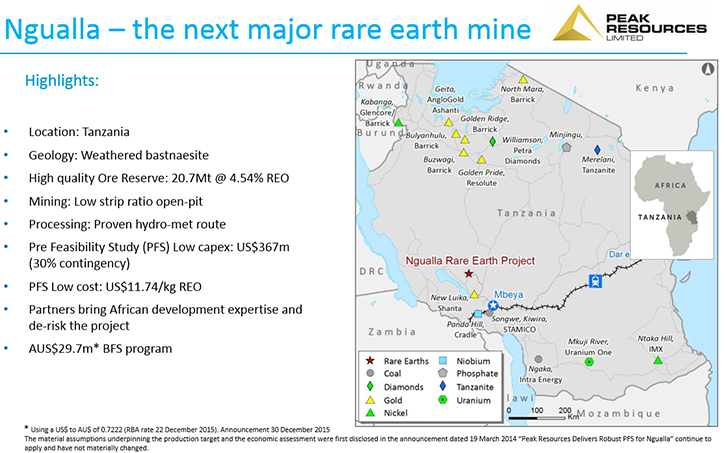

Peak Resources (ASX: PEK) Advances Ngualla Rare Earth Deposit toward Production with High Grades and Low Capex in Tanzania

|

By Dr. Allen Alper

on 2/1/2016

Darren Townsend, Managing Director of Peak Resources (ASX: PEK), shares with readers the progress the company is making toward rare earth production at the Ngualla rare earth deposit located in Tanzania.

Mr. Townsend said, “I’m a mining engineer by background. I started off my career with Rio Pinto in the iron ore business and then progressively got to smaller and smaller companies with more and more specialty type metals. My operational experience with specialty metals is that I built and then operated, for over five years, the world’s largest Tantalum mine. Since then I have been getting involved with junior explorers. Prior to joining Peak Resources, I was the CEO of a Canadian listed company called Canadian Wildcat with a Niobium and rare earth project in Kenya, where I did all the resource drilling scenarios for the mining license. Then I joined Peak two years ago. I joined the company because I knew the Technical Director and because of the quality of the project. He and I used to work together at another company called De Grey Mining. I also used to run into Peak’s then Chairman, Alistair Hunter, at a number of industry events. That is how I got to know about the company and the project. “

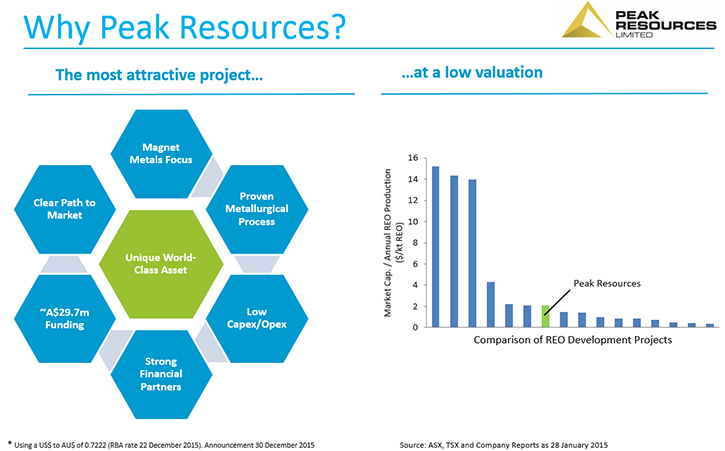

Townsend was drawn to the company because of the Ngualla project. He said, “I was very impressed by the size and the quality of the project. Rare earth projects really come down to grade and metallurgy. That is the key aspect, metallurgy and composition of the rare earth. We are lucky that Ngualla is very high in Neodymium and Preseodymium, which are the magnet metal rare earths. It is the world’s highest grade developed project for those two metals. Those two metals are the most valuable of the rare earths. The bulk of the composition of high powered magnets is made from these two metals.”

The company is moving forward on feasibility at this time. Mr. Townsend said, “We are in the process of completing the bankable feasibility study at the moment. We have finished the rare earth resource drill outs and obviously the prefeasibility study. We have financing partners in Appian, a private equity group out of London and IFC, part of the World Bank. They are our partners in the project. They are actively supporting us with the completion of the bankable feasibility study. We aim to complete that study by the end of 2016.”

