Carbine Tungsten Ltd. (ASX: CNQ) Supplies Tungsten to Major Japanese Market. Seeks to Build Additional Facilities.

|

By Dr. Allen Alper

on 10/29/2014

Jim Morgan, the Managing Director of Carbine Tungsten (ASX: CNQ), offered new information about the progress of his Australian-based project at the recently held ITIA meeting. Jim Morgan, the Managing Director of Carbine Tungsten (ASX: CNQ), offered new information about the progress of his Australian-based project at the recently held ITIA meeting.

Said Morgan, “My personal background is one of project development. I’ve helped develop six major Greenfield mines around the world in my career ranging from Australia, Africa, Indonesia and the Philippines. This is my first venture into tungsten. Prior to that, other project s developed were in uranium, titanium, Gold and copper. I prefer to work with small cap companies and help them grow. The uranium company, for example, grew to be the best performing stock on the ASX for quite some time. Whilst the project at Mt Carbine is a relatively simple brown-fields re-establishment. My prior experience has been in developing projects that can’t be delivered quite so easily in some remote and difficult locations. So the Mt Carbine project is idyllic. Far North Queensland represents a very low risk, low cost project when benchmarked against the very few other potential tungsten projects”.

Morgan uses a group of experienced managers to move his projects forward. He said, “I have been very lucky to have a group of top class people that have collaborated with me for the last twenty-five years or so, on and off. We have managed to gravitate together and we enjoy delivering challenging projects to make them a great success. We have delivered a number of projects successfully around the world that have helped to turn some small cap mining companies into mid tier or majors and the team has some fun in overcoming the challenges along the way. My team includes a number of managers and some senior staff from the original operational mine in the 70’s and 80’s at the Mt Carbine mine operation, when it was Australia’s largest open pit tungsten producer. These include the key geologist and metallurgist who have consistently believed, passionately, in the unrealized value and incredible upside of the Mt Carbine project, based on their direct prior hands on working experience at the old mine operation. That confidence and passion has remained burning for over 28 years. We also have, as part of our experienced board, a Canadian director that previously as a consulting metallurgist was familiar with the past Mt Carbine operations. He too has worked internationally in evaluating a large number of projects for many major mining companies around the globe. My task then is simply one of steering and facilitating a great team to deliver a great project and grow the company from a small cap miner to its maximum potential to benefit our company and all stakeholders, shareholders, investors, employees, local community and our off take and funding partners.

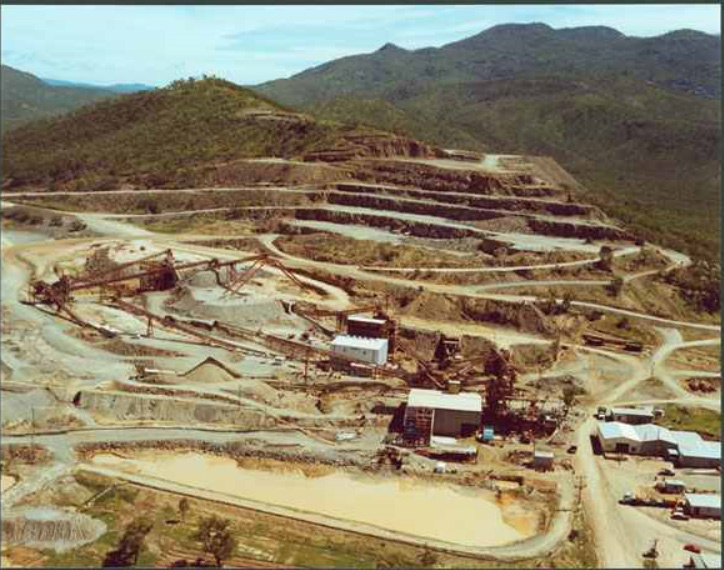

The project itself is located in the state of Queensland in Australia. Said Morgan, “The Mt Carbine tungsten project in northern Queensland has been historically mined for over 100 years. It is quite an exciting project; because Mt Carbine, along with the majority of the western world’s other tungsten mines, closed down during the late 80’s and 90’s due to Chinese oversupply of cheap tungsten into the market. Nowadays the situation has completely changed. China is now exporting very little tungsten concentrate to the rest of the world. Now the Chinese prefer to supply only finished tungsten products. Tungsten concentrate prices are remaining relatively strong whilst many other metal commodity prices have declined significantly. So bringing hard rock production to market as soon as possible is a key objective. We have also been in production from our research and development tailings retreatment project. We are still working on it, in terms of recovering high grade tungsten concentrate from processing tailings. That is to say it is the waste from the previous open cut mines production that we have been processing. We are focusing on our hard rock assets and are very mindful of the tungsten price in relation to conducting ongoing tailings operations. We consider the tailings project an R & D project that has taken us through a valuable learning curve and given us tungsten production experience and won credibility as a supplier to our off take partners”.

