Sierra Metals (TSX: SMT) Expands Production and Exploration at Yauricocha, Bolivar and Cusi Mines Located in Mining-Friendly Peru and Mexico

|

By Dr. Allen Alper

on 2/26/2016

Mark Brennan, President and CEO of Sierra Metals (TSX: SMT), took the time to speak with Metals News about the progress that the company has been making in the last year. Mr. Brennan was a cofounder of Desert Sun. Then as President of Largo Resources he led the acquisition of the Maracas vanadium property, arranged funding and directed development of the project for it to become one of the world’s largest and lowest cost primary vanadium mines.

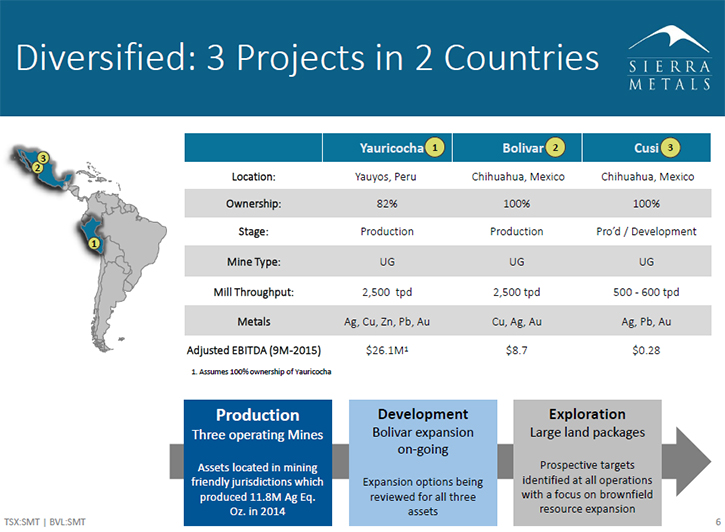

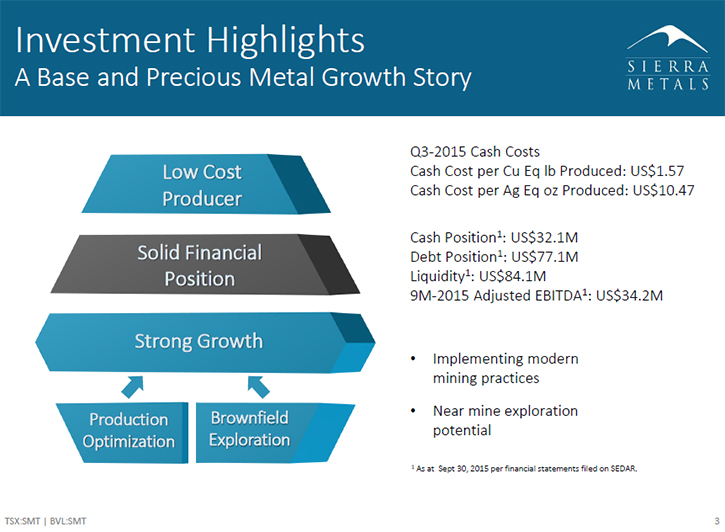

Mr. Brennan said, “Sierra Metals is a Canadian listed company with three production assets. Our flagship asset is the Yauricocha property in Peru, which is a couple hundred miles southeast of Lima. We have two production assets in Mexico, in the state of Chihuahua. One is the Bolivar property and the other is the Cusi property. The objective for Sierra is to build on these three mines. These mines have historically been some of the lowest cost producers in polymetallic metals. Traditionally, we have a very low cost operation, but obviously we are experiencing a very difficult and challenging market environment. At the same time, we are looking to be healthy and positive for the year as we look to grow our balance sheet.”

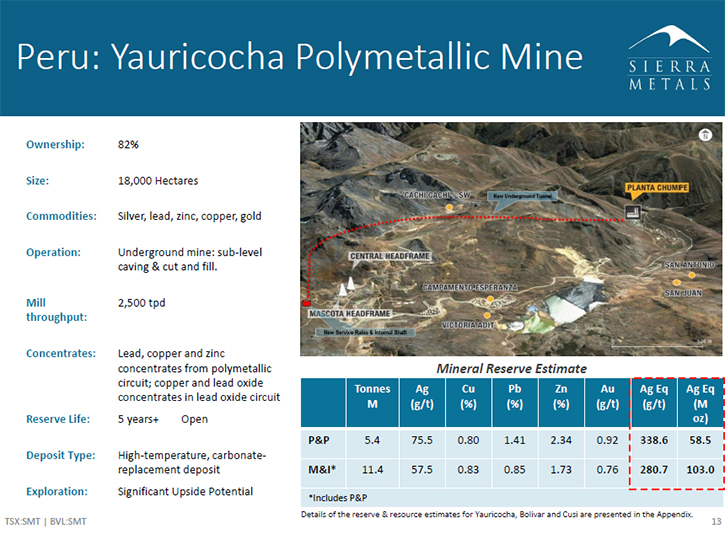

Yauricocha is the flagship of the company’s assets. Brennan said, “Yauricocha is a mine that has been in production since 1948. It is a very prolific mine that we are continuing to exploit. Historically it has been run like a private company mine, where previous ownership has just followed the vein, spent very little on exploration and development and cut costs over-aggressively. They didn’t plan for the long term and bring in new mineral resources and/or mines, which would have required new capital. The sole direction was really to pull money out of the project.”