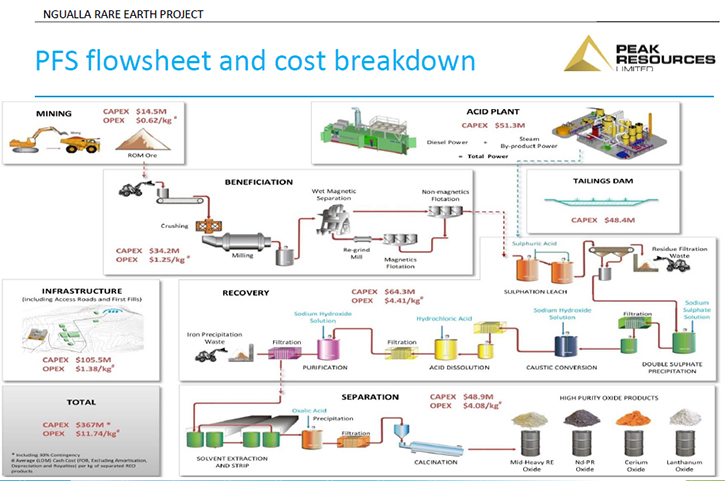

Financially, the company is in a good position and is using the funding from the Appian/IFC transaction to further the feasibility study and pilot plant testing. Townsend said, “We did a transaction of about $25 million US approximately, and we have had about US $17 million dollars come in so far. We still have the last phases of funding to come in. It is a great time to be doing a study. As you can imagine, the consultants are a bit cheaper than they were a few years ago. Not only are the rates competitive, but we can get access to the A-teams. We have access to some of the top people in these organizations. We have just successfully completed the beneficiation pilot plant. That is where we take the raw ore from the pit, which grades around five percent, and we have proven through a pilot plant that the average grade that we get from a concentrate is about 40%. That is a really big advantage of the project as it is a high grade for rare earths. We aim to commence the hydro met pilot plant this quarter”

Peak Resources has also added experienced leaders to the team. Townsend said, “Rocky Smith, [the new Peak Resources COO], came from MolyCorp. He has five years of operational experience of commissioning a rare earth operation. There are only two or three people outside of China who have done that. He is a huge asset to the team. He brings a wealth of experience with him. That adds to our existing team and gives a huge tick of confidence to join a junior developer. He wouldn’t have joined us if he were not confident in the project.”

It will take a bit of time before the company is ready to make a final decision on whether to build the plant. Mr. Townsend said, “The decision to build the project will be about mid-2017. It will take about six months to organize the debt financing off the back of the bankable feasibility study. The main product that we are looking to produce will be a Neodymium / Praseodymium mixed rare earth oxide, which will be 99.9% purity. This product is used in super strong magnets and are used in drive motors of hybrid and electric vehicles and wind turbine drive motors.”

The company aims to release new capex and opex numbers in the first half. Mr. Townsend said, “We are quietly confident with our cerium rejection strategy, and focusing on the magnet metals Neodymium and Praseodymium should leave some improvement in our cost numbers.”

Townsend believes that the demand for technology metals will drive the business and should interest investors. He said, “The market for rare earths in terms of the metals that we will be producing has a strong annual growth of 7%. There is good demand in the sector based on technology with the highest growth sectors being electric and hybrid vehicle applications and wind turbines. We happen to have the world’s highest grade undeveloped deposit for these two magnet metals. We are the best of the class coming through in an ever shrinking fish pond.

The next key advantage is our metallurgy. That drives the economics of the project. Our capex is significantly lower than any other. Our PFS capex was $360 million dollars, which we aim to lower, and it is lower than most other rare earth projects. We have a very long life mine, a 30 plus year mine life using 22% of the global resource. Adding guys like Rocky Smith to the team allows us to build it and operate the project.”

http://www.peakresources.com.au

Head Office

Address

Ground Floor, 5 Ord Street

West Perth

Western Australia 6005

Telephone

+61 8 9200 5360 +61 8 9200 5360 +61 8 9200 5360

Facsimile +61 8 9226 3831

Email: info@peakresources.com.au

|

|