Unlike some other tungsten companies that are exploring or building, Morgan’s company already has proven experience in delivering tungsten concentrate into the market said Morgan, “We have been supplying Mitsubishi from our R&D tailings retreatment operation. We know what tungsten concentrate actually looks and feels like to produce and what the concentrate market requirements are. There are very few producing mines, it is a small club. There seems to be a lot of hopefuls, but not a lot can deliver. We don’t actually fit that mold. We are a company that has a proven past operation and proven people that will bring the hard rock mine back on and have extensive experience in doing so.

We have already been in production from our R&D tailings operation we are now fully focusing on developing our hard rock stockpiles and open cut mine production. We will continue our tailings retreatment R&D work as a small side operation. There are some differences in concentrate pricing from China to Europe particularly as there are no direct concentrate prices quoted in Europe and very little Chinese concentrate is actually exported from China. Thus the concentrate price in China is a Chinese domestic price only and not directly relevant to western based countries. As with other scarce and strategically important metals, one of the key points of interest for off takers and end users is long term security of supply. We believe that is yet another key advantage and potential upside advantage to our project, given our long term production history and future realistic exploration opportunities.

On October 7th Carbine Tungsten Limited (“CNQ”) announced that it has received notification from Mitsubishi Corporation RtM Japan (“RtMJ”) that the board of RtMJ has approved, subject to the finalisation of documentation, a US 15 million dollar secured loan (including prepayment fund of the previous US 1 million dollar loan) to fund CNQ’s initial phase of its Hard Rock Tungsten Project for the implementation of its 12 million MT stockpile project.

While the company has been predominantly supplying tungsten to Japan, they see a future in other areas of the world. Said Morgan, “We see ourselves as a mainly western world potential supplier. We have also had Chinese interest and remain open to that. Our main funding partner has been Mitsubishi of Japan. We have had a long relationship with them and they have agreed to fund a fifteen million dollar stockpile project. There are 12 Million tonnes of pre-mined material available at the surface. The past proven process of gravity separation is basically being re-used with some modern enhancements. We have the past operations metallurgist as part of our team to add other processing smarts learnt from the past hard rock processing operations. The fifteen million dollars is going to be used to purchase the equipment that we need. It is a whole new build. The project already has a power supply, water, tailings dam and road – everything you might expect from a mine that has been shut down.”

The company has already arranged for all of the major permitting and deposits that are needed to proceed. Said Morgan, “Our approvals are in place with the financial bonds held with the government that will allow the project to move forward as we wish. We are waiting on the cash from Mitsubishi. They announced last spring that they had completed extensive technical due diligence. We have now passed their legal due diligence and discussed the security deed and we are about to make some announcements around that shortly. I’m expecting an announcement about that imminently. We see this as a staged project. The next stage following the hard rock stockpiles will be to re-start the open pit. That is the real excitement of the project. We want to benefit from the old open pit grade.”

The resource itself is quite robust. Said Morgan, “The stockpile project will deliver six thousand tons of WO3, and we have an additional twenty thousand tons modeled for over ten years of production when the open pit capacity is combined. We have a relatively untouched area of exploration that extends for two kilometers. The mine is in a highly tungsten mineralized zone. In the existing open pit, the general mineralized split is favoring wolframite, which is one of the metals that seems to be in favor for direct Ferro tungsten use. Ore in the pit is dominated by wolframite, with a wolframite to scheelite ratio of approximately 80:20. The current resource is JORC 2012 compliant. Our development model will focus on the higher grade wolframite production. The stock market investors want to see the funding come in from Mitsubishi. We have been quite grateful to have some funding to do some test work. They have also paid for some of the environmental work that we have done. One of the challenges was not to sell all of our production just to one off taker unless the arrangement is favorable in the long term to our company. That can potentially deplete the upside unless the right deal can be struck. Tungsten is a commodity that is used in very many facets of modern manufacturing and is in short supply. So we are very keen on tungsten. The attendees at this conferences display it as strategically significant. It is a future-proof material. Our project is proven and the resource is likely to show future upside. We have a very strong team and a world class tungsten project.”

http://www.carbinetungsten.com

Carbine

Tungsten Limited

50 Scott Street, Bungalow, Cairns, Qld 4870

PO Box 1040, Bungalow, QLD 4870

Email: info@carbinetungsten.com.au

Website:

www.carbinetungsten.com.au

|

|