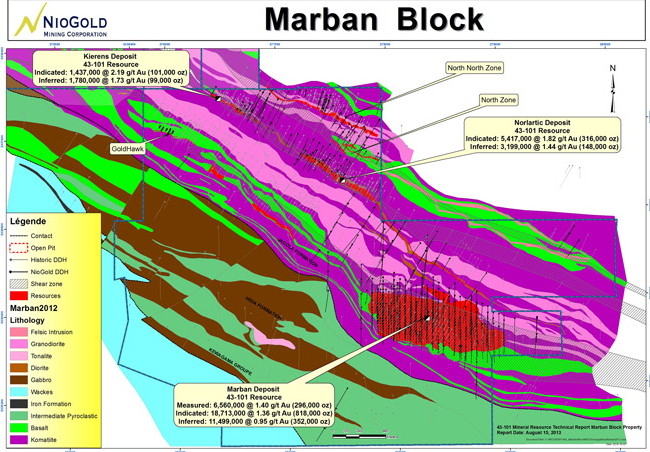

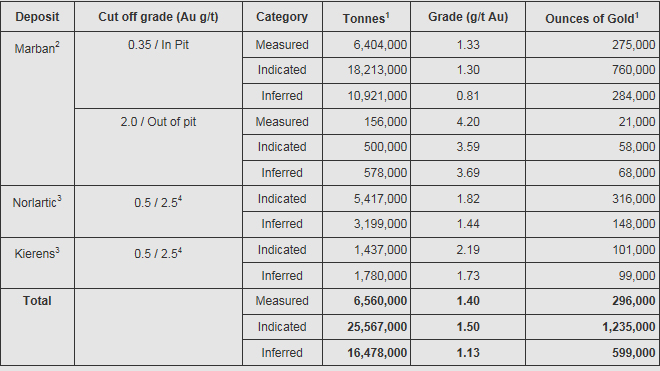

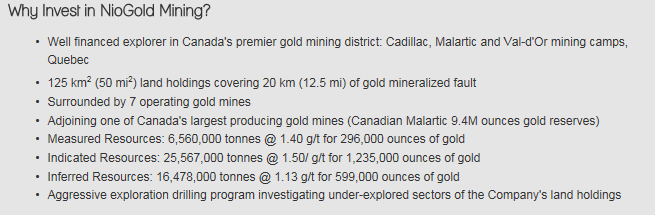

Osisko Gold Royalties has a substantial position in NioGold Mining. Said Wares, “We have a 19.9% equity position. I became the President and CEO of NioGold and Sean Roosen (who is also Chairman and CEO of Osisko Gold Royalties Ltd) is on the Board as Chairman. NioGold has an excellent land position in the Malartic and Val-d’Or gold camps, including 3 deposits with significant resources at Marban, Norlartic and Kierens. We’ve decided to redirect the corporate objectives at NioGold as we are totally focused on the Marban deposit at the present time. We want to bring that deposit into the reserve category within an 18 to 24 month timeframe. We do believe that the gold market and junior equity market will turn around within the next year or two. We want to position NioGold with a solid asset and be ready for a production decision when the market turns around.”

In order to achieve these goals, the company is currently drilling. Wares said, “We are working on a drill program on Marban. Because of the drop in commodity prices, there has been a slump in drilling activity and drilling costs have gone way down. We are happy to report that our costs are $85.00 a meter. That’s Canadian dollars per meter, so that would translate to about US$22.00 per foot. That is all in, including assaying and logging and so on. I haven’t seen prices this low in a long time, and because we are well-financed we can capitalize on that. Our current plan is for 40,000 meters of drilling, but we can continue drilling up to 50,000 meters if necessary, to convert the entire deposit to measured and indicated. The next step will be a preliminary economic assessment with a reserve statement. Marban is a low grade surface deposit which will be an open pit operation. I want to emphasize that it is only 12 kilometers away from the Canadian Malartic mine, which is producing at 1 gram per tonne. We believe that we will be able to outline reserves at 1.3g or 1.4g gold per tonne at Marban. We are talking about toll-milling the ore or maybe just selling it outright. That is our current business plan.”

The business plan is based on the information NioGold currently has on the Marban deposit. Wares said, “The deposit has good metallurgy with a high percentage recovery of the gold and it is soft rock that will be relatively easy to crush. The ore would blend well with the Canadian Malartic mineralization. Because the Marban ore can be processed easily, it will relieve some of the pressure to the grinding circuit at Canadian Malartic. If we can provide higher grade material than is currently being processed, that would also increase their ounces of production.”

“The timetable for our current drilling program is to complete it this summer. We will report the drill results and an upgraded resource estimate by the fall. At that point we will decide if we need more drilling or if we can go right to a PEA (Preliminary Economic Assessment). If we can go to the PEA, we should be able to have the reserve statement within a year to 18 months on the Marban deposit.”

“We are fully funded for the 50,000 meter program,” said Mr. Wares. “We want to do additional metallurgy testing on the Marban mineralization to understand better the grade recovery curves, and possibly do some column leach tests. The ore looks pretty porous and I would like to take a crack at a column leach test. That would take 20 weeks which will take us into the third quarter of 2015.”

The results of the leach test will help Wares and his team determine the next steps. Said Wares, “If the test works, then we will have an option to take Marban into production ourselves. Heap leach production of sulphide ore would be a first in the Abitibi. Kinross Gold is currently operating a successful sulphide leaching operation at Fort Knox in Alaska, so it could be possible at Marban. The cost of heap leaching is so low that it would allow us to produce gold at US$400 to $450 an ounce. That is something we will look at carefully. “

Longer term plans for the Marban Block property (including the Norlartic and Kierens deposits) are for more exploration as well as infill drilling in 2016. There are currently about 800,000 ounces on those other deposits. These resources would be potential additions to any production from the Marban deposit.

“Right now we are trading at about $0.35 Canadian. Given the potential reserves on this property, the market cap is really low. There is a lot of upside on the Marban and the other two deposits. The property is smack in the middle of the Abitibi gold camp and has all the infrastructure we need. This is an opportunity to take advantage of an upturn in the gold market with a deposit that has a really good chance of going to production in the next few years,” said Mr. Wares. “Investors should look for companies that can convert their assets into reserves. It is a simple story. NioGold is a great investment opportunity.”

Disclosure:

The Alper family owns NioGold stock.

For more information:

http://www.niogold.com

|

|