Vital Metals (ASX: VML) Takes 100% Control of Watershed Tungsten Project in Australia with Permitting Completed

|

By Dr. Allen Alper

on 2/3/2016

Mark Strizek, Director of Vital Metals (ASX: VML), took the time to update readers about the progress that the company has made on their Watershed tungsten project located in Australia since taking 100% control over the project.

Mr. Strizek said, “As a recap, over the last four years, we have come to a fork in the road. With the help of our joint venture partner JOGMEC (Japan Oil, Gas and Metals National Corporation)., we have been able to get the funding and the technical assistance through the DFS and get all the environmental approval, having all the mining leases and working through all the Aboriginal or First Nations approvals. We would have loved to see a Japanese partner in there, but unfortunately it wasn’t to be. I know that JOGMEC tried their hardest to find one for us, but because they couldn’t they have now departed the scene. I guess that puts us in the position of having 100% of the project, so we are free to deal, so we will look forward.”

Vital Metals is still open to a partner for their Watershed tungsten project. Mr. Strizek said, “All of those contacts we made in Japan could still become an offtake or something, but obviously there is work to be done there. What we had found was that last year there were parties that had expressed an interest, but they wanted to see the project 100% in Vital’s hands or they didn’t want to work with the Japanese. It is one of these things in life. We had a great time with our previous partners. The outcome is a little different than where I thought we would be when we signed on, but I’m excited about the year and the years ahead as we look to try to bring Watershed into production.”

