King Island Scheelite (ASX: KIS) Makes Progress with Australia-Based Dolphin Tungsten Project, Dewaters Old Mine

|

By Dr. Allen Alper

on 11/8/2015

Johann Jacobs, Chairman of King Island Scheelite (ASX: KIS) spent time recently at the ITIA meeting and shared his thoughts about the market and the progress of the company. He said, “As expected the meeting was very downbeat in terms of demand and pricing. The people I spoke with in the meeting did see some light on the horizon going forward with an uptick in prices sometime in early 2016.”

Jacobs said, “The major reason for the downturn in demand is obviously the world oil price. The number of oil rigs out in the field is less than half of what it was twelve months ago.” Tungsten is in demand as part of the hardware needed for mining and oil exploration and production. Jacobs said, “Obviously, the drill bits are a large consumer of tungsten. Having said all that, we have experienced a 35% decline in the Australian dollar against the American dollar which has offset some of the US$ price reductions.

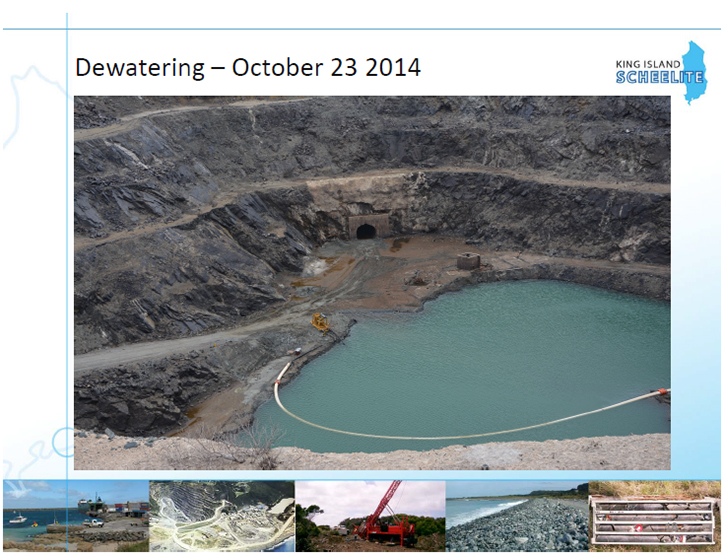

The company has moved forward to improve the old mine that is on site. Jacobs said, “What we have done over the last twelve months is to dewater the old mine pit, which was closed in 1990. It filled up with water when it was closed. We had a very large pump in there moving 425 liters a second and that carried on for over three months. The mine is all but dry, except for the sump right at the bottom of the mine’s open cut. The portal that gives access to the underground mine is dry.”

The company has not explored the old underground mine as yet. Said Jacobs, “We have not done any reconnaissance into the underground mine, but the portal is totally visible and exposed. We then did some drilling in January and sent a large sample for analysis to see if the assumptions that we built for the open cut feasibility study are all confirmed with the geology down there.”

Working on the analytics has been a large part of King Island’s focus over the last quarter. Said Jacobs, “Over the last couple of months, we have worked pretty hard on completing the DFS and it is now approximately 95% complete. The other thing that is important is that about three weeks ago we released a revised JORC compliant reserve statement that gives us a reserve of 3.14 million tons at 0.73 %WO3 grade. That is a very high contained metal and our metal is 8.28 million tons at 0.97 %WO3 grade and includes the underground at 1.2% WO3 grade”

The grade increases as the mine gets deeper, which will help with the economics of the project. Said Jacobs, “As the mine increases in depth, the grade also increases. That goes a long way into offsetting the increasing mining costs. The anticipation for the open cut in the feasibility study is an eight year mine. We did do an eight year scoping study on the underground but that isn’t in the feasibility study. So the feasibility study shows that we will produce about four thousand tons of 65% concentrate per year, which will result in about 2600 tons per annum of WO3.”

The company is currently working to find offtake partners that can assist in the financial aspect of the project. Jacobs said, “At the moment, we are talking to potential offtake partners. The offtake partners are crucial in getting financing.” In addition, the company is exploring other financial options. Said Jacobs, “In parallel to talking to the offtake partners, we are also talking to debt people as well as equity partners or investors. That’s what we are concentrating on for the next quarter.”

The costs of the project are also being re-examined currently. Jacobs said, “The capital costs would include a full mine fleet if we were going to mine the operation ourselves, we would be looking at about eighty million Australian dollars. The operating costs (these are the average costs which would be lower in the first four years) excluding interest costs, would be about $155 Australian dollars per metric ton unit. If today’s prices are $185 US that would give us $260 dollars Australian that would give net revenue of around $200 against costs of $150.”

Like many businesses working in the mining industry, King Island Scheelite is facing challenges with the current conditions of the markets. Jacobs said, “The difficulty we have right at this point is talking to financiers given the price declines over the last two years. We need some sophisticated guys that believe that the market is at a low point.” In addition to talking to financiers, they are also looking at ways to reduce energy costs and improve their processing technology. Jacobs said, “There are government agencies that would be interested in a hybrid solution that would reduce our energy costs by about 30%. There is a significant savings there. We are also looking at ore sorting that would help reduce the ore reporting to the processing plant – which could significantly reduce operating costs.

Jacobs feels confident that the management has the experience to take the project to the next level. He said, “There are a number of investors, who are significant shareholders in the company. They are very experienced mine people who were all founders of a company called Excel Coal. It was acquired for more than $2 billion dollars. They built it up over eight years. They are very experienced investors. The Dolphin project is all but totally permitted. We are looking for some slight alterations from the Environmental Protection Agency. We have all the other authority. Once the funds come in, we are ready to commence.”

Investment Highlights

One of the world’s known highest grade tungsten deposits, with a reserve grade of 0.73% (open-cut) and a resource grade of 1.20% (underground) compared to peers published at between 0.15% to 0.4%

Mineral reserve of 3.14 million tonnes at 0.73% WO3 supports initial open cut mine life of eight to nine years

Large Scale capacity with the Dolphin Project expected to mine and mill 450,000 tpa of ore and produce an average of around 4,000 tpa of tungsten concentrate (65% WO3), containing around 2,600 tpa of WO3, upon completion

Low capital cost redevelopment, with upfront estimated expenditure of A$78.5M including A$1.4M expenditure to date, mainly on the processing plant design and dewatering the pit

Low operational costs through initially utilizing the existing open cut mine

Sound understanding of geological conditions, benefiting from almost a century of historical mining operations

The Board and management have significant experience in the development and operation of mining assets, working for some of the leading mining companies in Australia and globally

The Board, and other top five shareholders, own over 50% of the issued shares

http://www.kingislandscheelite.com.au/

Level 26, 259 George

Street

Sydney NSW 2000

Telephone: +61 (0)2 8622 1400

Facsimile: +61 (0)2 8622 1401

|

|