Largo Resources (TSX.V: LGO) Secures Financing to Allow Advancement of the World’s Highest Grade Vanadium Project in South America

|

By Dr. Allen Alper

on 1/1/2016

Mark Smith, President and CEO of Largo Resources (TSX: LGO), updated readers on the progress that is being made in assuring that Largo has the financing it needs to move forward with vanadium projects located in South America and Canada.

Smith said, “We are very happy about the refinancing with the bank. We have been working on that for a while. We finally got to the point where the sheet was fine and we could announce it. The market was happy with it as well.”

Smith has only been with the company for a short amount of time. He said, “I started April 1, 2015, so I have been with the company for close to eight months now. It was really a situation where the startup was not working the way that everyone had anticipated. The financial needs were certainly hitting the company in the March, April and May timeframe. So I came in with my eyes wide open and I knew that we had some things that needed to be corrected.”

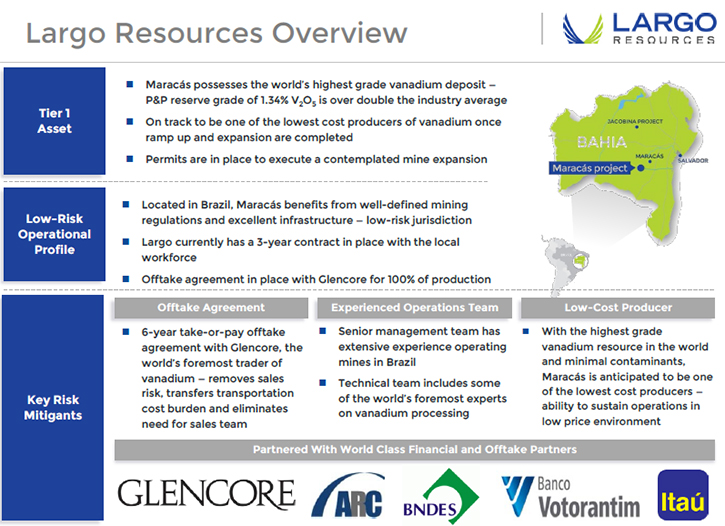

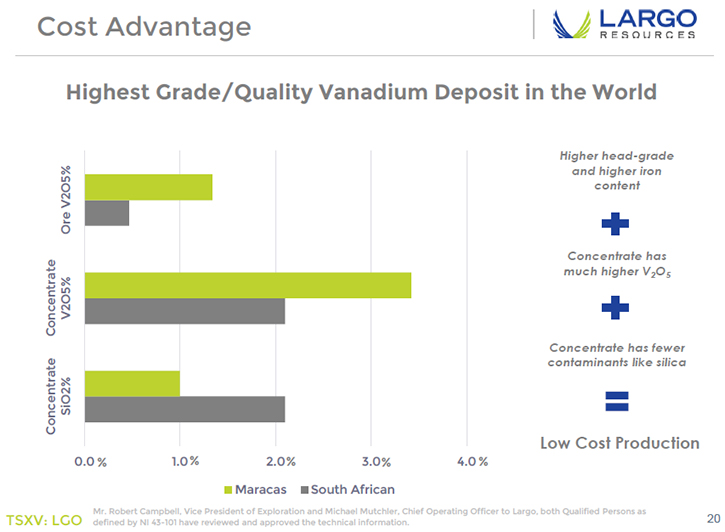

Smith looked carefully at the company before he decided to take on the leadership. He said, “What really attracted me to Largo and to coming on to Largo was the resource itself, which I think is absolutely world class in nature. Every possible way to look at it is world class. It is a huge, gigantic resource and its ore grade is two to three times the most prominent vanadium deposit. Things like silicates; it has some of the lowest silica as well.”

