Eastmain Resources (TSX: ER) Advances Eau Claire Gold Deposit in Quebec with Outstanding Grades

|

By Dr. Allen Alper

on 3/2/2014

Eastmain Resources (TSX: ER) recently visited the Metals and Minerals Show where they took time to speak with the media and potential investors about the progress they are making at the Eau Claire gold deposit in Quebec.

According to Don Robinson, President and CEO of the company, “We laid out 2000 channel samples from the 450 West Zone where we have discovered some of the best assay results ever seen on the project, including up to 39.2 grams gold per tonne across 8.5 m.” Eastmain’s 2013 drilling from the Eau Claire gold deposit includes 122 intersections with an average grade of 10.8 grams gold per tonne across 4.25 m. Said Robinson, “2013 trench sampling and drilling has confirmed wide zones of high grade gold with intercepts of 10.9 grams gold across 12.0 metres in hole 501 and bonanza grade assays of 131.48 grams gold per tonne over 2.0 m in hole 524. There are 85 gold-bearing veins that have been discovered to date.”

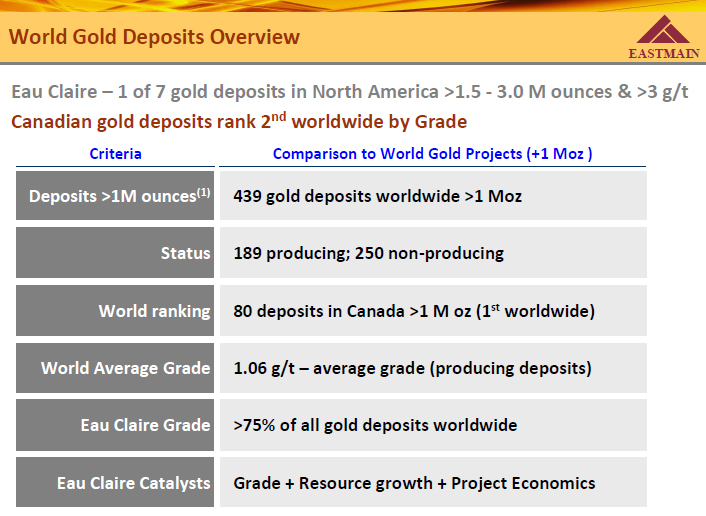

What makes the work done by Eastmain so unique is that the quality of the deposit is quite different from what other exploration companies are currently experiencing. Robinson said, “The grade of this project is what makes it amazing. The average open pit grade of our project is currently 4.67 grams gold per tonne, compared to many larger projects containing in the order of 1 gram gold per tonne.” Despite the smaller size of the Eau Claire project, Robinson and his team have concluded that they will produce three to five times more gold per tonne of rock than the average producer, thereby decreasing their costs and improving their profitability. Robinson commented that, “Our industry has lost sight of economics in exchange for size.” Potential profitability is what makes Eastmain’s Eau Claire project so attractive.

Currently, the company is not seeing a lot of reaction from the markets. Robinson said, “Our objective is focused on defining high grade potentially mineable resources at the top third of the deposit. We have intersected excellent grades and thicknesses ranging from 5 to 15 meters, well above the resource cut-off parameters. Gold grade is the principal value driver at Eau Claire along with mine ready infrastructure including a permanent road and power located nearby. Dr. Robinson reported that, “The deposit is 1.8 kilometers long and 900 meters deep. We are currently drilling holes underneath and lateral to the open pit target within 150 to 300 meters of surface to expand and define additional mineable resources.”

This work is focused on determining the amount of gold that may be available for processing at Eau Claire. Robinson said, “The more ounces we can get into the an open pit classification, the better. We have a substantial drilling program of 30,000 meters that will continue until the week before Christmas. This will provide news flow for the market and necessary data for the resource.” Adding to their news stream is designed to help the company get information out to stockholders and potential investors. Said Robinson, “It gives us ammunition to build our economic model.”

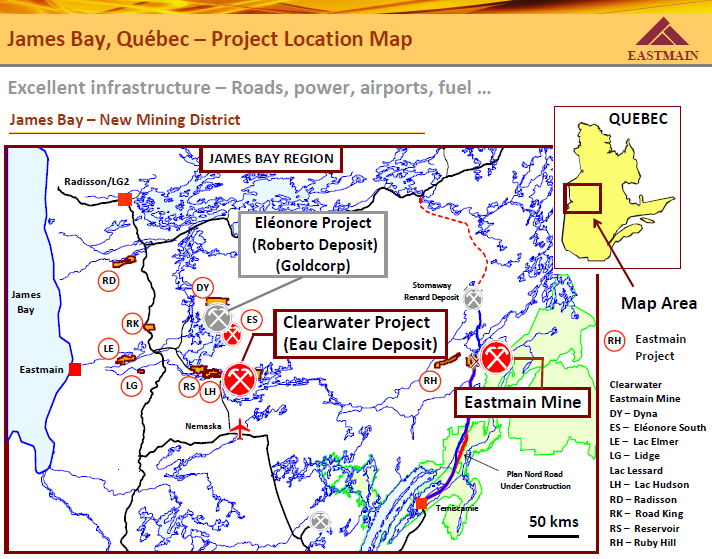

Eastmain’s efforts at staying active have benefitted the company. Said Robinson, “We are closing a private placement that is oversubscribed for $4.5 million. That is an enviable position to be in under these market conditions. We are financed through 2015. As stewards of the company, our job is to keep the company strong while minimizing dilution. If you aren’t able to keep exploration activity going, it is hard to keep the market interested, especially a market that is acting like a deer in the headlights. We are one of the most active explorers in the James Bay district of Quebec and 100% owners of two gold deposits. The drilling is adding value to this asset.”

As the company advances the project, they are adding to their management and technical teams. Robinson said, “One of the things we are prioritizing is to fortify the technical group with experience in mining and development. We have recently added experience to our development team with the appointment of Mr. Serge Bureau, an expert in mining development of both open pit and underground operations."

The Eau Claire gold deposit represents one of seven undeveloped gold deposits in North America containing from 1.5 to 3.0 million ounces of gold at a grade in excess of 3.0 grams per tonne.

Why should investors consider Eastmain as a stock to add to their portfolio? Robinson said, “We are in a mining-friendly jurisdiction. We have a major shareholder in Goldcorp. They have been a shareholder for ten years and have invested over $10 million dollars in the company. We have been able to keep exploration activity going in strong and weak markets. We acquired the Eastmain Mine for $4 million dollars, which included $40 million in surface infrastructure when the market was down. The project has become an important asset. The Eastmain Mine includes 10 kilometres of real estate that covers the "mine horizon". This former gold producer has significant exploration potential and made money when gold was $300 an ounce. We have twelve projects in this new mining district that cover more than 1200 kilometres in total. We have flown airborne surveys over the top six in the last six months. We have been able to demonstrate significant exploration success in a difficult market. My partner and I are shareholders and are cognizant of dilution. Our principal objective is to demonstrate that there are sufficient resources to support a long-life, low cost, highly profitable gold deposit for a minimum mine life of 10 years."

Disclosure

Allen Alper owns Eastmain

Resources Stock.

http://www.eastmain.com/

Corporate Address 36 Toronto

Street, Suite 1000

Toronto, Ontario

M5C 2C5

Canada

Exploration Office 834572, 4th Line EHS,

Mono, Ontario

Canada

L9W 5Z6

(519) 940-4870 (519) 940-4871 (fax)

info@eastmain.com

|

|