Interview of Scott Parsons, VP of Investor Relations of Alamos Gold Inc. (TSX: AGI, NYSE: AGI): Strong Balance Sheet, Very Strong Portfolio and Developing Six low-Cost Projects

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC`

on 5/24/2016

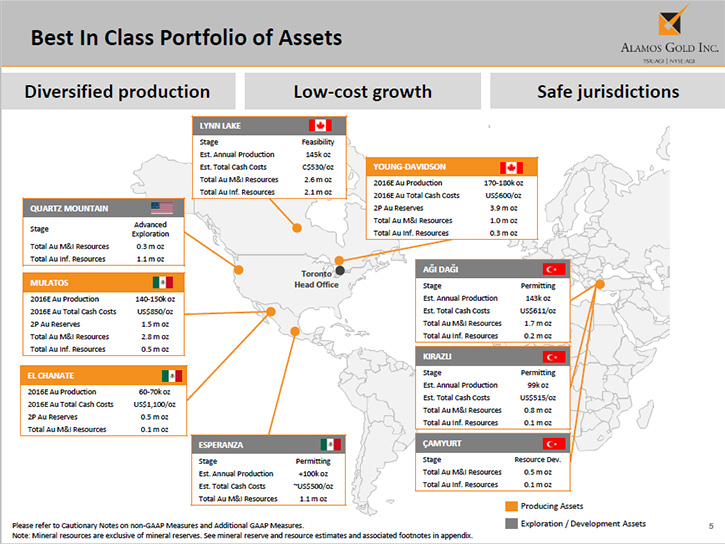

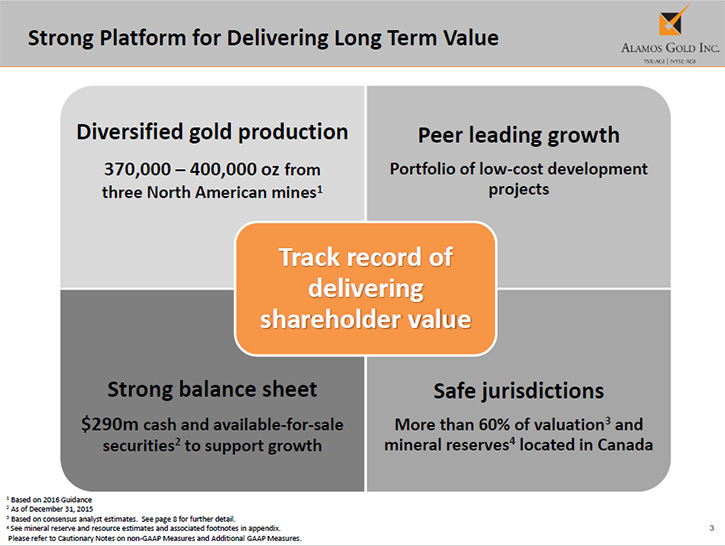

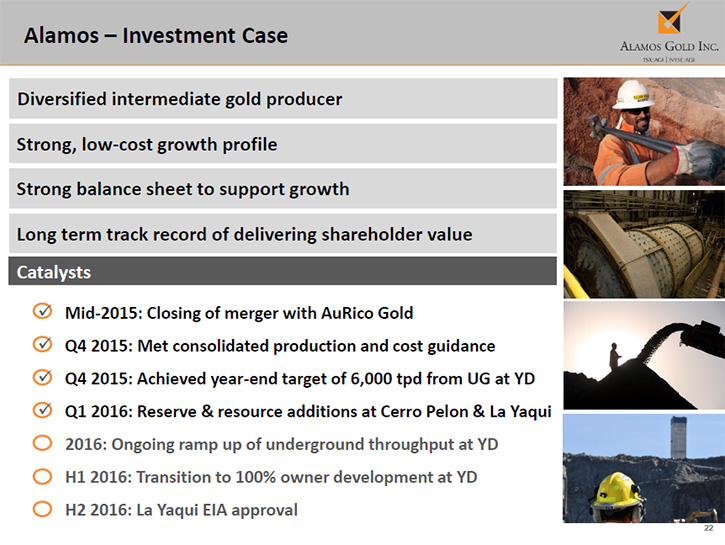

Alamos Gold, Inc. (TSX: AGI, NYSE: AGI) is a growing gold producer with diversified gold production from three mines in Canada and Mexico, two of the best mining jurisdictions in the world. The company also has a portfolio of six low cost development projects. According to Scott Parsons, VP of Investor Relations of Alamos Gold Incorporated, they also have one of the stronger balance sheets in the mining space. The company expects to produce 370,000 to 400,000 ounces of gold in 2016.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Scott Parsons, who is VP of Investor Relations of Alamos Gold Incorporated. Scott could you tell me what the focus is at Alamos Gold?

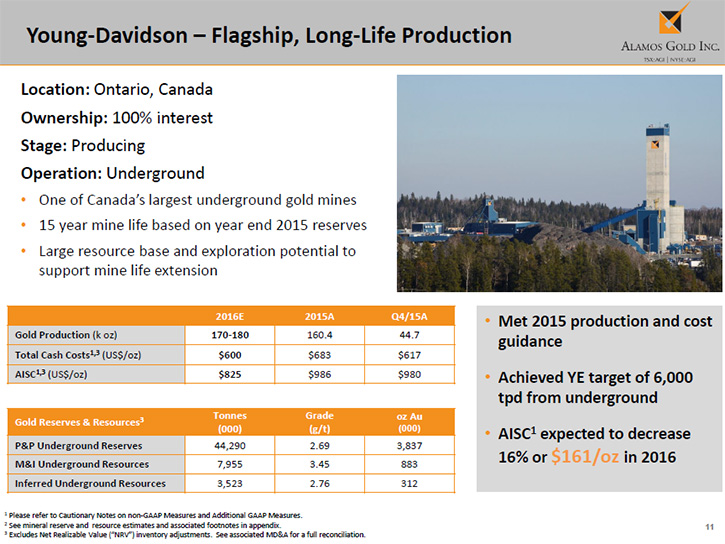

Scott Parsons: We are a diversified gold producer with three operations in North America. We have the Young-Davidson mine in Northern Ontario, Canada and the Mulatos and El Chanate mines in Sonora, Mexico. Our near term focus is on completing the underground ramp-up at our Young-Davidson mine in Ontario and developing the higher grade Cerro Pelon and La Yaqui deposits at our Mulatos mine in Mexico. Once these expansions are complete, we will utilize the free cash flow growth from these operations to help fund future growth from our development pipeline.

Dr. Allen Alper: Sounds very good. Could you tell me a bit more about your exploration and development projects in Mexico, Turkey, Canada and The United States?

Scott Parsons: We believe we have one of the best portfolios of growth projects among the intermediate producers. We have six development projects located in Turkey, Canada, Mexico and the United States.

All of our development projects share similar characteristics. They are all open pit projects and, with the exception of Lynn Lake in Manitoba, they are all heap leach projects, which will be low cost to develop and low cost to operate.

Our Turkish projects are our most advanced and currently in the permitting phase. Kirazlı, the first of these to be developed, has been granted approval of its Environmental Impact Assessment and we are currently working towards its forestry and operating permits. After that we will be in a position to start construction. But our focus is on completing the respective expansions at Young-Davidson and Mulatos before we embark on building out our Turkish projects and the rest of our development pipeline.

Dr. Allen Alper: That is great to have a low cost position. Can you tell me a bit about what differentiates Alamos Gold Inc from other companies?