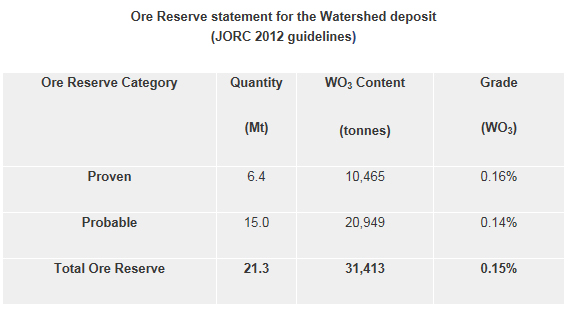

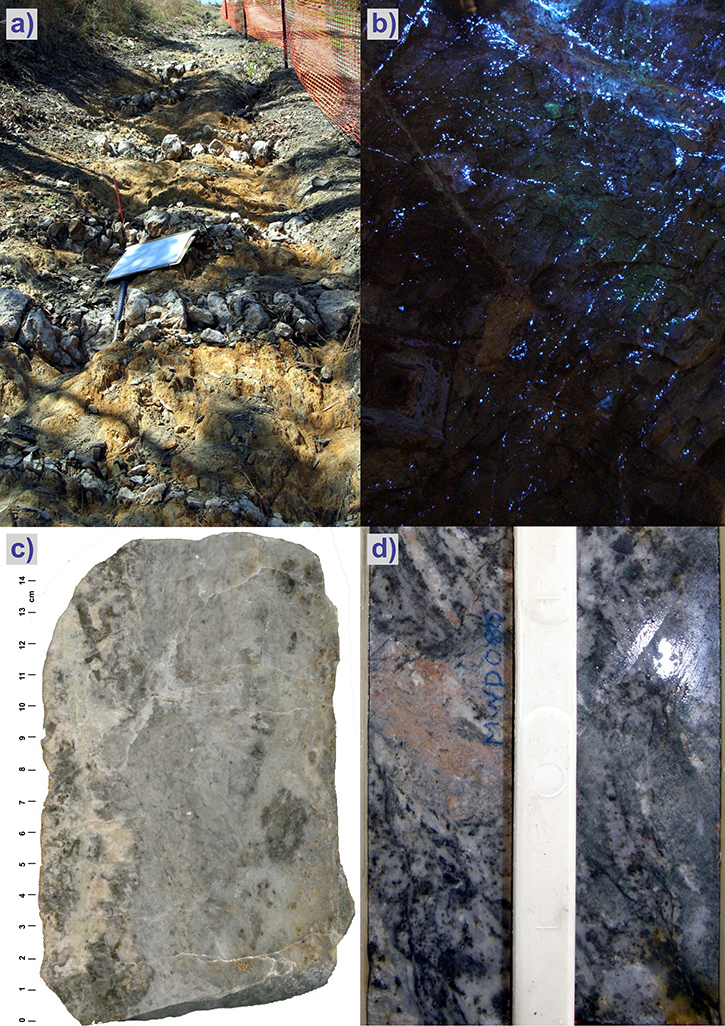

The Watershed project is unique in its size. Strizek said, “It is a fairly large resource outside of China. It definitely slots in the top ten. I think one of the key things for us is that we can produce a premium high grade tungsten concentrate without any contaminants. We don’t need to play a blending game. We have no uranium, we have no thorium and we have no arsenic. All the points that pull you up on moly, they just don’t exist. We have a very high quality material that can really be placed anywhere in the world, so I think that is number one.”

The project also has a long life in a friendly mining community. Mr. Strizek said, “We have substance in terms of a ten year project, so it is at an attractive price point that seems to be improving as we look at it. It is in a good jurisdiction. Australia is a good place to know where you stand when you invest. It is subject to a long standing rule of law and has been a very favored mining destination for investors for decades, even centuries, almost.”

Strizek believes that investors will appreciate the quality of the project. He said, “The other reason to invest is that we see the current DFS as a starting opportunity to grow it organically. There are good targets at surface that are drill ready. Also, below the current reserve and pit there are some exceptional grades, and we think there is an underground target. I mean, when we look at some of our peers, the pit we have below is a pit again almost. The underground target looks very attractive; I mean historically one of our highest grades was 20 meters at 1.27 WO3 that was drilled in 2008. It just needs further definition.”

Mr. Strizek believes that over time the company will gain the information they need to take the project to the next level. He said, “Understanding the pit and the geology and getting production going could give us more resources. Right now we are in a position where the project is held 100% by Vital. In terms of our capex and opex, we have announced that through 2015 in terms of our capex it will come down to $140 AU. We have seen some opportunities to simplify the flow sheet. That means we can eliminate some equipment. It provides a real multiplier. Our target is to push it down to $100 million AU. We think we can achieve that. On prices, that would put us at about $70 million dollars for ten years for recoverable tungsten. In terms of operating costs, we have seen a dramatic resetting of labor costs in Australia. That price is resetting and is making Australia much more competitive. At the current prices, we are around the breakeven point. As we look forward, groups from China are seeing big losses. They are reacting the right way in restricting supply. As you see the price come back to $250 it puts Watershed in a good position.”

Demand is looking better in the tungsten markets. Said Strizek, “As we have looked back, the demand side is looking really good. The automotive industry looks pretty healthy. The supply side looks like it got out of kilter. The uncertainty that came out with the WTO ruling meant that we don’t know what China will do. Ultimately, that will develop the situation of pushing the price back. Right now, though, the price is down. In talking to the end users, Western end users want reliable opportunities for concentrate. You have some artisanal or semi-mechanized, but it isn’t that substantial. For the security of the industry, we need to see a change. We are seeing a movement away from Mom and Dad operations to large, high-margin projects.”

In the end, Strizek says that investors should look at what Vital Metals has to offer. He said, “We are leveraged to the tungsten price. There is no substitute. There is a good opportunity to buy and see the recovery. The project is approved and we are optimizing it all the time. We have a good basis to go forward.”

http://vitalmetals.com.au/

Phone +61 8 9388 7742 +61 8 9388 7742 +61 8 9388 7742

Fax +61 8 9388 0804

General Email vital@vitalmetals.com.au

Mark Strizek – Chief Executive Officer

Email mark.strizek@vitalmetals.com.au

Phone +61 8 9388 7742 +61 8 9388 7742 +61 8 9388 7742

|

|