Plymouth Minerals Limited (ASX: PLH) Explores Tungsten and Tin Project at Morille Deposit in Mining-Friendly Spain

|

By Dr. Allen Alper

on 12/2/2014

Adrian

Byass, the Managing Director of Plymouth Minerals Limited (ASX: PLH), shared

information with Metals News at the recently held ITIA meeting about their

tungsten and tin Morille project located in Spain. Since that conference,

Plymouth has recently announced it has completed the purchase by making the

final payment on its 80% stake in Morille.

Mr. Byass said, “My

background is geology and economics.

From those two, I have always ended up going to the exploration/development

side of the industry. My experience has

been in a spectrum of minerals, many of which are not the norm, like tungsten

and molybdenum. I was lucky enough to be involved in Wolf Minerals since the

IPO and left that company last year.” Mr.

Byass identified this project shortly after departing from Wolf and notes that

“with this project, I have taken some of the skills I have learned recently at

Wolf and am now applying those to our new project.”

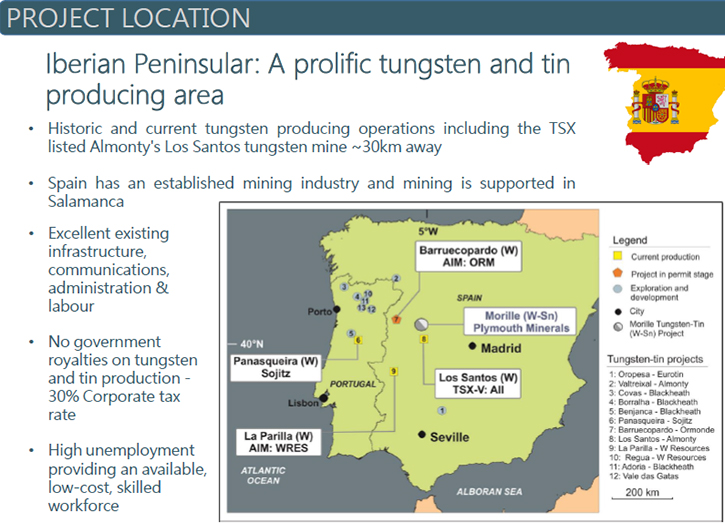

The Morille project represents a historical resource. Said Byass, “We have a brown field project in the Iberian Peninsula. Where we are located is about 190 kilometers west of Madrid. We are between Los Santos and another project (owned by Ormonde Mining Plc) that is going through permitting right now.” Adrian Byass and his team are enthusiastic about their project in that there are other successful projects nearby. Byass said, “We take stock in the fact that Los Santos was permitted and started within the last decade. There is great infrastructure and minerals in Spain. It has a sophisticated and educated workforce and a supportive government. The project has over 30 worked mines on it.” The project was operated by many different operators over their time on a myriad of smaller and separate leases. Said Byass, “The drop in tungsten price caused the mining to stop. This has allowed the ground to be consolidated into a simplified and larger holding. We can now use a cohesive exploration plan. This allows us to properly plan and optimize this project. We will be focusing on this.”

The project itself has moved forward based on a limited amount of historical exploration. Byass said, “Prior to our involvement there were only a few holes drilled. We have historical production of approximately three quarters of a million tons of tungsten bearing ore. There was great opportunity. We have conducted a first pass of exploration drilling and it shows extensions of mineralisation out of historical pits as well as new areas/zones.” Byass and his team believe that the actions they have taken, with their exploration, have removed the questions from the project. He said, “We have de-risked the project from our viewpoint post acquisition. We have been doing scout drilling without limited supporting information on drill targets and have had good success.” This scout drilling has brought the company back some good results. Mr. Byass said, “We wanted to be cost effective and smart. We got good results based on an area that has not seen any drilling before.” To move the project forward, the company will begin the more formal process of defining exactly what is available at the Morille deposit. Said Byass, “Our next stage is to define a resource. We intend to deliver a resource in 2015.”

In order to secure the next level of financing, the company will go through the exploration process to ensure they have all the data that is needed. Byass said, “We have a systematic but straightforward process. We can make a concentrate that is salable. We are doing some testing. Because this is a brownfields project, we are looking to optimize our process and to firm up the size, potential and scope to see how much we want to drill.”

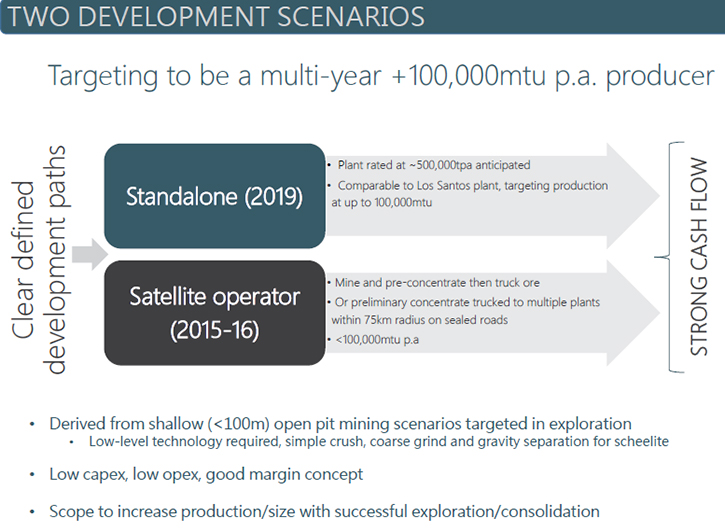

Byass and his team feel that the Morille deposit has a great deal of potential. He said, “We believe this project can be a standalone project or we can look at a satellite operation within a 100 kilometer radius. It is really up to the Board and the management how quickly things will move forward. In 2015, the process will be driven by the results and the price of tungsten. We believe we could easily be looking for permitting. The capital we are looking at here is beneficial for our company.”

To get the project off the ground, Mr. Byass and his team are looking at a reasonable capex. He said, “Because we are looking at a crush process, we are looking at the low tens of millions of dollars. We are definitely sub-$40 million dollar mark, and likely below $30 million dollars. That is pretty good for what could be turning out 100,000 MTU’s per year. This part of central Spain is rural and fairly low yield farmland. There are villages near us. We have sealed roads inside our permit area. We have power and excellent infrastructure. We have ease of bringing it to market and bringing supplies in as well as an immediate workforce. We will be looking to use the grid power. There are power lines within a couple km of our prospect area. There is no impediment to accessing the Spanish grid. That would run quite comfortably. I have a really good Board. We have more senior people from the minerals industry as well as those who have experience in tungsten and capital raising. Importantly, it is the people on the ground. We have geologists on the ground and mining engineers. These people live within 20 kilometers of the project. We have excellent support from the community and they are invested in making the project move forward. We have excellent single focus exposure. We have a clearly undervalued project. We have something that we know is good and we are going to do something about it.”

Plymouth Minerals Limited

Level 1, 350 Hay Street

Subiaco WA 6008

Australia T: +61 8 64616350 F: +61 8 2101872

www.plymouthminerals.com Adrian Byass

Managing Director

E:

abyass@plymouthminerals.com

|

|