Scott Parsons: There are four attributes that make Alamos Gold stand out from many of our peers. We are a diversified gold producer. We have one of the best growth profiles of our peer group. We have a strong balance sheet with a little under $300 million in cash and available for sale of securities to support our growth. Last, but not least, our assets are located in safe jurisdictions highlighted by our three producing mines, which are in two of the best jurisdictions in the world, in Canada and Mexico.

Among the intermediate peer space, several companies possess one or two of these attributes but not many possess all four. I think that positions us well to deliver shareholder value over the long term.

Dr. Allen Alper: That is excellent. Could you tell our readers more about your Alamos - AuRico merger?

Scott Parsons: Alamos and AuRico matched up very well in that they both had different strengths which complemented each other. AuRico had Young-Davidson, a flagship, long-life underground gold mine located in Canada, and a higher debt position.

Alamos on the other hand had the Mulatos mine in Mexico, a very strong balance sheet with no debt, and a strong development pipeline. Given the relative strengths of the companies, the merger has created a much bigger and stronger company which is better equipped to outperform in any gold price environment.

Dr. Allen Alper: That sounds like an excellent approach. How about the Carlisle Goldfields acquisition?

Scott Parsons: AuRico already had an agreement with Carlisle Goldfields whereby they had a 25% interest in the project with an agreement to earn-in up to 60%. We liked the project given its attractive economics and location in Manitoba and saw an opportunity to consolidate 100% ownership on terms that made sense for both sets of shareholders.

Dr. Allen Alper: That sounds like a great approach.

Could you tell me a bit about the management team and Board of Alamos Gold?

Scott Parsons: We have a strong Board comprised of key members of the former AuRico and Alamos Boards. Similarly, several key members of the AuRico management team joined Alamos complementing and strengthening what we believed was an already experienced management team.

Dr. Allen Alper: That sounds great. Could you tell me a little bit about your capital structure?

Scott Parsons: We have about 263 million basic shares outstanding which at current share prices gives us a Canadian dollar market cap of approximately $2.2 billion. We have approximately $283 million in cash and short term investments and $315 million in long term debt due in 2020. We are listed on the TSX and the New York Stock Exchange with approximately 75% of our shares institutionally held. Some of our largest shareholders include Van Eck, BlackRock, Tocqueville, Sun Valley and Donald Smith.

Dr. Allen Alper: That sounds like you have a very strong investor base. That sounds great. Could you tell me the primary reasons why our readers/investors should invest in Alamos Gold Inc?

Scott Parsons: We believe are one of the best positioned companies to deliver shareholder value over the near and long term. This stems from being a diversified producer with an attractive growth profile. Part of this growth is coming from our expansions at our existing operations with the rest coming from our portfolio of development projects of which we are receiving little value within the market today. We believe there is a lot of value to be unlocked in our development pipeline as we advance these projects towards production. Our assets are located in safe jurisdictions and we have one of the stronger balance sheets to support our near and longer term growth plans.

Dr. Allen Alper: That sounds excellent. Is there anything else you would like to add?

Scott Parsons: With the ramp up at Young-Davidson we are at an inflexion point where production is growing while capital spending and costs are decreasing.

We expect the operation to turn free cash flow positive in 2016 with growing free cash flow over the next several years. We expect Young-Davidson to be a significant source of free cash flow for a very long time.

Similarly we are expecting production to increase and costs to decrease further at our Mulatos mine with the development of the higher grade Cerro Pelon and La Yaqui deposits. These deposits also happen to be our best exploration targets. We have had a tremendous amount of exploration success thus far, having recently announced a 145% increase in the combined reserve and resource on both projects. We are continuing to invest heavily into exploring both deposits and see good potential for further reserve and resource growth.

Dr. Allen Alper: That is excellent. That is really great.

http://www.alamosgold.com

Alamos Gold Inc.

181 Bay Street, Suite 3910

Toronto, ON M5J 2T3

Toll Free: 1-866-788-8801

Tel: 416-368-9932

Fax: 416-368-2934

Email: info@alamosgold.com

|

|