The Largo team has worked diligently to deal with the issues that the company was having. Smith said, “You start out with a great resource and you start working on the metallurgy and that was the problem that we were having. With the vanadium, the problem was trying to pull it out of the ore and trying to get a sellable product that we can offer to the customer. We have really worked hard on the metallurgy. I’m happy to say that at this time, after about eight months with the company, I feel very confident that the technology issues that we were facing are behind us. We are now looking at some of the highest recoveries of vanadium known in the world. When you couple really good technology that puts recoveries with an ore body that is already the highest vanadium ore grade in the world, those are two awfully good things going in your favor.”

Smith feels confident that the company is on the right track. He said, “Most important of all is that I did my due diligence on the company before I started. The one thing I noticed was the caliber of people and the commitment that these people had to making this resource be what it could be. That attracted me by far and away the most. In my thirty four years of being in the mining business, I guess one of the easiest formulas I’ve found is that when you have a world class ore body, your metallurgy is working and you have people who are unbelievably passionate about excellence and commitment that is a recipe for success. I like to be part of successful things. I strongly believe that Largo is now positioned to be a successful vanadium mining company well into the future.”

Like many other companies in the mining sector, Largo has been affected by low prices. Smith said, “We firmly believe the markets will improve. We believe that we have our house in order. If it weren’t for the excessively low price of vanadium right now, people would already see that. I hold out a lot of hope on where the market is going.”

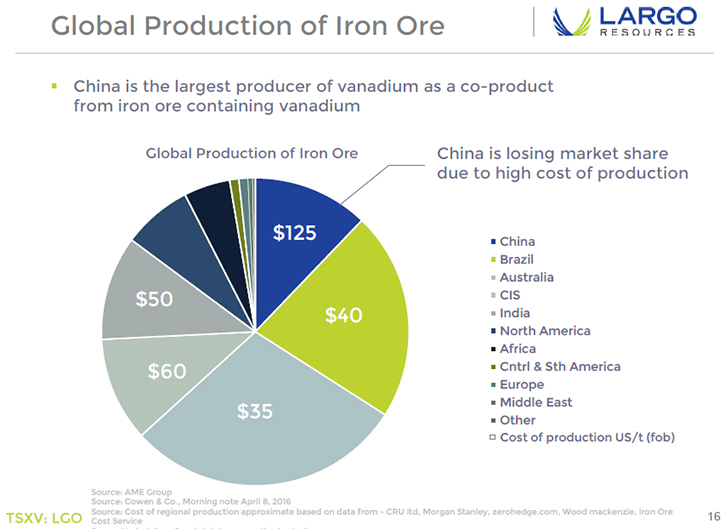

Smith believes there could be a rapid turn in the vanadium price. He said, “A couple of entities are now in bankruptcy and most of the world’s working inventory of vanadium is quite low. If you start thinking about the vanadium world market and the majority is coming out of China as a result of co-product production. They take the iron ore and when they make steel, they pull the vanadium out of the slag material. That slag is the result of the majority of vanadium on the market is coming from. The vanadium is skyrocketing in China because the steel making is going down. That means the vanadium production in China is going down. We could have a very tight market in a very short amount of time. There are eight producers in China that produce about 80% of the world’s vanadium. It doesn’t take a lot to see that there could be major impacts in a short amount of time. That is the reason that we have been able to convince our banks and investors that Largo should last over time. We have a lot of stars that are starting to align.”

Financially, the company has one more hurdle to overcome before they are able to get access to their financing. Smith said, “We have equity on our books. We have about 180 million shares outstanding. Of the 180 million shares, there are fewer than six shareholders that make up 80% of the company. The small amount of shareholders that make up the large amount of ownership understand the progress we have made on the metallurgy side and want to keep us going into the future. There is a condition before we close on our loan, they want us to raise $20 million dollars as an equity infusion. Knowing our shareholders, I feel confident that we can do that. They will help us to keep the company in the condition that it deserves to be in. We have some of the finest vanadium people in the world. Because of the support of our shareholders, we will have the ability to carry on.”

Disclosure

Dr Allen Alper is a former Director of Largo Resources and has a financial interest in the company.

http://www.largoresources.com/

Largo Resources Ltd.

55 University Ave. Suite 1101

Toronto, Ontario, Canada M5J 2H7

416-861-9797

|

|