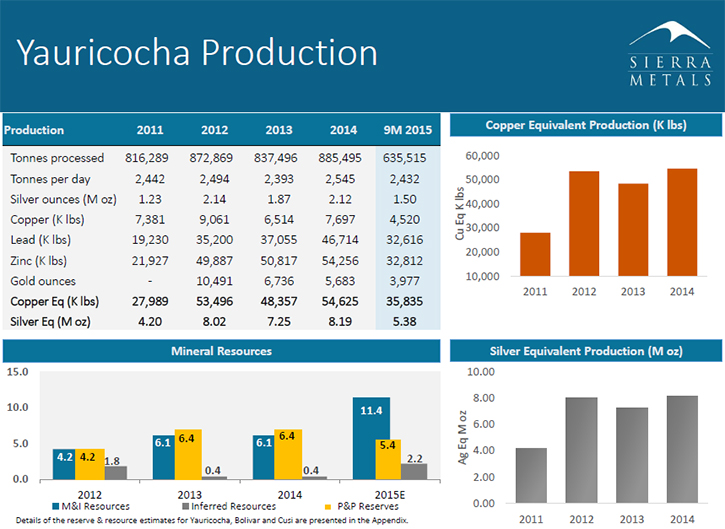

The direction for the Yauricocha mine has changed since Sierra and the new management team took over. Mr. Brennan said, “Since we became involved in March of last year, we have come in and restructured the mining operations and are looking to optimize production. We have renewed the top three managers at the mine. We are moving away from existing methodologies, which have been slow, laborious and not entirely safe. Currently, we are transitioning to best practices, modern technology and advancement techniques that have all been used in North America to really accelerate and grow our production, while at the same point aiming to reduce costs. We see some strong growth coming from Yauricocha in the coming years. Yauricocha has traditionally produced about 2,500 tons per day. New management is targeting production of 4,000 tons a day within the next 24 months. From that perspective, we see very strong growth coming from the central mine area.”

The company is also looking at ways to grow the company through increases to the mineral reserves at each of the mines. Brennan said, “What we are also looking at is brownfield exploration growth. Brownfield is essentially the exploration and hopeful discovery of ore bodies within a kilometer of the headframe, which can be brought into production very quickly; we are not looking at regional exploration. We have had brownfield success with the recent discovery of the Esperanza Zone located approximately 400 metres from the central mine. We have about five areas near Yauricocha in addition to the Esperanza Zone that we are very excited by and consider to be high value targets. We will continue to drill at Esperanza to expand the zone and complete infill drilling, with a view to bring some production in from that zone in the third quarter this year. We have also started drilling on a number of the other areas and hope to have more news out by the end of the second quarter. We expect to see some very positive results from these targets. Our goal is to release drilling grouped as a proof of concept which can demonstrate the potential of a zone rather than just release one-off drill holes.”

One of the benefits of the properties that Sierra owns is that they offer a wide range of products. Mr. Brennan said, “We are producing silver at Yauricocha as the primary product. That is followed by zinc then lead, copper and gold. It truly is a polymetallic mine, with very strong production coming from multiple commodities.”

Bolivar and Cusi are other projects that Sierra is looking to expand. Mr. Brennan said, “Bolivar in Mexico has been growing very dramatically. It is very similar to Yauricocha in that it is a carbon replacement deposit. Bolivar was running at less than 400 tons per day in 2011, and now it is running at 2,500 tons per day. We expect that it will grow to 4,000 tons per day soon. It doesn’t have the same ore quality as Yauricocha, but it is a profitable mine nonetheless. Our expectation is that our exploration there will give us success and increase the grades and that will increase the value of the mine. Cusi produces about 600 tons per day and is the baby of the family. The deposit has about 32 million ounces of silver equivalent ounces in resources. We are hoping that Cusi will transition in 2016 to a full production mine from development. We have built it up and developed it in the last few years and we are now looking at more production and positive cash flow from the mine. Cusi is a thermal deposit which is different from Yauricocha or Bolivar.”

Brennan has positive things to say about mining in Peru and Mexico. He said, “Peru has been a very friendly mining jurisdiction. The government institutions are very receptive and pragmatic and they understand the importance of mining for Peru. They try to be very supportive and helpful to the mining community, and at the same time institute the mining procedures and safety procedures. With respect to Mexico, it can be a bit more complicated legal environment. The legal environment is fraught with unusual circumstances, but the government has been very supportive to the mining industry. We are operating in areas that are safe for mining, very manageable and have a long history of mining.”

In the short term, the company is looking to improve their balance sheet. Mr. Brennan said, “The chief objective is to be profitable and to maximize cash flow. We have a very healthy balance sheet with limited debt and liabilities. From that perspective, our objective will be to improve our balance sheet each year. We are also looking at growth from our production optimization and brownfield exploration programs which give Sierra strong growth appeal.”

http://www.sierrametals.com

Investor Relations

Mike McAllister

Sierra Metals Inc.

T +1 866 493 9646

info@sierrametals.com

|

|